A Look into the Implied Volatilities of Crude Oil and Natural Gas

Crude oil’s implied volatility was 37.1% on September 9, 2016. Its 15-day average implied volatility is 35.1%.

Sept. 12 2016, Published 9:31 a.m. ET

Crude oil’s implied volatility

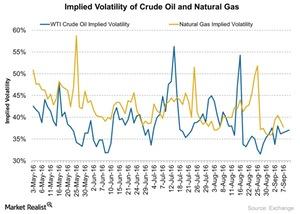

Crude oil’s (UWTI) (USO) (OIIL) (USL) (SCO) (DWTI) implied volatility was 37.1% on September 9, 2016. Its 15-day average implied volatility is 35.1%. This means that crude oil’s current implied volatility is 5.7% above its 15-day average.

Crude oil’s implied volatility spiked to 56.3% on July 13, 2016. Since then, its implied volatility has fallen 34.1%. From July 13 to date, US crude oil active futures contracts have risen 2.5%. From September 2 to September 9, US crude oil rose 3.2%. Its implied volatility fell 9.7% during that period.

What about natural gas?

Natural gas’s (UNG) (DGAZ) (BOIL) (FCG) (UGAZ) (GASL) implied volatility was 37.8% on September 9, 2016. Its 15-day average implied volatility is 41.3%. This means that natural gas’s current level of implied volatility is 8.5% below its 15-day average.

Natural gas’s implied volatility spiked to 58.7% on May 25, 2016. Since then, it has fallen 35.6%. Since May 25, natural gas has risen 41.3%. Last week, natural gas October futures fell 2.5%, while their implied volatility rose 4.9%.

Energy ETFs

This analysis could be important for natural gas–tracking ETFs such as the ProShares Ultra Bloomberg Natural Gas ETF (BOIL), the Direxion Daily Natural Gas Related Bear 3X ETF (GASX), the United States Natural Gas ETF (UNG), and the Direxion Daily Natural Gas Related Bull 3X ETF (GASL).

This analysis could also be important for crude oil–tracking funds such as the United States Oil ETF (USO) and the Credit Suisse X-Links WTI Crude ETN (OIIL).