Low-entry barriers intensify competition in airline industry

Short-term outlook above expectations The IATA (International Air Transport Association) has revised its forecast upwards on global airline profitability after the free fall of crude oil prices in the second half of 2014. Global net profit for 2014 is now estimated at $19.9 billion, higher than $18 billion projected in June. Profitability is expected to […]

Dec. 31 2019, Updated 12:54 p.m. ET

Short-term outlook above expectations

The IATA (International Air Transport Association) has revised its forecast upwards on global airline profitability after the free fall of crude oil prices in the second half of 2014. Global net profit for 2014 is now estimated at $19.9 billion, higher than $18 billion projected in June. Profitability is expected to rise to $25 billion in 2015, which represents a margin of 3.2% and a net profit per passenger of $7.08. This is ~18% year-over-year growth from $6.02 in 2014 and double the $3.38 in 2013.

Long-term outlook by region

According to the 20-year passenger growth forecast released by the IATA in October 2014, global passenger traffic will more than double to 7.3 billion in 2034, from 3.3 billion in 2014, representing a ten-year compounded annual growth rate (or CAGR) of ~4%. The expected growth in air travel will also result in increased employment opportunities and a higher contribution to economic activity. The outlook by region is summarized below.

- The North American market is expected to grow by 3.3% annually. The United States will continue to be the largest air passenger market in terms of traffic over the next 20 years. Major US airlines, including Delta Air Lines, Inc. (DAL), United Continental Holdings Inc. (UAL), American Airlines (AAL), Alaska Air Group, Inc. (ALK), JetBlue Airways Corporation (JBLU), and Southwest Airlines Co. (LUV), have contributed in a major way to profitability in the region. The North American market has the highest profitability compared to all other regions.

- China is the next biggest market. With an average annual growth rate higher than that of the United States, China is expected to overtake the United States by 2030. Investors can participate in a high-growth projection of the Chinese market by investing in ETFs such as iShares FTSE China 25 Index Fund (FXI), and the iShares MSCI China Index Fund (MCHI).

- China, the United States, India, Indonesia, and Brazil will be the five fastest increasing markets by 2034 based on additional passengers per year. By 2034, China is expected to add 856 million passengers, followed by the United States with 559 million passengers, India with 266 million passengers, Indonesia with 183 million passengers, and Brazil with 170 million passengers.

Industry needs to improve returns to attract investors

Investors should know that like any other industry, the airline industry is not immune to risks. Risks of fluctuating input costs and a high dependence on uncertain economic conditions constantly challenge companies in the industry.

As for the industry’s economic profit, calculated as ROIC-WACC (return on invested capital against weighted average cost of capital), invested capital has been negative. With a growing market potential, especially in emerging countries, the new capital requirement to fund aircraft purchases is estimated at $4–$5 trillion over the next two decades. The industry will need to improve returns over and above WACC in order to attract investors and capital providers.

ROIC profits expected to improve

Significant improvements have already been witnessed recently by the narrowing of the gap between WACC and ROIC. ROIC is expected to improve to 6.1% in 2014 and 7% in 2015, from 4.9% in 2013. It remains a concern, however, that ROIC has constantly been lower than the industry’s WACC, which falls in the range of 7%–8%.

Although returns continue to fall short of the cost of capital, the gap will decrease to 1.2% in 2014 and 0.8% in 2015, compared to 2.3% in 2013. Airlines have recently improved profit margins driven by economic growth and lower fuel costs. The profitability outlook for the global airline industry is provided in part 15 of this series.

Due to improved profitability and higher returns generated from investments, US airlines, including Delta Air Lines, Inc. (DAL), United Continental Holdings Inc. (UAL), Alaska Air Group, Inc. (ALK), JetBlue Airways Corporation’s (JBLU), and Southwest Airlines Co. (LUV), are increasing investments and expanding operations. Transportation ETFs such as iShares Transportation Average ETF (IYT) and SPDR S&P Transportation ETF (XTN) have derived higher returns from airline stocks.

Airlines see low profit per passenger

Demand for air travel and capacity has seen tremendous growth in the airline industry, but profitability is comparatively low even though unit costs have fallen by half over the past 40 years. Most of the efficiency gains from lower costs were passed on to customers in the form of lower airfares.

According to the IATA (International Air Transport Association), airlines have reduced airfares by more than 60% in the last 40 years. The impact of high airline operating costs, interest, and tax expenses is evident from the huge difference between revenue per passenger and net profits per passenger. The IATA reports that in fiscal year 2012, airlines generated $228 in revenue per passenger. However, after adjusting for costs, interest, and taxes, the net profit per passenger was only $2.56.

This is a concern as the industry will not be able to attract capital requirements for aircraft purchases and other nonaircraft capital expenditure or provide adequate returns to shareholders. The capital-intensive nature of the industry and the fact that about 75% of the world’s airlines are majority owned by the private sector require that returns on invested capital are high enough to attract investments.

Regions vary in margins and performance

Margins and operational performance of airlines vary for each region due to differences in cost of operations, economic conditions, government policies and regulations, demand, taxation policies, impact of currency fluctuations, and so on. All regions except Africa showed positive net profits and EBIT (earnings before interest and taxes) margins in 2013. Even African airlines are forecast to show improved margins and profitability in 2014 and 2015.

North America has outperformed all other regions in 2013, followed by Asia Pacific and the Middle East. Delta Air Lines, Inc. (DAL), United Continental Holdings Inc. (UAL), American Airlines (AAL), Alaska Air Group, Inc. (ALK), JetBlue Airways Corporation (JBLU), and Southwest Airlines Co. (LUV) are the major US airlines that have improved profitability and efficiency of operations. They’ve also provided good returns for holders of iShares Transportation Average ETF (IYT) and SPDR S&P Transportation ETF (XTN). Refer to part 14 of this series for more details on airline profitability by region.

Impact of fluctuation in crude oil prices

The price of crude oil has a significant impact on the airline industry’s cost structure since fuel costs comprise ~30% of an airline’s operating costs. In 2011, the cost of crude oil accounted for ~75% of the cost structure of jet fuel, excluding taxes. Refining margins accounted for 13%. The rest was for transportation, storage, and logistics. Efficiency in fuel consumption through technology advancement has reduced the fuel cost burden to a large extent.

Efficiency gain expected for 2014

According to the IATA (International Air Transport Association), although passenger and cargo traffic is expected to increase by 65% and 37%, respectively, fuel consumption is expected to increase only by 17%. In 2004, 65 billion gallons of fuel were consumed for 2 billion passengers and 38 million tons of cargo.

In 2014, only an estimated 76 billion gallons are expected to be consumed for 3.3 billion passengers and 52 million tons of cargo. Lower jet fuel prices and improved fuel efficiency contribute to the efficiency gain.

Crude oil prices will likely drop more

Crude oil prices are currently falling due to high levels of production and a mismatch between demand and supply fundamentals. The IATA forecasts that the fuel price per barrel will decrease to $99.9 in 2015, from $124.5 in 2013. Based on these forecasts, airline fuel cost will decrease to 26% of operating costs by 2015, from 30% in 2013.

Airlines hedge the risk of fluctuating crude oil prices by using financial instruments such as commodity derivatives that enable them to fix the future purchase price of fuel. The benefit each airline can derive from rising or falling crude oil depends on the level of hedging. When fuel prices rise, airlines pass on higher costs by increasing the fuel surcharge, a component in air ticket pricing.

Different by region

Airlines’ fuel costs vary by region. North American airlines, which form part of the SPDR S&P Transportation ETF (XTN), benefit from the fact that crude oil prices are denominated in US dollars. This exposes airlines from other regions to exchange rate fluctuations in addition to fluctuations in crude oil prices.

Fuel costs for Brazilian airline Gol Linhas Aéreas Inteligentes (GOL), for example, accounted for 42% of its operating cost compared to an average of ~34% for US airlines, including United Continental Holdings Inc. (UAL), American Airlines (AAL), Alaska Air Group, Inc. (ALK), Delta Air Lines, Inc. (DAL), JetBlue Airways Corporation’s (JBLU), and Southwest Airlines Co. (LUV).

Ancillary revenue growth

Ancillary revenue has more than doubled in the last four years, increasing the contribution to airline revenue from 4.8% to 6.7%. Ancillary revenue is vital for airlines as it contributes to higher profit margins as well as satisfies customers with additional features and services.

Net profit margin for the airline industry is estimated at 2.4%, or $5.42 per passenger, while ancillary revenue is projected to yield $15.02 per passenger.

What does ancillary revenue include?

Ancillary revenue is defined by IdeaWorksCompany as revenue generated by direct sales to passengers or indirectly as part of the travel experience beyond the sale of tickets. It’s broadly categorized into the following four sources:

- Frequent Flier programs. These are customer loyalty programs in which an airline awards customers free miles. Revenue from the sale of such miles or points to program partners such as hotel chains, car rental companies, cobranded credit cards, online malls, retailers, and communication services qualify as ancillary revenue.

- À la carte features. These are additional features added to enhance the travel experience. They includes onboard sales of food and beverages, baggage checking, seat space, call center support for reservations, fees charged for purchases made with credit or debit cards, priority check-in and screening, in-flight entertainment systems, wireless Internet access, and so forth.

- Commission-based products. These are commissions airlines earn on the sale of hotel accommodations, car rentals, travel insurance, and duty-free and other consumer products onboard.

- Advertising sold by an airline. This is revenue generated from in-flight magazines and other advertisements in the aircraft or airport lounges.

Contributions to global ancillary revenue

According to estimates from Ideaworks, North America, Europe, and Asia Pacific airlines will contribute ~38%, 30%, and 22%, respectively, to the total global ancillary revenue. For US airlines, 55% of total ancillary revenue is from the sale of frequent flyer miles, 25% from baggage fees, and 15% from other à la cate services.

Among airlines in America in fiscal year 2013, Spirit Airlines reported the highest ancillary revenue as a percentage of total revenue of 38%, followed by Alaska Air Group (ALK) at 17%, United Continental Holdings (UAL) at 15%, JetBlue Airways Corporation (JBLU) at 12%, Southwest Airlines Co. (LUV) at 9%, American Airlines at ~8%, and Delta Air Lines, Inc. (DAL) at 6.7%.

Stocks for most US airlines are held by Transportation ETFs such as iShares Transportation Average ETF (IYT) and SPDR S&P Transportation ETF (XTN).

How customer preferences vary by region

The airline industry is a global business offering services to passengers all over the world. Passengers from various parts of the world have unique preferences due to their cultural distinctions. Service preferences also vary according to length of the trip and the purpose of travel.

Legacy carriers in the United States, including Delta Air Lines, Inc. (DAL), United Continental Holdings Inc. (UAL), and American Airlines (AAL), not only cater to the domestic market but derive around 15% to 30% of their revenues from international markets. Airlines are rapidly expanding into international markets. Even Southwest Airlines Co. (LUV) launched its international operations this year. The SPDR S&P Transportation ETF (XTN) has benefited from growth in the US airline industry.

Customer preferences by region

Below are of some differences in customer preference by region as reported by PricewaterhouseCoopers (PWC):

- For international business travelers from the United Kingdom, seat comfort is a priority when traveling long-haul distances. It’s different for business travelers from China who are more willing to pay a premium for services such as rebooking after delays or cancellations. This is because the on-time performance of airlines in China is poor due to airport congestion and poor infrastructure. US business travelers are in the middle, preferring better seat space and device connectivity.

- Travelers from the United Kingdom and Brazil are more likely than US travelers to pay a premium for bundles or package options.

- Chinese business travelers use tablets three times more than flyers in other markets. US business flyers use smartphones more than UK business travelers.

- While price is the primary purchase driver in most markets, Chinese business travelers consider reputation a priority. Winning flying trust is more important in these markets.

Airlines that are mindful of these preferences and offer appropriate services are likely to outperform in a competitive industry. Product differentiation is key not only to attract customers and gain loyalty but also to boost revenue and profitability. Airlines all over the world are increasingly depending on revenue from ancillary sources to boost their performance. In the next article, we’ll provide an overview of the growth in ancillary revenue for airlines.

Sensitivity to economic cycles

Travel spending for business purposes is highly sensitive to general business conditions, including the level of industrial production, business confidence, and corporate profitability. During a recession, businesses cut travel expenditures as investments and profitability decline. According to the U.S. Travel Association, corporate spending on business travel in 2008 and 2009 declined by 1% and 11%, respectively, and corporate investment declined by 3.6% and 16%, respectively, due to the global recession. Volume of prices recovered, however, after the great recession.

Growth in business travel

According to the Global Business Travel Association (or GBTA), the total number of domestic business trips in the United States increased by 4.7% year-over-year to 468.6 million in 2013. Around 40% of the total business expenditure was for meetings and business conferences. In 2014, domestic business travel expenditure is expected to rise by 5.6%, driven by higher prices and a 5.6% growth in the number of trips. Even international business travel spending is expected to increase by 10% in 2014.

The GBTA BTI (business travel index) activity is on an upward trend and is expected to reach 137 by the end of 2014. A rise in travel budgets is a positive factor since companies lift restrictions on travel only when they’re more confident about economic recovery. Major US airlines, including Delta Air Lines, Inc. (DAL), United Continental Holdings Inc. (UAL), American Airlines (AAL), and Southwest Airlines Co. (LUV), are part of the SPDR S&P Transportation ETF (XTN). They’re increasingly concentrating on business travelers to drive the premium air travel segment since they’re less sensitive than leisure travelers are to airfare changes.

Leisure travel is major portion of revenue

Leisure travel, which is primarily for recreational purposes, accounted for ~70% of the total travel expenditure in 2013. It’s driven by general economic conditions, consumer confidence, and level disposable income. The US economy generated a tax revenue of $91.9 billion on the $621.4 billion spent on leisure travel in 2013. A total of 1.6 billion trips were for leisure purposes, and three out of four domestic trips were for leisure purposes. Top leisure activities included shopping, visiting friends and relatives, dining at fine restaurants, and going to beaches.

A major portion of the revenue for the top US airlines, including Delta Air Lines, Inc. (DAL), United Continental Holdings Inc. (UAL), American Airlines (AAL), Alaska Air Group, Inc. (ALK), JetBlue Airways Corporation (JBLU), and Southwest Airlines Co. (LUV), is derived from passengers traveling for leisure purposes. These passengers are highly sensitive to changes in airfares.

Transportation ETFs such as iShares Transportation Average ETF (IYT) and SPDR S&P Transportation ETF (XTN) have invested in shares of major US airlines.

Importance of business travel

Corporate profitability is an important driver of business travel, which accounted for the remaining 30% of travel expenditure. According to the U.S. Travel Association, tax revenue on $266.5 billion spent on business travel amounted to $42 billion. Business travel is essential to improve productivity through new sales, customer retention, and knowledge sharing, which will reflect positively on company performance. It’s estimated that for every dollar invested in business travel, companies generate an average of $9.5 in revenue and $2.9 in profit. In the next article, we’ll discuss the growth in business travel in the United States and the sensitivity of business travel budgets to changes in economic conditions.

How business affects the airline industry

The airline industry primarily provides passenger and cargo transportation services as well as other ancillary services to enhance the passenger travel experience. Passenger revenue accounts for about 75% to 80% of total revenue, and revenue from cargo services ranges from 8% to 12%. Industry demand is correlated directly to macroeconomic trends such as GDP (gross domestic product) growth, industrial productivity numbers, disposable income, and consumer confidence. Hence, the airline industry is largely affected by business cycles. It’s a highly competitive industry, and airline companies are constantly struggling to improve operational efficiency and customer service to maintain profitability. Profitability is under pressure by volatile fuel costs, which account for 30% of the total expense and are driven by fluctuating crude oil prices.

Passenger traffic and capacity continue to increase

According to the ICAO (International Civil Aviation Organization), global passenger traffic increased by 5.2% year-over-year in 2013, representing the fourth consecutive positive growth for the airline industry since 2009. The trend has continued in 2014 with a 5.8% year-over-year growth in passenger traffic during the first eight months. Growth in traffic for international markets was higher than the domestic market.

In 2013, the average traffic growth of the top five US airlines, including Delta Air Lines, Inc. (DAL), United Continental Holdings Inc. (UAL), Alaska Air Group, Inc. (ALK), JetBlue Airways Corporation (JBLU), and Southwest Airlines Co. (LUV), was ~3%. Investors can invest in US airline stocks through the SPDR S&P Transportation ETF (XTN).

Even capacity has increased since 2009, but the rate of growth in capacity (4.8% in 2013) has been lower than the ten-year compounded annual growth rate of 5.1%. In 2013, Asia Pacific had the highest share in capacity of 32%, followed by 27% for Europe, 25% for North America, 9% for the Middle East, 5% for Latin American and the Caribbean, and 3% for Africa. Capacity growth rate is higher in the Middle East and emerging markets of Asia-Pacific, Latin America, and Africa.

It’s evident from the increase in load factor that airlines have successfully managed to strike a balance between the growth in demand and supply. Load factor improved to 79% in 2013, the highest level and 5.7% higher than 73.3% recorded in 2004.

Supplier power

The air transport supply chain consists of aircraft manufacturers, lessors, air navigation service providers (or ANSPs), travel agents, and freight forwarders. The supply chain also includes providers of other services such as computer reservation systems (or CRS), catering, ground services, and maintenance, repair, and overhaul (or MRO).

As seen in the chart below, all the airline suppliers generate higher returns compared to airlines, and returns vary for each business partner. Computer reservation services providers, travel agents, and freight forwarders are the most profitable with returns more than double the cost of capital. The bargaining power of aircraft manufacturers is high, as there’s a limited number of suppliers. The major portion of the world’s demand for aircraft requirements is addressed by two top manufacturers: Boeing and Airbus. Even many airports and ground handling companies are local monopolies.

Customer power

Customers have a high bargaining power since the industry deals with a perishable product with limited options to differentiate their services from competitors’ products. However, airlines do have various classes of seats to customize services according to customers’ requirements. Low-cost carriers such as Southwest Airlines Co. (LUV) provide low-fare options for travel, while legacy carriers such as Delta Air Lines, Inc. (DAL), United Continental Holdings Inc. (UAL), and American Airlines (AAL) provide more customer service and amenities for a higher price. JetBlue Airways Corporation (JBLU), on the other hand, caters to the niche segment who look for better features and benefits that low-cost carriers don’t provide and at a reasonable price that network carriers can’t provide. The SPDR S&P Transportation ETF (XTN) holds stocks of the major US airlines.

Passengers, especially those traveling for leisure purposes, are highly price-sensitive. Customers also have other travel options to consider such as high-speed trains, private jets, cars ships, and buses. Some business customers may choose not to travel at all for events such as business meetings that can be accomplished via technologies such as video conferencing. Airlines, however, will remain the only option for extremely long-haul distances.

Low barriers to entry

The airline industry is highly competitive and capital-intensive. Because of its capital-intensive nature, fixed costs and barriers to exit are high. Competition in the airline industry is intense as barriers to entry are low due to liberalization of market access, a result of globalization. According to the IATA (International Air Transport Association), about 1,300 new airlines were established in the last 40 years.The following summarizes the nature of competition in the airline industry:

- Competition increases when new airlines enter the market or when existing airlines expand services to new markets. Existing airlines benefit, however, from economies of scale and rights on airport slots, and hence, expansion into new markets has fewer entry barriers compared to new airlines.

- The capital requirement for aircraft acquisition is high and can deter new airlines from entering. However, the impact of this is reduced due to the availability of leasing options and external finance from banks, investors, and aircraft manufacturers.

- Switching cost is low for customers. Although loyalty programs are useful to retain customers across alliances, they’re not very useful in retaining customers between airlines within an alliance.

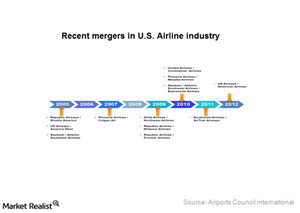

Recently, there has been a wave of industry consolidation resulting from mergers and acquisitions, which has reduced competition in a few regions. Mergers of major US airlines have resulted in a reduction in the number of key players from 11 in 2005 to just six in 2014. The six major airlines in the United States, including Delta Air Lines, Inc. (DAL), United Continental Holdings Inc. (UAL), Alaska Air Group, Inc. (ALK), JetBlue Airways Corporation (JBLU), Southwest Airlines Co. (LUV), and American Airlines (AAL), account for 94% of market share by capacity and are part of the SPDR S&P Transportation ETF (XTN). For more details on this, refer to U.S. airline industry consolidation and restructuring. In the Chinese aviation industry, on the other hand, there has been an increase in competition from the proposed launch of 19 new airlines. The big three Chinese airlines are also facing competition from high-speed train service and the promotion of low-cost carriers. Rising competition in the Chinese aviation industry may impact yield.

Air transport’s contribution to the US economy

Air transport contributes to economic development by enabling the movement of passengers and goods across borders, irrespective of the distance. According to the IATA (International Air Transport Association), global air travel has expanded tenfold and air cargo fourteenfold compared to only a threefold to fourfold rise in world GDP. Share of air transport in the US GDP has also increased over the years, as shown in the chart below.

Airline business models

The business structure of airlines, including network, fleet, and cost structure, differ for legacy carriers and low-cost carriers (or LCCs). Legacy carriers operate a hub and spoke network structure with several aircraft types. Low-cost carriers operate on the point-to-point model. After the US airline deregulation in 1978 and the emergence of LCCs, competition intensified as air fares were reduced, making air travel more affordable. Southwest Airlines Co. (LUV) was instrumental in revolutionizing the US industry with a differentiated business model. The point-to-point model adopted by Southwest Airlines, JetBlue Airways Corporation (JBLU), and other LCCs focuses on short-distance, regional, nonstop routes between origin and destination rather than having connecting flights at hubs, as in the hub and spoke model adopted by legacy carriers such as Delta Air Lines, Inc. (DAL), American Airlines (AAL), and United Continental Holdings Inc. (UAL). Transportation ETFS such as iShares Transportation Average ETF (IYT) and SPDR S&P Transportation ETF (XTN) hold 35% to 40% in airline companies. Exposure to airlines can also be gained through funds such as the Fidelity Select Air Transportation Portfolio.

Cost structure

Although the hub and spoke model provides broad network coverage through a large, diversified fleet size, it also adds to the complexity and cost of operation. In an industry characterized by intense competition with customers expecting wider network coverage at competitive prices, airline carriers have been forced to mix competitive business models called the hybrid model. This model combines the cost-effectiveness of the low-cost model with diversified and broader ranges of services and routes offered by legacy carriers. Recently, the cost gap between LCCs and legacy carriers has narrowed. Refer to Low cost carrier strategies to maintain competitive advantage for more details on the cost structure of airlines in the United States.

Global travel and tourism

Travel and tourism is one of the largest and fastest growing global service industries. According to the World Travel and Tourism Council (or WTTC), the travel and tourism industry’s total contribution to the global economy rose to $6,990 billion, or 9.5% of the GDP (gross domestic product), and is expected to grow by 4.3% to $7,289 billion, or 9.6% of the GDP, in 2014. The growth in travel expenditure was driven by changing lifestyles and higher disposable incomes.

Travel expenditure in the United States

In the United States, travel and tourism attributed to 2.7% of the US GDP in 2013. Total travel expenditure amounted to $2.1 trillion; $887.9 billion of that was incurred directly on travel, and $1.2 trillion was the impact of travel on other industries. In addition, the industry contributed 14.9 million jobs and tax revenues of $134 billion. Leisure travel and business travel are the broad categories under which travel expenditures are analyzed. Classifying travel expenditures based on the purpose of travel will help identify the important drivers of growth in the industry. We’ll have more details on this in part seven of this series.

Businesses that cater to the growing demand for travel include airlines, trains, buses, hotels, casinos, cruise ships, and tour operators. In the next article, we’ll discuss the impact of the air transport industry on the US economy. Transportation ETFs such as iShares Transportation Average ETF (IYT) and SPDR S&P Transportation ETF (XTN) hold shares of major US airline companies, including Delta Air Lines, Inc. (DAL), United Continental Holdings Inc. (UAL), American Airlines (AAL), Alaska Air Group, Inc. (ALK), JetBlue Airways Corporation (JBLU), Southwest Airlines Co. (LUV), and companies from many other transport subsectors such as ground freight and logistic companies, aerospace and defense, and air freight and courier services.