Marathon Petroleum Corp

Latest Marathon Petroleum Corp News and Updates

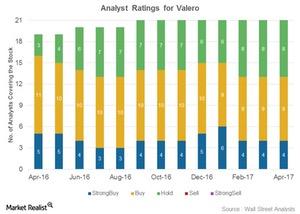

Why Short Interest in Valero Soared in 2017

Valero Energy (VLO) has witnessed a rise in its short interest since mid-February 2017.

Analyst Ratings for Valero: Why the ‘Hold’ Ratings?

VLO’s mean price target of $72 per share implies around a 10% gain from its current level.

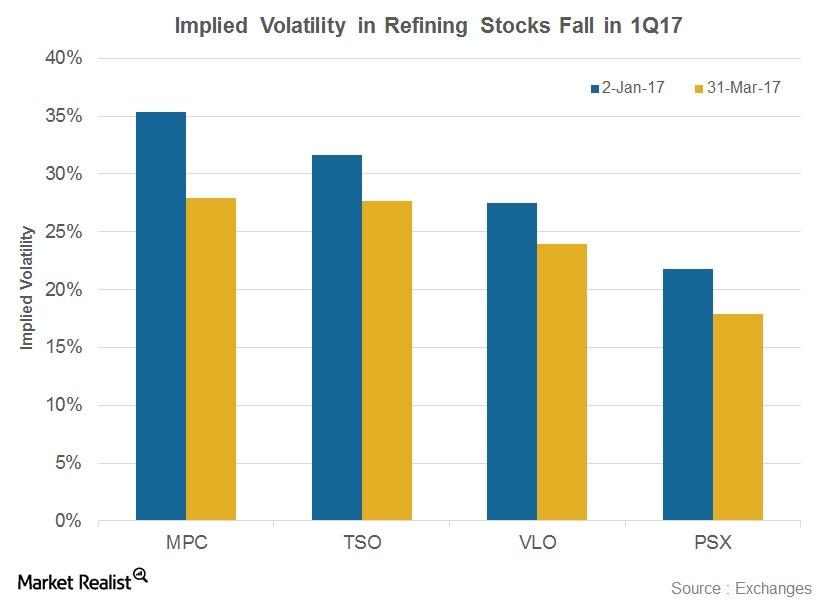

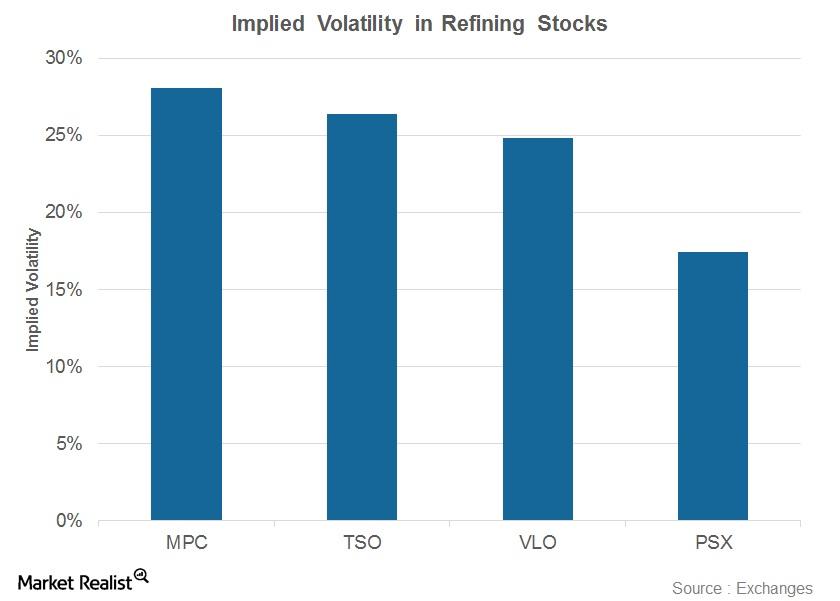

Refining Stocks’ Implied Volatilities Tumbled in 1Q17

Refining stocks’ implied volatilities have witnessed falls in 1Q17. Marathon Petroleum’s (MPC) implied volatility fell 7% to 27.9% from January 2 to March 31, 2017.

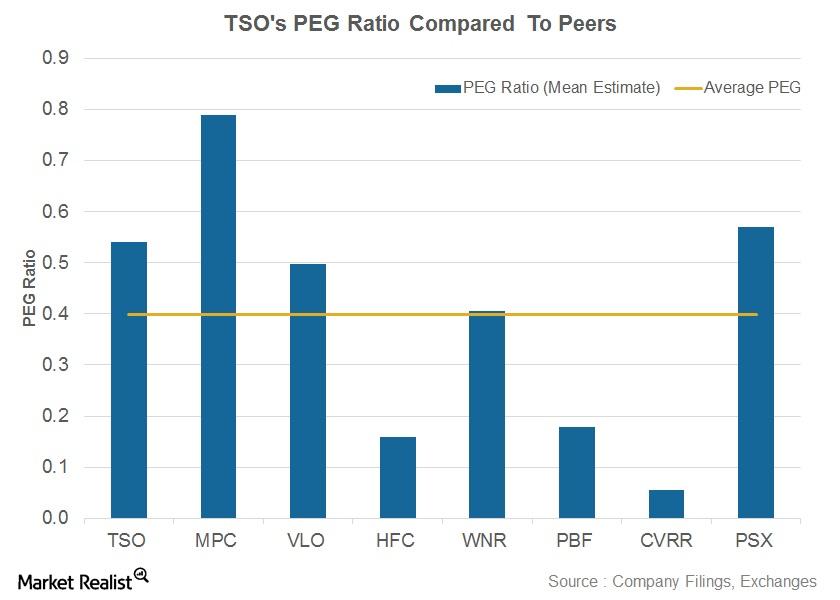

How Does Tesoro’s PEG Compare to Its Peers’?

In this article, we’ll compare Tesoro’s (TSO) PEG ratio (price-to-earnings to blended growth rate) to those of its peers. We’ve considered the mean estimate of PEG.

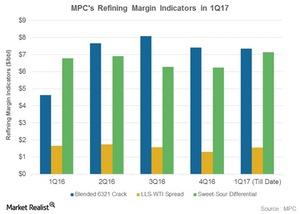

Could Marathon Petroleum’s Refining Earnings Rise in 1Q17?

Marathon Petroleum’s refining earnings are impacted by the blended LLS 6-3-2-1 crack, the sweet-sour differential, and the LLS-WTI spread.

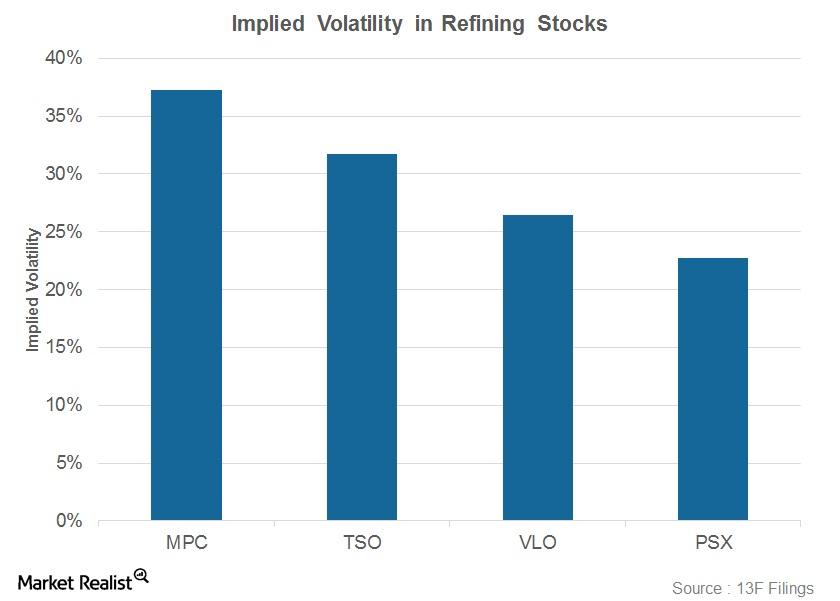

Understanding the Latest Implied Volatility in Refining Stocks

Marathon Petroleum’s implied volatility currently stands at 28%—the highest level among peers Valero, Tesoro, and Phillips 66.

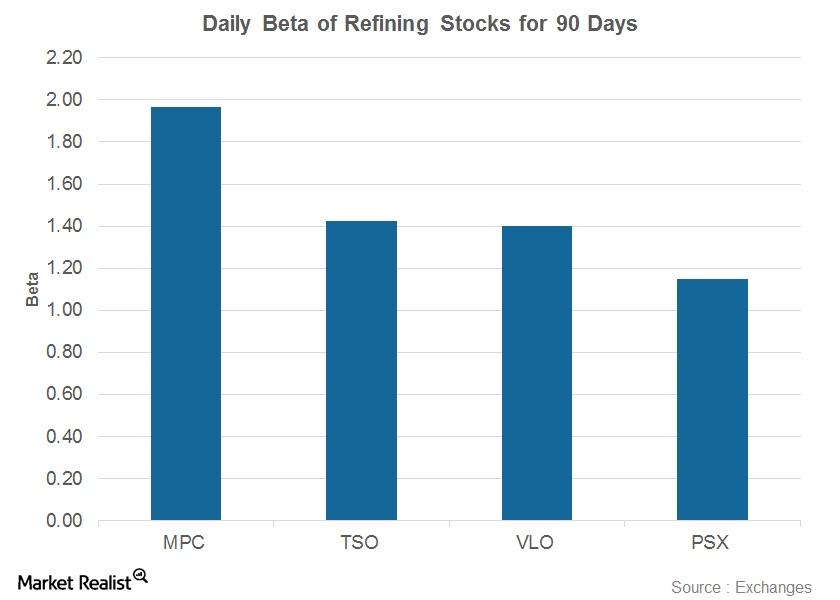

Refining Stock Betas: Who Could Pop?

On March 2, 2017, Marathon Petroleum’s 90-day beta stood at 2.0—the highest among peers Valero, Tesoro, and Phillips 66.

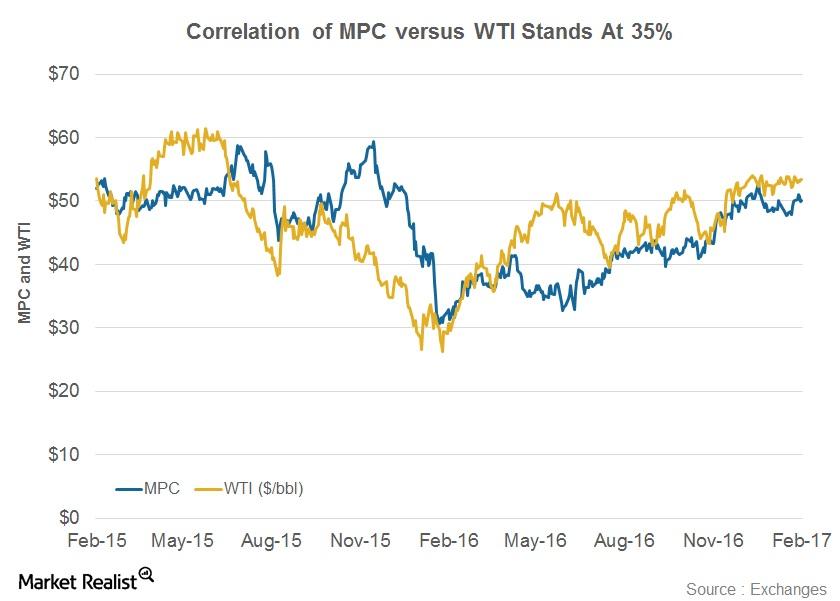

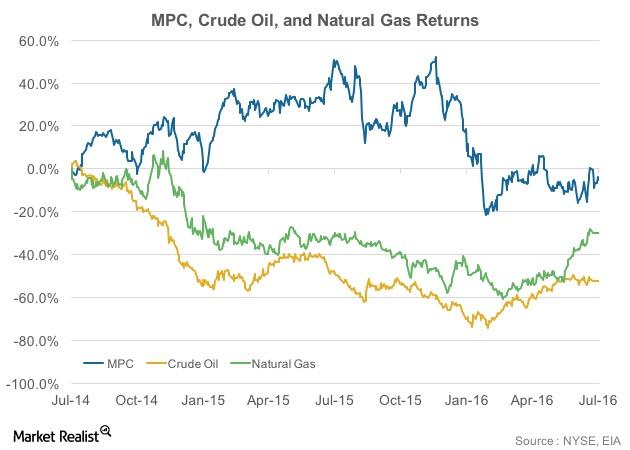

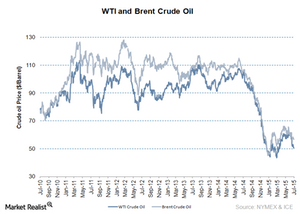

Understanding the Correlation between MPC’s Stock and Oil Prices

The correlation coefficient of Marathon Petroleum and WTI stands at 0.35—a positive but feeble correlation.

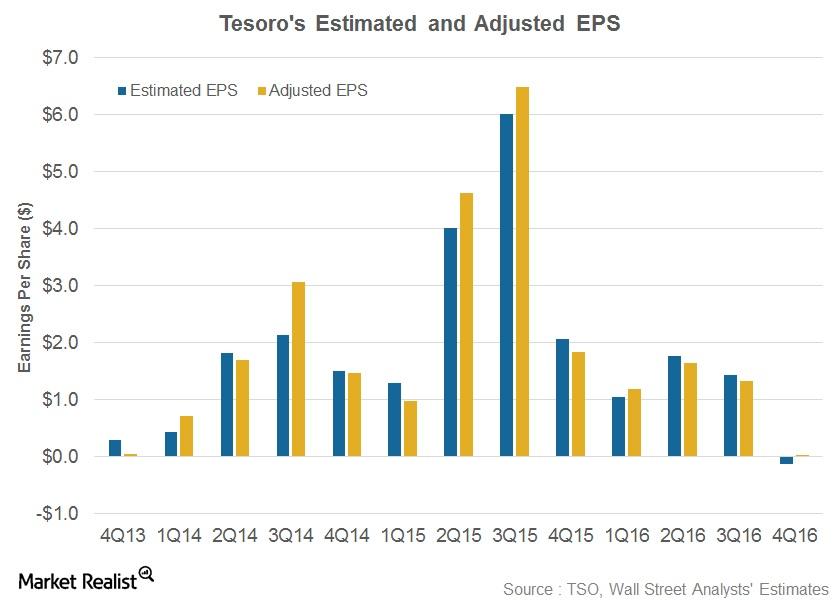

Tesoro Stayed Positive despite the Fall in Its 4Q16 Earnings

Tesoro (TSO) posted its 4Q16 results on February 6, 2017. It reported revenues of $6.6 billion, which missed Wall Street analysts’ estimates.

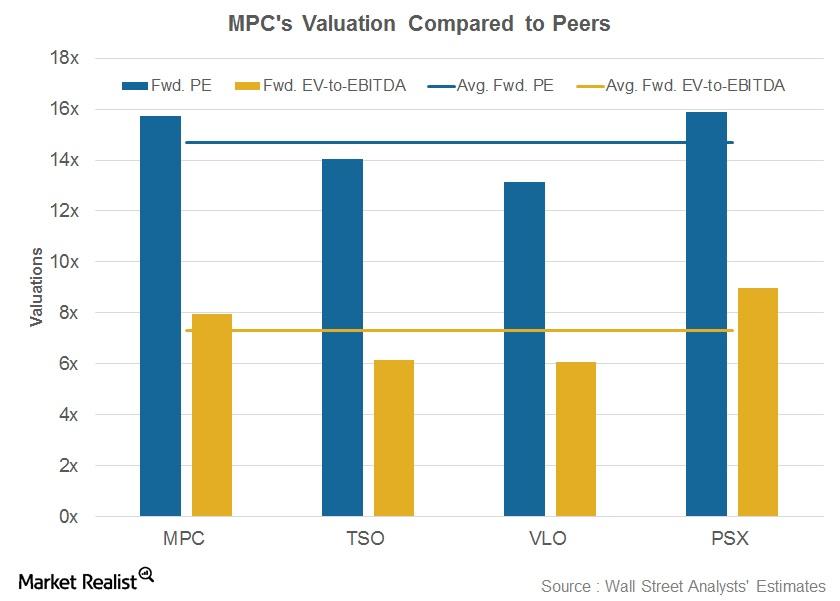

MPC’s Dropdown Plans: Where Do Its Valuations Stand?

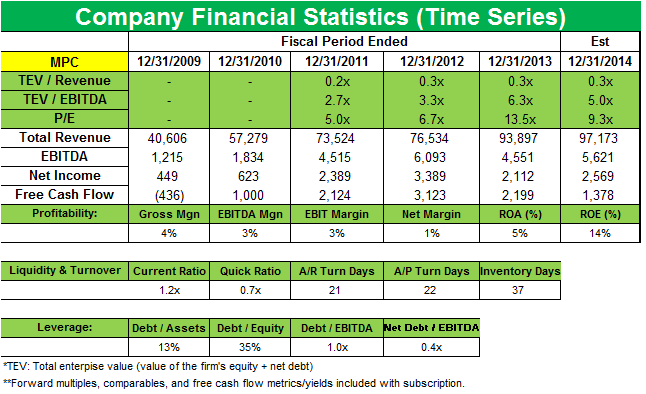

After MPC proposed the dropdown plan, MPC’s forward price-to-earnings (or PE) and EV-to-EBITDA stood at 15.7x and 8x, respectively.

Where Are Refining Stocks’ Implied Volatilities Positioned?

Marathon Petroleum’s (MPC) implied volatility currently stands at 37%, the highest among its peers.

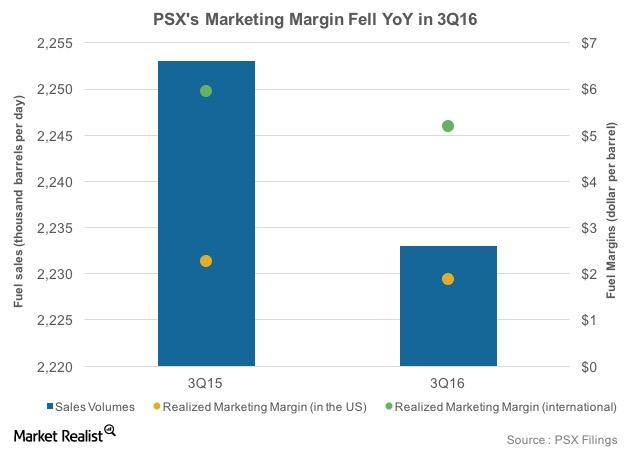

How Did Phillips 66’s Marketing Segment Perform in 3Q16?

Phillips 66’s adjusted EBITDA from its Marketing segment fell 22% from 3Q15 to $429 million in 3Q16 due to weaker marketing margins and lower volumes.

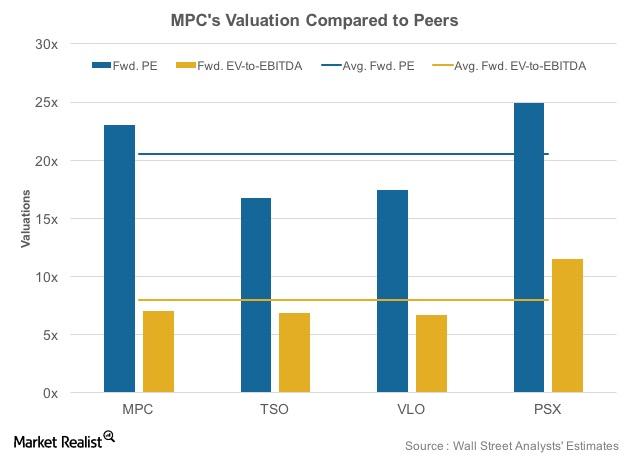

Elliott’s Recommendation: Where Does Marathon’s Valuation Stand?

After Elliott Management’s recommendations, Marathon Petroleum’s forward EV-to-EBITDA multiple stood at 23.1x.

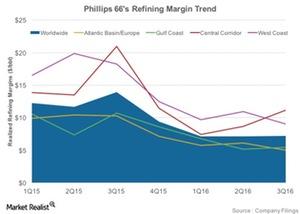

How Refining Margins Are Key Indicators of Refining Profitability?

Refining margins are dependent on input crude oil cost, product slate, and prices of refined products and are indicators of overall profitability.

What Key Factors Impact Refining Profitability?

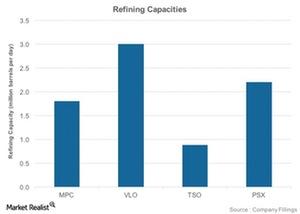

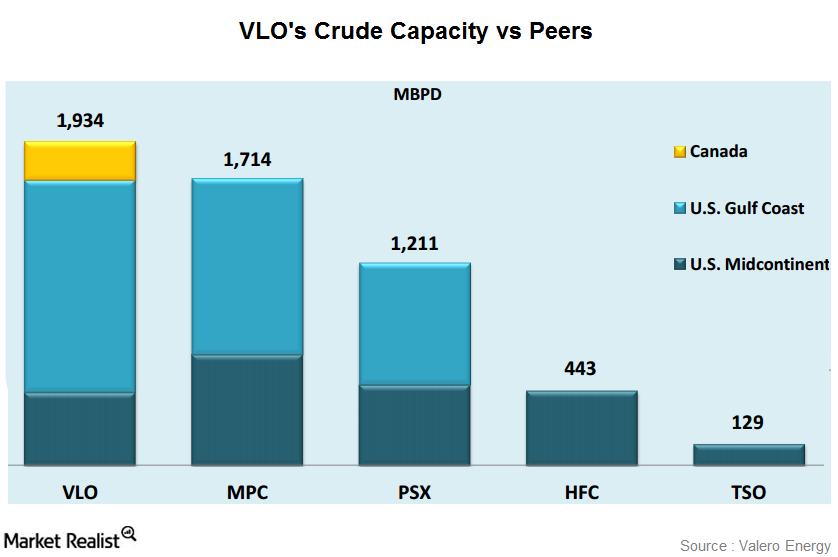

The key factors influencing refining profitability include refining capacity, complexity, and utilization rates.

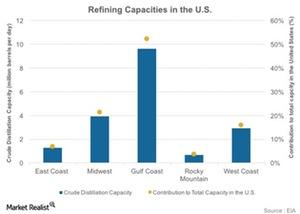

US Gulf Coast: The Largest Refining Region in the Country

The Gulf Coast, a key US refining region, accounted for 9.6 MMbpd of total refining capacity, which represents 52% of the total refining strength in the US.

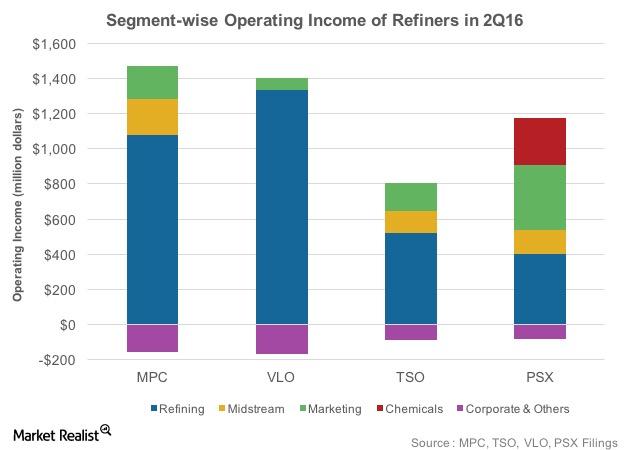

How PSX’s Operating Income Differs from Those of MPC, VLO, TSO

Refiners such as PSX, MPC, VLO, and TSO are now focusing on diversifying their earnings models to shield themselves from the volatile refining environment.

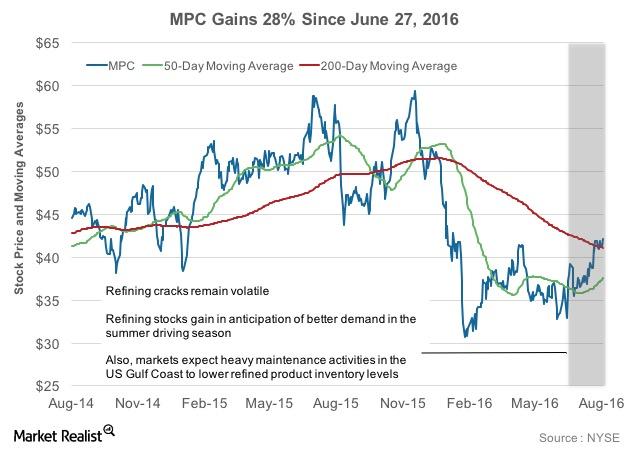

Marathon Petroleum’s Stock Performance: Up by 28% since June 30

Since the end of June, Marathon Petroleum’s (MPC) stock has risen by 28%. MPC has crossed over its 50-day and its 200-day moving averages during this period.

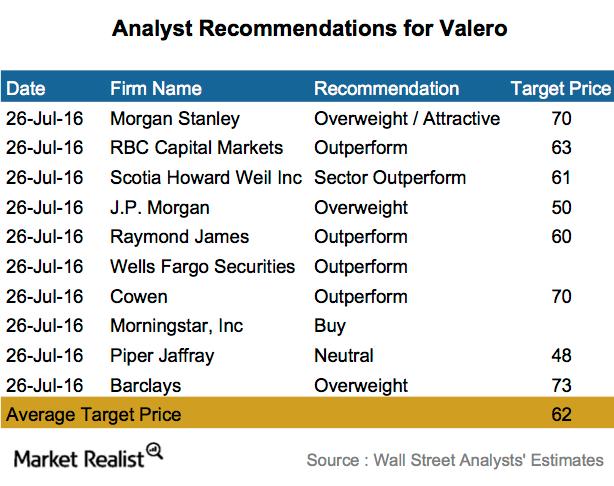

What Do Analysts Recommend for Valero after 2Q16 Earnings?

Nine out of ten companies surveyed rated Valero (VLO) a “buy,” “overweight,” or “outperform.”

How Has Marathon Petroleum Stock Performed Pre-Earnings?

Between July 2014 and November 2015, Marathon Petroleum (MPC) stock rose 51%. But after that, the stock fell until early 2016.

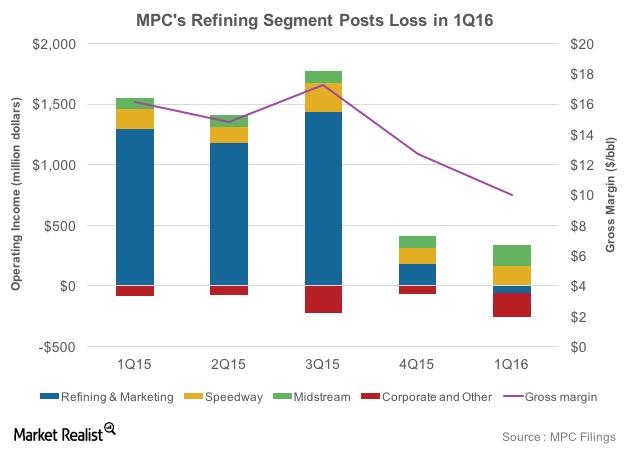

How Will Marathon Petroleum’s Refining Earnings Shape Up in 2Q16?

Marathon Petroleum’s (MPC) refining segment’s operating income plunged to -$62 million in 1Q16 due to a fall in its gross refining and marketing margin.

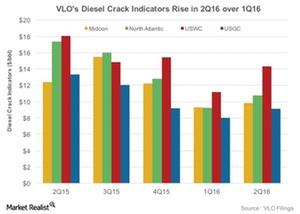

What Can We Expect from Valero’s Diesel Crack Indicators in 2Q16?

Valero’s diesel crack indicators have been rising in 2Q16 compared to 1Q16. The US West Coast, where VLO has 0.3 MMbpd refining capacity, saw the largest rise of $3.20 per barrel.

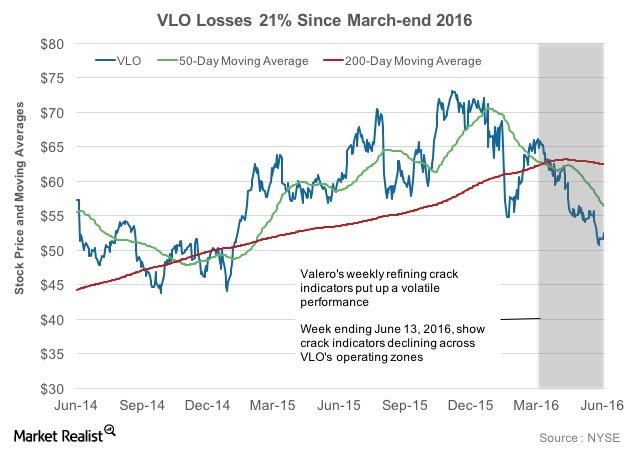

Why Has Valero Stock Fallen 21% since the End of March?

Amid stock price volatility, Valero rose 20% from February 8–March 28, 2016, and crossed over its 50-day and 200-day moving averages.

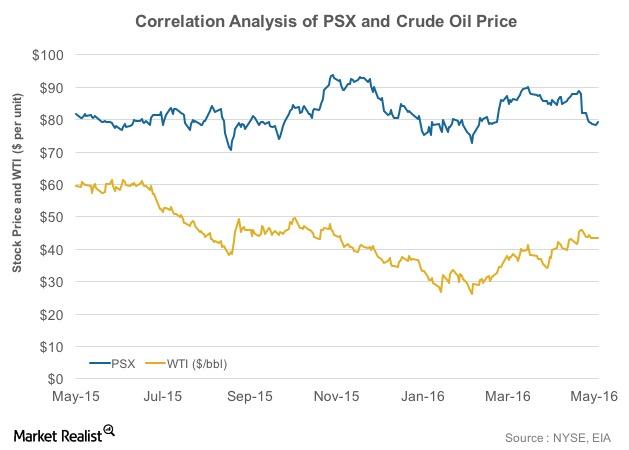

Phillips 66 and the Price of Crude Oil: A Correlation Analysis

The correlation value of Phillips 66 (PSX) and crude oil prices shows that the price of PSX stock moves in line with WTI prices to a certain extent.

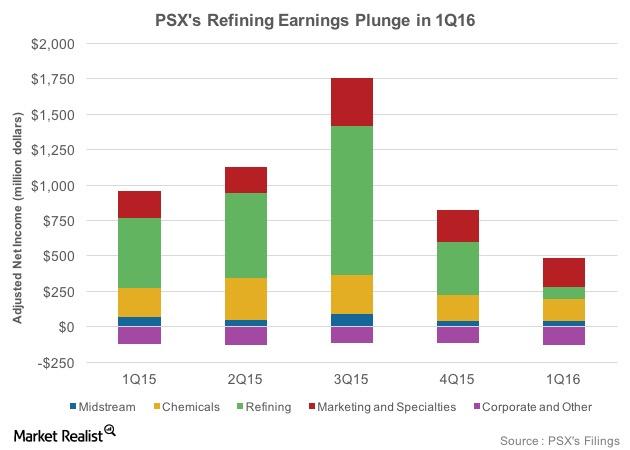

Phillips 66 Segments: A Fully Integrated Downstream Model

Phillips 66 (PSX) has segments in refining, midstream, chemicals, and marketing. In 1Q16, the refining segment contributed $86 million, or 24%, to its adjusted net income.

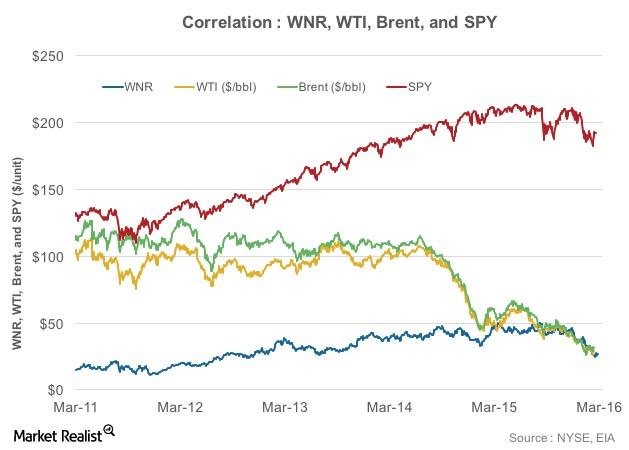

What’s the Relationship between WNR, Crude Oil Prices, and SPY?

The correlation coefficient of Western Refining versus WTI and Brent stands at -0.53 and -0.64, respectively.

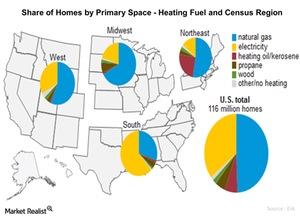

US Households Prefer Electricity and Natural Gas for Home Heating

Natural gas is used as heating fuel in 48% of the homes across the country, electricity is used for heat in 38% of homes, and the rest of the fuels are used for heat in the remaining 14% of homes.

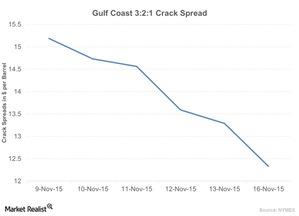

Crack Spread Narrowed: Is There Less Demand for Crude Oil?

The benchmark US Gulf Coast 3:2:1 crack spread fell ~12.50% last week. It hit ~$13.28 per barrel on Friday, November 13, 2015.

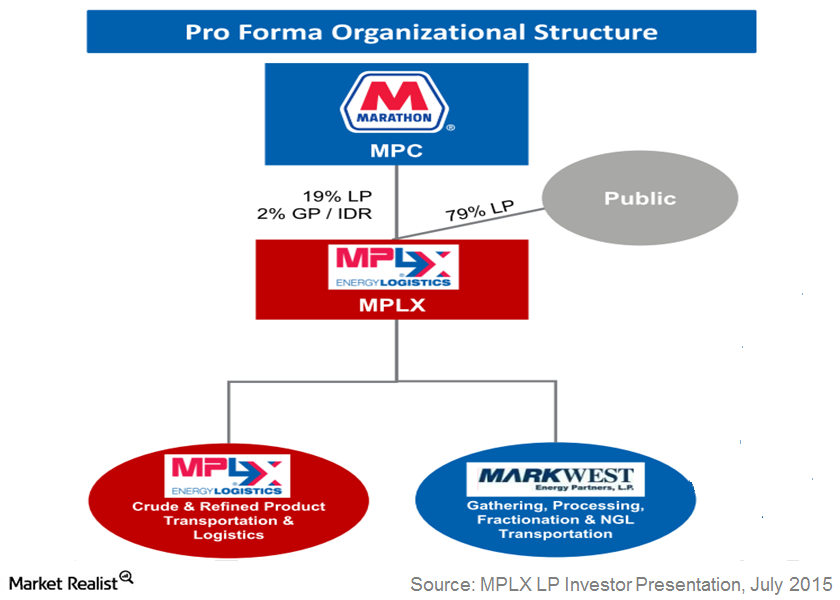

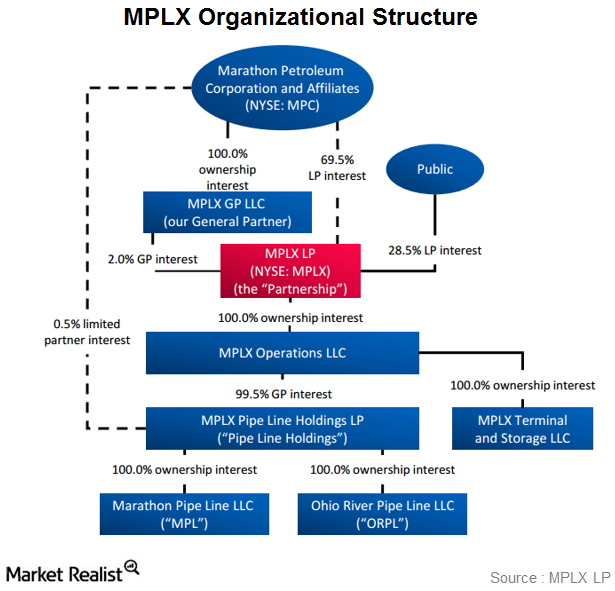

MarkWest-MPLX Merger: Big News for the Midstream Energy Sector

In a press release published on July 13, 2015, MarkWest Energy Partners (MWE) and MPLX LP (MPLX) announced that the two MLPs have agreed to merge.

Brent and WTI Crude Oil Prices Widen in the Depressed Oil Market

August WTI crude oil futures contracts fell by $0.74 and closed at $50.15 per barrel on July 20. Brent fell by $0.45 and settled at $56.65 at the close of trade.

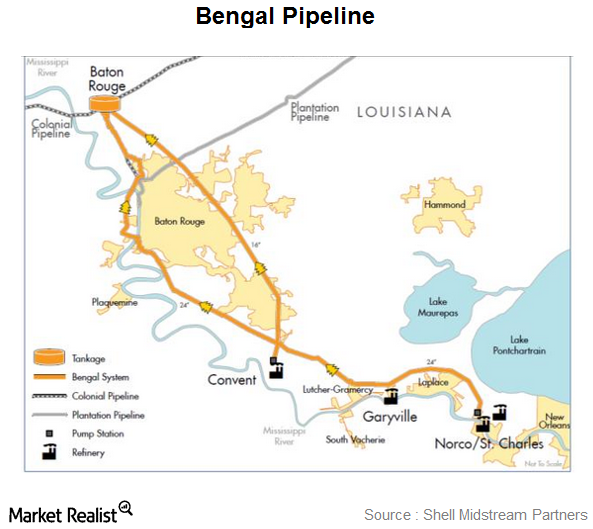

Shell Midstream Partners Refined Products Pipeline Systems

The Colonial pipeline system is the largest refined products pipeline in the US based on barrels per mile transported.

MPLX LP: The Midstream Link in Marathon Petroleum’s Chain

MPLX LP (MPLX) is a master limited partnership, or MLP. It was formed by independent refiner Marathon Petroleum Corporation (MPC).

Why Valero Energy benefits from export opportunities

Location-advantaged refiners like Valero Energy (VLO), Phillips 66 (PSX), and Marathon Petroleum (MPC), with refineries along the Gulf Coast, can export refined products.

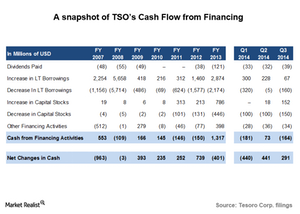

Tesoro’s cash flow from financing activities

Tesoro’s activities at the cash flow from financing level have been both a source and a destination for Tesoro’s cash over the years.

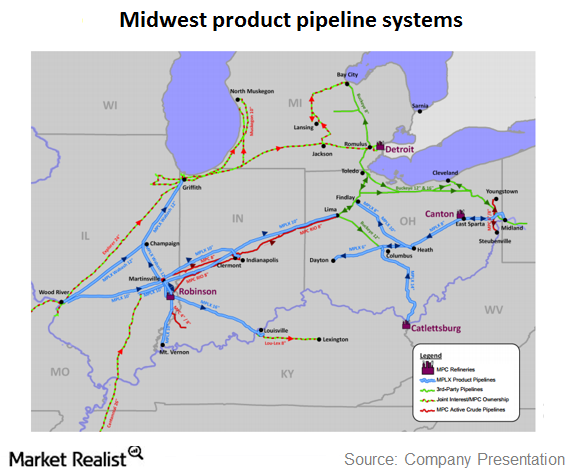

The MPLX Midwest product pipeline systems

Canton to East Sparta consists of two parallel pipelines that connect MPC’s Canton refinery with the MPLX East Sparta, Ohio, breakout tankage and station.

Soros Fund Management opens a new position in Marathon Petroleum

George Soros’ Soros Fund Management added a new position in Marathon Petroleum (MPC) that accounts for 0.45% of the fund’s 1Q 2014 portfolio.