Why China Is Important To The Global Economy

As the second-biggest economy in the world, China is important. It’s also growing at a much faster rate than the biggest economy, the US.

Jan. 28 2015, Updated 9:05 p.m. ET

A new paper, “Braking China. . . Without Breaking the World,” from the BlackRock Investment Institute offers a nice list of six reasons why this is the case. Here are the reasons in no particular order.

1. China has quickly become the second-largest economy in the world.

2. China contributed almost half of the global growth in 2013, much more than the United States.

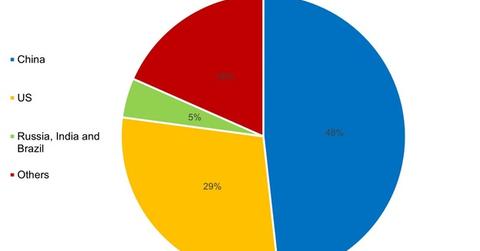

Market Realist – China is important to the world because it makes up 50% of the world’s GDP growth.

The pie chart above shows the contribution of some major economies to global GDP (gross domestic product) in 2013. The final data for 2014 aren’t available for most countries.

As you can see, China (FXI) made up almost 50% of the world’s GDP growth in 2013. That’s because China is the second-biggest economy in the world. Also, it’s growing at a much faster rate than the US, the biggest economy in the world.

The US made up about 29% of the change in global GDP in 2013. The US is a huge economy, with a GDP of around $16,800 billion. Even if it grows by 1%, it contributes a lot to global growth in terms of the bottom line.

Russia (RSX), Brazil (EWZ), and India (EPI) combined made up 4.5% of the world’s GDP growth in 2013. This just goes to show the gulf between China and other emerging markets (EEM).

A slowdown in China will negatively impact the economies exporting to China. Europe (EZU), Southeast Asia, Japan (EWJ), and South Korea (EWY) are some of China’s biggest import partners.

In the next part of this series, we’ll look at the effect of a Chinese slowdown on commodity markets.