Reliance Steel and Aluminum

Latest Reliance Steel and Aluminum News and Updates

How Do Aluminum Inventories Work?

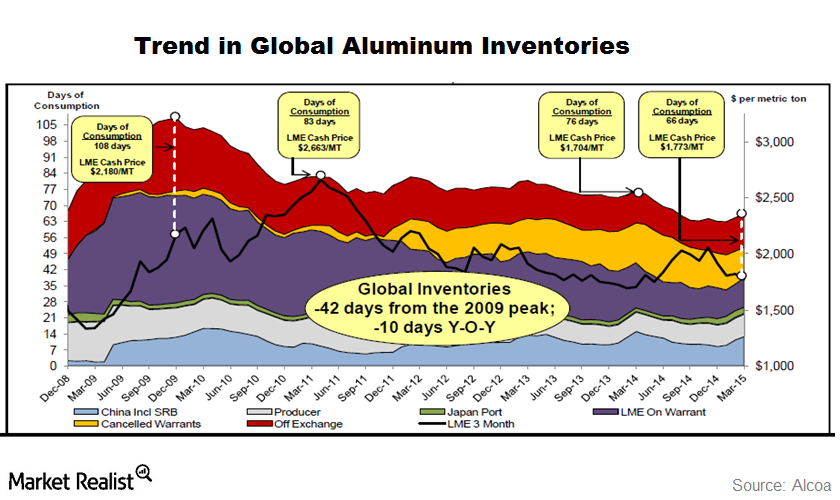

Aluminum inventories with London Metal Exchange (or LME) registered warehouses have declined this year. Aluminum inventories have been on a decline for almost two years.Materials Why investors need to understand the cost curve

Primary aluminum and alumina are commodity products. Producers don’t have much control over their pricing. The prices are decided by market dynamics.Materials Must-know: An investor’s guide to Nucor’s supply chain

To fulfill its iron ore requirements, Nucor has a DRI plant in Trinidad.Materials Why metal service centers are important for U.S. Steel

Metal service centers account for about one-fifth of U.S. Steel’s total revenues. This makes these centers an important customer segment for the company.Materials Why Alcoa is positioned well to serve the automotive industry

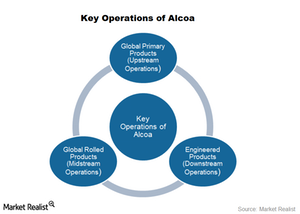

Alcoa is working to expand its capacity in Tennessee. It’s a $275 million investment. Alcoa expects that the facility will be operational by mid-2015.

How Investors Can Play The Steel Industry

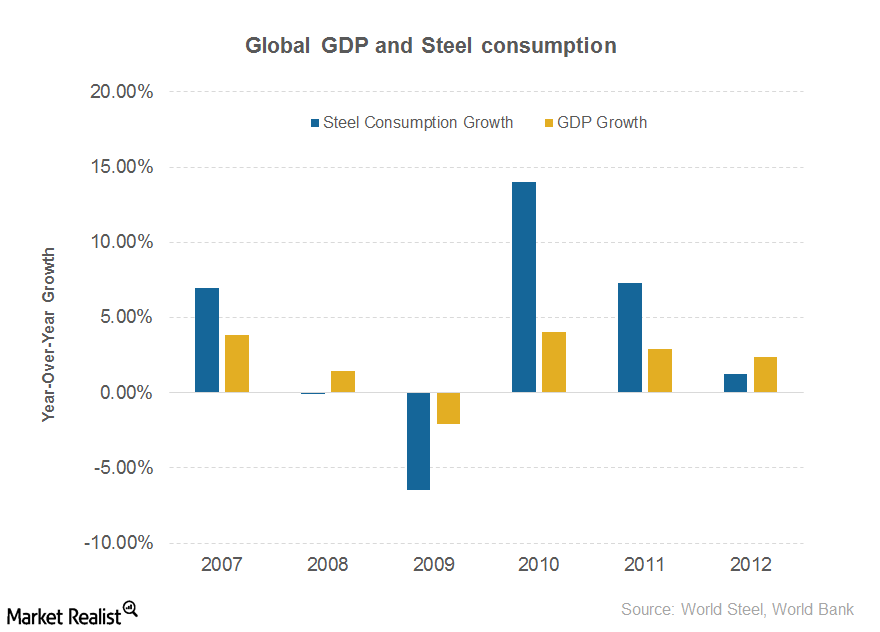

Steel is a cyclical industry and is dependent on the growth in economic activity. In this series, we’ll learn key facts related to the steel industry and how investors can play the steel industry.Materials Key drivers of steel consumption: A must-know overview

Steel serves as a raw material for various industries. You and I don’t consume the crude steel that’s produced in factories directly.

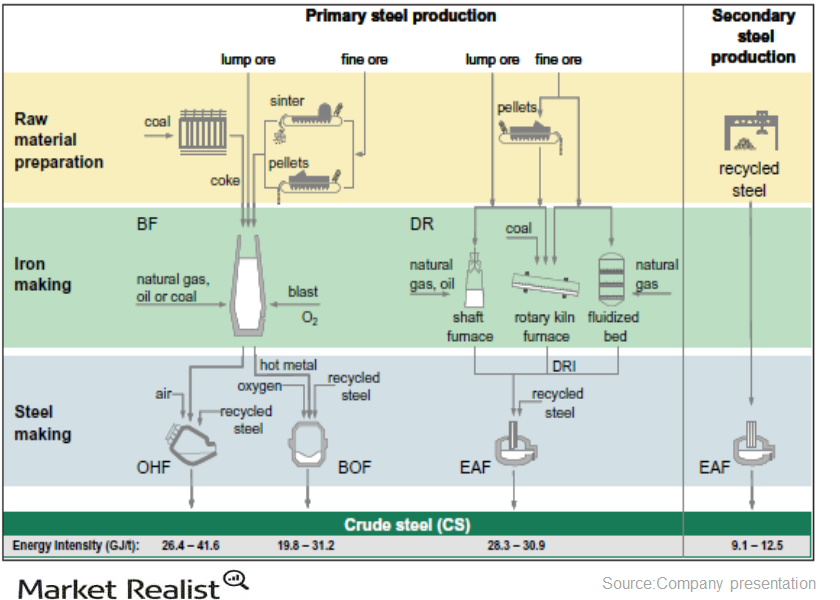

Steelmaking: An investor’s guide to the raw materials and process

Iron ore, steel scrap, and coal are three main raw materials for steelmaking. Steelmaking is a raw material–intensive business.

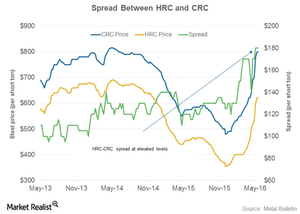

What Slowdown? US Steel Prices Rose 50% This Year

Steel companies’ earnings are sensitive to changes in steel prices. In recent quarters, their earnings have been negatively impacted by falling steel prices.

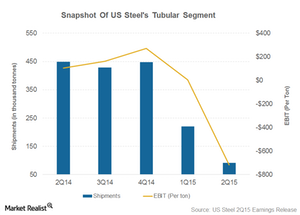

Losses Widen in U.S. Steel’s Tubular Segment as Fixed Costs Rise

Demand for OCTG products is expected to be subdued in the coming months. This would continue to put pressure on U.S. Steel’s Tubular segment.

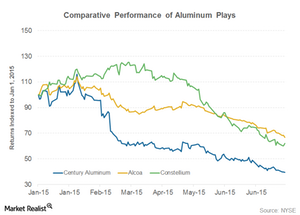

Alcoa at a 52-Week Low: What Should Investors Do?

Alcoa was trading at its 52-week low on July 23 and closed at $9.96—breaching the psychologically crucial level of $10 per share for two consecutive days.Materials Must-know: Why Nucor is different from its competitors?

According to Nucor “Empowerment isn’t a corporate buzzword—it’s a way of life.”

Key Takeaways from Alcoa’s 1Q 2015 Earnings

Alcoa (AA) reported its 1Q 2015 earnings on April 8. It reported net income of $195 million on revenues of $5.8 billion.

Why direct reduced iron facilities could be a key driver at Nucor

Nucor recently started production at its DRI plant in Louisiana.

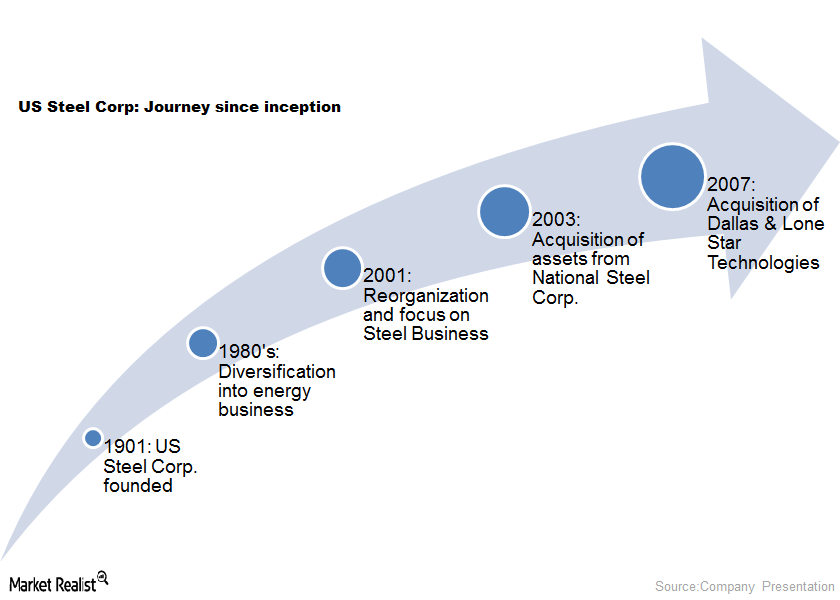

Must-know: The history of US Steel Corporation

After trying its hands at various businesses, the company finally consolidated the operations in 2001.

Must-know: ArcelorMittal’s competitive landscape

Since the products are similar, the switching costs aren’t very high for buyers.

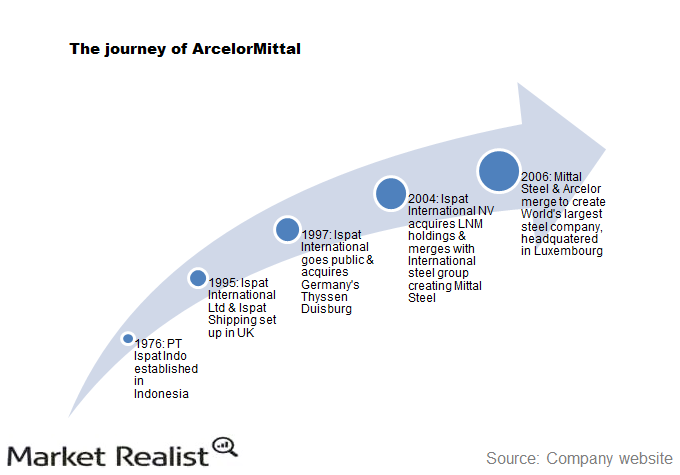

Overview: ArcelorMittal—leader in steel manufacturing

In 2007, the newly merged ArcelorMittal continued its expansion strategy by announcing 35 transactions worldwide.