PowerShares Active US Real Estate ETF

Latest PowerShares Active US Real Estate ETF News and Updates

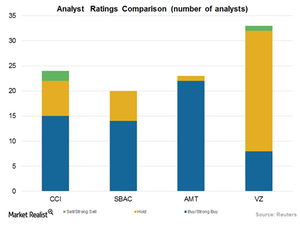

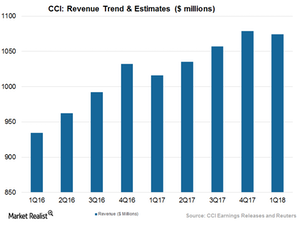

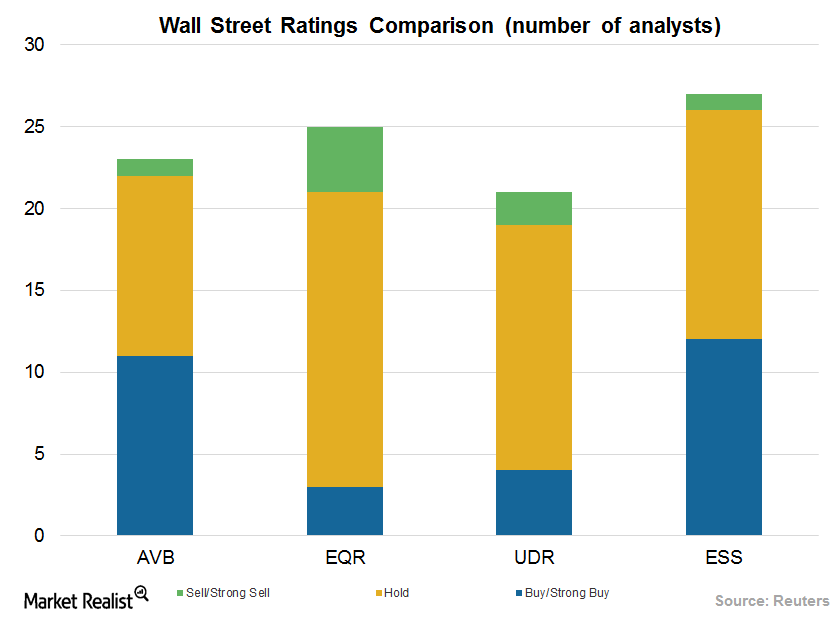

Crown Castle on the Street: Inside the Analyst Ratings

Analysts have given CCI a mean price target of $106.83, implying a rise of 7.1% from its current level of $99.75.

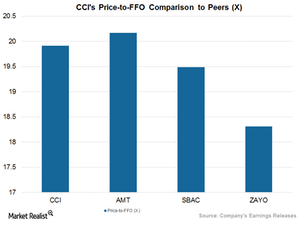

Where Crown Castle Stands among the Biggest Industry Players

CCI’s higher price-to-FFO multiple reflects the company’s ability to yield consistent capital value and its distribution of reliable and steady dividends.

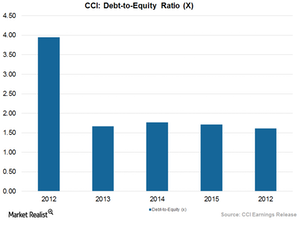

How Well Is Crown Castle Leveraging Its Balance Sheet?

It’s extremely important for REITs to maintain optimum debt levels, and managers work constantly to leverage balance sheets in the best possible ways.

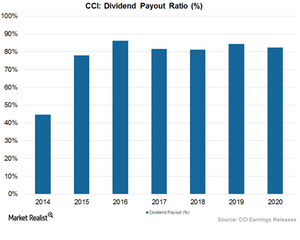

Why Some Are Investors Are Bullish on Crown Castle

REITs (real estate investment trusts) typically have to pay 90% of their taxable income to shareholders to qualify as an equity.

Is Telecom Consolidation Threatening Crown Castle?

The changing political scenario under the Trump administration has led to the anticipation of widespread M&A activity in the telecom industry.

Crown Castle amid the 5G Threat to Cell Towers

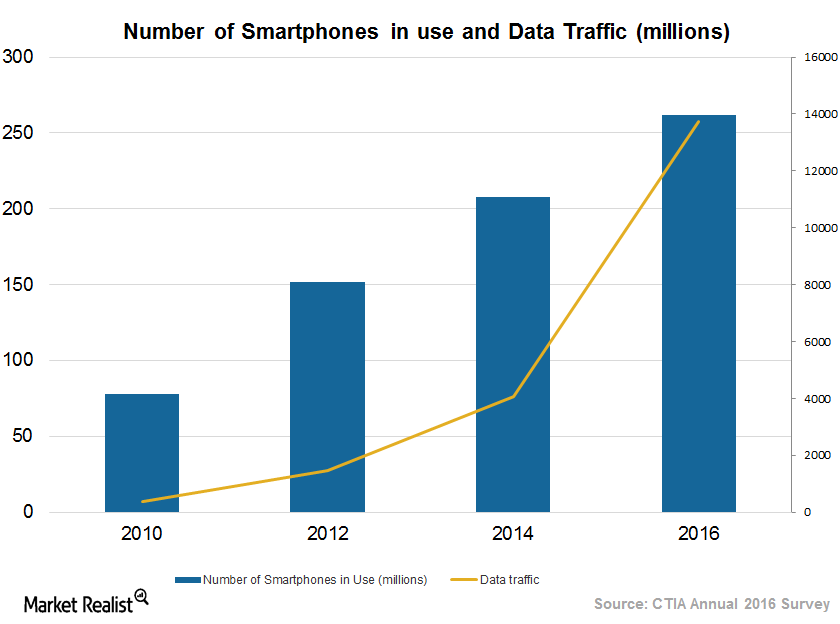

Many wireless providers are now opting for 5G (fifth-generation) technology for higher speeds and network reliability.

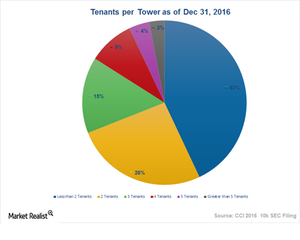

Inside Crown Castle’s Business Model

Crown Castle is expected to ride high on higher profitability, and analysts expect it to register significant AFFO (adjusted funds from operations) growth.

Why Crown Castle Expects to See Revenue Growth

Crown Castle is expected to keep riding high on its current growth trajectory, driven by strategic investments and exposure to the booming small cell business.

How Wall Street Analysts Rate American Tower

Analysts gave AMT a mean price target of $143.14, implying a rise of 8.7% from its current level of $131.70. In May 2017, 22 of 23 analysts covering AMT stock issued “buy” or “strong buy” ratings.

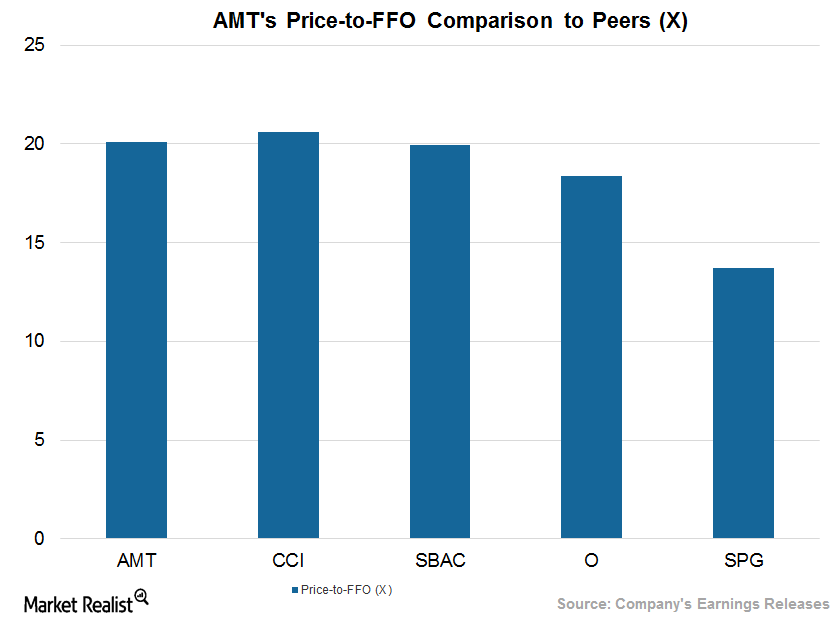

Comparing American Tower with Retail REITs in Its Industry

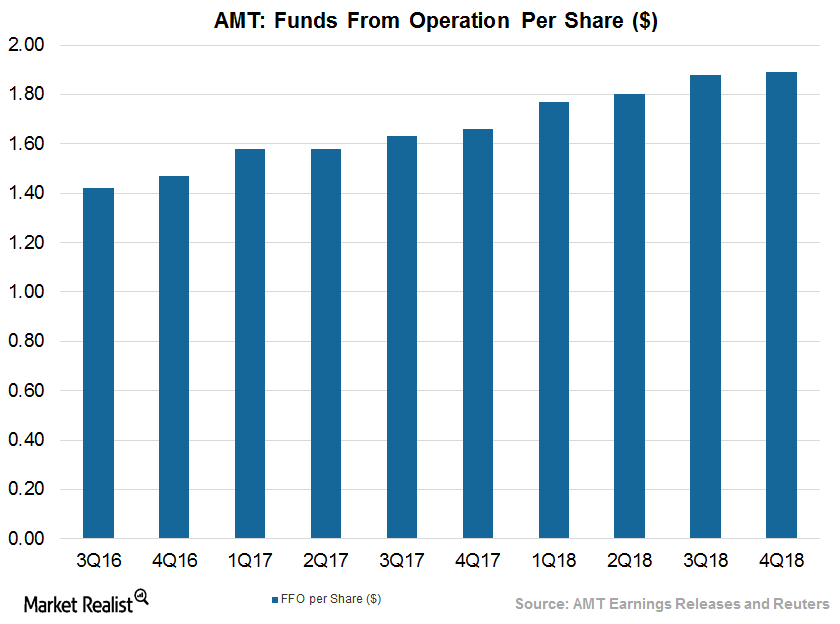

AMT’s current price-to-FFO multiple is ~20.1x.

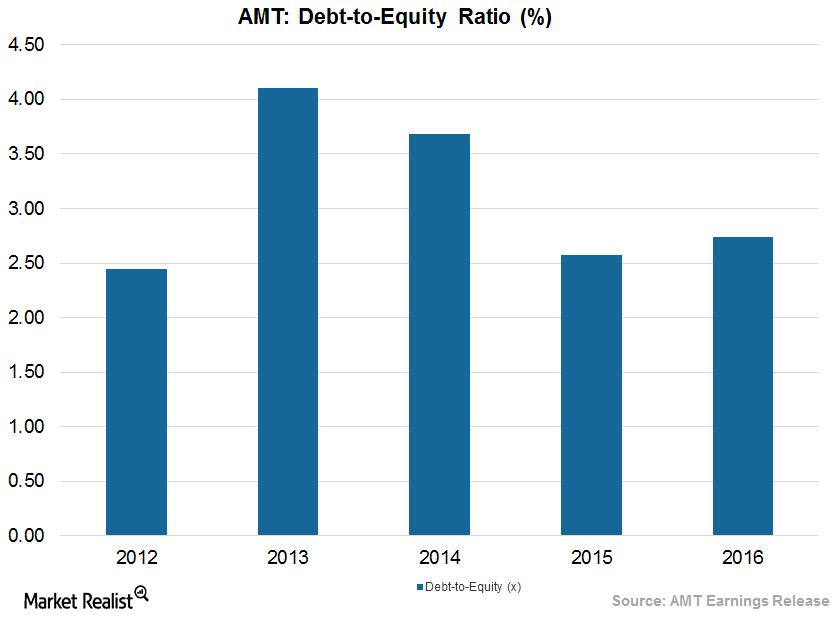

How Well Does American Tower Manage Its Balance Sheet?

AMT reported a debt-to-equity ratio of ~2.8x in 1Q17. The industry median debt-to-equity ratio is ~1.1x.

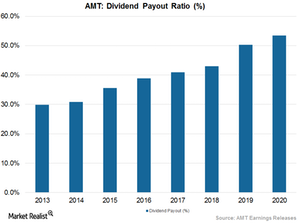

American Tower: A Rewarding Stock for Shareholders

AMT has maintained a consistent dividend yield over the last two years. Its dividend yield was ~1.8% in 2015 and ~2.0% in 2016.

How Telecom Industry Ownership Could Affect American Tower

Under the leadership of Ajit Pai and Jeffrey Eisenach, the FCC is expected to unblock several stalled deals as well as pave the way for some new deals.

5G Is the Future of Internet Data—Is It a Threat to AMT?

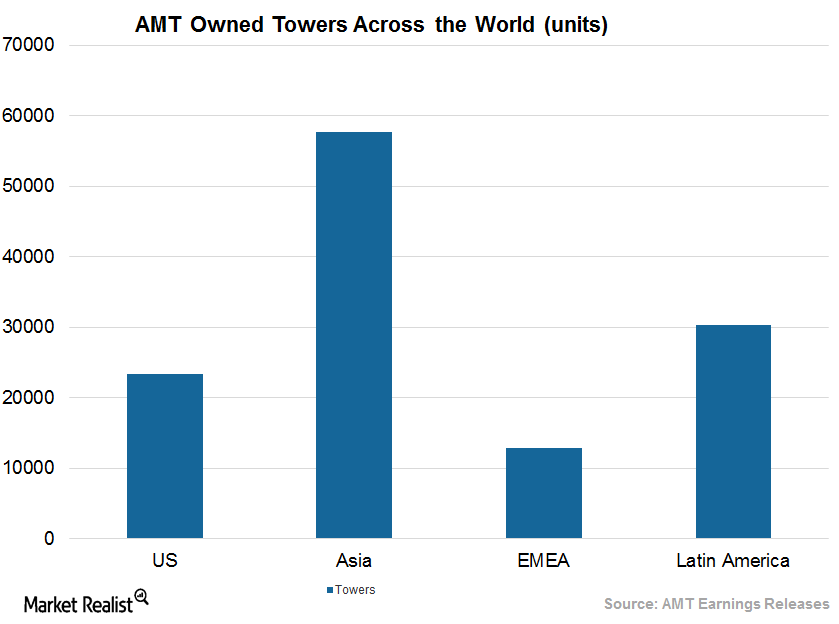

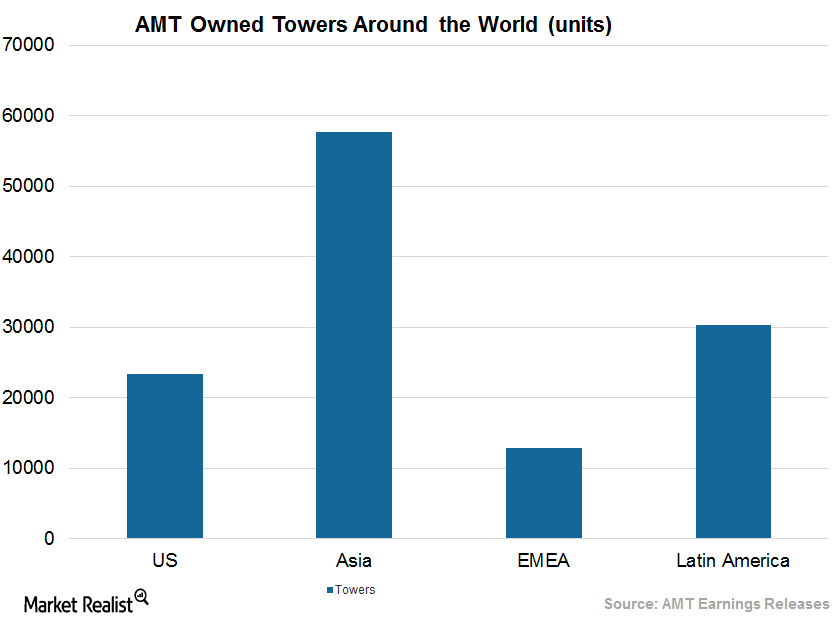

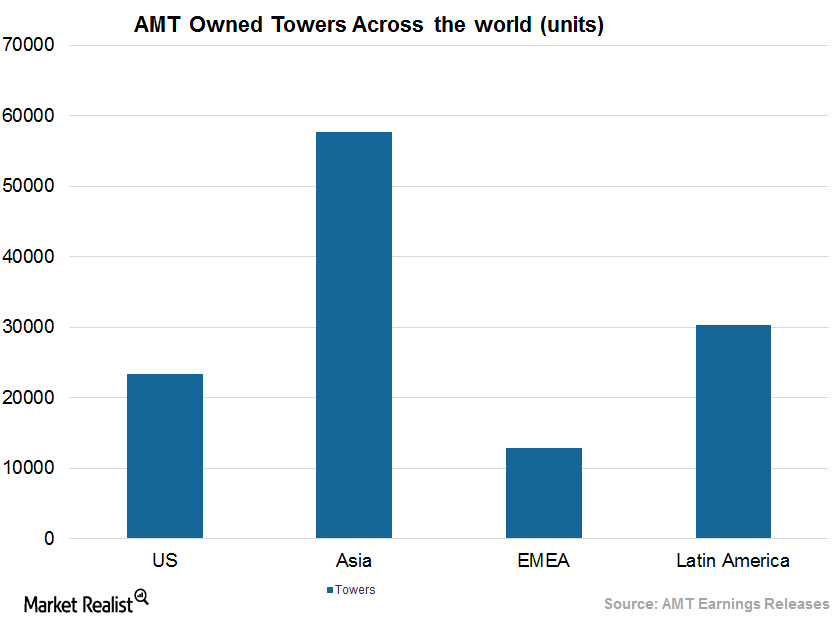

More than 95% of AMT’s towers are located in suburban and rural areas, where the majority of the US population resides.

American Tower’s Business Model Seeks Consistent Profitability

AMT maintains non-cancellable long-term leases with an initial term of ten years. Almost 50% of the company’s leases have a renewal date of 2022 or beyond.

American Tower’s Enhanced Fiscal 2017 Outlook on Growth Opportunities

American Tower’s (AMT) revenues rose ~26% in 1Q17, driven by 22% growth in its Tenant Billings business and 8.6% growth in its Organic Tenant Billings business.

American Tower Rises above Uncertainty in Wireless Tower Sector

For fiscal 2017, American Tower (AMT) expects to report adjusted funds from operations exceeding $2.8 billion. This figure is $55 million, or ~2%, higher than expected by the company.