Marriott International Inc

Latest Marriott International Inc News and Updates

An Overview of Hyatt Hotels’ Competition

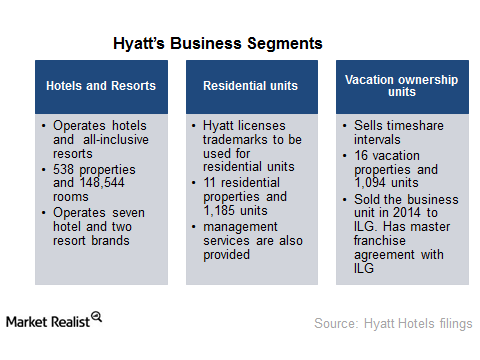

Some of Hyatt’s competitors—Hilton (HLT), Marriott (MAR), Wyndham (WYN), and Starwood (HOT)—compete in all the segments: Hotels and Resorts, Residential Units, and Vacation Ownership Units.

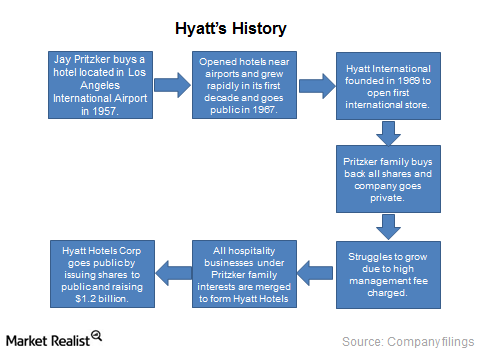

The Investor’s Introduction to Hyatt Hotels

A global hospitality group, Hyatt (H) operates industry-leading brands such as Park Hyatt, Andaz, Hyatt, Grand Hyatt, and Hyatt Regency. As of December 31, 2014, the company operated 587 properties with more than 155,000 rooms.

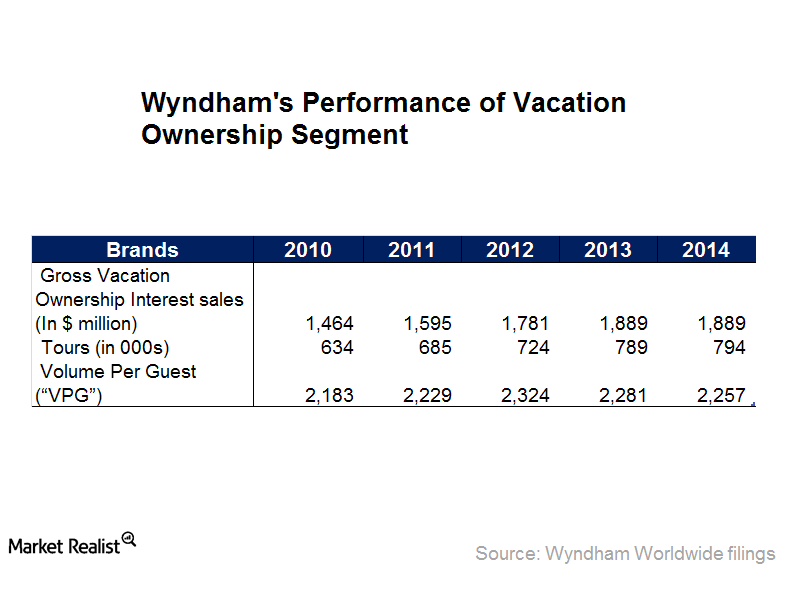

What’s Driving the Revenues of Wyndham Worldwide’s Vacation Ownership Segment?

Vacation unit sales rely on disposable income available to customers. The stable US economy and growing household incomes have positive impacts on Wyndham.

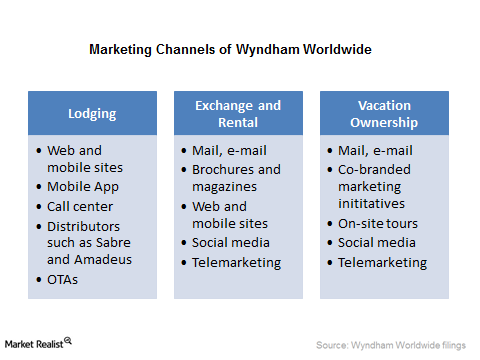

How Wyndham Uses Technology to Offer Greater Value to Its Clients

Wyndham invests in technology to improve its e-commerce capabilities and marketing abilities and to help it differentiate itself from competitors.

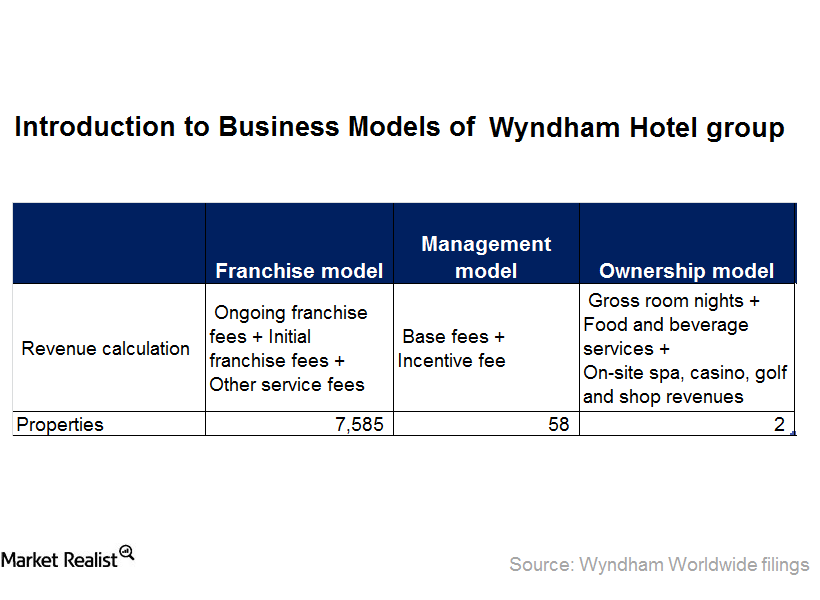

A Rundown of Wyndham Worldwide’s Wyndham Hotel Group Segment

Wyndham Hotel Group provides services under a franchise model but also offers professional oversight and operations support under a management model.

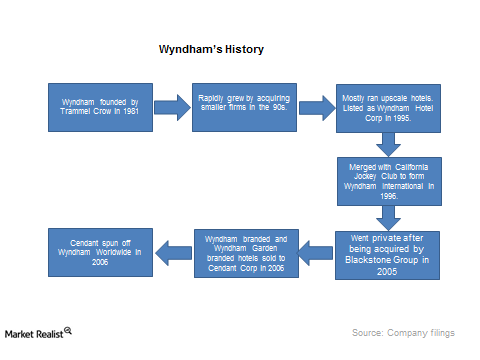

Introducing Wyndham Worldwide, a Hotel Super Power

Wyndham Worldwide is considered the world’s largest hotel franchiser. It owns the world’s largest vacation ownership and exchange network.

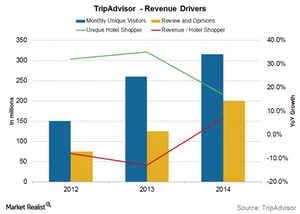

TripAdvisor’s Revenue Drivers for Its Largest Revenue Stream

What are the key revenue drivers of TripAdvisor’s (TRIP) click-based advertisement revenue? We can break them down into a few key metrics.

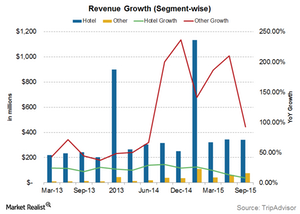

Which Segment Will Continue to Drive TripAdvisor’s Growth?

The hotels segment is TripAdvisor’s main segment, contributing about 82% of the company’s total revenues.

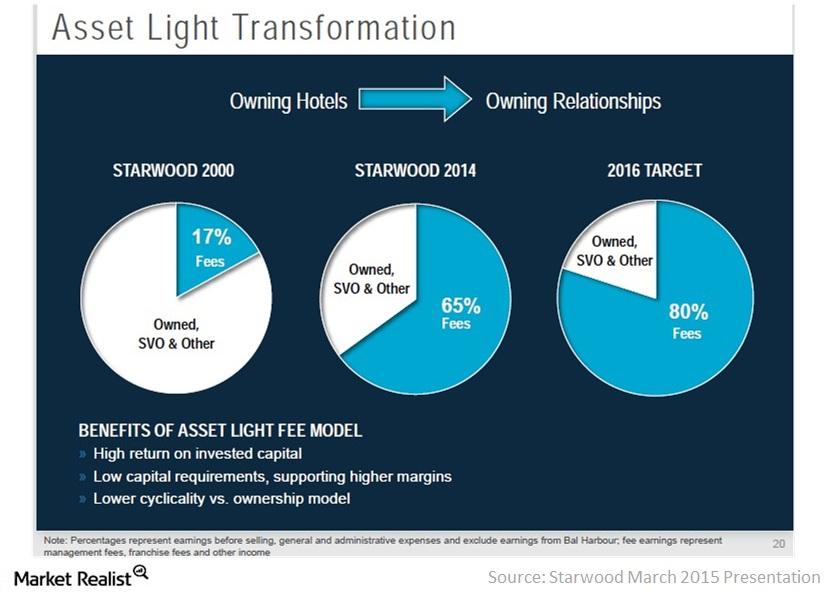

Analyzing Starwood’s Asset-Light Strategy

In 2006, Starwood’s management embarked on an asset-light strategy. It decided to sell a significant portion of Starwood’s owned hotel portfolio.

Starwood’s Vacation Ownership Business Spin-Off

On February 10, 2015, Starwood Hotels and Resorts announced plans to spin off its vacation ownership business into a separate publicly traded company.

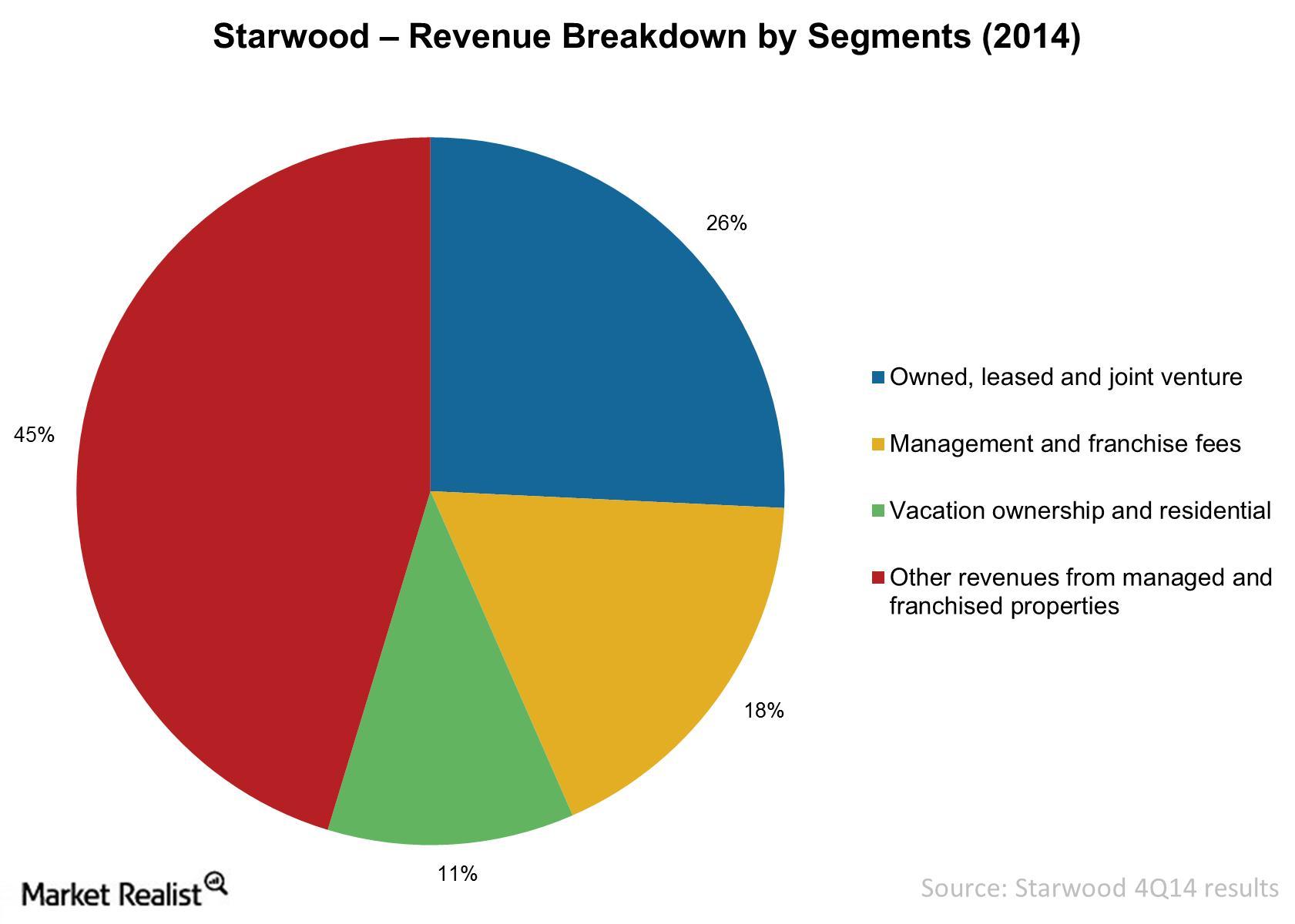

What Are Starwood’s Revenue Sources?

The revenue from owned, leased, and consolidated joint ventures is primarily derived from hotel operations. This includes room rentals and food and beverage sales.

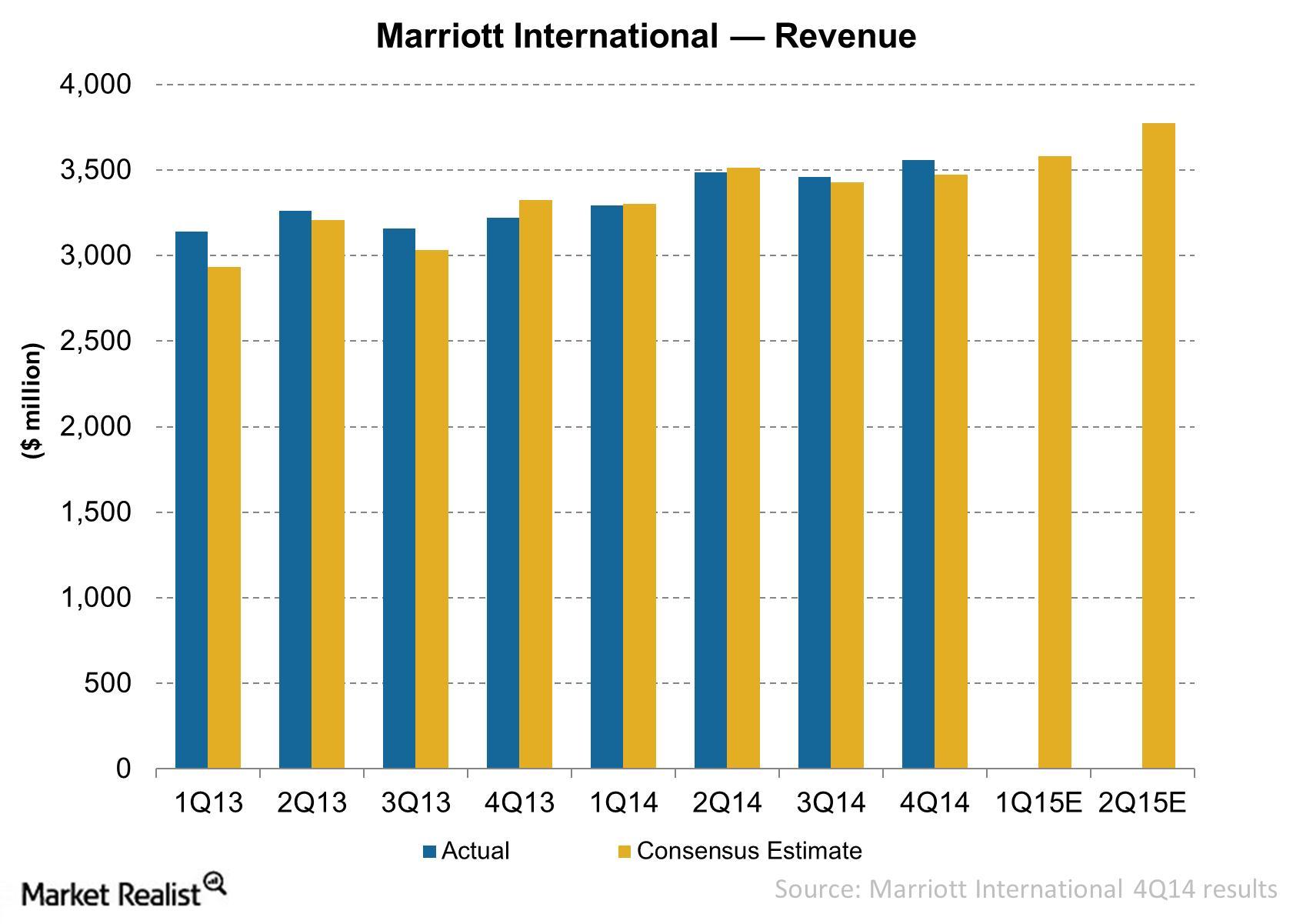

Why Marriott’s Revenue Increased in 2014

Marriott’s revenues totaled nearly $3.6 billion in the fourth quarter of 2014, compared to $3.2 billion in the fourth quarter of 2013.

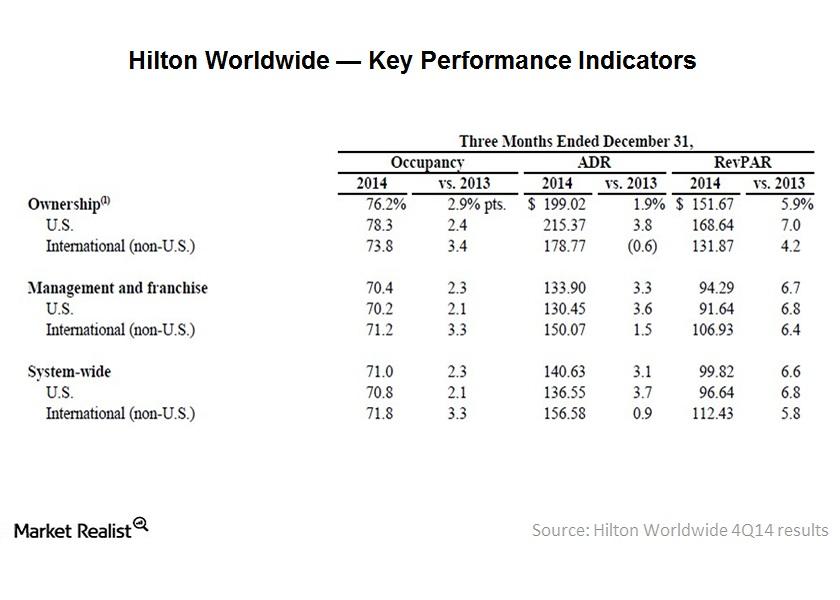

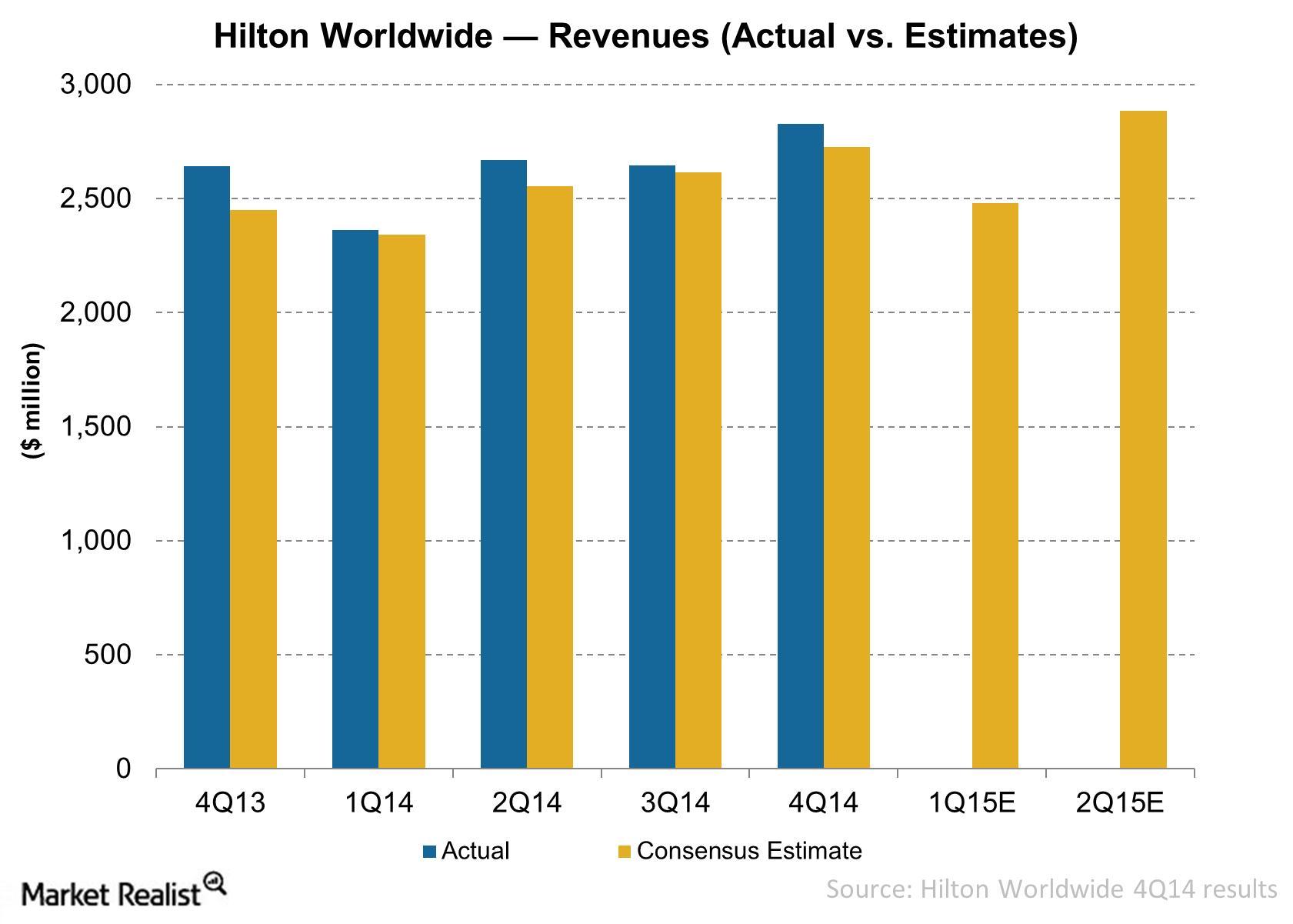

Hilton’s revenue was driven by occupancy and room pricing

Hilton Worldwide (HLT) generates revenue from its hotel operations. Hilton’s system-wide occupancy increased 2.3% YoY to 71% in 4Q14.

Why did Hilton’s revenue increase in 2014?

Hilton’s 4Q14 revenue increased 7% YoY to $2,828 million. For 2014, its revenue increased by 10.5 billion, or 7.9%—compared to 2013.Consumer Why Marriott’s hotels have a specific ownership structure

Marriott (MAR) operated a total of 3,916 hotel properties in fiscal year 2013. Most of these properties were either managed, franchised, or licensed.

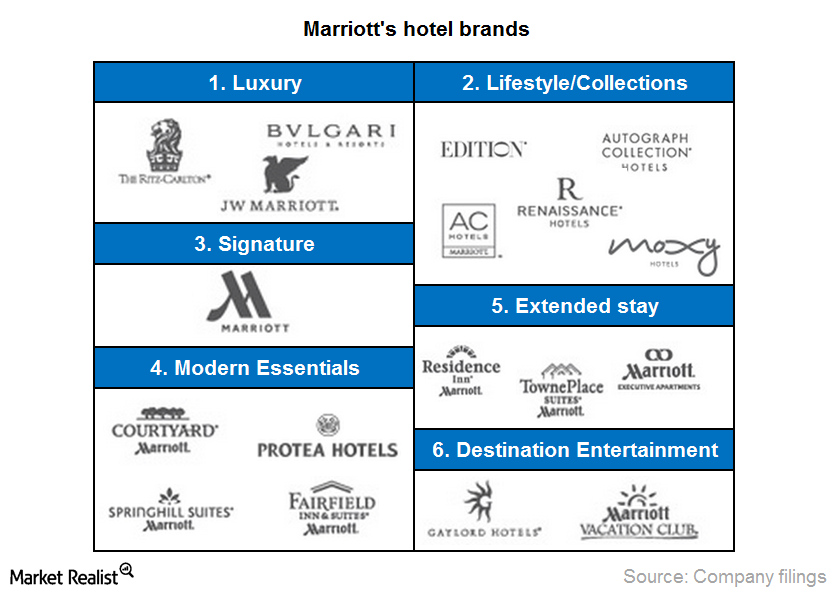

Why it’s important to understand Marriott’s brands

Marriott has a diverse portfolio of 18 brands. It describes the brands as “individually distinct and collectively powerful.”

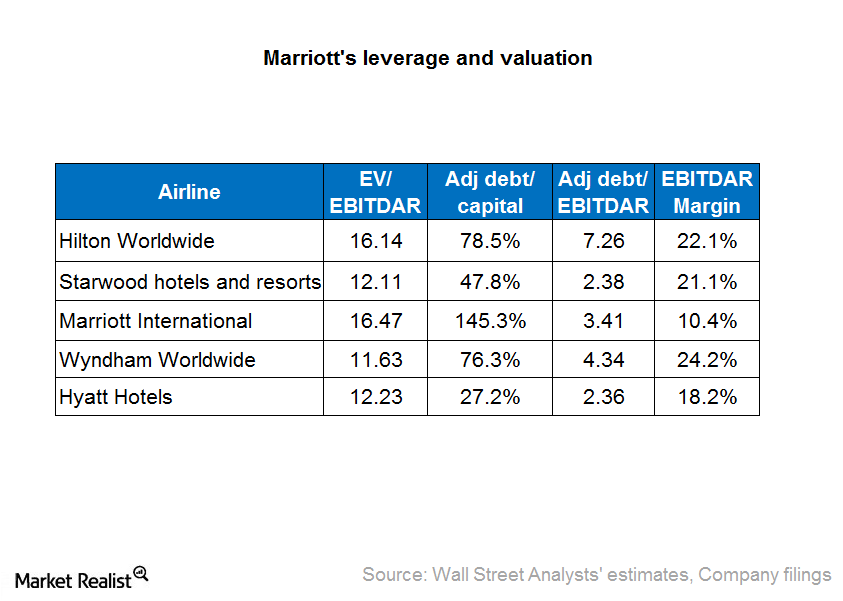

Why the EV/EBITDAR multiple is best for valuing hotel companies

The EV to EBITDAR multiple is used in businesses where there’s significant rental and lease expenses—hotels and airlines. We’ve used this to analyze Marriott’s valuation.Consumer Understanding Hilton’s operating cost

Hilton has operating expenses related to its owned and leased hotels and timeshare properties. This is separate from depreciation and amortization expenses.Consumer Key revenue drivers for the hotel industry

RevPAR is calculated by dividing hotel room revenue by the total available room nights. It’s used in the hotel industry to measure the company’s ability to generate greater revenue from each room.Consumer Must-know: Hilton gets revenue from its timeshare segment

Timesharing—also known as vacation ownership—is a method of getting the right to use a vacation property like a hotel or a resort. The buyer owns “timeshare interests” or intervals.Consumer A breakdown of Hilton’s revenue by segments

Timeshare revenue accounted for ~18% of total revenue from segments. The company generates revenue by marketing and selling timeshare interests and managing resort operations.Consumer Why Hilton expanded its presence in the international market

Hilton’s hotels, resorts, and timeshare properties are spread across 91 countries and territories. On December 31, 2013, Hilton’s portfolio consisted of 678,630 rooms.Consumer Hilton’s market share in the domestic and international market

Hilton’s growth plans are measured by the number of rooms under construction. Its growth plans rank first in the industry in all its markets—domestic and international.Consumer Why InterContinental Hotels’ “asset-light” strategy drives growth

The company said on its website that its “business model is focused on franchising and managing hotels, rather than owning them, enabling us to grow at an accelerated pace with limited capital investment—we call this ‘asset light.’