How the Dollar Is Affecting Oil

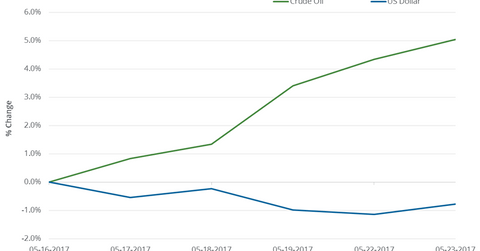

US crude oil (DBO) (USL) (OIIL) July futures rose 5% between May 16 and May 23, 2017.

Nov. 20 2020, Updated 4:31 p.m. ET

US dollar and crude oil

US crude oil (DBO) (USL) (OIIL) July futures rose 5% between May 16 and May 23, 2017. The US Dollar Index (UUP) (USDU) (UDN) fell 0.8% during this period.

In the last five trading sessions, US crude oil and the Dollar Index moved inversely. The correlation between them stood at -79.4% as the two moved in opposite directions three out of five times in the trailing week.

A weaker dollar could boost crude oil prices because a fall in the dollar decreases the price of oil for oil-importing countries. The opposite can also hold true.

Interest rate and crude oil

The US dollar could be impacted by the Fed’s interest rate decisions. Though the Fed maintained the benchmark rate at its last monetary policy review on May 3, 2017, the market expects rates to move up two more times by the end of 2017. So, because of their effect on the dollar, interest rates can affect oil prices.

The above analysis could be important for ETFs like the Direxion Daily Energy Bear 3X ETF (ERY), the Direxion Daily S&P Oil & Gas Exploration & Production Bear 3X ETF (DRIP), the United States Brent Oil ETF (BNO), the First Trust Energy AlphaDEX ETF (FXN), and the United States Oil ETF (USO).

What does the long-term correlation say?

Between September 2007 and June 2013, the rolling one-month correlation between crude oil and the US dollar was negative in most instances.

However, since June 2013 to date, the correlation ranged between -64.0% and 43.0%. The correlation was positive in many instances. So, fundamental factors likely dominated oil price movements. Right now, Trump’s economic, energy, and climate policies along with OPEC’s production cut decision could be oil’s crucial drivers.