Analyzing Viking Global Investors’ Positions in 4Q14

Viking Global Investors is an US-based hedge fund. The total value of Viking Global’s US long portfolio decreased to $21.78 billion in 4Q14.

March 16 2015, Published 10:22 a.m. ET

Viking Global Investors

Viking Global Investors is an US-based hedge fund. It was founded by Andreas Halvorsen—the firm’s current CEO. In this series, we’ll discuss some of the notable positions the hedge fund traded in 4Q14. The quarter ended in December 2014.

The total value of Viking Global’s US long portfolio decreased to $21.78 billion in 4Q14—from $24.90 billion in 3Q14.

Viking Global’s notable positions in 4Q14

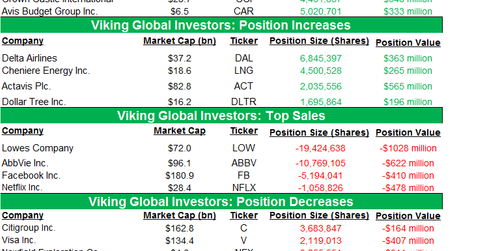

The hedge fund started new positions in Walgreens Boots Alliance (WBA), NXP Semiconductors (NXPI), Crown Castle International (CCI), and Avis Budget Group (CAR).

Viking Global increased its position in Delta Air Lines (DAL), Cheniere Energy (LNG), Actavis Plc (ACT), and Dollar Tree (DLTR).

It decreased its position in Citigroup (C), Visa (V), Newfield Exploration (NFX), and Alibaba (BABA). It also exited positions in Lowe’s (LOW), AbbVie (ABBV), Facebook (FB), and Netflix (NFLX).

Viking Global’s top holdings

Viking Global’s top holdings include Illumina at 7.03%, Walgreens Boots Alliance at 6.62%, Valeant Pharmaceuticals International at 5.96%, and Actavis Plc at 5.42%.

Illumina (ILMN) and Actavis Plc (ACT) have a 0.24% and 0.67% exposure, respectively, to the iShares Russell 1000 Growth ETF (IWF). IWF tracks the performance of 680 publicly listed companies in the growth sector.

Viking Global Investors has over 62 stocks in its portfolio.

In the next part of this series, we’ll discuss Viking Global’s position in Walgreens Boots Alliance.