Did China’s Imports Rise on Its Structural Shift in June 2017?

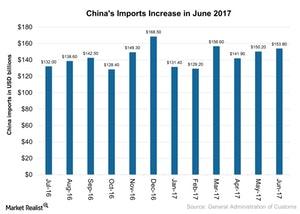

China’s (FXI) imports rose to $153.8 billion in June 2017, a 17.2% rise year-over-year (or YoY) and a 2% rise month-over-month.

July 21 2017, Updated 10:40 a.m. ET

China’s 2017 imports

China’s (FXI) imports rose to $153.8 billion in June 2017, a 17.2% rise year-over-year (or YoY) and a 2% rise month-over-month. The country’s resilient domestic demand so far in 2017 seems to be helping the growth in its imports.

However, uncertainty related to the pace of import growth remains due to headwinds from China’s (MCHI) policy tightening activities. Let’s look at China’s imports over the last year.

Imports in June 2017

China’s (ASHR) imports in June 2017 saw a slower rise compared to the 14.8% rise they saw in May 2017. However, the rise was higher than the market’s expectation of 13.1% for June. The country’s 2017 imports have been supported by growth in global demand as commodity prices (DBO) such as iron ore have recovered slightly after an extended period of contraction. However, in the last two months, commodity prices have been on a falling trend.

China’s structural shift

China’s (YINN) structural shift from an export-based economy to a more consumption-based economy has resulted in increased government investment in infrastructure development. This increased government investment is expected to support the country’s economic activity, resulting in growing demand for raw materials.

China’s economic growth based on its consumption is expected to continue driving Chinese imports in the future. However, headwinds such as monetary policy tightening and the country’s protectionist stance are expected to impact Chinese (EEM) trade and imports.

Many global (ACWI) economies trade heavily with China. South Korea (EWY), the United States (SPY), Japan (EWJ), Germany (EWG), and Asia (ASEA) are the country’s top import origins.

Let’s look at the Chinese yuan’s 2017 performance in our next article.