Mead Johnson Nutrition Co

Latest Mead Johnson Nutrition Co News and Updates

Emerging Markets Drive Abbott’s Nutritional Business Growth

In 1Q17, Abbott Laboratories’ (ABT) Nutritional segment reported revenue of nearly $1.6 billion, a year-over-year (or YoY) fall of ~1%.

Mead Johnson Plans to Focus on R&D to Support Innovations

Mead Johnson follows a strategy of investments in innovation, having expanded its liquids portfolio and rolled out its key specialty formulas across Asia.

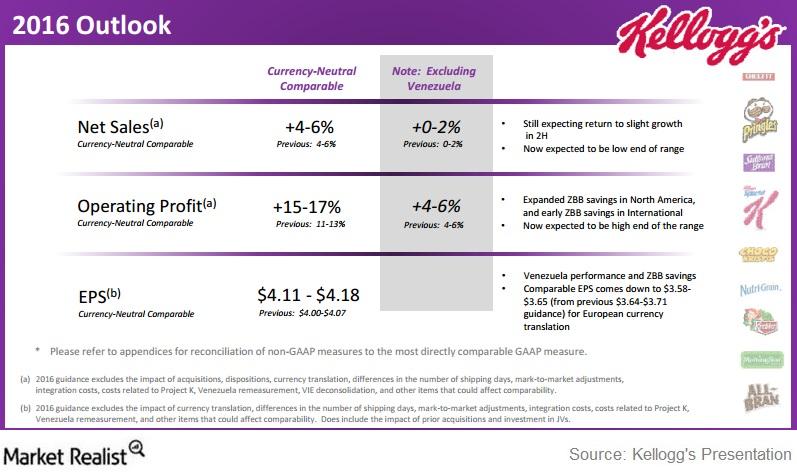

What Made Kellogg Update Its Fiscal 2016 Guidance?

In its fiscal 2Q16 earnings release, Kellogg stated that it expects its fiscal 2016 cash flow from operating activities to be ~$1.7 billion.

Analysts’ Ratings of Mead Johnson Nutrition after 2Q16 Earnings

On August 1, 2016, Mead Johnson Nutrition Company (MJN) was trading at $87.72. After 2Q16 earnings, the average broker target price for Mead Johnson Nutrition increased by 4% to $94.90 from $91.0.

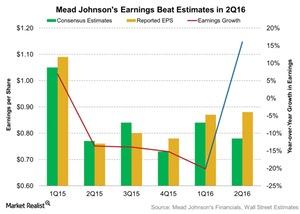

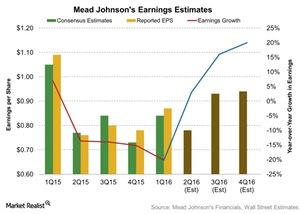

Why Did Mead Johnson Nutrition’s Earnings Rise 16% in 2Q16?

In 2Q16, Mead Johnson Nutrition’s (MJN) EPS (earnings per share) increased 16% to $0.88, compared to $0.76 in 2Q15.

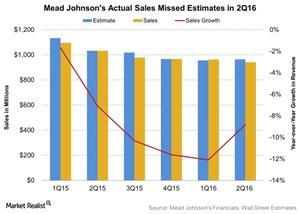

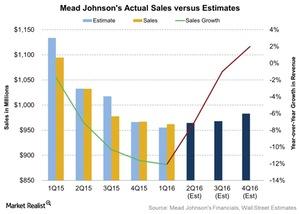

What Hurt Mead Johnson Nutrition’s Revenue in 2Q16?

In 2Q16, Mead Johnson (MJN) reported a drop in revenue of ~9% to $942 million, compared to revenue of ~$1.0 billion in 2Q15.

What Analysts Recommend for Mead Johnson ahead of 2Q16 Results

As of July 15, 2016, Mead Johnson (MJN) was trading at $91.38.

What Could Help Mead Johnson’s Earnings in 2Q16?

Analysts are expecting Mead Johnson’s adjusted EPS to be $0.78 compared to $0.76 in 2Q15.

What Will Hurt Mead Johnson’s 2Q16 Revenue?

Analysts are expecting Mead Johnson’s revenue to be $964 million for 2Q16. That’s a fall of 7% compared to 2Q15 revenues of $1.0 billion.

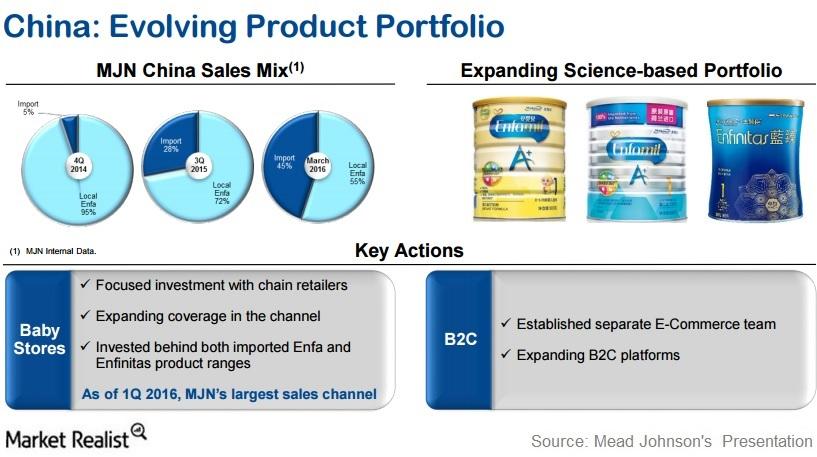

How Is Mead Johnson Improving Its Product Portfolio in China?

China accounts for around one-third of Mead Johnson’s global business.

How Has Mead Johnson Grown through Innovation?

Mead Johnson (MJN) participated and discussed some key strategies in the Deutsche Bank Global Consumer Conference held last month.

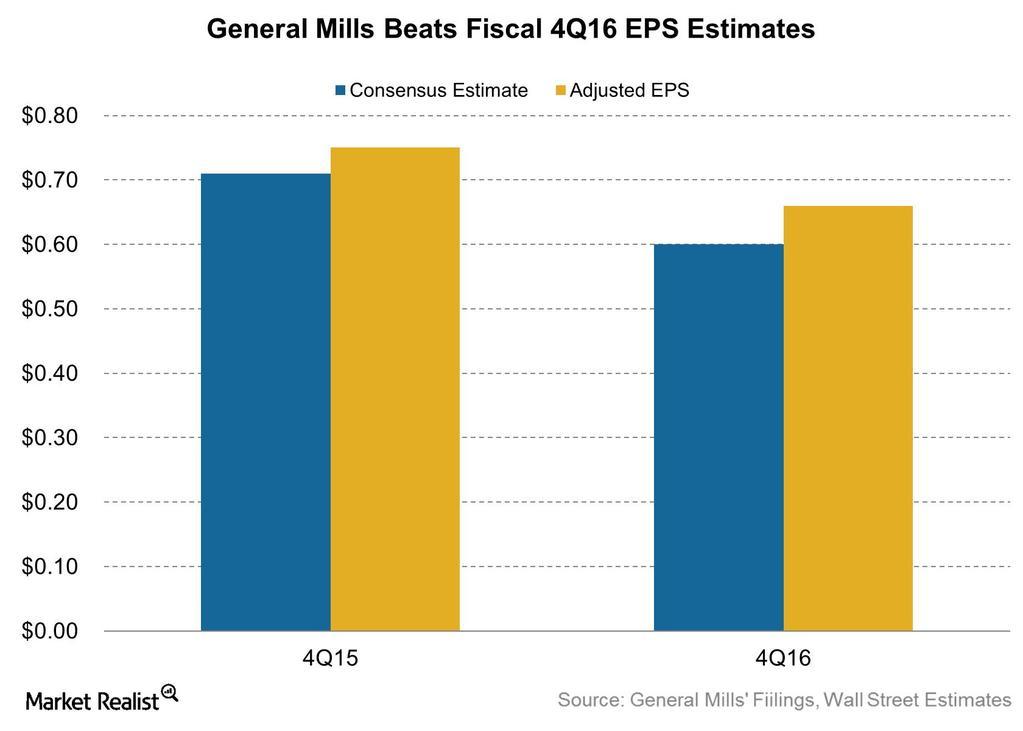

Why Did General Mills’ Earnings Fall in Fiscal 4Q16?

General Mills’ (GIS) fiscal 4Q16 earnings beat estimates by 10%. Adjusted EPS, however, declined 12% compared to fiscal 4Q15.

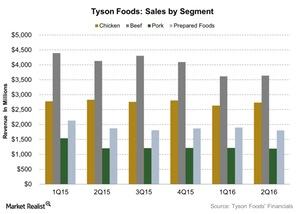

Chicken, Beef, or Pork: Which Segment Drove Tyson Foods’ Revenue?

In Tyson Foods’ Chicken segment, sales improved in 2Q16. The segment reported $2,737 million in net sales.

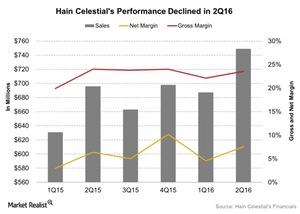

How Did Hain Celestial Perform in Fiscal 2Q16?

Hain Celestial Group’s (HAIN) fiscal 2Q16 had the strongest revenue performance in its history. The net sales for 2Q16 were $752.6 million.

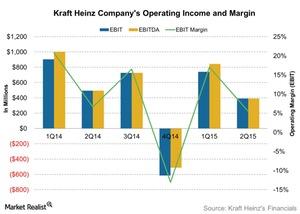

The Kraft Heinz Merger and Its Benefits

Pittsburgh-based H.J. Heinz Holding Corporation acquired Kraft Foods in October. After the merger, the company changed its name to Kraft Heinz.

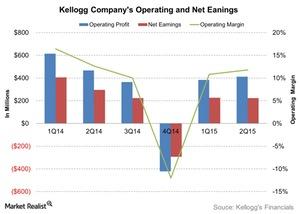

Kellogg’s Acquisitions and Their Benefits

The price of Kellogg’s acquisition of Diamond Foods is expected to reach over $1.5 billion, and Kellogg could offer the company between $35 and $40 per share.

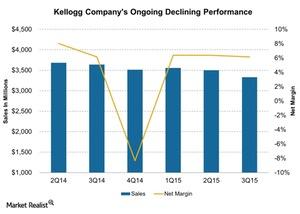

Kellogg Company’s Disappointing Performance in 3Q15

The Kellogg Company’s (K) net sales in 3Q15 fell 8.5% quarter-over-quarter to $3.3 billion due to the effect of currency translation. The company also missed analyst estimates of $3.4 billion in revenue.