Kimco Realty Corp

Latest Kimco Realty Corp News and Updates

GGP and Other Retail REITs Struggle to Exist in Digital Era

During 1Q17, General Growth Properties’ (GGP) occupancy rate (same-store leased percentage) fell to 95.9% from 96.6% in 1Q16.

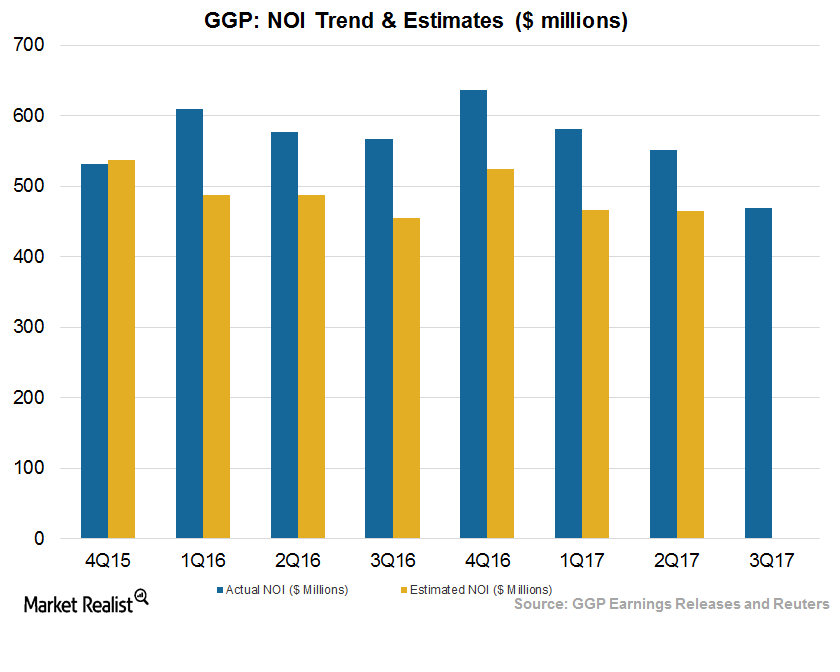

How GGP Managed Its Expenses in 2Q17

In 2Q17, GGP (GGP) reported NOI (net operating income) of $551.0 million, which came in higher than the previous year at $554.0 million.

Simon Property Group faces competition from online retailers

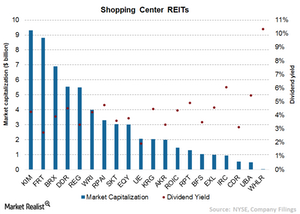

Simon Property Group is by far the biggest shopping center REIT in the U.S., with a market capitalization of $53 billion. The next biggest REITs are less than half Simon’s size.

Shopping Center REITs Are Sensitive to Economic Cycles

Shopping center REITs mainly own and operate shopping centers that are smaller than retail malls. They’re mainly driven by higher consumer spending.

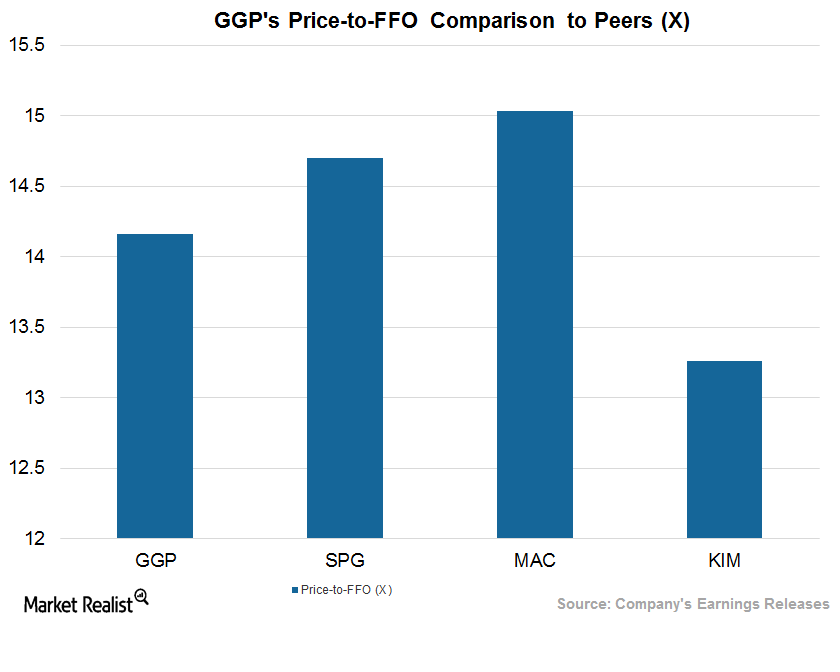

How GGP Stacks Up against Its Peers after 2Q17

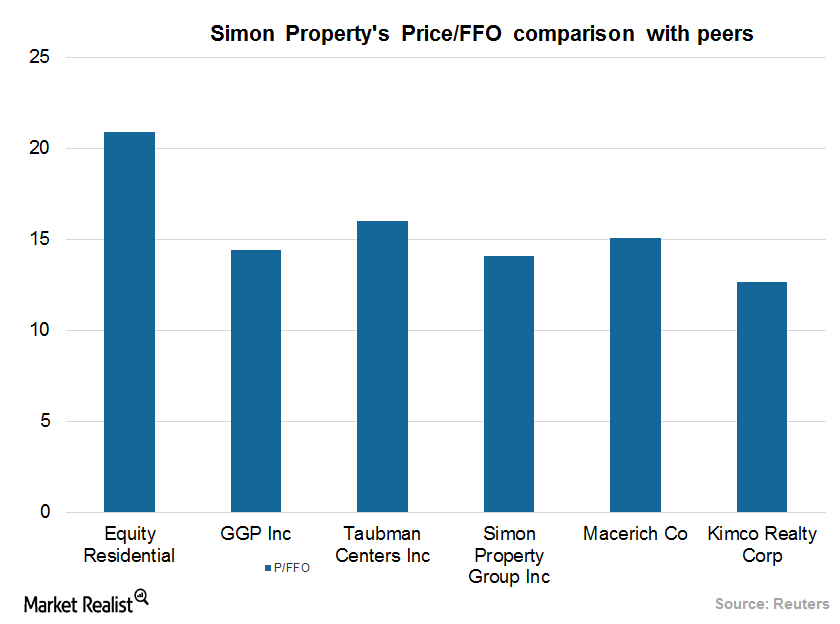

GGP’s estimated price-to-FFO multiple for fiscal 2018 is 14.2x, which is at a premium compared to its peers.

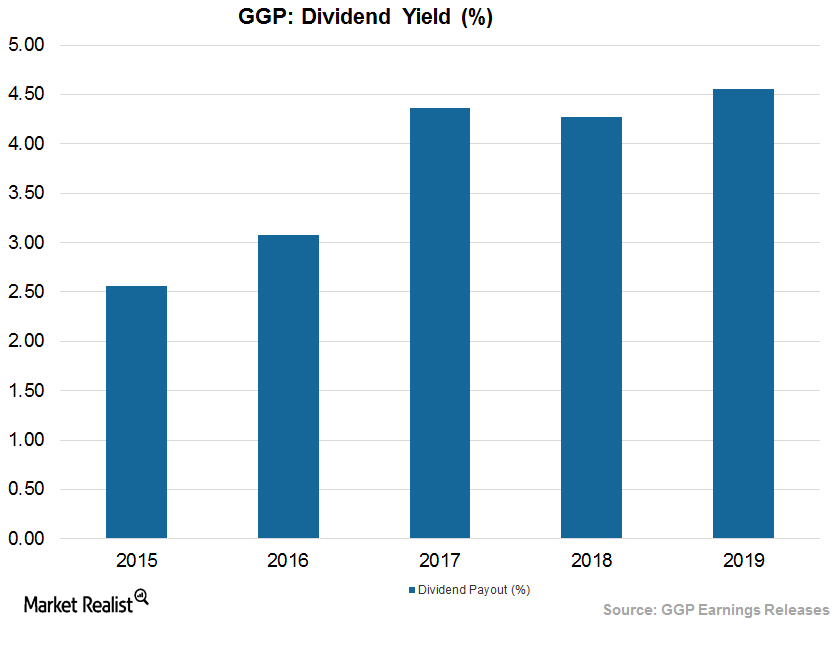

GGP’s Generous Return to Stockholders in 2Q17

In 2Q17, GGP (GGP) paid $17.5 million in dividends to its shareholders. That was higher than $13.3 million paid a year ago.

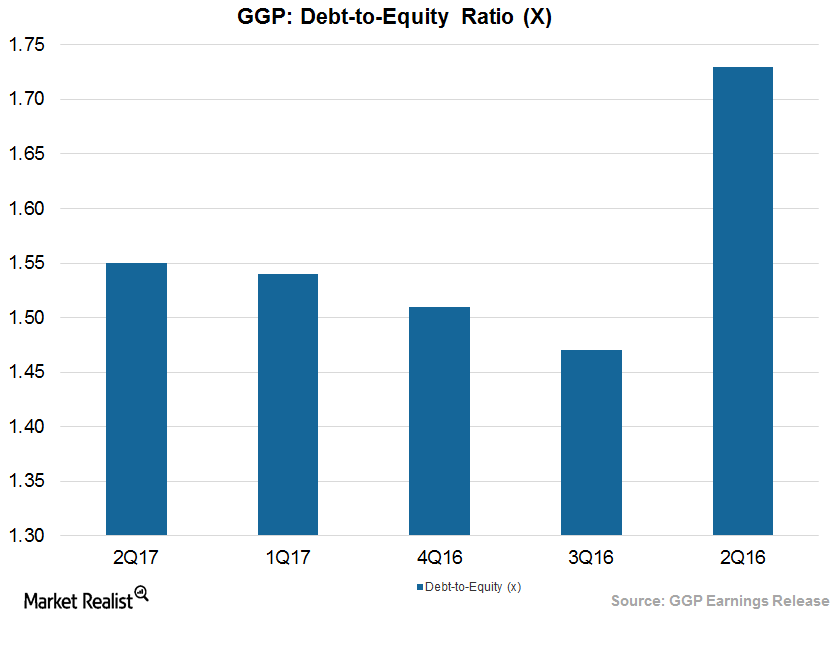

GGP Has High Debt-to-Equity Ratio as of 2Q17: Can It Be Lowered?

GGP maintained a debt-to-equity ratio of 1.55x for 2Q17. That was higher than the industrial mean of 1.07x.

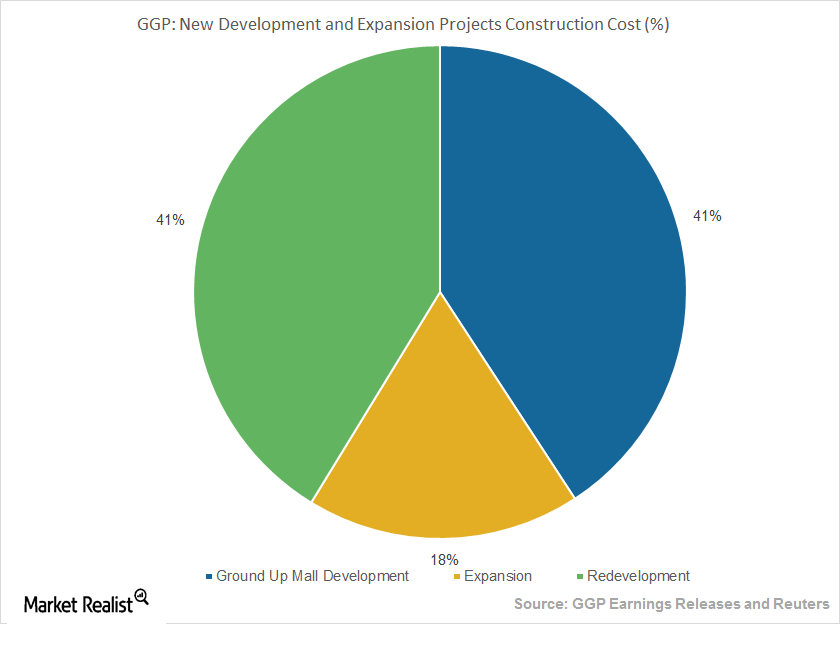

GGP Grew in 2Q17 Due to Development and Redevelopment

GGP has redeveloped its vacant spaces for non-retail uses such as restaurants, entertainment zones, fitness centers, and grocery stores.

What Caused GGP’s Soft Rent Growth in 2Q17?

GGP’s (GGP) minimum rent fell by $17.0 million in 2Q17, mainly because of dilution resulting from the sale of an interest in the Fashion Show Mall in Las Vegas n 2016.

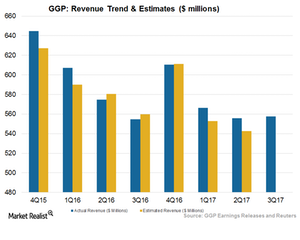

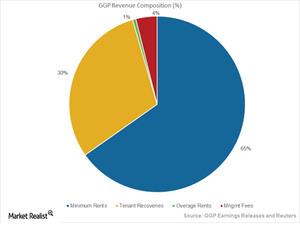

GGP’s Revenue Rode High in 2Q17, Backed by New Leases

GGP’s minimum rent fell 3.9% to $349.2 million, and tenant recoveries fell 4.6% to $161.9 million. Overage rent fell 25.0% to $3.3 million.

GGP’s 2Q17 Results from an Investor’s Perspective

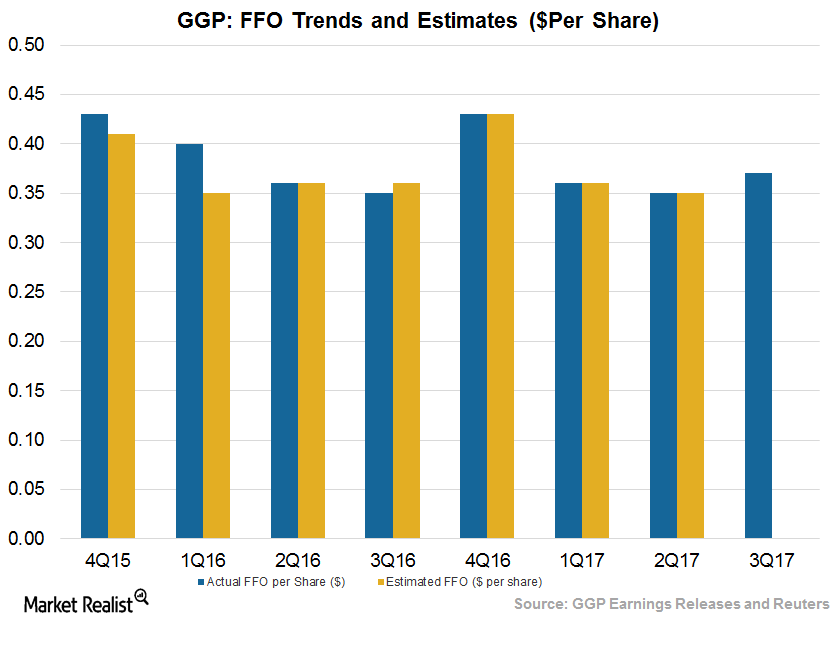

GGP (GGP) reported funds from operations (or FFO) of $0.35 per share, which was in line with Wall Street estimates. Adjusted FFO remained flat year-over-year.

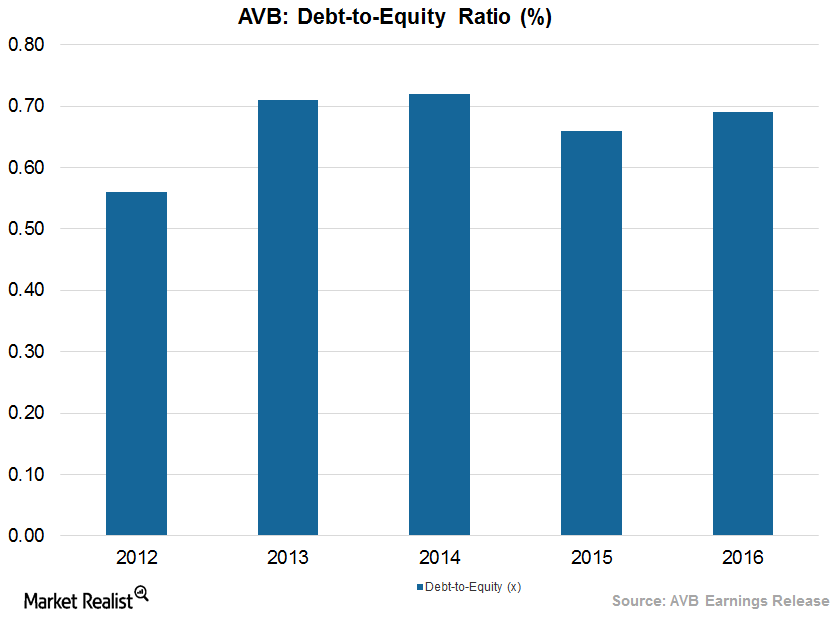

How AvalonBay Communities Leverages Its Balance Sheet

AvalonBay has been able to maintain a low debt-to-equity ratio in the last five years. The company reported a debt-to-equity ratio of ~1.5x in 1Q17.

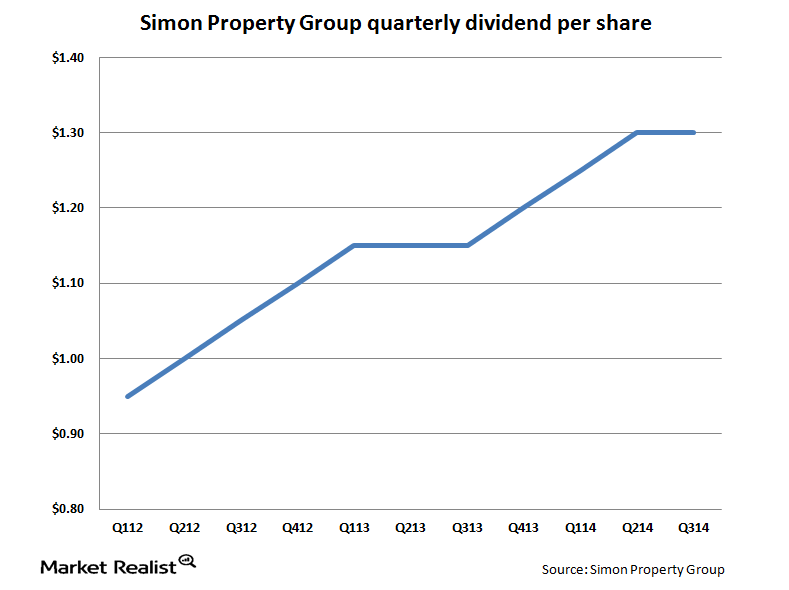

Investing in Simon Property Group: Relative Valuation

Simon Property Group’s current price-to-FFO multiple is ~14.1x.