Avis Budget Group Inc

Latest Avis Budget Group Inc News and Updates

The Avis Short Squeeze Resulted in Hedge Fund Losses, but Not for Everyone

Avis Budget Group (CAR) is the latest to explode as a meme stock. What are hedge funds' losses following the short squeeze?

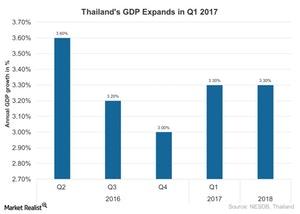

Will Thailand Continue Its Economic Expansion in 2Q17?

Thailand saw impressive growth in 1Q17 due in part to external demand and public investment. Its GDP rose 3.3% in 1Q17 as compared to a 3% rise in 4Q16.

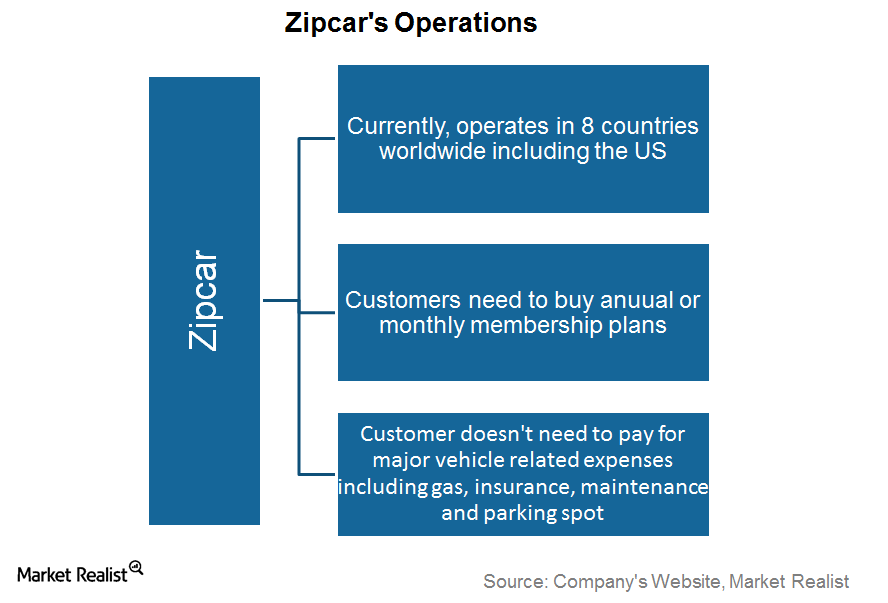

Understanding Zipcar’s Business Model

Founded in 2000, Zipcar was one of the car-sharing industry’s early entrants.