What Were the Implied Volatilities for Crude Oil and Natural Gas?

Crude oil’s (UWTI) (USO) (OIIL) (USL) (SCO) (DWTI) implied volatility was 35.3% on September 30, 2016.

Oct. 3 2016, Published 5:04 p.m. ET

Crude oil’s implied volatility

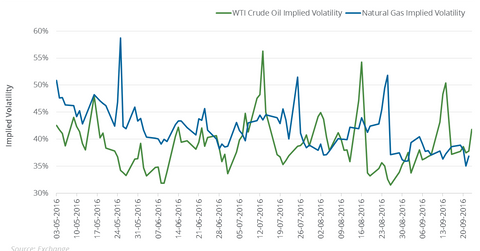

Crude oil’s (UWTI) (USO) (OIIL) (USL) (SCO) (DWTI) implied volatility was 35.3% on September 30, 2016. Its 15-day average implied volatility is 40.8%, which means that crude oil’s current implied volatility is 13.5% below its 15-day average.

Crude oil’s implied volatility rose to 56.3% on July 13, 2016. Since then, its implied volatility has fallen 37.3%. Over this period, US crude oil active futures contracts have fallen 7.8%.

From September 23 to September 30, crude oil’s implied volatility fell 15.6%. WTI crude oil gained on account of the fall in crude oil inventories and the OPEC deal we discussed in part one of this series.

What about natural gas?

Natural gas’s (UNG) (DGAZ) (BOIL) (FCG) (UGAZ) (GASL) implied volatility was 40.1% on September 30, 2016. Its 15-day average implied volatility is 38.5%, which means that natural gas’s current level of implied volatility is 4.2% above its 15-day average.

Natural gas’s implied volatility rose to 58.7% on May 25, 2016. Since then, it has fallen 31.7%. Since May 25, natural gas has risen 46.7%. Last week, natural gas November futures fell 3.6%, while their implied volatility rose 8.9%. The fall in prices last week corresponds to the forecasts for cooler temperatures.

Energy ETFs

This analysis could be important for natural-gas-tracking ETFs such as the ProShares Ultra Bloomberg Natural Gas ETF (BOIL), the Direxion Daily Natural Gas Related Bear 3X ETF (GASX), the United States Natural Gas ETF (UNG), and the Direxion Daily Natural Gas Related Bull 3X ETF (GASL).

This analysis could also be important for crude-oil-tracking funds such as the United States Oil ETF (USO) and the Credit Suisse X-Links WTI Crude ETN (OIIL).