Tidewater Inc

Latest Tidewater Inc News and Updates

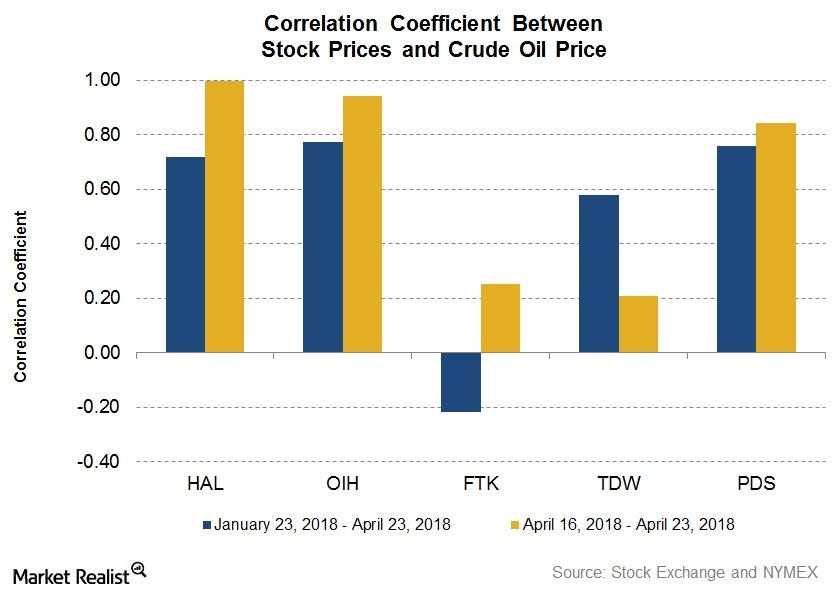

How Halliburton Has Reacted to Crude Oil Prices

Between April 16 and April 23, Halliburton (HAL) stock’s price correlation with crude oil was 0.99, showing that Halliburton and crude oil prices have been strongly correlated in the past week.

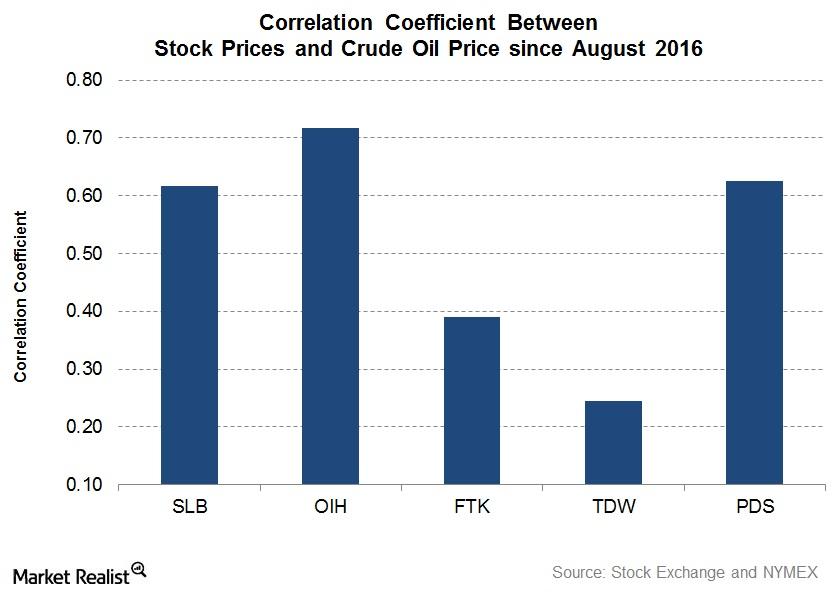

How Schlumberger Correlates with Crude Oil

The correlation coefficient between the West Texas Intermediate (or WTI) crude oil price and Schlumberger’s (SLB) stock price between August 4, 2016, and August 4, 2017, is 0.62.

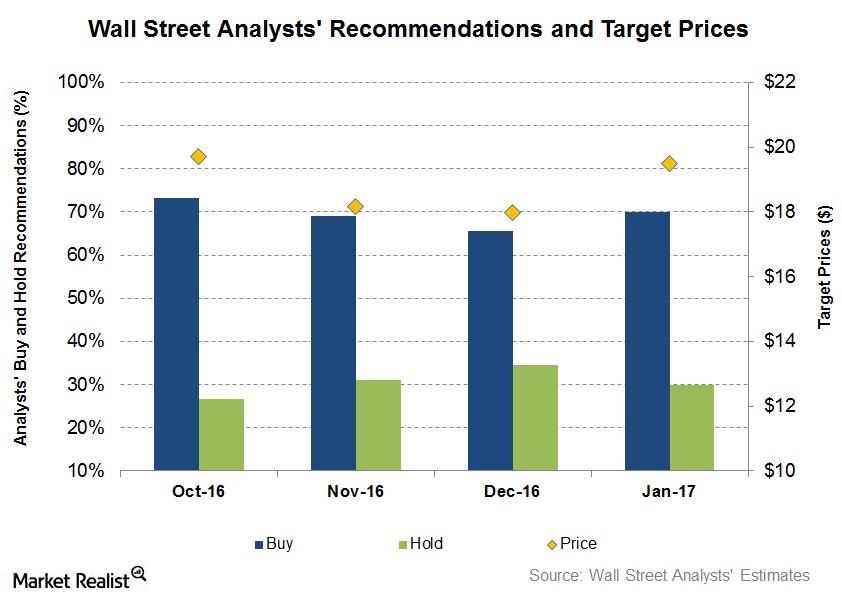

How Have Superior Energy’s Recommendations Changed before the 4Q16 Earnings?

On January 6, 2017, ~70% of the analysts tracking SPN recommended a “buy” or some equivalent for the stock, while ~30% of the analysts issued a “hold.”

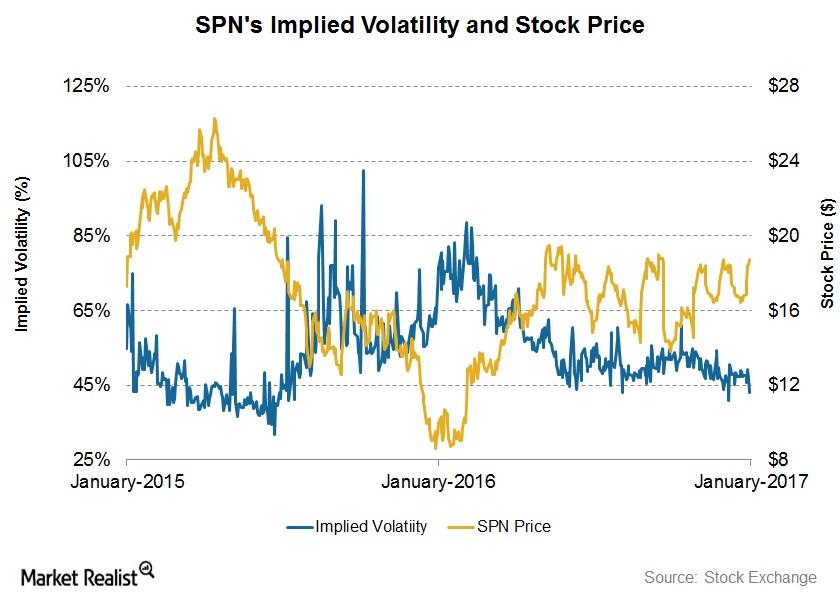

How Volatile Is Superior Energy Services in 1Q17?

On January 6, SPN had an implied volatility of ~43%. Since SPN’s 3Q16 financial results on October 24, 2016, its implied volatility has fallen from 54%.

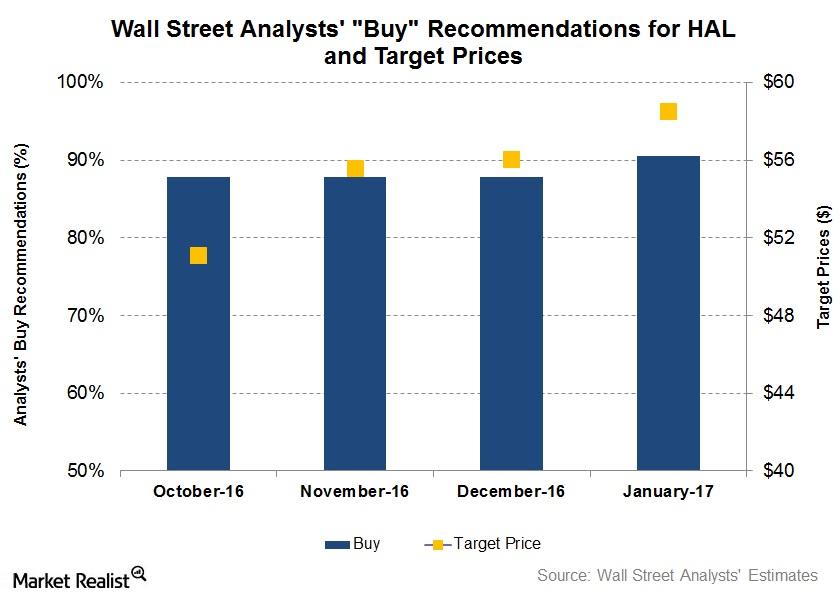

Wall Street’s Forecasts for Halliburton before Its 4Q16 Earnings

On January 3, 2017, 90% of the analysts tracking Halliburton (HAL) rated it a “buy” or some equivalent.