Williams Companies Inc

Latest Williams Companies Inc News and Updates

What is XLE? Exploring Midstream Energy Company Exposure

Companies in the midstream sector that are included in the XLE portfolio include Kinder Morgan, Oneok, the Williams Company, and Spectra Energy.

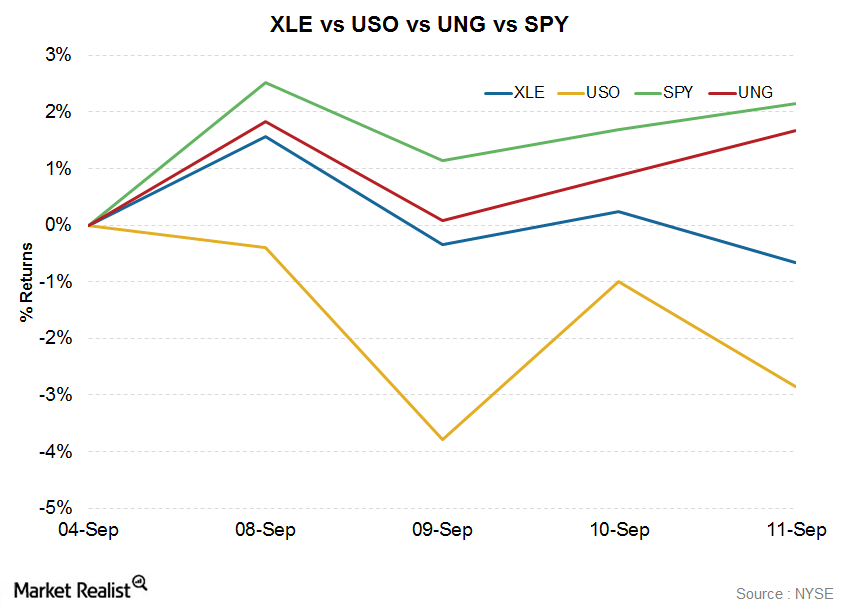

XLE Outperforms USO Last Week

The Energy Select Sector SPDR ETF (XLE) fell 0.66% in the week ended September 11. XLE tracks a diverse group of 45 of the largest American energy stocks in the S&P 500 Index (SPX).

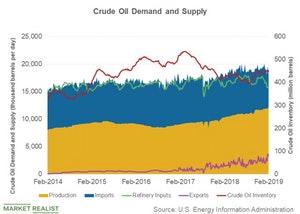

What Might Cap Rising Crude Oil Prices?

The US crude oil (USO) supply includes domestic production and imports. The supply gets consumed as inputs to refineries and exports.

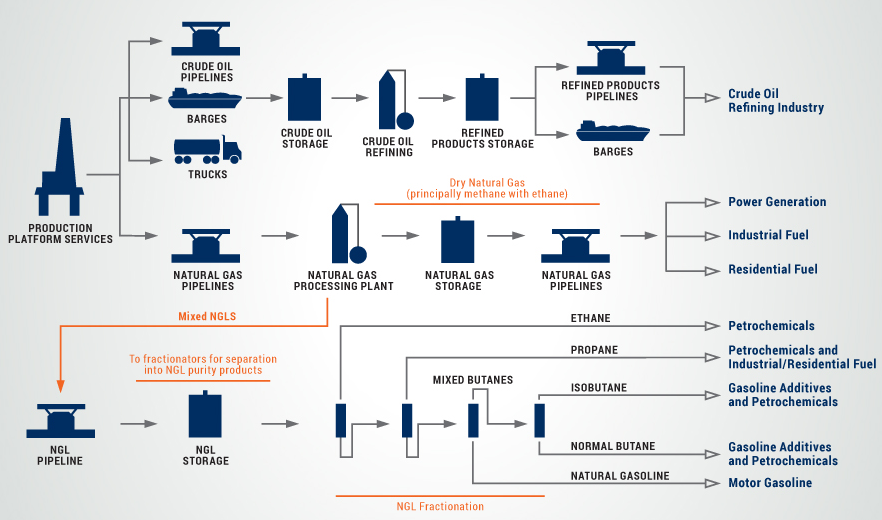

KMI, WMB, and OKE: Understanding Their Key Business Focus

Kinder Morgan transports natural gas, refined petroleum, crude oil, condensate, CO2, and other products through its network of pipelines.

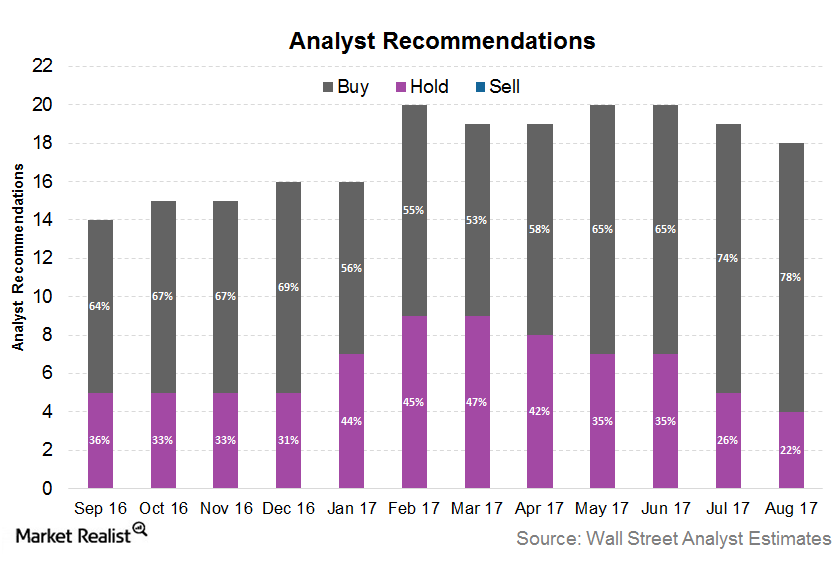

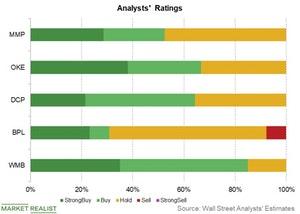

Are Analysts Bullish on Williams Companies?

About 78.0% of analysts rate Williams Companies (WMB) a “buy,” while the remaining 22.0% rate it a “hold” as of August 21, 2017.

Why ONEOK Has Outperformed Its Peers in 2018

ONEOK (OKE) stock has risen ~21% so far in 2018, outperforming its peers in the midstream sector.

How Will Energy Transfer Stock Perform in 2020?

Energy Transfer (ET) stock had a weak run despite strong earnings growth in 2019. Here’s a look into how analysts think ET will perform in 2020.

Williams Companies: What Could Lift Its Ailing Stock?

Williams Companies stock fell for the seventh consecutive day on Wednesday and closed almost at an 11-month low. Midstream stocks are trading weak.

Key MLP and Midstream Rating Updates Last Week

On January 16, Barclays raised its rating for Williams Companies (WMB) from “equal weight” to “overweight.”

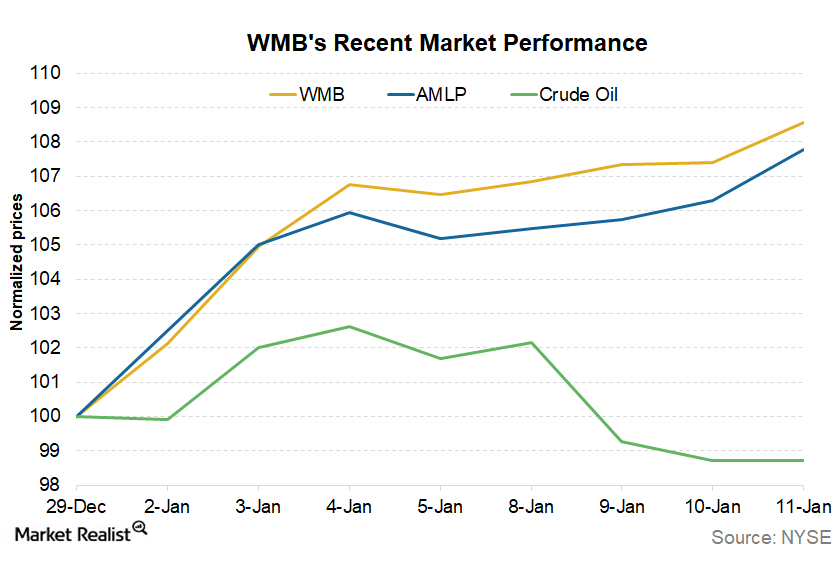

WMB Has Risen ~9% in 2018 So Far: Can the Gains Continue?

Williams Companies (WMB) has had a massive start to the year. It’s risen nearly 9% in seven trading sessions in 2018. Overall, the C corporation GP (general partner) has risen ~14% since the start of December 2017.

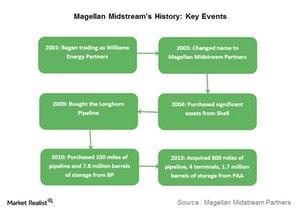

Magellan Midstream Partners: A Brief History

Magellan’s history Magellan Midstream Partners (MMP), which began trading in 2001, has grown through various asset acquisitions and expansion projects over the years. Magellan was formerly a part of Williams Companies (WMB). The company started trading as Williams Energy Partners in 2001, and changed its name to Magellan Midstream Partners in 2003. In 2004, the […]

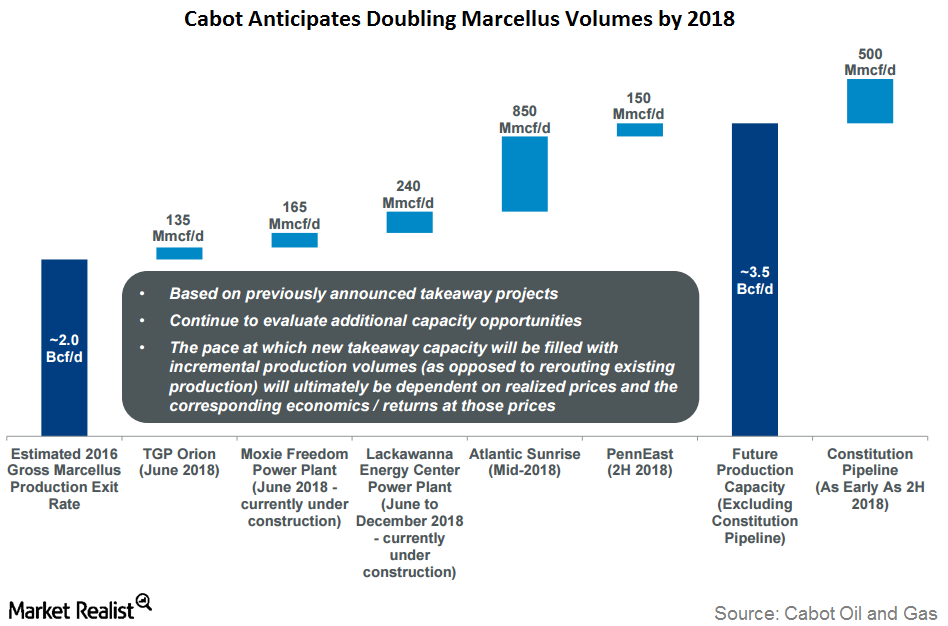

Why Cabot Awaits the Atlantic and Constitution Pipeline Projects

Cabot Oil & Gas’s stock price momentum has slowed, but its stock has recently been rising, mirroring natural gas prices.

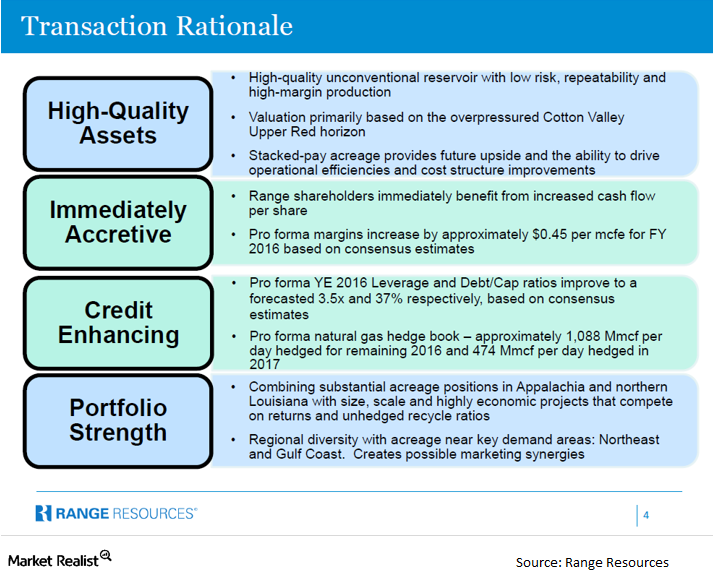

Rationale for the Memorial Resource-Range Resources Transaction

Range Resources is growing its portfolio in the Southeast US. Natural gas exports seem to be a promising growth area. The deal will enhance its credit profile.

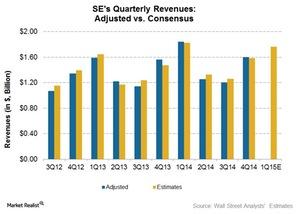

Spectra Energy 4Q14 earnings beat estimates

Spectra Energy 4Q14 adjusted earnings beat estimates by 46%. On average, adjusted EPS has exceeded consensus EPS by ~9% in the past ten quarters.

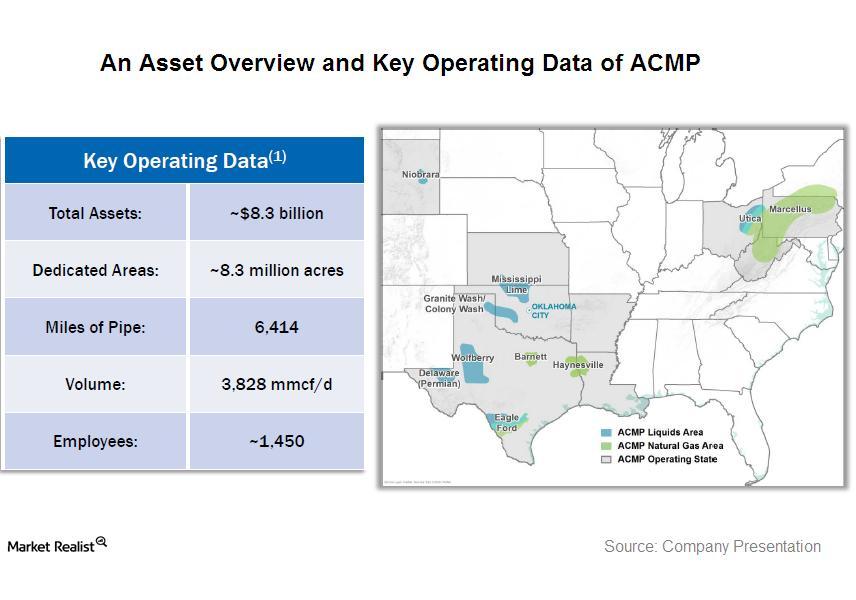

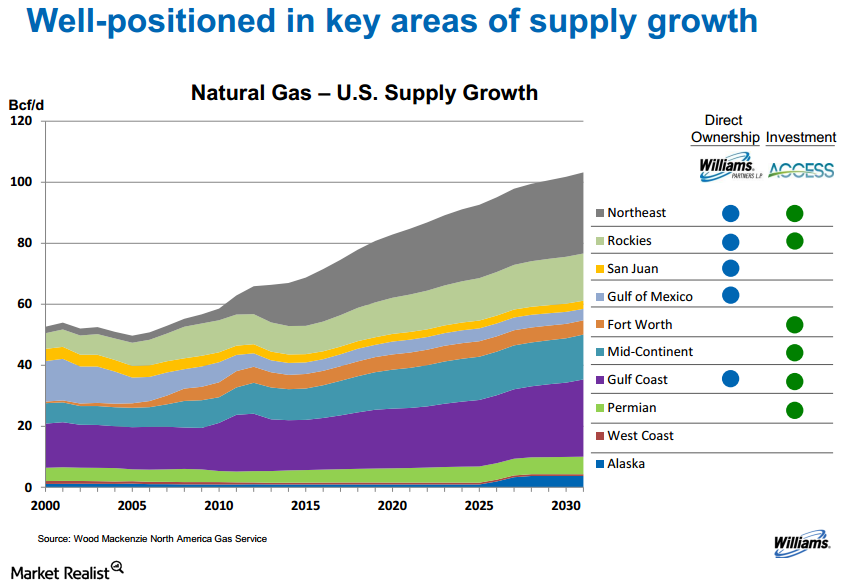

An introduction to Access Midstream Partners’ business and assets

Access Midstream Partners is a master limited partnership, which owns, operates, develops and acquires natural gas, NGLs, and oil gathering systems and other midstream energy assets.

Why Third Point initiated a position in Williams Companies

Third Point started a new 2.83% position in gas pipeline operator Williams Companies, Inc.