Illumina Inc

Latest Illumina Inc News and Updates

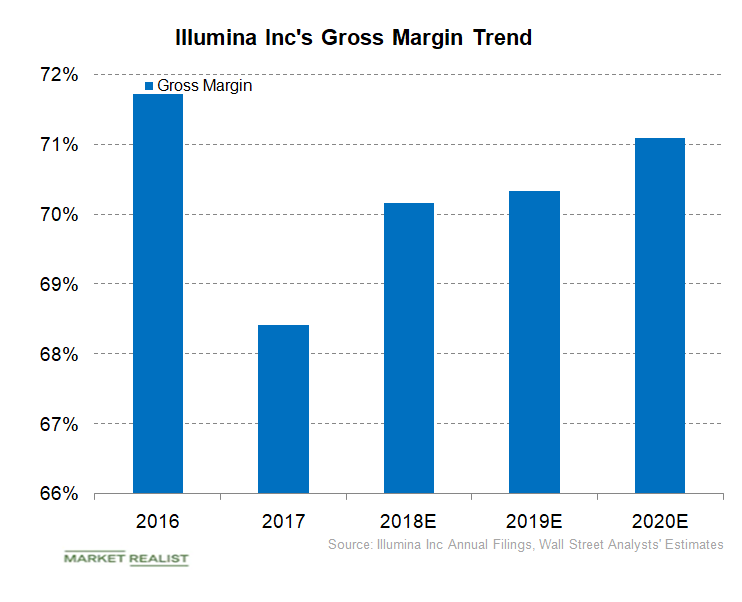

Understanding Illumina’s Gross Margin Trend

Illumina’s cost of product revenue increased from $173.0 million in the third quarter of 2017 to $184.0 million in the third quarter of 2018.

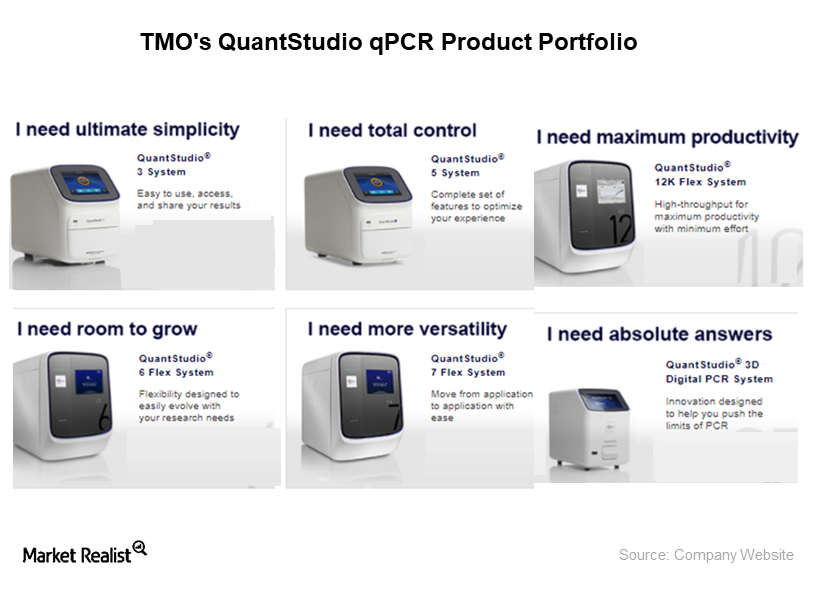

Thermo Fisher Expands Its Partnership with Genome Diagnostics

In December 2017, Thermo Fisher Scientific (TMO) expanded its partnership with Genome Diagnostics (or GenDx), a Netherlands-based firm offering molecular diagnostics solutions.

Thermo Fisher Scientific Accelerates Its Semiconductor Sequencing

On June 29, 2017, Thermo Fisher Scientific (TMO) announced the addition of three new products to its semiconductor failure analysis workflows portfolio.

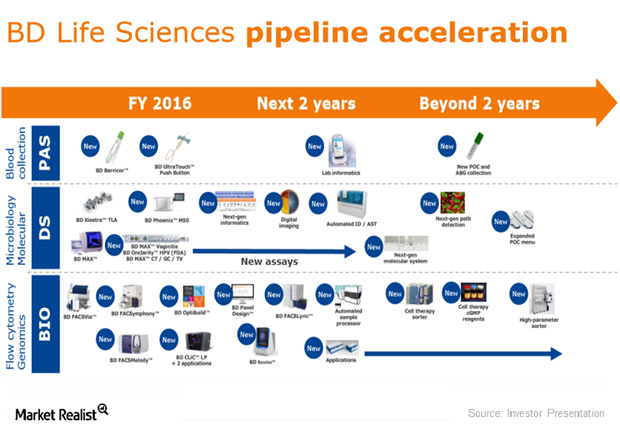

BD Lifesciences’s Product Pipeline Could Boost Its Fiscal 2017 Growth

Becton, Dickinson and Company (BDX) recently launched BD Barricor and BD Ultra Touch Push Button under its Pre-Analytical Systems division.

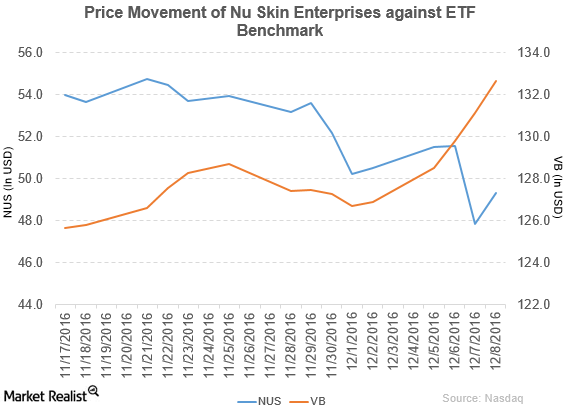

Sidoti Upgrades Nu Skin Enterprises to ‘Buy’

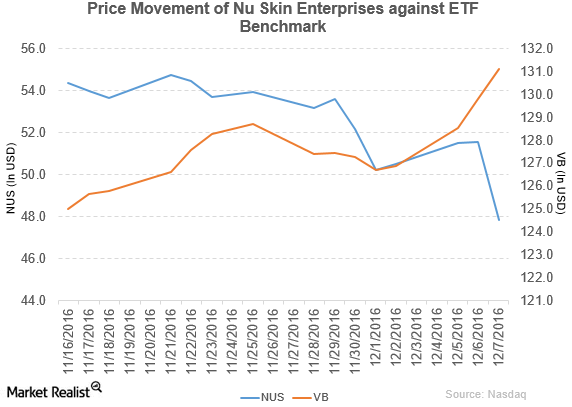

Price movement Nu Skin Enterprises (NUS) has a market cap of $2.7 billion. It rose 3.1% to close at $49.32 per share on December 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.8%, -7.9%, and 34.7%, respectively, on the same day. NUS is trading 6.3% below its 20-day moving average, […]

Nu Skin Enterprises Made Changes in Its Management

Nu Skin Enterprises (NUS) has a market cap of $2.6 billion. It fell 7.2% to close at $47.85 per share on December 7, 2016.

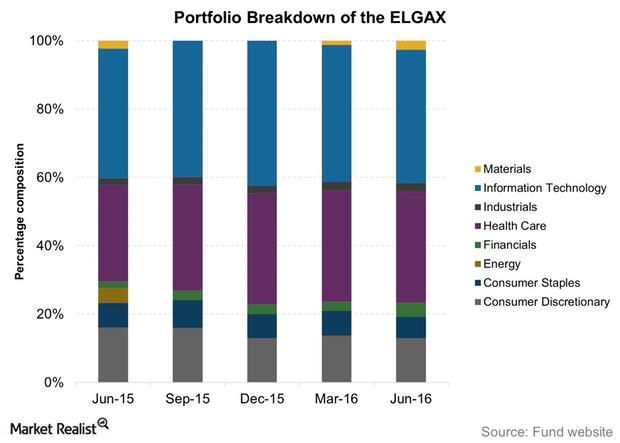

Columbia Select Large Cap Growth Fund: Sector Composition YTD 2016

The Columbia Select Large Cap Growth Fund (ELGAX) invests at least 80% of its assets in common stocks of US-based and foreign companies with market caps in the range of companies in the Russell 1000 Growth Index.

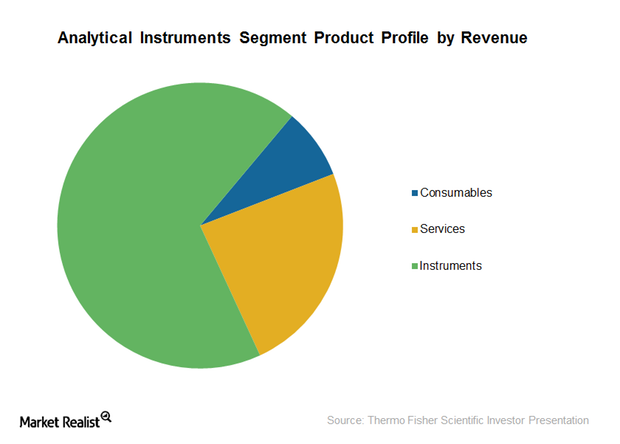

Thermo Fisher Scientific’s Analytical Instruments Business Segment

Thermo Fisher Scientific’s Analytical Instruments segment earned revenues of ~$3.3 billion in 2014, representing organic growth of around 4%.

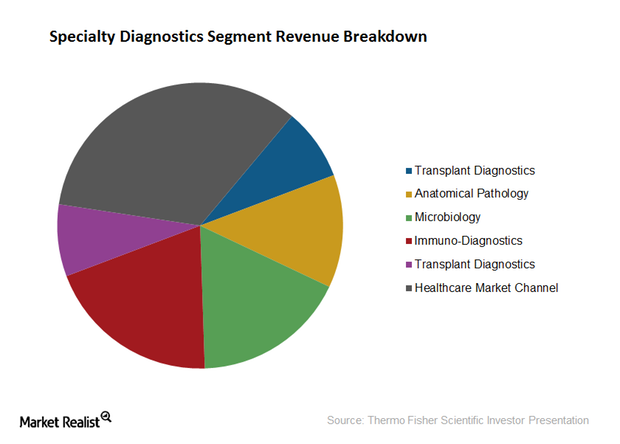

Specialty Diagnostics Segment of Thermo Fisher Scientific

A leading provider of diagnostic products and services, Thermo Fisher Scientific (TMO) has witnessed strong recurring revenues and high margins in the Specialty Diagnostics Segment over the years.

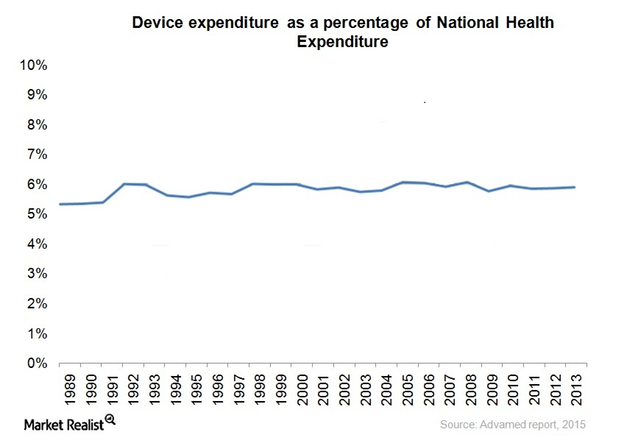

Analyzing Cost Structure for Medical Device Companies

As per the US Census, spending on medical devices in the US has been constant for over a decade between 2005 to 2015.

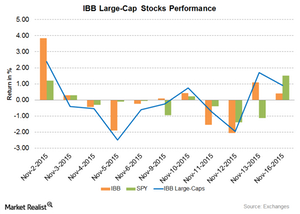

Illumina Continued to Rise, Led the Large-Cap Stocks

Illumina (ILMN) rose by 2.7% on November 16, 2015. It rose for the fourth consecutive trading session. Illumina rose 10% in the trailing five-day period.

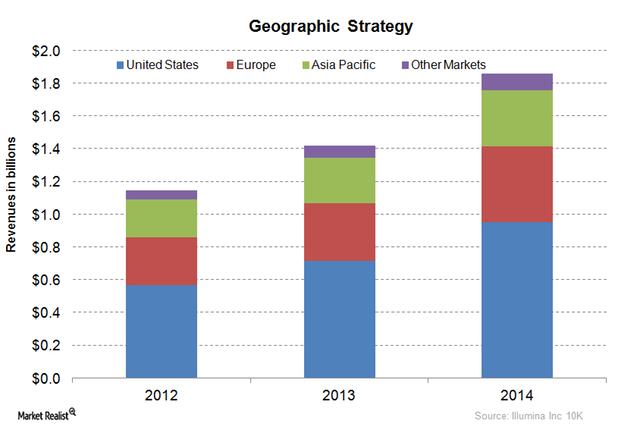

Illumina’s Market Expansion Strategy for Genome Sequencing

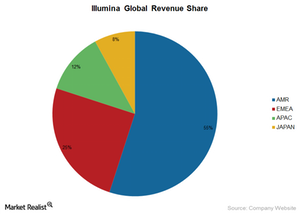

Illumina’s Market Expansion Strategy includes targeting the United States, Europe, and China for population sequencing projects.

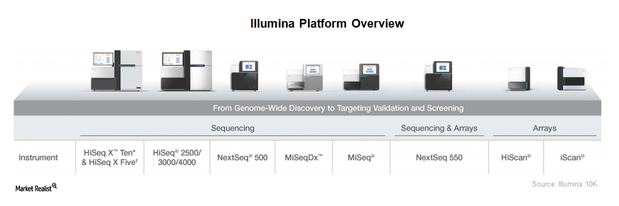

Illumina’s Key Products

Illumina’s key products are based on the company’s NGS (next-generation sequencing) technologies.

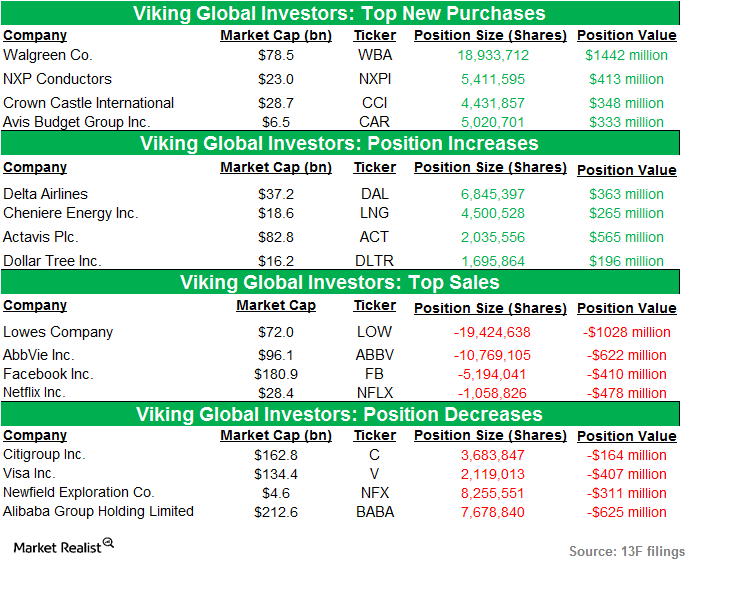

Analyzing Viking Global Investors’ Positions in 4Q14

Viking Global Investors is an US-based hedge fund. The total value of Viking Global’s US long portfolio decreased to $21.78 billion in 4Q14.

Why Illumina’s outlook is so bright

Illumina’s outlook is outstanding, as it has posted excellent 3Q14 results and its earnings continue to be bullish.