Primero Mining Corp

Latest Primero Mining Corp News and Updates

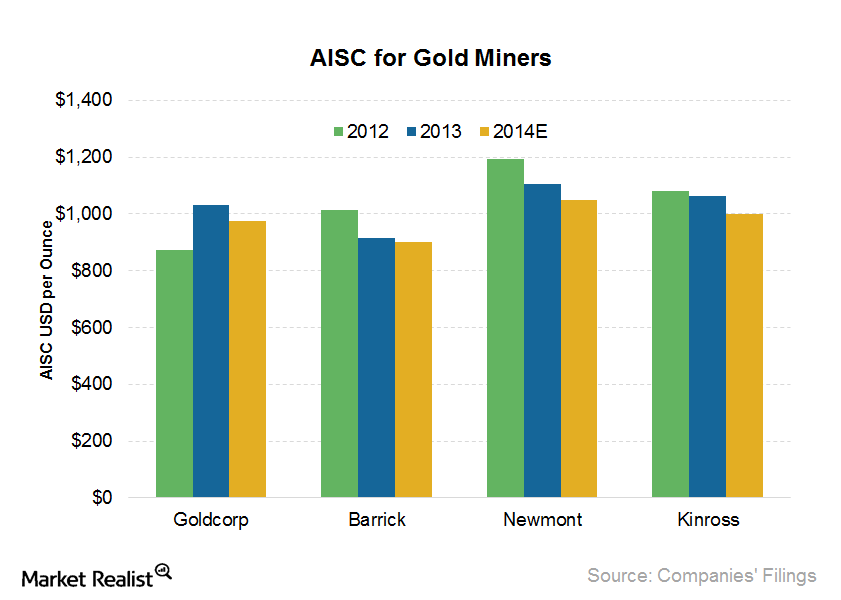

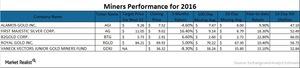

Goldcorp’s cost reduction compared to its peers

Goldcorp’s (GG) all-in sustaining costs (or AISC) are falling. In 2013, its AISC was $1,031 per ounce. It expects the AISC to be in the range of $950–$1,000 for 2014.

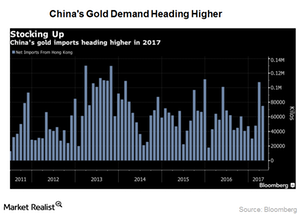

What Rising Physical Gold Demand Could Mean for Prices

After falling 18% in 1Q17, physical demand for gold seems to have picked up in 2Q17.

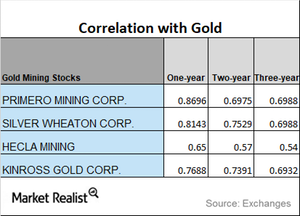

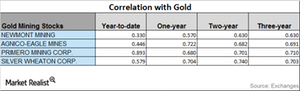

What Are Miners’ Correlation Trends?

Gold is the most dominant among the four precious metals. It’s important that investors analyze how miners are moving compared to precious metals.

Mining Stocks: Understanding Correlation

When you look at mining stocks’ performance, it’s important to analyze their correlation with gold. These stocks typically take their directional cues from gold, which is the most dominant among precious metals.

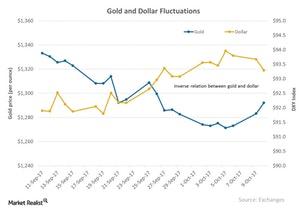

Which Elements Impact Precious Metals?

Gold fell for the third consecutive day on October 18, 2017, as the US dollar regained strength. However, October 19 was an up day for gold and silver.

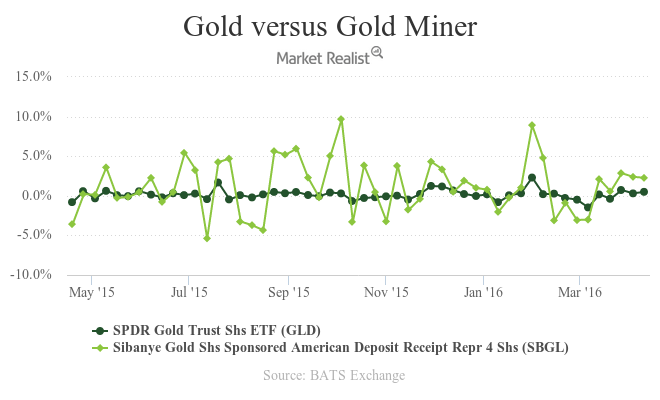

A Correlation Analysis of Some Important Miners

Among the miners that we’re looking at in this part of the series, Sibanye Gold has the lowest correlation to gold on a YTD basis, while Gold Fields has the highest correlation to gold.

How Miners Correlate to Gold

Mining funds that have a strong relationship to precious metals are the Global X Silver Miners (SIL) and the VanEck Vectors Gold Miners (GDX).

Reading the Correlation of Mining Shares

Monday, September 25, 2017, was a day of revival for mining shares as tensions in North Korea resurfaced.

How Gold, Silver, and Mining Companies Performed on September 18

On September 18, gold fell 1.1% and closed at $1,306.90 per ounce. Of the precious metals, silver fell 3.1% and closed at $17.10 per ounce.

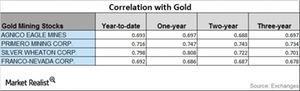

A Correlation Study of Mining Stocks in September 2017

Among the four miners we’re looking at, Gold Fields has the highest correlation to gold on a YTD basis, while Sibanye Gold has the lowest correlation to gold.

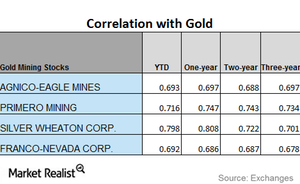

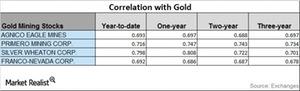

The Correlation Analysis of Miners through August 2017

Silver Wheaton has a three-year correlation of ~0.70 with gold and a year-to-date correlation of ~0.80.

Miners: Correlation Trends in August 2017

Silver Wheaton has the highest correlation with gold, while Franco-Nevada has the lowest correlation.

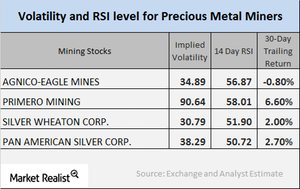

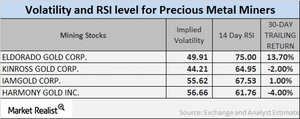

Unpacking the Technical Indicators for Mining Stocks

Mining stocks have bounced back from the choppy markets we’ve seen over the past month. On July 20, most mining stocks saw upward movements in their prices.

Why RSI levels of Mining Shares Are Rising

On June 6, the implied volatilities of Alamos Gold, Primero Mining, Silver Wheaton, and Franco-Nevada were 51.1%, 90.6%, 30.8%, and 24.5%, respectively.

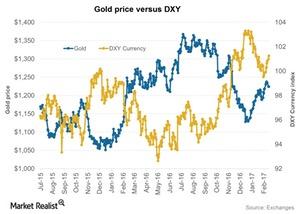

What’s the Correlation between the Dollar and Gold in Last 5 Days?

One of the critical elements that plays on precious metals besides the overall market sentiment is the US dollar.

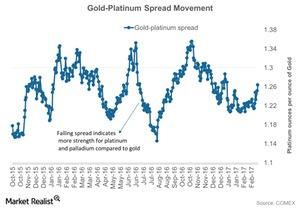

Platinum Is the Worst Performer So Far—Reading Its Spread

The gold-platinum spread was ~1.3 on April 26, 2017. The gold-platinum spread RSI on that day was 59.

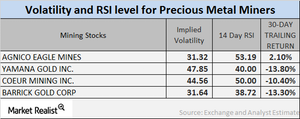

Understanding Mining Stock Volatility in March

Now that mining companies have begun witnessing revivals from their losses earlier this year, it becomes crucial to examine the volatility figures and RSI.

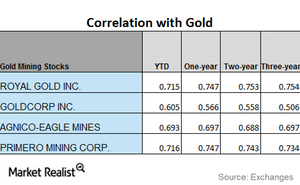

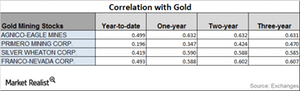

Mining Stocks: An Upward or Downward Correlation to Gold?

Agnico-Eagle Mines has the highest correlation to gold year-to-date. Primero Mining is the least correlated to gold.

Mining Stocks and Gold Prices: Reading the Correlation

It’s important to understand which mining stocks have overperformed and underperformed precious metals.

Analyzing the Correlations of Precious Metals Mining Stocks

Mining companies that have high correlations with gold include B2Gold (BTG), Royal Gold (RGLD), Agnico Eagle Mines (AEM), and Primero Mining (PPP).

Inside Gold’s Upward and Downward Correlation Trends

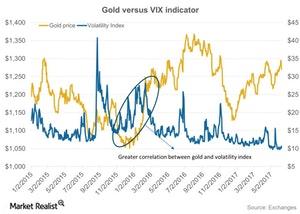

Precious metal prices have risen due to uncertainty since Donald Trump won the US presidential election.

How Are Mining Stocks Reacting in 2017?

The rate hike phenomenon in December 2016 played negatively for precious metals.

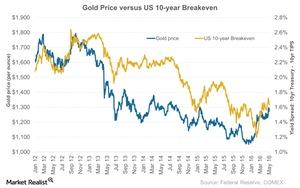

Will Gold Keep a Close Watch on Inflation Numbers?

Donald Trump’s recent victory is shining a light on the possibility of a rise in inflation and how such a rise could work for gold.Macroeconomic Analysis How Has the US Dollar Affected Platinum Prices?

The current weakness in the rand made it fall to all-time lows against the US dollar in early 2016 but has helped mining companies.

What’s Next for Gold Investors?

Gold gave steady returns to investors for the first two months of 2016 as unrest and instability continued in the markets. However, March started with some ups as well as downs for gold.

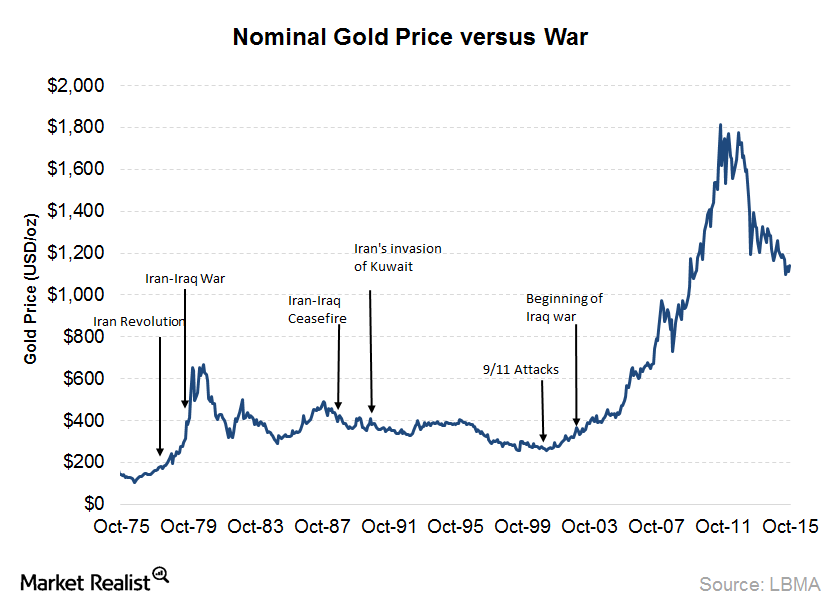

How the Threat of War Affects Gold Prices

Gold’s safe haven appeal might lead investors to gold and other precious metals in terms of heightened geopolitical tensions and war.