The Whitewave Foods Company

Latest The Whitewave Foods Company News and Updates

How’s ADM Advancing with Its Portfolio Management Strategy?

As part of its portfolio management strategy, Archer Daniels Midland (ADM) sold its Brazilian sugar cane ethanol operations.

A Look at WhiteWave Foods’ 3Q16 Performance

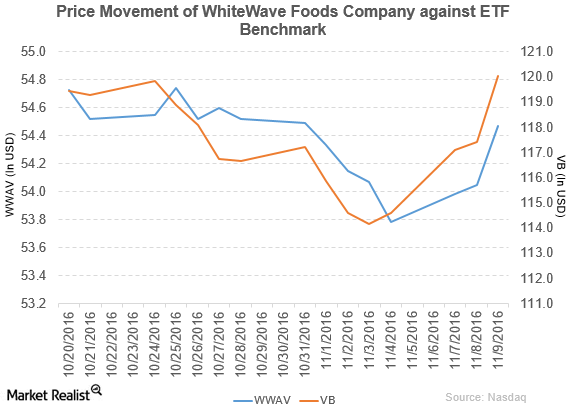

Price movement WhiteWave Foods (WWAV) has a market cap of $9.7 billion. It rose 0.78% to close at $54.47 per share on November 9, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 0.59%, 1.7%, and 40.0%, respectively, on the same day. WWAV is trading 0.37% above its 20-day moving average, 0.44% […]

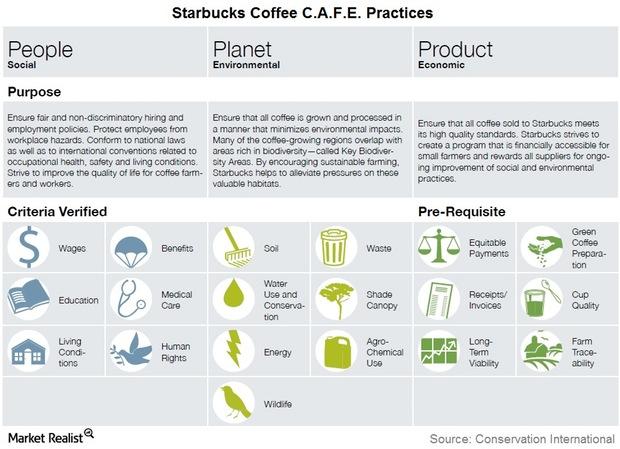

How Starbucks Brews Up Sustainable Products

A sustainable coffee effort In the previous article, we looked at industry-level and investment-level examples of how things have been on the sustainable investment front and the developments that are helping certain industries. In this article, we’ll look at a company-level example by way of Starbucks (SBUX). Starbucks employs sustainability standards called C.A.F.E. (Coffee and […]

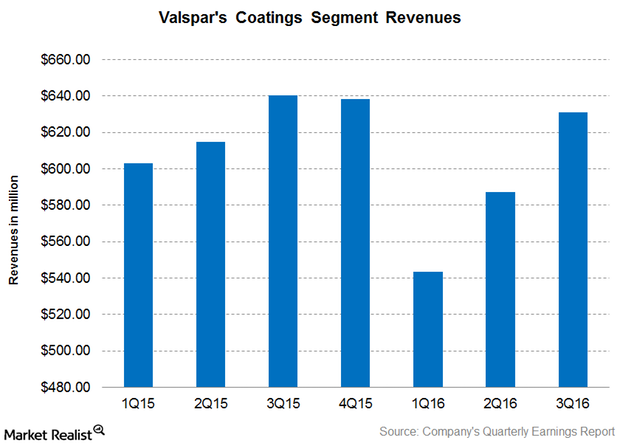

Why Did Valspar’s Coatings Segment Revenue Fall in 3Q16?

Valspar (VAL) reports its revenue under two segments, namely: the coatings segment and paints segment.

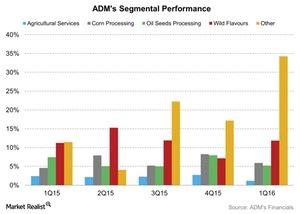

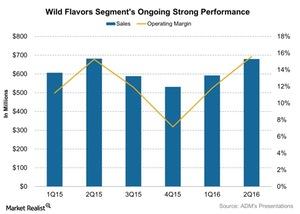

What Benefited ADM’s WILD Flavors and Specialty Ingredients in 2Q16?

Archer Daniels Midland’s management mentioned that the WILD Flavors and Specialty Ingredients’ results were in line with the same quarter last year.

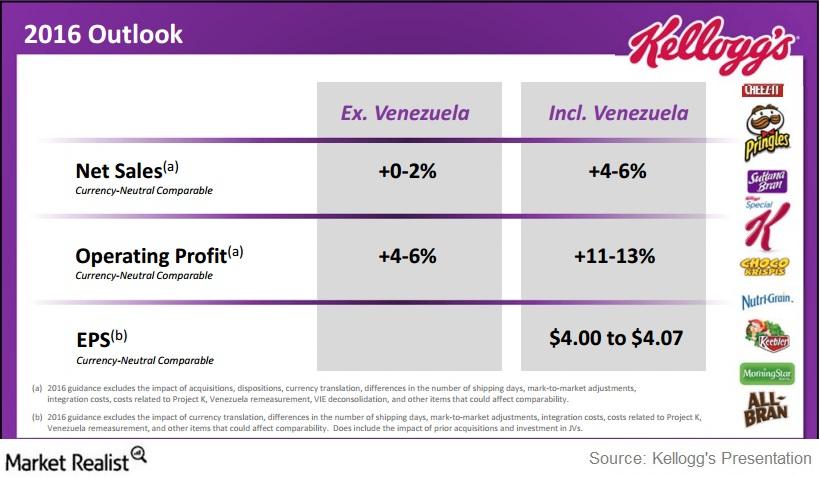

What’s Kellogg’s Updated Guidance for Fiscal 2016?

Kellogg (K) updated its fiscal 2016 guidance for currency-neutral comparable net sales, operating profit, and earnings per share.

How’s Cal-Maine Trading Compared to Its Key Moving Averages?

As of July 18, 2016, Cal-Maine Foods (CALM) closed at $44.18. It traded 8.3% below its 100-day moving average and 0.7% below it 50-day moving average.

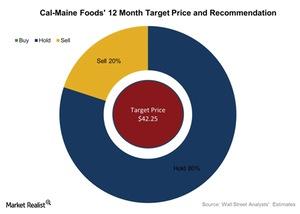

What Do Analysts Recommend for Cal-Maine Foods after 4Q16?

The average broker target price for Cal-Maine Foods rose slightly to $42.25 from $41.5—4.5% lower than the closing price of $44.18 on July 18, 2016.

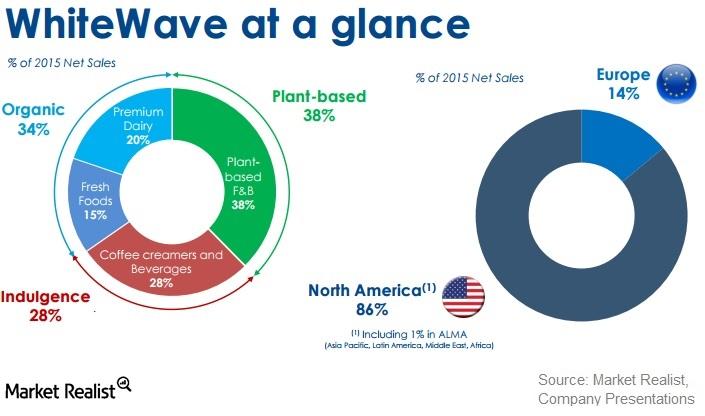

How Can WhiteWave Foods Add to Danone’s Business?

WhiteWave Foods (WWAV) currently generates around 80%–85% of its total revenue and operating profit from North America alone.

What Are the Benefits of Danone’s WhiteWave Acquisition?

Danone will be acquiring WhiteWave Foods for $56.25 per share in an all-cash transaction. This makes WWAV’s total enterprise value ~$12.5 billion.

Why Did JPMorgan Chase Downgrade WhiteWave Foods?

On July 8, 2016, JPMorgan Chase (JPM) downgraded WhiteWave Foods’ (WWAV) stock to a “neutral” rating from an “overweight” rating.

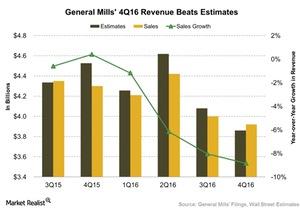

What Drove Down General Mills’ Revenue Growth for Fiscal 4Q16?

General Mills’ (GIS) net sales for fiscal 4Q16 fell 9% year-over-year. However, they beat analysts’ estimates by 2%.