Highlights of Citadel Advisors’ 4Q14 Portfolio

Citadel Advisors’ 4Q14 portfolio increased by 3.63% to $82.66 billion from $76.77 billion in 3Q14.

March 31 2015, Updated 10:16 a.m. ET

Citadel Advisors

Citadel Advisors is a financial institution and hedge fund based in Chicago. The fund was founded in 1990 by Kenneth C. Griffin. Citadel Advisors is one of the leading investors in financial markets around the world. The fund works to discover and capture new opportunities, and it aims to deploy its capital across a diverse range of investment strategies.

Citadel Advisors wants to generate high risk-adjusted investment results for its capital partners and investors. According to Citadel Advisors’ management team, it has some of the most talented employees in the industry. Citadel Advisors’ 4Q14 portfolio increased by 3.63% to $82.66 billion from $76.77 billion in 3Q14. The fourth quarter ended in December. The fund’s 4Q14 portfolio had 3,535 positions.

Key positions traded by Citadel Advisors in 4Q14

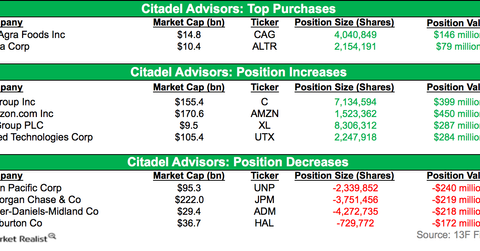

During the fourth quarter of 2014, Citadel Advisors added new positions in ConAgra Foods (CAG) and Altera (ALTR). The fund increased its positions in Citigroup (C), Amazon (AMZN), XL Group (XL), and United Technologies Corporation (UTX). The fund decreased its positions in Union Pacific Corporation (UNP), JPMorgan Chase (JPM), Halliburton Company (HAL), and Archer Daniels Midland Company (ADM).

The above chart shows the top ten positions that Citadel held at the end of 4Q14. The top positions include Apple (AAPL), Priceline (PCLN), Facebook (FB), and Google (GOOG) (GOOGL).

The fund manages more than $20 billion in investment capital on behalf of institutional investors and families with high net worth. Citadel Advisors’ main activities also include equity and options market making. Globally, Citadel Advisors is one of the biggest firms. The fund practices order flow internalization, which accounts for a major portion of its revenue.

In the next part of the series, we’ll discuss Citadel’s position change in ConAgra Foods (CAG). CAG has exposure to the Consumer Staples Select Sector SPDR Fund (XLP) and the iShares Morningstar Mid Value ETF (JKI).