Oil Market Could Be Pricing in a Supply Deficit

The rise in the premium, along with the rise in oil prices in the trailing week, could mean that the market expects a supply deficit in the oil market.

Nov. 20 2020, Updated 2:53 p.m. ET

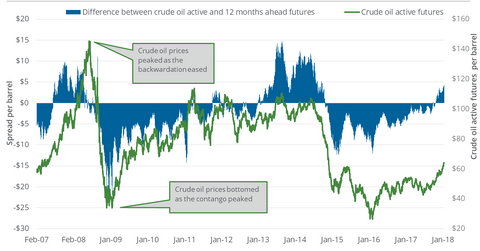

Futures spread

On January 12, 2018, the difference between the February 2018 futures contract and the February 2019 futures contract was $4.24. The difference is the “futures spread.” On the same day, the February 2018 futures traded at a higher price than the February 2019 futures. On January 5, 2018, the futures spread was at a premium of $3.17. Between these two dates, US crude oil futures rose 4.7%.

A rise in the premium could boost oil prices. For example, we haven’t seen it in the trailing week. A drop in the premium could pull prices lower. If the futures spread is at a discount, it could pull oil prices lower. The discount was at $2.60 on June 21, 2017—the day with the lowest closing level for US crude oil prices since August 11, 2016. Any fall in the discount could support oil prices, while prices are pressured when the discount rises.

Oil supply

The rise in the premium, along with the rise in oil prices in the trailing week, could point to the market’s expectation for a supply deficit in the oil market. The IEA’s oil market report on January 19, 2018, could reveal important statistics related to oil’s demand and supply situation. The economic crisis in Venezuela could harm its oil production. OPEC’s monthly oil market report on January 18, 2018, could also be important for oil prices.

Another boost in oil prices could have a positive impact on the S&P 500 (SPY) and the Dow Jones Industrial Average’s (DIA) energy exposure.

Energy sector

The futures spread at a premium could impact US oil producers’ (XOP) (DRIP) (IEO) risk management techniques. It also influences midstream companies (AMLP).

On January 12, 2018, US crude oil futures contracts’ closing levels from February 2018 to January 2019 were in a descending pattern. The price pattern could boost ETFs like the United States 12 Month Oil ETF (USL), the United States Oil ETF (USO), and the ProShares Ultra Bloomberg Crude Oil ETF (UCO). These ETFs have exposure to US crude oil futures.