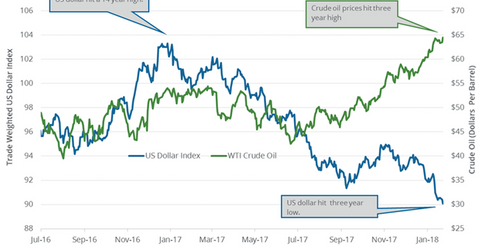

US Dollar Hit a 3-Year Low: Is It Bullish for Crude Oil?

The US Dollar Index (UUP) fell 0.34% to 90.09 on January 23—the lowest level since December 2014. The fall supported crude oil prices on January 23, 2018.

Jan. 25 2018, Updated 5:45 a.m. ET

US dollar

The US Dollar Index (UUP) fell 0.34% to 90.09 on January 23, 2018—the lowest level since December 2014. The fall supported crude oil (DWT) (UWT) prices on January 23, 2018. Crude oil is a dollar-denominated commodity.

The US dollar has fallen 2% year-to-date. However, US oil (SCO) prices have risen 6.7% during the same period. Higher prices favor funds like the Vanguard Energy ETF (VDE) and the iShares Global Energy ETF (IXC).

On January 23, 2018, the European Commission said that the Eurozone consumer confidence rose to 1.3 points in January 2018 from 0.5 points in December 2017. The reading was higher than the market estimates of an increase to 0.6. Consumer confidence was also at the highest level since 2000. It pressured the US dollar on January 23, 2018.

The US Dollar Index depreciated ~9.8% in 2017. WTI crude oil prices increased ~12.4% in 2017, partly supported by a weak dollar. Higher oil (UCO) prices favor energy producers (FXN) (PXI) like Laredo Petroleum (LPI), Whiting Petroleum (WLL), and W&T Offshore (WTI).

US dollar’s highs

The US dollar tested 103.8 on January 3, 2017—the highest level in 14 years. It impacts the PowerShares DB US Dollar Bullish ETF (UUP), which follows the US dollar’s performance.

Impact

The Fed might hike the US interest rate three times in 2018, which would be bullish for the US dollar. The US dollar could lag its peers due to the improving economy outside the US. Major central banks could hike interest rates in 2018. Moves in the US dollar could impact oil (UWT) prices.

Next, we’ll discuss some crude oil price forecasts.