Targa Resources Corp

Latest Targa Resources Corp News and Updates

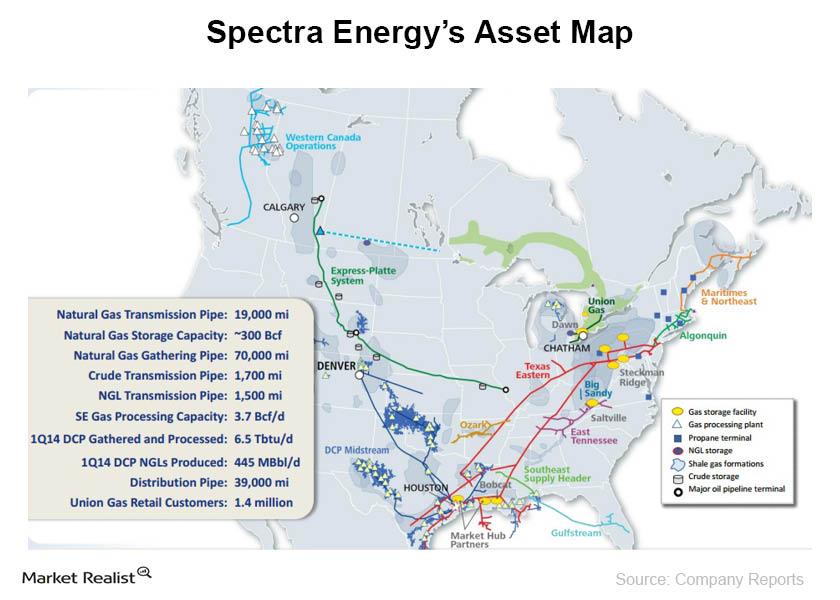

An investor’s guide to Spectra Energy Corp. and its earnings

Spectra Energy Corp. (SE), headquartered in Houston, Texas, owns and operates a large and diversified portfolio of natural gas–related assets in North America.

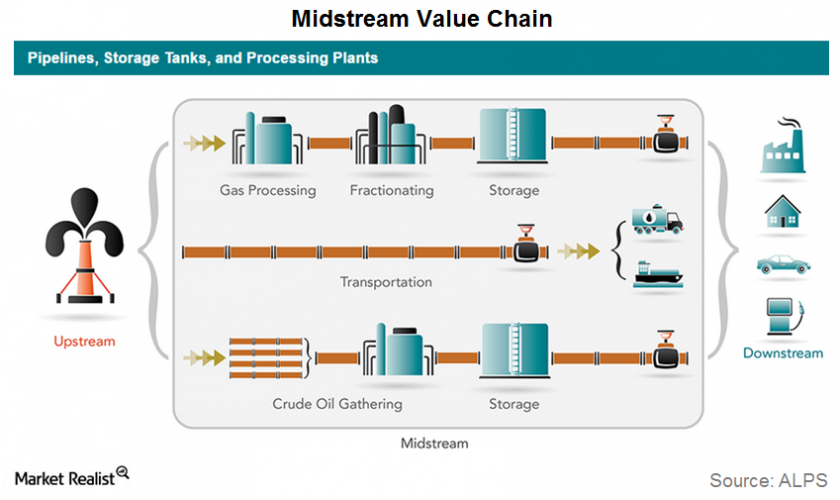

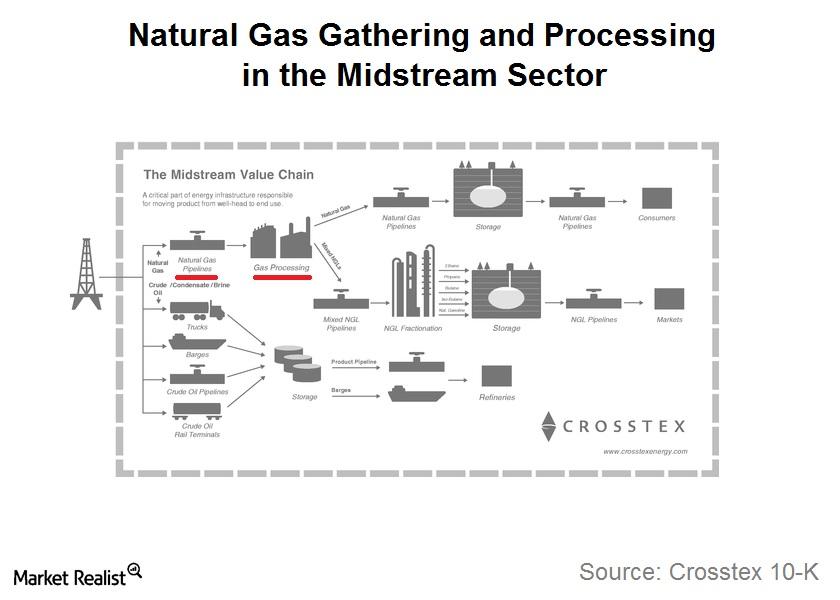

MLPs: How They Operate in the Midstream Energy Industry

Most MLPs operate in the midstream energy industry. They’re mainly involved in gathering, processing, storing, and transporting energy commodities.

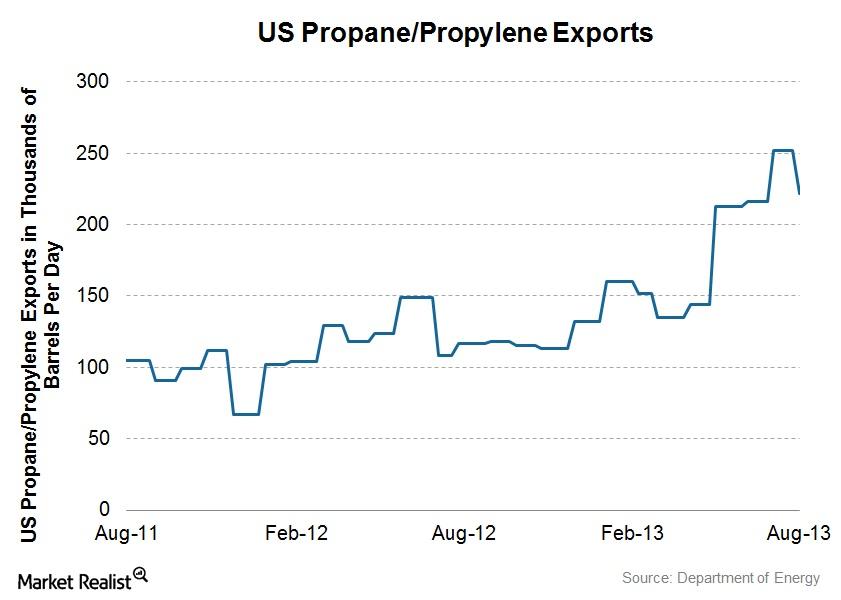

Why some MLPs are benefitting from increased propane exports

Significantly higher rates of propane exports have helped to boost propane prices—and the margins of some MLP names.Energy & Utilities Why Targa Resources’ segment operating margins changed in 1Q14

In 2013, the company processed an average of 780.1 million cubic feet per day of natural gas and produced an average of 91.9 thousand barrels per day of NGLs.

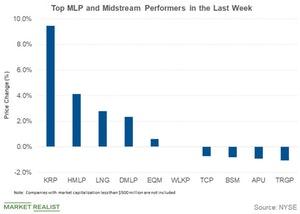

LNG and EQM: Which Midstream Companies Outperformed Last Week?

Cheniere Energy (LNG) was among the top midstream gainers last week. The stock rose 2.8% during the week.

Why natural gas gathering and processing are important for MLPs

Natural gas gathering and processing is a significant part of the operations of many midstream master limited partnerships.

Why Frac Spreads Affect Some MLP Stocks

Companies in the natural gas processing space—many of which are MLPS—keep an eye on the fractionation or “frac” spread. Here’s why.

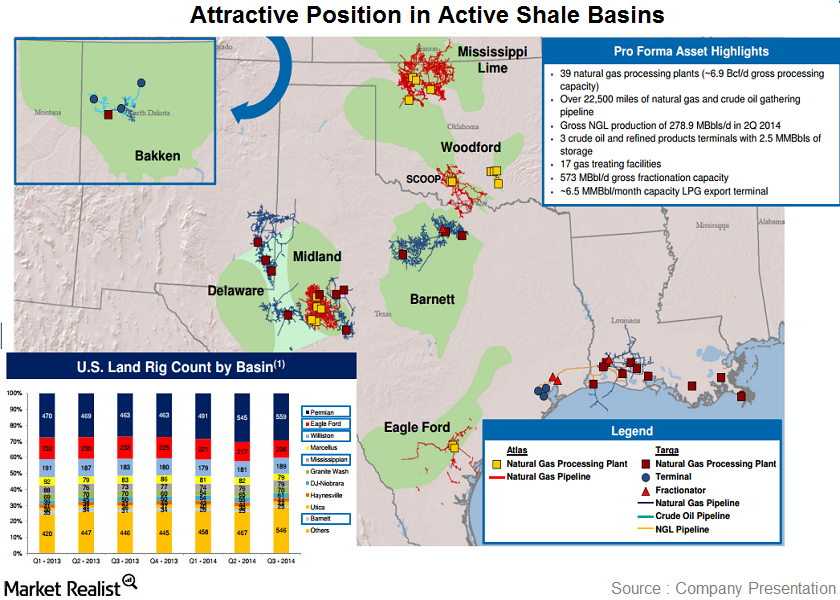

An overview of the Targa Resources and Atlas Pipeline deal

The combined company will create a midstream enterprise with more than 22,500 miles of crude oil and natural gas pipelines across the U.S. The $7.7 billion deal is expected to close in the first quarter of 2015.

These Midstream Players Have Created Maximum Wealth for Investors

In this series, we’ll look at the historical outliers in midstream energy, which have generated massive wealth amid turbulent times.

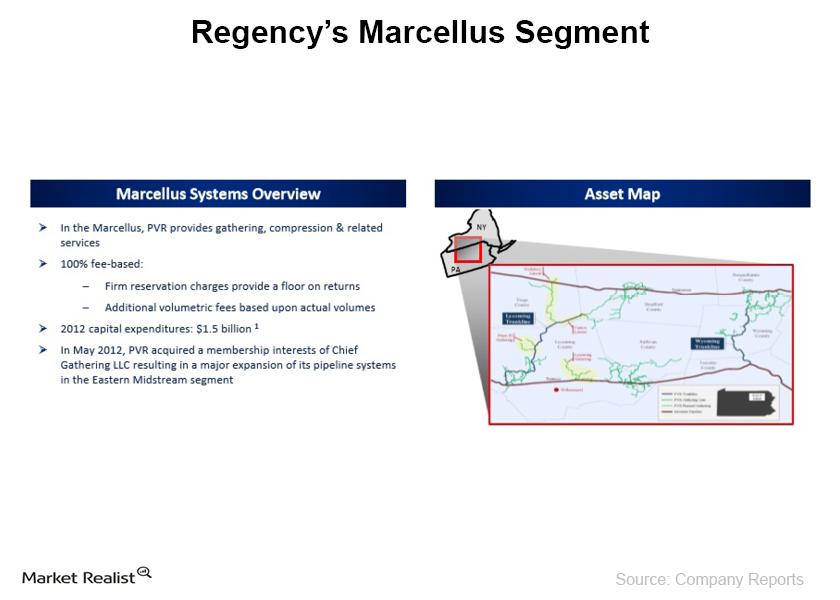

Regency’s PVR Midstream acquisition means Marcellus Shale exposure

Regency recently acquired a foothold in the Marcellus by buying PVR Partners LP in March this year in a deal worth $5.6 billion, specifically to boost its footprint in the Appalachian Basin.

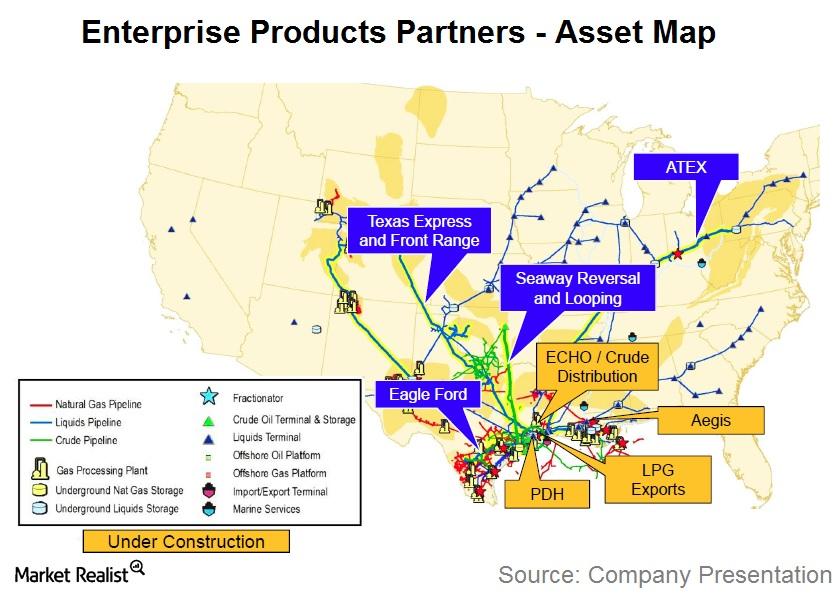

Key points from Enterprise Products Partners’ analyst day meeting

Enterprise Products Partners (EPD) is one of the largest master limited partnerships operating in the midstream energy space.

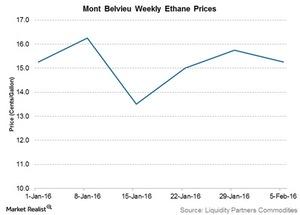

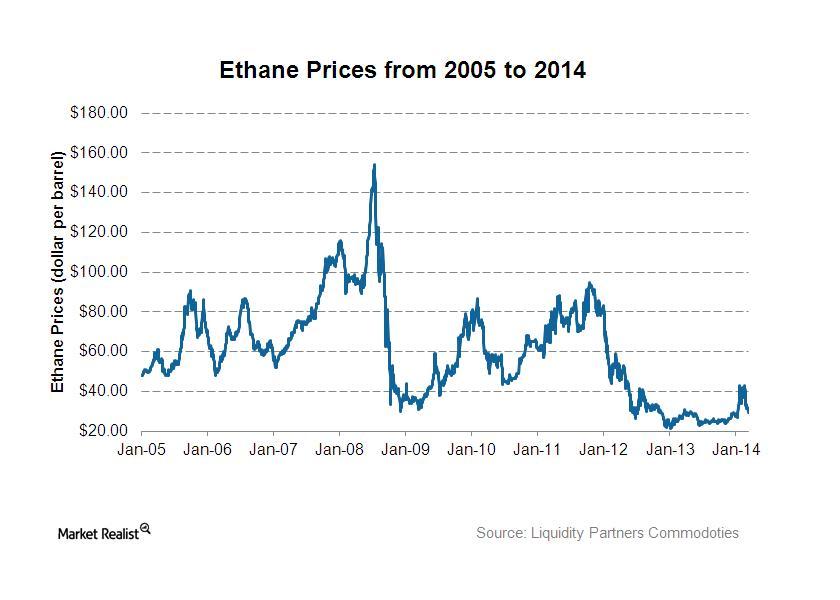

Ethane Prices Fall 3%: Impact on MLPs

Mont Belvieu ethane prices fell 3% to $0.15 per gallon in the week ending February 5, 2016. Ethane prices had risen 5% to $0.16 per gallon in the previous week.

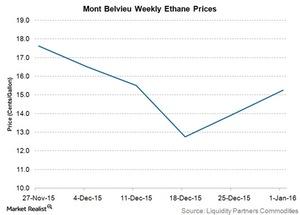

Ethane Prices Rose, Benefiting MLPs

Mont Belvieu ethane prices rose 9% to $0.15 per gallon in the week ended January 1, 2016, from $0.14 per gallon in the previous week.

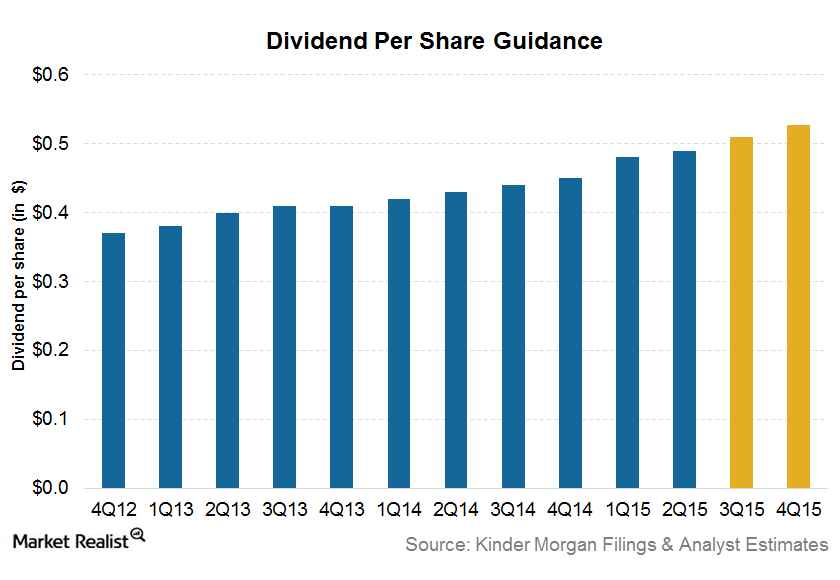

Kinder Morgan’s Outlook for the Rest of 2015

According to Wall Street analysts’ consensus outlook, Kinder Morgan’s (KMI) dividend is expected to grow by ~15.3% year-over-year by the end of 2015.

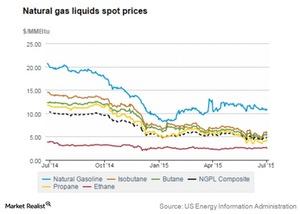

Why the Natural Gas-NGL Price Spread Impacts Energy MLPs

Natural gas processing MLPs typically benefit when the price of NGLs is high relative to natural gas.

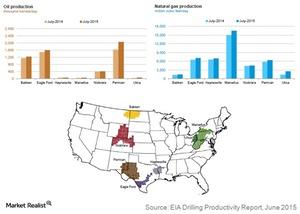

Must-Know: The 7 Regions for Oil and Gas Production in the US

The EIA (Energy Information Administration) monitors seven key tight oil and gas regions in the US.

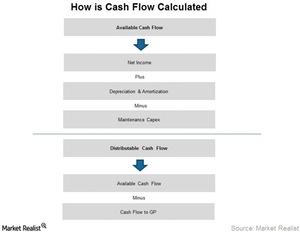

The Importance of the Distribution Coverage Ratio

The distribution coverage ratio is the most important ratio for MLPs, as it highlights the cash available to the LP unit holders divided by the cash distributed to LP unit holders.

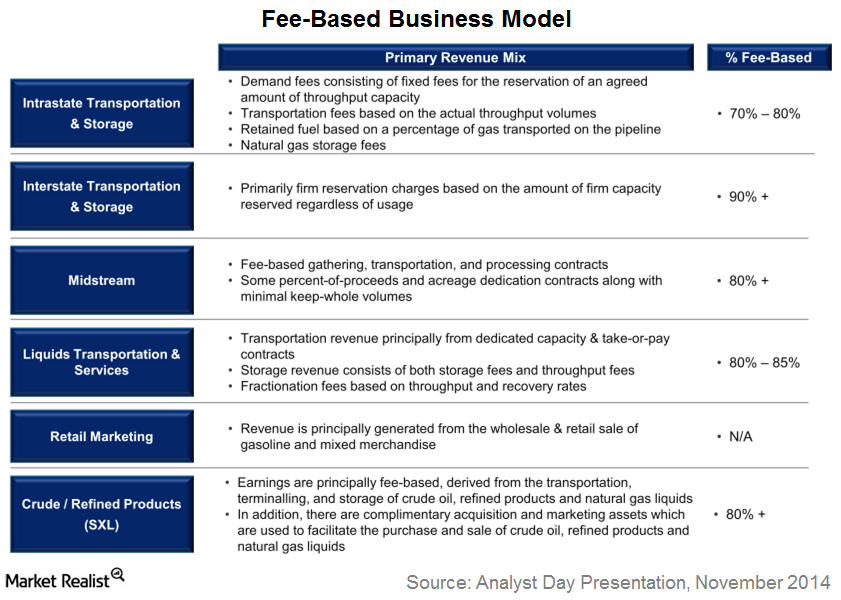

Energy Transfer Partners’ Fee-Based Model Drives Performance

Considering the rock solid performance of ETP during the slump in energy prices, it is clear that ETP has more fee-based contracts.

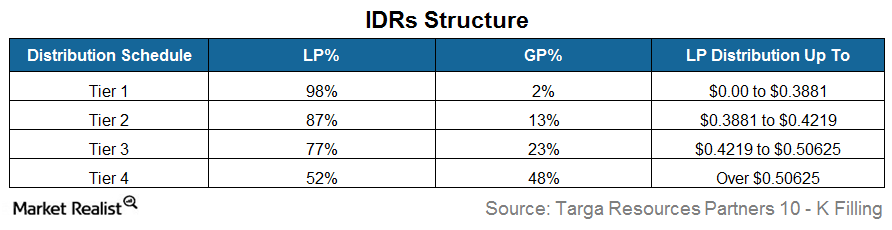

IDRs: How Do They Impact MLPs?

IDRs entitle the GP to receive a higher percentage of incremental cash distributions after certain target distribution levels have been achieved for the LP unitholders.

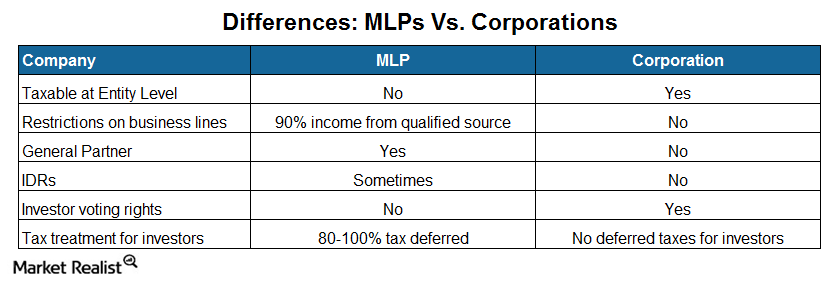

Analyzing the Differences: MLPs versus C Corporations

MLPs’ tax structure is the major difference that separates them from C Corps. MLPs’ earnings aren’t taxed at the partnership level. The taxes are passed to the unitholders.

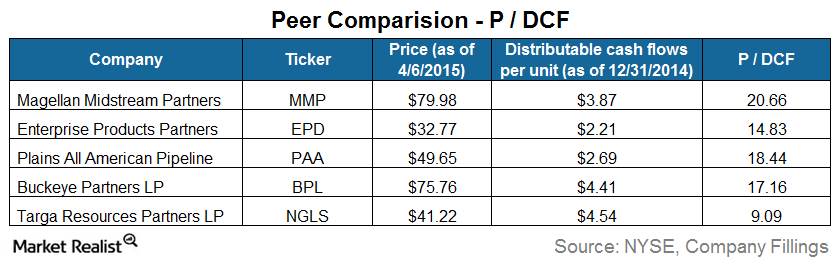

Valuing MLPs: Price-to-Distributable Cash Flow Ratio

MLPs’ valuations are different from other stocks. To value MLPs, the widely used PE ratio isn’t as useful as the PDCF ratio.

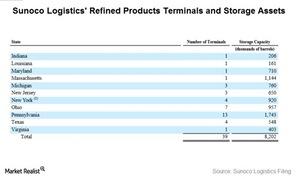

An Overview of Sunoco’s Terminals Facilities

Sunoco’s terminals facilities business operates crude oil, refined products, and natural gas liquids (or NGL) terminals.

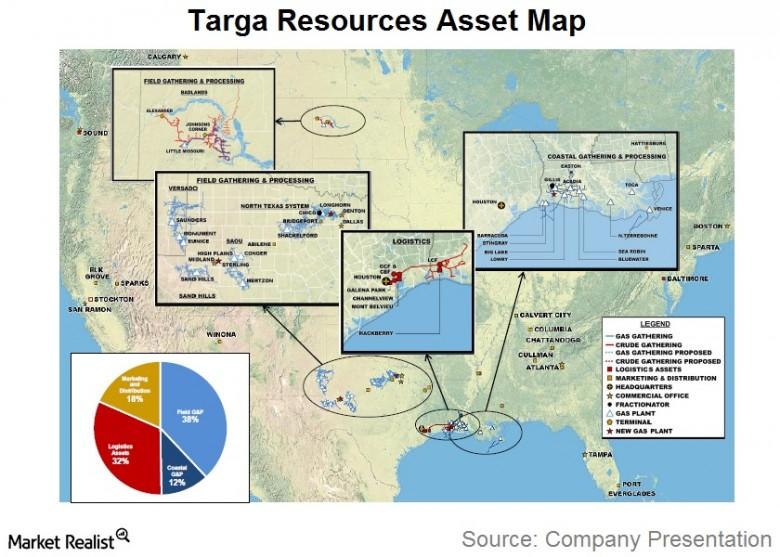

Must-know business overview: Targa Resources Partners

Targa Resources Partners LP (NGLS) is a master limited partnership operating in the midstream energy space. Targa Resources Corp. (TRGP) is the general partner of NGLS.

Ethane production and its effects on natural gas processors

With attractive NGL pricing relative to naphtha refinery streams, the feedstock percentage of NGLs has been increasing, with ethane taking a disproportionate share of the total.