US Crude Oil Production Is near August 2015 High

The EIA (U.S. Energy Information Administration) reported that US crude oil production rose by 13,000 bpd (barrels per day) to 9,265,000 bpd on April 14–21.

Nov. 20 2020, Updated 1:43 p.m. ET

US crude oil production

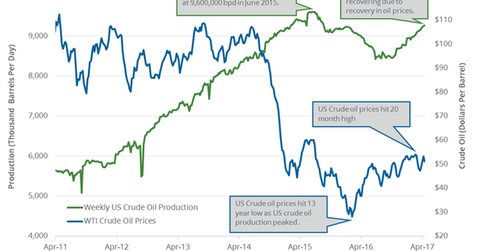

The EIA (U.S. Energy Information Administration) reported that US crude oil production rose by 13,000 bpd (barrels per day) to 9,265,000 bpd on April 14–21, 2017. Production rose 0.1% week-over-week and 3.6% year-over-year. US crude oil production is near the highest level since August 21, 2015. The rise in US crude oil production is bearish for crude oil (ERY) (ERX) (IYE) prices.

Lower crude oil prices have a negative impact on oil and gas producers’ earnings like PDC Energy (PDCE), Devon Energy (DVN), Cobalt International Energy (CIE), and Continental Resources (CLR). For more on crude oil prices, read Part 1 of this series.

Peaks and lows

US crude oil production peaked at 9,600,000 bpd in June 2015. In contrast, it hit a low of 8,428,000 bpd for the week ending July 1, 2016—the lowest level since June 2014. Since then, US crude oil production has risen ~9.9%.

US crude oil output estimates

The EIA estimates that US crude oil output will average 9,220,000 bpd and 9,900,000 bpd in 2017 and 2018, respectively. US production will likely hit a 48-year high in 2018. Production averaged 8,880,000 bpd in 2016.

US production could rise in 2017 due to the following factors:

- technological advances are leading to a rise in US drilling activity even at lower crude oil prices

- higher crude oil prices in 2017 compared to 2016

- implementation of President Trump’s proposed energy policies

The rise in production could pressure US crude oil (PXI) (USL) prices. The US might be the main producer to offset the fall in the crude oil supply from major oil producers’ output cut deal.

Tyche Capital Advisors thinks that if US production rose at the current pace, it would offset the reduction in supply from major oil producers’ output deal.

In the next part of this series, we’ll take a look at US crude oil refinery demand and crude oil imports.