Will the OPEC and Non-OPEC Meeting Drive Crude Oil Futures?

September WTI (West Texas Intermediate) crude oil (RYE) (VDE) (UCO) futures contracts rose 1.1% to $49.58 per barrel on August 4, 2017.

Nov. 20 2020, Updated 12:10 p.m. ET

US crude oil futures

September WTI (West Texas Intermediate) crude oil (RYE) (VDE) (UCO) futures contracts rose 1.1% to $49.58 per barrel on August 4, 2017. Brent crude oil futures rose 0.80% to $52.42 per barrel on August 4, 2017.

Crude oil futures rose due to the following factors:

- There was a better-than-expected rise in US jobs data in July 2017. It could support energy demand and prices.

- There was a fall in US crude oil inventories on July 21–28, 2017.

- There was record US gasoline demand.

- The S&P 500 (SPY) (SPX-INDEX) was near a record.

However, Brent and WTI crude oil prices fell less than ~1% last week due to the following;

- Weekly US crude oil production hit a two-year high.

- OPEC’s crude oil production hit a 2017 high in July 2017.

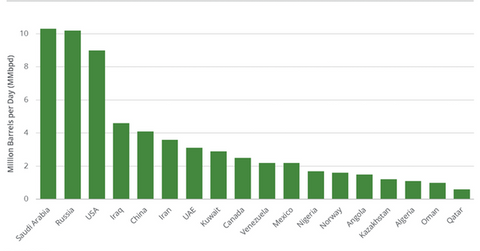

- OPEC crude oil exports rose by 370,000 bpd (barrels per day) to 26.11 MMbpd (million barrels per day) in July 2017.

US crude oil futures rose 18% since the ten-month low in June 2017 due to bullish drivers. Crude oil prices are near a two-month high. Higher crude oil prices have a positive impact on oil and gas producers such as Sanchez Energy (SN), Chevron (CVX), ExxonMobil (XOM), and Goodrich Petroleum (GDP). However, crude oil prices have fallen 13.3% year-to-date due to bearish drivers.

OPEC’s meeting in Abu Dhabi

At OPEC’s meeting in November 2017, OPEC and non-OPEC producers agreed to cap production by 1.8 MMbpd for six months from January 2017 to June 2017.

At the meeting in May 2017, OPEC and non-OPEC producers agreed to cap production by 1.8 MMbpd from January 2017 to March 2018.

At the meeting on July 24, OPEC and non-OPEC producers agreed to cap production for Libya and Nigeria. However, OPEC didn’t declare the capping dates. The meetings were meant to reduce excess oil from the market and support oil prices.

OPEC and non-OPEC producers will meet in Abu Dhabi on August 7–8, 2017. The meeting’s agenda is increasing compliance towards the production cut deal.

An expectation of an increase in compliance towards the production cut deal in August 2017 and fall in OPEC’s crude oil exports could support crude oil prices. The rise in crude oil (XLE) (XOP) (USO) prices could benefit energy investors in equity ETFs and energy stocks.

In this series, we’ll take a close look at crude oil price drivers.