PowerShares Dynamic Market ETF

Latest PowerShares Dynamic Market ETF News and Updates

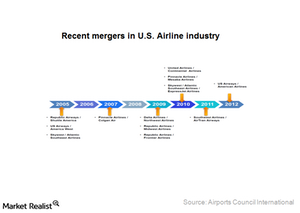

Low-entry barriers intensify competition in airline industry

Short-term outlook above expectations The IATA (International Air Transport Association) has revised its forecast upwards on global airline profitability after the free fall of crude oil prices in the second half of 2014. Global net profit for 2014 is now estimated at $19.9 billion, higher than $18 billion projected in June. Profitability is expected to […]

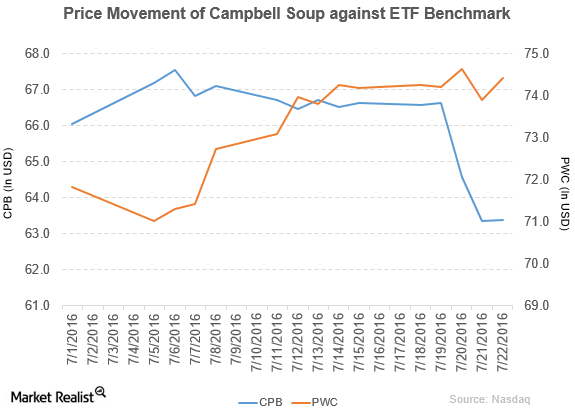

Campbell Soup Announces Its Target and Strategies

Campbell Soup fell by 4.9% to close at $63.38 per share in the third week of July. Its weekly, monthly, and YTD price movements were -4.9%, 1.7%, and 22.5%.

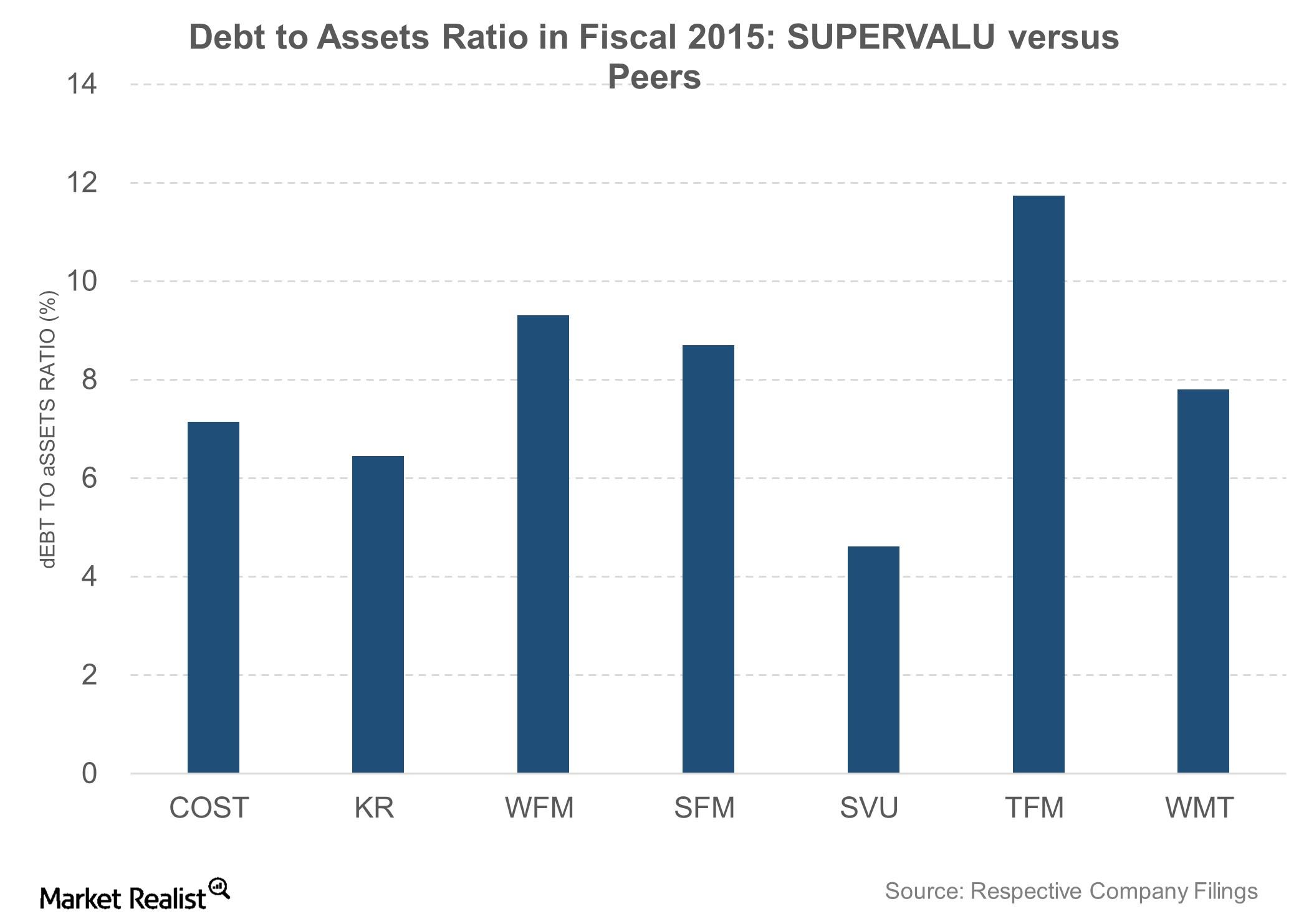

SUPERVALU’s Strengths, Weaknesses, Opportunities, and Threats

It’s important for investors to understand SUPERVALU’s current strengths and weaknesses as well as its potential opportunities and threats.