Traders Are Tracking US Natural Gas Inventories

The EIA reported that US gas inventories fell by 18 Bcf (billion cubic feet) to 3,772 Bcf on November 3–10, 2017.

Nov. 17 2017, Published 9:44 a.m. ET

EIA’s natural gas inventories

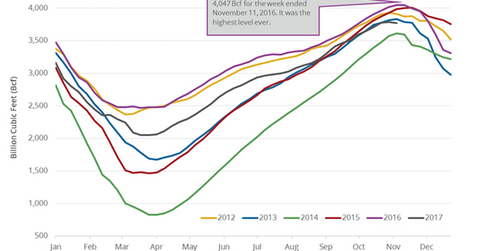

The EIA (U.S. Energy Information Administration) published its weekly US natural gas inventories report on November 16, 2017. It reported that US natural gas inventories fell by 18 Bcf (billion cubic feet) to 3,772 Bcf on November 3–10, 2017. The inventories fell 0.5% week-over-week and by 271 Bcf or 6.7% year-over-year.

Wall Street analysts expected that US natural gas inventories would have fallen by 14 Bcf on November 3–10, 2017. A larger-than-expected withdrawal in natural gas inventories supported US natural gas (DGAZ) (UGAZ) (BOIL) prices on November 16, 2017.

US natural gas active futures are near a six-month high. High gas (GASL) (FCG) prices benefit natural gas producers (FXN) (IYE) like Southwestern Energy (SWN), Exco Resources (XCO), EOG Resources (EOG), and Antero Resources (AR).

Historical context

US natural gas inventories’ five-year average addition for this period of the year was at 15 Bcf. The inventories rose by 34 Bcf during the same week in 2016. US natural gas inventories also rose by 15 Bcf for the week ending November 3, 2017.

US natural gas (BOIL) (UNG) prices rose on November 16, 2017, due to the fall in natural gas inventories—compared to the historical averages, which show a rise for this week.

Impact

For the week ending November 10, 2017, US natural gas inventories are 2.6% below their five-year average. However, they were 21% above the five-year average during March 2017. US gas inventories rebalanced towards historical average levels.

The EIA estimates that US gas inventories could fall more in the next few months, which could benefit US natural gas (DGAZ) (FCG) prices.

In the next part, we’ll discuss how US natural gas rigs impact natural gas prices.