iShares Morningstar Mid-Cap Value

Latest iShares Morningstar Mid-Cap Value News and Updates

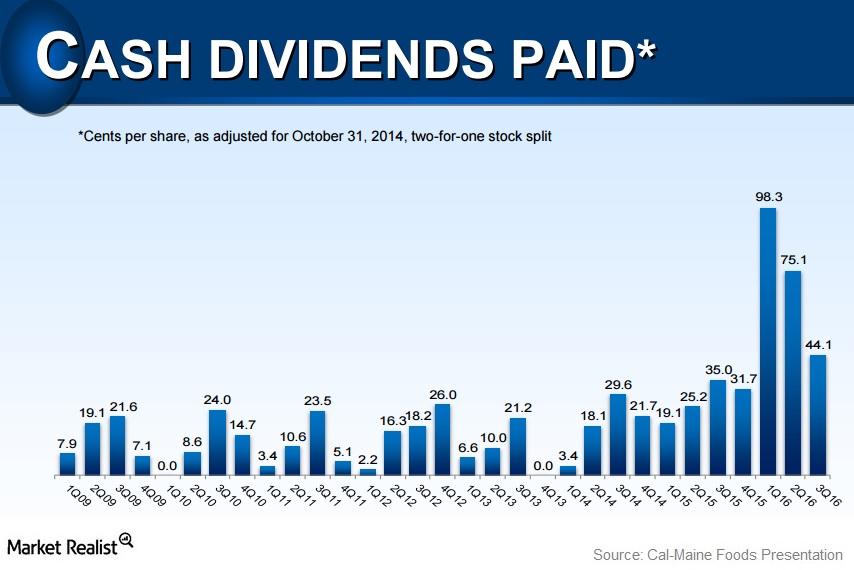

Analyzing Cal-Maine Foods’ Variable Dividend Policy

Cal-Maine has a variable dividend policy in place. It has a dividend yield of 5.8% as of June 28. Management raised the dividend at a CAGR of 15.3% over five years.

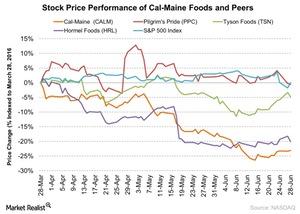

Why Did Cal-Maine Shares Fall 23% in the Last 3 Months?

Cal-Maine Foods (CALM) saw declining growth in its shares in the last three months. The company’s shares are trading close to its 52-week low.

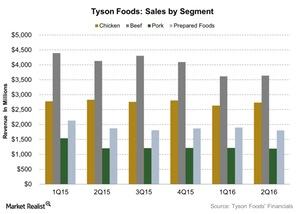

Chicken, Beef, or Pork: Which Segment Drove Tyson Foods’ Revenue?

In Tyson Foods’ Chicken segment, sales improved in 2Q16. The segment reported $2,737 million in net sales.