US Natural Gas Futures Could Fall in 3Q17

The CFTC reported that hedge funds decreased their net long positions on US natural gas futures and options contracts 28% to 39,569 on August 1–8, 2017.

Aug. 18 2017, Published 10:53 a.m. ET

Hedge funds

On August 18, 2017, the CFTC (U.S. Commodity Futures Trading Commission) will release its weekly “Commitment of Traders” report.

In its previous report, the CFTC reported that hedge funds decreased their net long positions on US natural gas futures and options contracts by 15,704 contracts or 28% to 39,569 on August 1–8, 2017.

Hedge funds were net short on US natural gas futures and options during the same period in 2016.

Hedge funds’ bullish bets fell for the third straight week. It suggests that hedge funds are bearish on natural gas (UNG) (BOIL) (FCG) (UGAZ) (DGAZ) prices. Lower natural gas prices have a negative impact on natural gas producers’ profitability like EQT (EQT), Range Resources (RRC), and Cabot Oil & Gas (COG).

US natural gas price forecasts

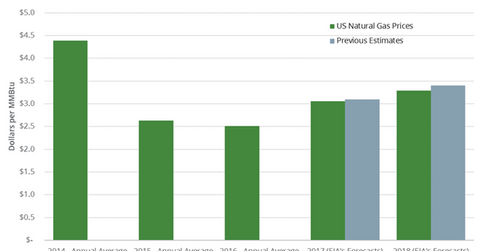

The EIA (U.S. Energy Information Administration) estimates that US natural gas prices could average $3.06 per MMBtu in 2017 and $3.29 per MMBtu in 2018. It estimates that US natural gas prices could average $3 per MMBtu in 3Q17. Prices averaged $3.08 per MMBtu in 2Q17.

US natural gas prices averaged $2.51 per MMBtu in 2016 and $2.63 per MMBtu in 2015. The World Bank estimates that prices could average $3.17 per MMBtu in 2017 and $3.60 per MMBtu in 2018.

Impact

President Trump’s energy plans could increase US natural gas production. It would pressure natural gas (KOLD) (UNL) prices.

Read Crude Oil: Price Forecasts and Hedge Funds’ Position for more information on crude oil price forecasts.

Read Will US Crude Oil Production Overshadow Inventory Draws? and Will Global Oil Demand Overshadow Ample Supplies? to learn more.