Weyerhaeuser Co

Latest Weyerhaeuser Co News and Updates

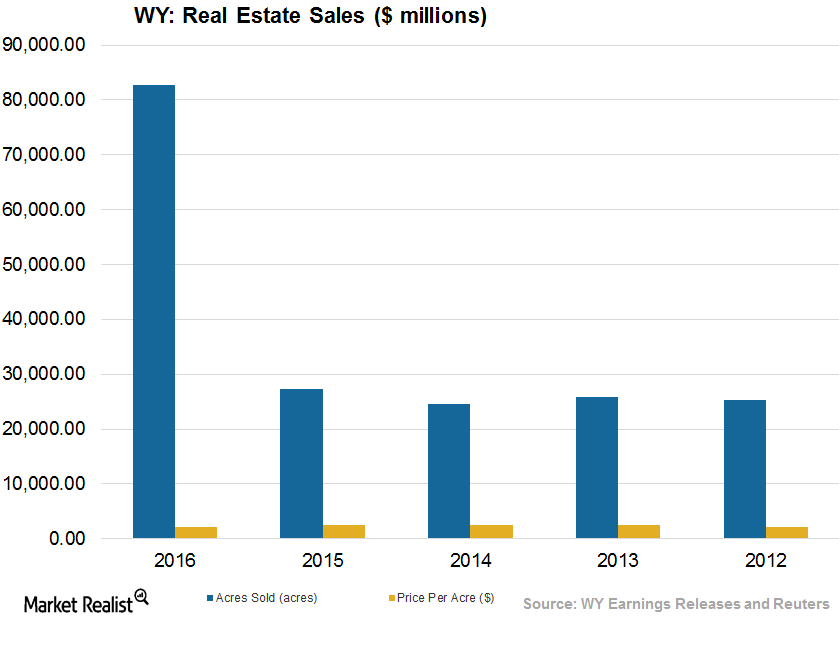

Understanding Weyerhaeuser’s Divestiture Policy

Weyerhaeuser (WY) has undertaken several divestiture policies in order to dispose of its underperforming and non-core businesses.

How Weyerhaeuser Fared in 2Q17: The Details

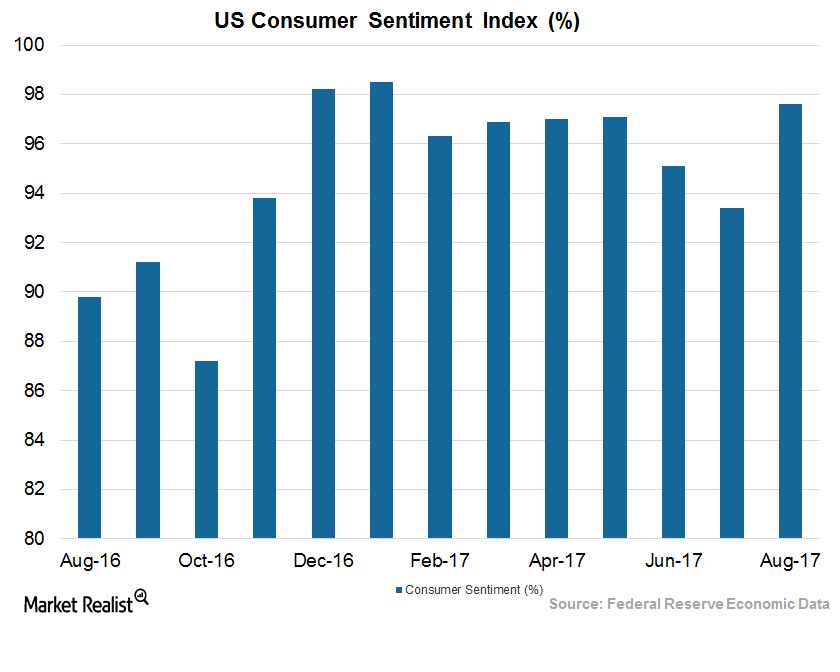

The growing economy has helped REITs including Weyerhaeuser (WY), Rayonier (RYN), Resolute Forests Products (RFP), and International Paper (IP) reap higher profits.

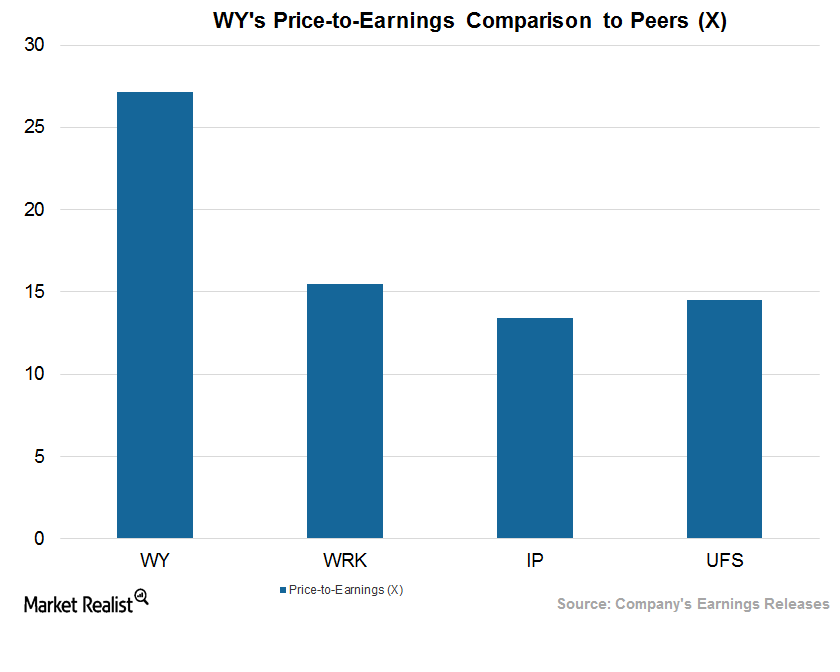

How Weyerhaeuser Compares with Peers

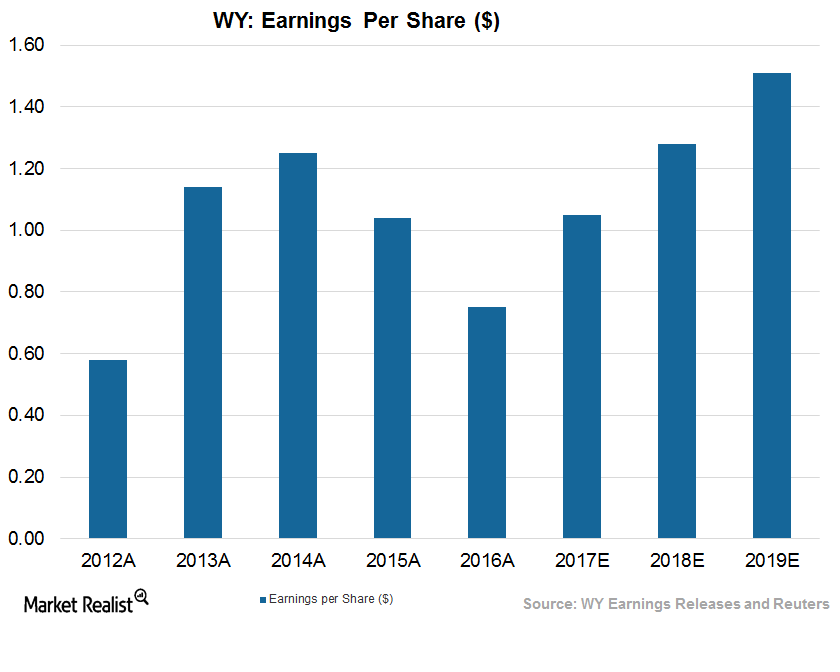

The expected performance of timberland REIT Weyerhaeuser (WY) for the rest 2017 and in 2018 can be best understood by its valuation multiples.

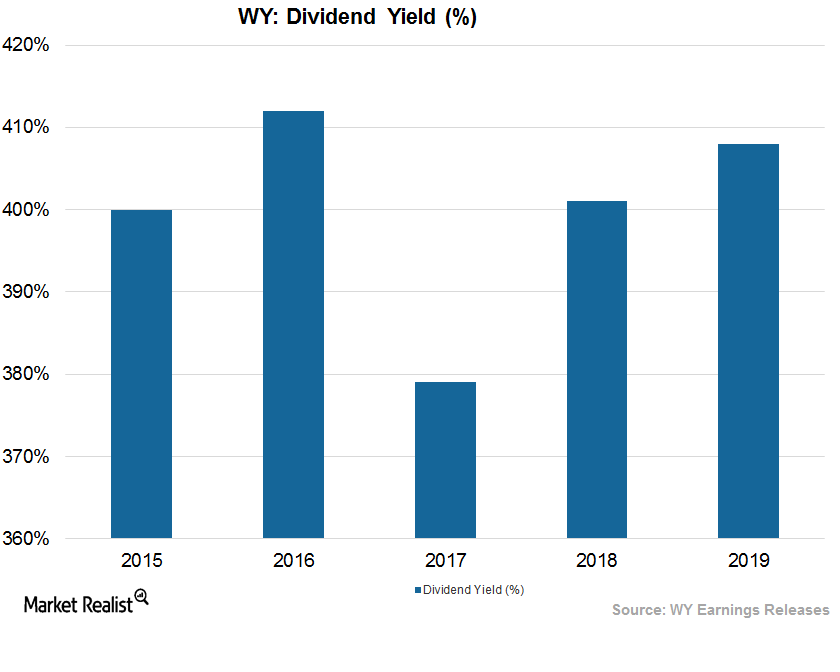

How Weyerhaeuser Treats Its Shareholders

REITs (real estate investment trusts) usually provide generous returns to their shareholders in the form of dividends or share buybacks.

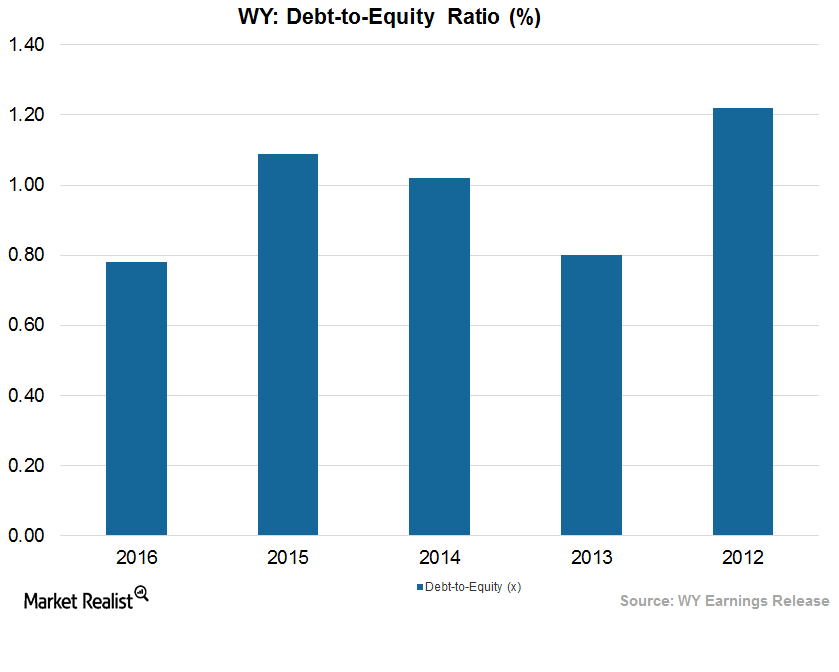

Is Weyerhaeuser Maintaining a Strong Balance Sheet?

REITs (real estate investment trusts) depend mostly on debt for their day-to-day functioning and working capital.

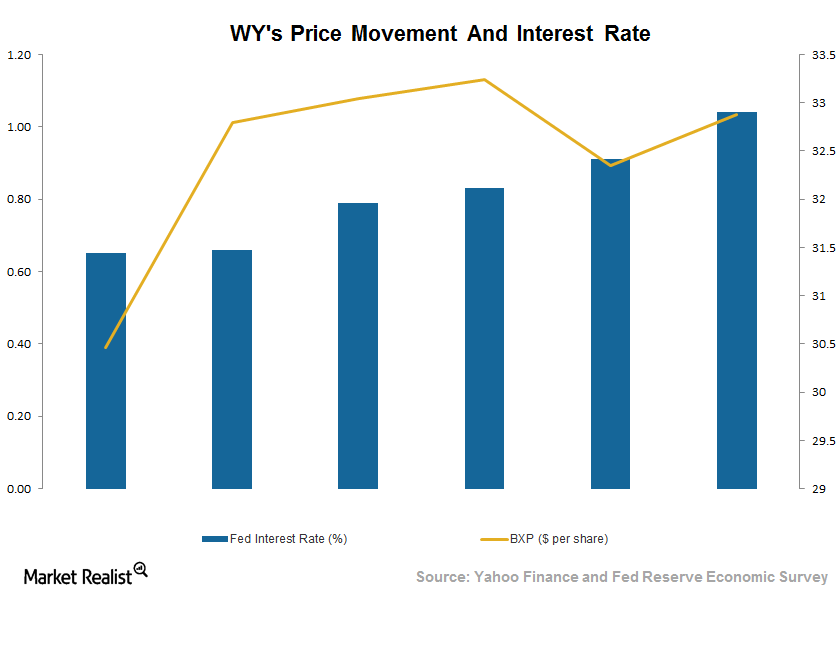

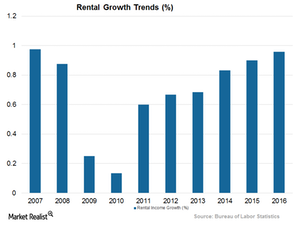

How Weyerhaeuser and REITs Can Fight the Interest Headwind

After thriving for a long time in a low interest rate environment, REITs (real estate investment trusts) are now facing a high interest rate.

How the Rising Interest Rate Affects REITs like Weyerhaeuser

REITs (real estate investment trusts) depend on debt and equity for their working capital, and so they’re directly impacted by the Fed’s interest rate policy.

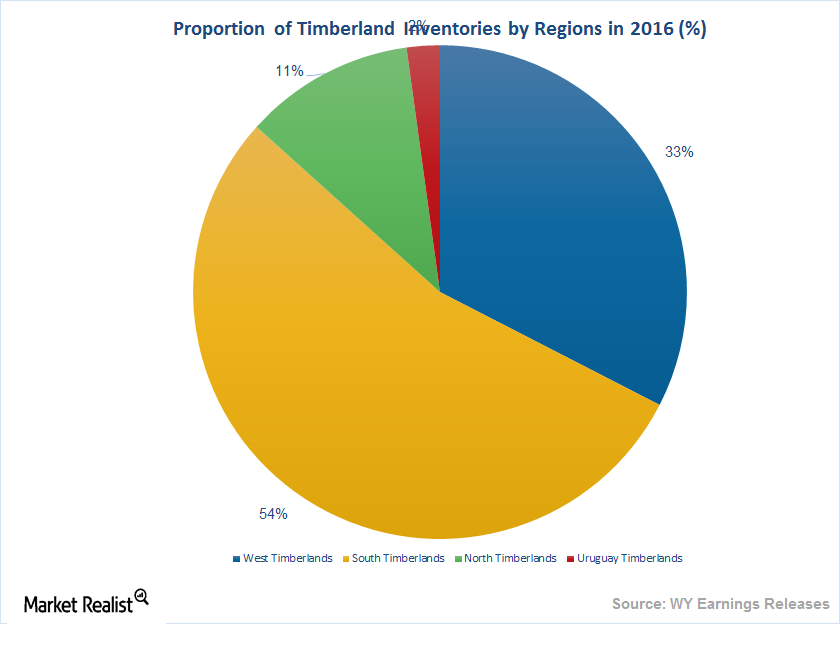

Inside the Weyerhaeuser-Plum Creek Merger

Timberland REIT (real estate investment trust) Weyerhaeuser (WY) owns almost 13.1 million acres of timberlands across the US.

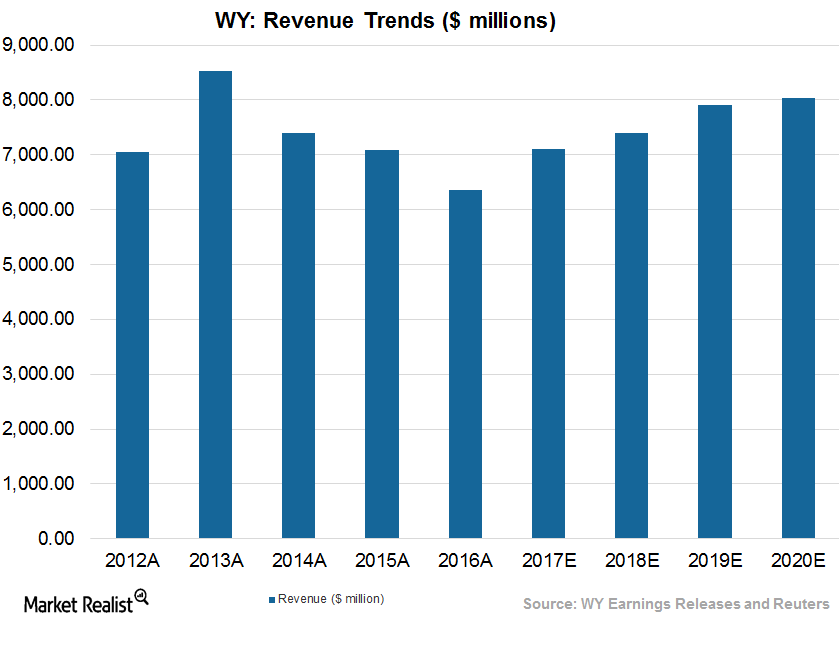

What Lies ahead for Weyerhaeuser in 2017?

Timberland REIT (real estate investment trust) Weyerhaeuser (WY) expects to continue its growth trajectory for the rest of 2017.

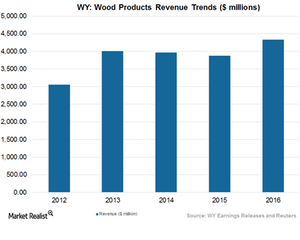

What Strong Wood Means for Weyerhaeuser’s Momentum

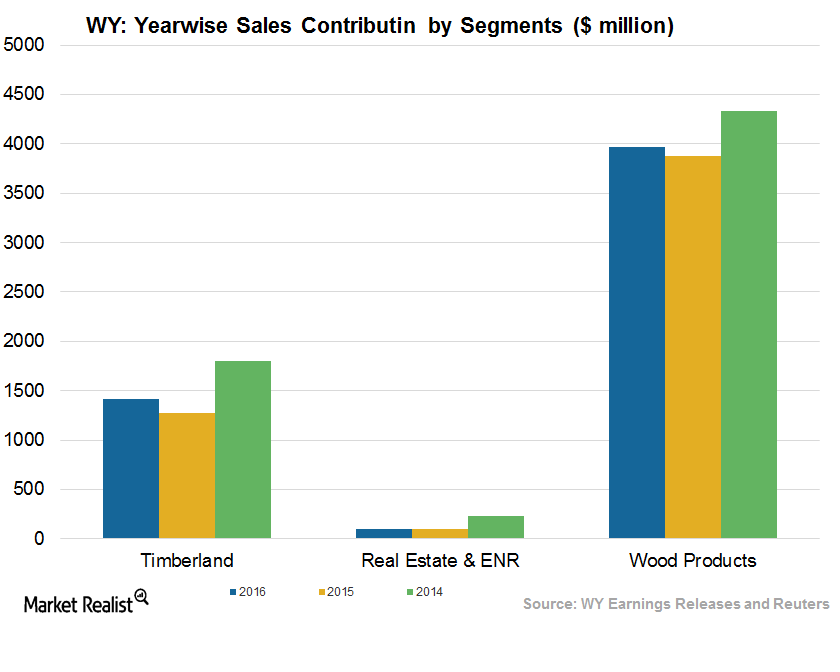

Timberland REIT (real estate investment trust) Weyerhaeuser (WY) has been able to use the opportunities of the booming housing sector to its advantage.

Behind Weyerhaeuser’s Growth Trajectory

Timberland REIT (real estate investment trust) Weyerhaeuser (WY) reported upbeat earnings results for 2Q17, backed by higher sales and prudent cost management.

How Weyerhaeuser and Timberland REITs Came through the Fire

Timberland REITs (real estate investment trusts) in the US don’t seem to be in doubt about their continued growth momentum in the near future.