SUPERVALU’s Strengths, Weaknesses, Opportunities, and Threats

It’s important for investors to understand SUPERVALU’s current strengths and weaknesses as well as its potential opportunities and threats.

By Sonya Bells

Dec. 11 2015, Updated 12:04 a.m. ET

Strengths, weaknesses, opportunities, threats

In this article, we’ll look at SUPERVALU’s (SVU) current strengths and weaknesses and understand its potential opportunities and threats.

Article continues below advertisement

Strengths

- SUPERVALU has a strong supply chain with superior distribution and logistics capabilities.

- The company has a diversified revenue stream with a nearly 50/50 distribution of revenues between wholesale and retail sales.

- Some of the company’s banners have strong regional ties and local brand equity.

- The company’s sale of its banners to Cerberus Capital Management in 2013 has provided it with much-needed relief from high debt levels. SUPERVALU can now focus on improving the profitability of its remaining businesses.

Weaknesses

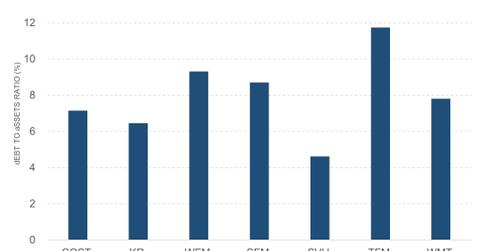

- SUPERVALU has a debt-heavy balance sheet, with a debt to asset ratio of 60% and a negative shareholder equity. The company has the most leveraged balance sheet in its peer group. The debt to asset ratios in the above chart are for the last-reported quarter for each company.

- The company has a heavy skew toward non-perishable items. Supermarket retailer Kroger (KR) derives ~50% of its sales from perishables, while organic retailer Whole Foods Market (WFM) derives ~67% of its sales from perishables. With just 23% of its wholesale sales from perishables, SUPERVALU lags in the Food at Home category.

- The company does not have a major differentiator that enables it to stand out from its competitors. For example, Whole Foods has long been known for its high-quality organic products, whereas Wal-Mart (WMT), on the other hand, has been known for its low prices.

Article continues below advertisement

Opportunities

- The separation of Save-A-Lot will be beneficial for all of SUPERVALU’s segments. The company will be able to focus on its remaining Independent Business and Retail Food segments, while Save-A-Lot will be able to handle competition from hard discounters such as Dollar General (DG) more efficiently.

Threats

- The role of wholesalers is diminishing as retailers and suppliers are consolidating. This will negatively impact SUPERVALU’s Independent Business segment, which the company aims to focus on in the near term.

- SUPERVALU’s conventional supermarkets are pressured by the value-oriented Wal-Mart and Kroger and by premium grocers such as Whole Foods Market.