Marvell Technology Group Ltd

Latest Marvell Technology Group Ltd News and Updates

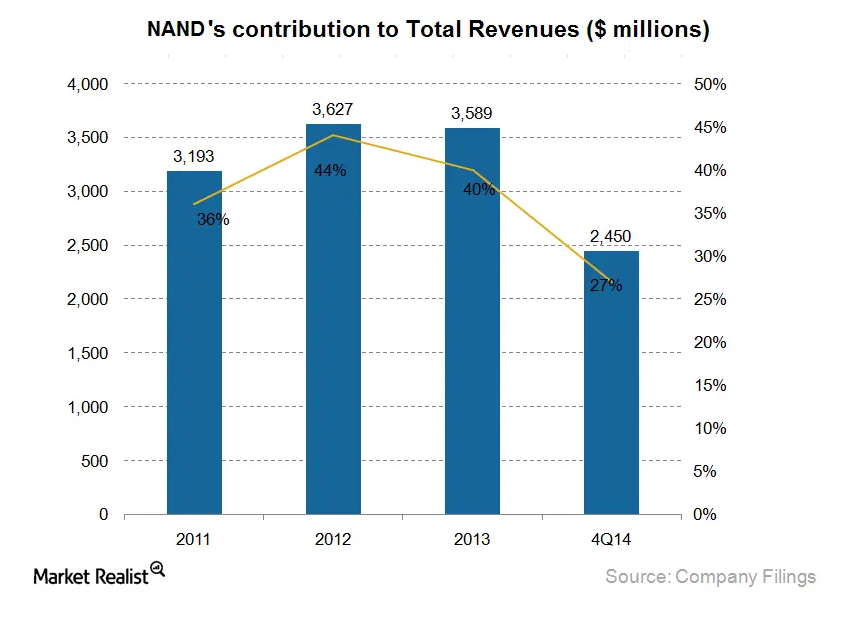

Why Micron’s NAND is an important business segment

These products offer higher performance, reduced power consumption, and better reliability when compared to traditional hard disk drives. This explains the product’s popularity and rapid proliferation as a data storage medium.

Marvell Technology's Strong Growth Prospects Make its Stock a Buy

On Apr. 20, Marvell Technology announced the completion of its acquisition of Inphi. What’s MRVL’s stock forecast after the merger?

Everything You Should Know before Investing in Nokia Stock

Nokia (NYSE:NOK) had a rough year in 2019. The stock fell more than 36% last year. Can the stock rebound in 2020?

Analyzing Broadcom’s Acquisitions in the Software Sector

Broadcom has been making many acquisitions in the software industry. The semiconductor giant seems to be drifting away from its core chip business.

Get Real: Tesla Bears and the ‘Tariff Man’

The Dow Jones Index needs a Santa Claus rally this year. Instead, the Dow Jones might have to contend with the “Tariff Man.”

Why Is Microchip Stock Rising Today?

Microchip stock rose in pre-market trading today after the company updated its financial guidance for the third quarter of fiscal 2020.

Cisco: Weak Revenues Warn Investors of a Slowdown

Cisco Systems (CSCO) has been delivering better-than-expected earnings and revenues in every quarter for the last two fiscal years.

Micron Stock Fell on Disappointing Guidance

Micron Technology reported upbeat fourth-quarter fiscal 2019 results on September 26 after the market closed. Micron stock fell 1.76% to $48.60 on the day.

Why Is NXP Buying Marvell’s Wi-Fi and Bluetooth Business?

NXP Semiconductors announced its intention to buy Marvell Technology’s wireless connectivity business for a cash deal worth $1.76 billion.

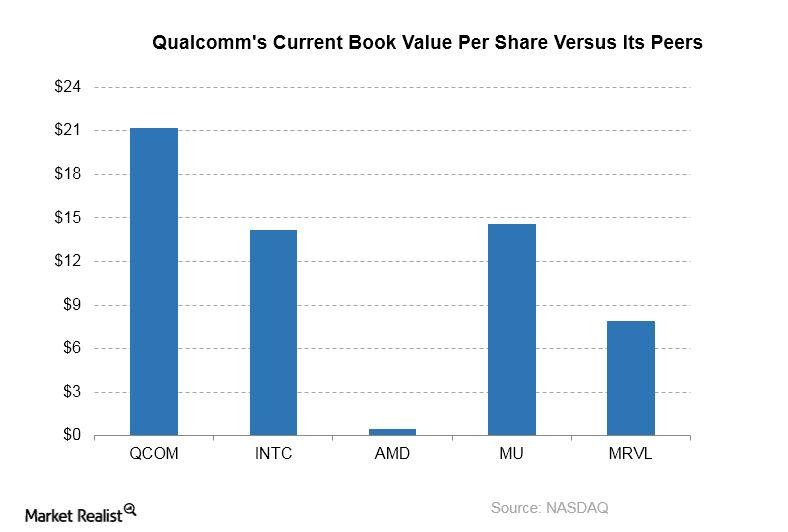

A Look at Qualcomm’s Valuation

Inside Qualcomm’s price and valuation multiples Qualcomm’s (QCOM) book value per share in 2016 was ~$21.20, compared with the expected book value per share of ~$20.60 in 2017. Qualcomm shares are trading at price-to-book value of ~2.7x. In comparison, Intel’s (INTC), Advanced Micro Devices’ (AMD), Micron Technology’s (MU), and Marvell Technology’s (MRVL) book values per […]

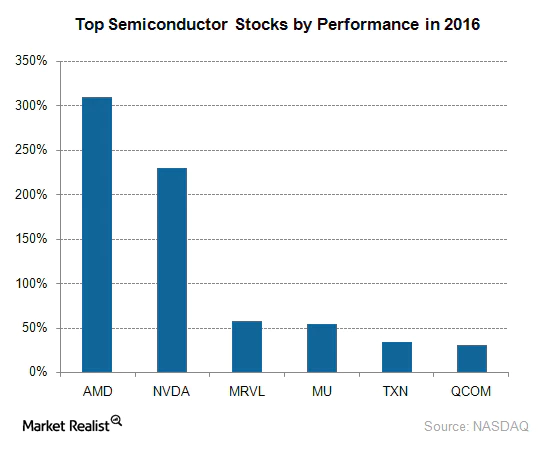

AMD Stock Continues to Fall in 2017

Advanced Micro Devices (AMD) stock fell 9.4% in the week ended January 20, 2017. Shares of the firm have fallen 14% since the start of 2017 after an incredible run last year.

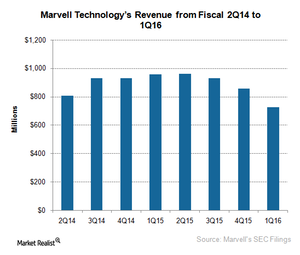

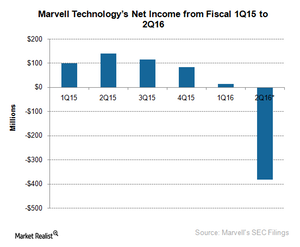

What’s the Root Cause of Marvell’s Problems?

Let’s dig into the cause of Marvell’s accounting issues, see how one thing led to another, and look at how its new management plans to untangle the chaos.

Marvell Hit by Several Internal and External Challenges

Marvell, a supplier of silicon solutions for storage, cloud infrastructure, IoT connectivity, and multimedia, has been making news for all the wrong reasons.

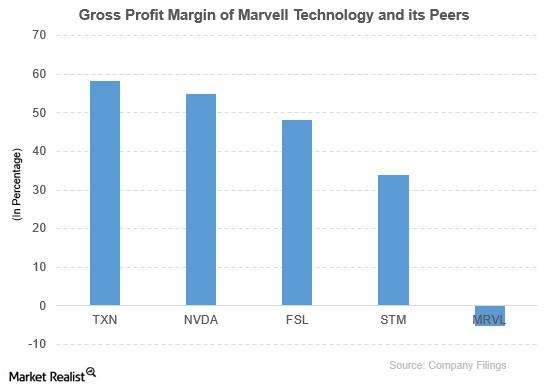

How Did Marvell Technology Compare to Its Peers?

Marvell Technology was outperformed by its peers based on the gross profit margin and PBV ratio. ETFs outperformed it based on the price movement and PBV ratio.