Mobileye NV

Latest Mobileye NV News and Updates

Intel's Mobileye Self-Driving Unit Plans to Go Public

Self-driving system manufacturer Mobileye plans to go public after a recent filing. Why did Intel purchase Mobileye in the first place?

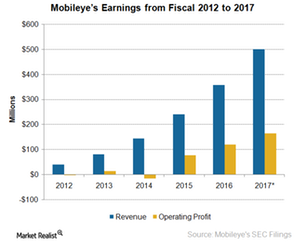

How the Acquisition of Mobileye Could Affect Intel’s Earnings

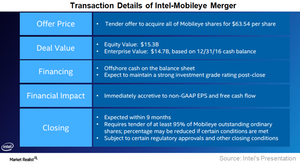

Intel (INTC) is acquiring Mobileye (MBLY) for $15.3 billion in order to grow in the autonomous vehicle market.

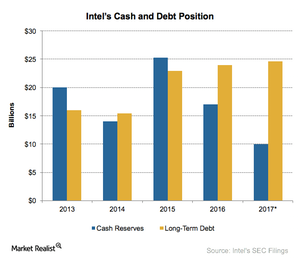

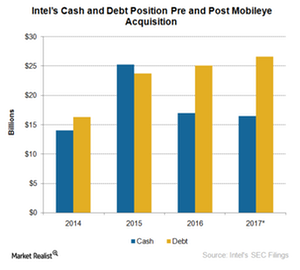

Should Investors Be Concerned about Intel’s Leverage?

Intel has long-term debt of $24 billion against cash reserves of $17 billion, resulting in net debt of $7 billion.

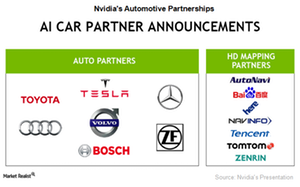

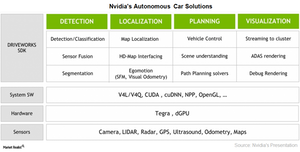

NVIDIA’s Strategy to Boost the Adoption of Autonomous Cars

NVIDIA is partnering with auto suppliers like Bosch, truck companies like PACCAR, and mid-tier carmakers like Toyota (TM) to increase the adoption of AI car platforms.

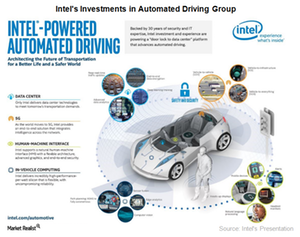

Behind Intel’s Transition into a Data-Centric Company

2017 started off slow for Intel (INTC) as it transitioned from being a PC-centric (personal computer) company to a data-centric company.

Could Intel Make the Mobileye Integration a Success?

Intel is looking to mitigate the integration risk by integrating its Automated Driving Group with Mobileye instead of integrating Mobileye into its business.

Intel’s History of Failed M&As: The Cause and the Impact

Intel (INTC) missed out on the mobile revolution, so now it’s trying to catch up, investing in areas such as autonomous cars and artificial intelligence.

Is Intel Taking a Huge Risk by Acquiring Mobileye?

The key risk Intel faces with the Mobileye acquisition is that Mobileye could fail to create an autonomous driving solution in time.

How the Mobileye Acquisition Could Impact Intel’s Earnings

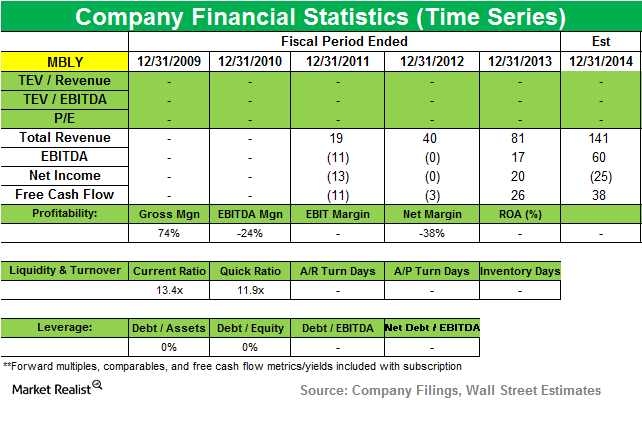

Intel (INTC) is acquiring Mobileye (MBLY) for a hefty premium compared to MBLY’s earnings.

What You Need to Know about the Intel-Mobileye Merger

Analysts are criticizing the Intel-Mobileye deal. They think the acquisition price is too high and the synergies from the merger are too low.

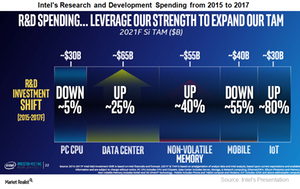

Where Is Intel Channeling Its Research and Development Efforts?

Intel (INTC) is in the midst of a major transformation, which makes Intel the top semiconductor R&D (research and development) spender in the world.

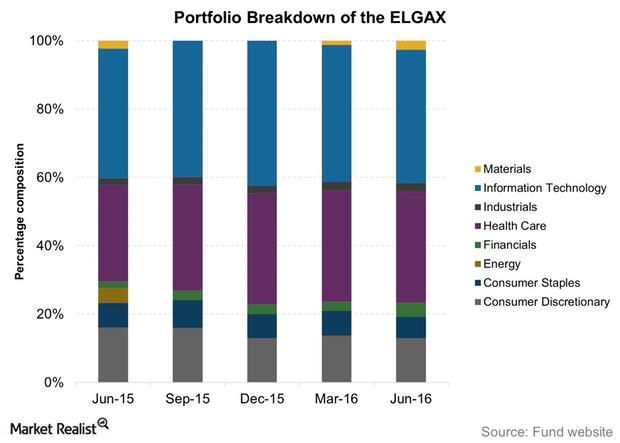

Columbia Select Large Cap Growth Fund: Sector Composition YTD 2016

The Columbia Select Large Cap Growth Fund (ELGAX) invests at least 80% of its assets in common stocks of US-based and foreign companies with market caps in the range of companies in the Russell 1000 Growth Index.

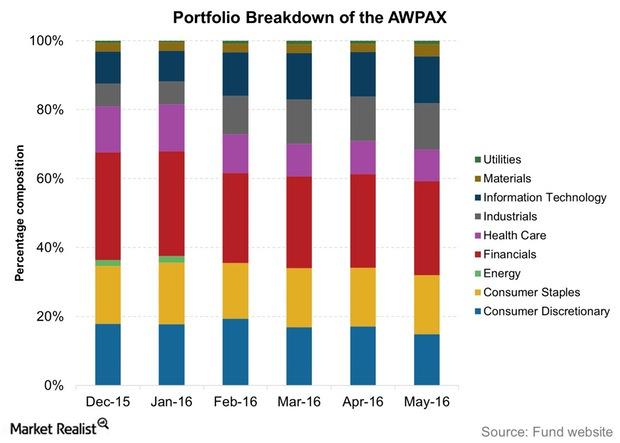

Portfolio Moves of the AB International Growth Fund in YTD 2016

The AB International Growth Fund’s assets were spread across 57 holdings in May 2016, and it was managing $334.2 million in assets.

Tiger Global starts new position in Mobileye

Mobileye, the Israel-based vehicle safety technology company, earned gross proceeds from its initial public offering of $1.023 billion.

Must-know: Tiger Global Management’s holdings in 3Q14

Tiger Global Management’s holdings included 48 stocks during the third quarter. The size of the fund’s US long portfolio fell slightly from $7.8 billion to $7.5 billion.