Gasoline Inventories Could Pressure Crude Oil Prices

The API estimates that US gasoline inventories rose by 4.19 MMbbls on September 22–29, 2017. The market expected a build by 1.08 MMbbls.

Oct. 4 2017, Updated 2:36 p.m. ET

API’s gasoline inventories

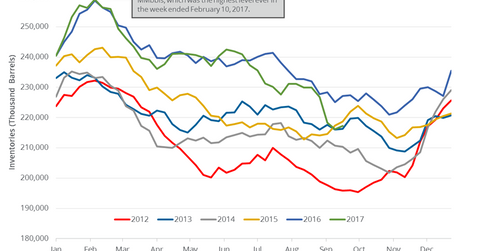

On October 3, 2017, the API (American Petroleum Institute) released the weekly crude oil and gasoline inventory report. It estimates that US gasoline inventories rose by 4.19 MMbbls (million barrels) compared to the market’s expectation of a rise by 1.08 MMbbls on September 22–29, 2017.

US gasoline (UGA) futures fell 1.1% to $1.54 per gallon in electronic trade at 2:25 AM on October 4, 2017. US crude oil (USO) (UWT) and gasoline futures fell due to the larger-than-expected build in gasoline inventories.

Moves in gasoline prices impact US refining companies (CRAK) like Holly Frontier (HFC), PBF Energy (PBF), and Marathon Petroleum (MPC). Likewise, moves in crude oil prices impact oil and gas producers (IXC) (IYE) like W&T Offshore (WTI) and Contango Oil & Gas (MCF).

API’s distillate inventories

The API added that US distillate inventories fell by 0.58 MMbbls on September 22–29, 2017. The market expected a draw in US distillate inventories by 1.8 MMbbls during this period.

EIA’s crude oil and gasoline inventory report

The EIA (U.S. Energy Information Administration) will release its weekly crude oil and gasoline inventory report on October 4, 2017, at 10:30 AM EST.

If the EIA reports a larger-than-expected rise in US gasoline inventories like the API did, it would pressure crude oil (UCO) (USL) prices. However, a fall in distillate inventories could support diesel prices. As a result, it might support crude oil prices as well.

In the next part of this series, we’ll discuss how gasoline demand impacts crude oil prices.