What’s the Natural Gas Outlook for This Week?

The weather forecast for October 3 to October 9, 2016, indicates that temperatures in the United States could remain higher than the five-year average for the period between October 3 and October 6.

Oct. 3 2016, Published 5:04 p.m. ET

What’s the weather forecast?

The weather forecast for October 3 to October 9, 2016, indicates that temperatures in the United States could remain higher than the five-year average for the period between October 3 and October 6. For the remaining days in the week, the temperature could fall sharply below its five-year mean. Between October 3 and October 9, the temperatures could start to cool.

Lower temperatures reduce the use of natural gas (UNG) (DGAZ) (BOIL) (FCG) (UGAZ) (GASL) for cooling purposes, which could be a bearish catalyst for natural gas during the week.

El Niño anomalies

Natural gas use for heating during the 2015–2016 winter season was low due to mild weather. El Niño kept temperatures warmer than normal. As a result, at the end of March 2016, US natural gas inventories were at 2.5 trillion cubic feet, which is 67% higher than levels in 2015 and 53% higher than the five-year average.

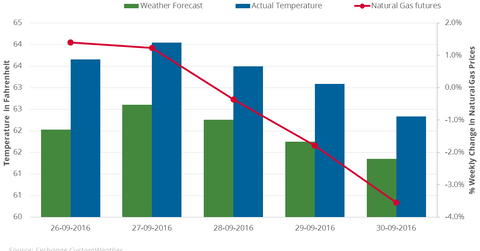

In the week ending September 30, 2016, temperatures were higher than forecasts. Natural gas futures fell 3.6% for that week.

Inventory data

On September 29, 2016, the EIA (US Energy Information Administration) announced a 49 Bcf (billion cubic feet) addition to natural gas inventory levels in the week ending September 23, 2016. The market had expected an addition of 57 Bcf to the inventory, according to a report by the Wall Street Journal.

The effect on ETFs

The above analysis could be important for natural-gas-tracking commodity ETFs such as the ProShares Ultra Bloomberg Natural Gas ETF (BOIL), the Direxion Daily Natural Gas Related Bear 3X ETF (GASX), and the Direxion Daily Natural Gas Related Bull 3X ETF (GASL).

In the next part, we’ll take a look at the recent impact of crude oil on the S&P 500 Index (SPY) (SPXL).