Which Energy Stocks Were Top Losers Last Week?

In the seven calendar days to December 22, 2017, oilfield services company Seadrill (SDRL) was the largest loser.

Dec. 27 2017, Updated 7:32 a.m. ET

Energy stocks

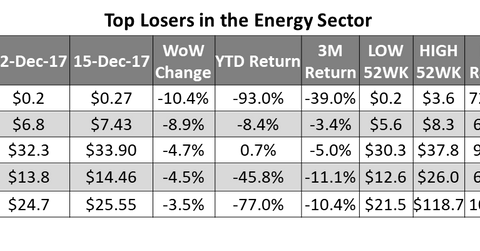

In the seven calendar days to December 22, 2017, oilfield services company Seadrill (SDRL) was the largest loser among the stocks that make up the VanEck Vectors Oil Services ETF (OIH), the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), the Energy Select Sector SPDR ETF (XLE), and the Alerian MLP ETF (AMLP). For a broader view, we’ve added a few US-listed integrated energy stocks to the list.

Other oilfield services stocks

Oilfield services stocks McDermott International (MDR) and Tidewater (TDW) ranked second and fifth, respectively, on our list of top energy losers last week. However, the VanEck Vectors Oil Services ETF (OIH) rose 5.3%, the second after XOP among our list of energy subsector ETFs we looked at in Part 2 of this series.

Midstream stocks Holly Energy Partners (HEP) and Enbridge Energy Partners (EEP) were the third and fourth largest losers, respectively, on our list in the past five trading sessions. The Alerian MLP ETF (AMLP) rose the least among energy subsector ETFs.

These stocks underperformed US crude oil futures and equity indexes such as the S&P 500 Index. The S&P 500 Index (SPY) rose 0.3%, and US crude oil futures rose 2%.