iShares JPX-Nikkei 400

Latest iShares JPX-Nikkei 400 News and Updates

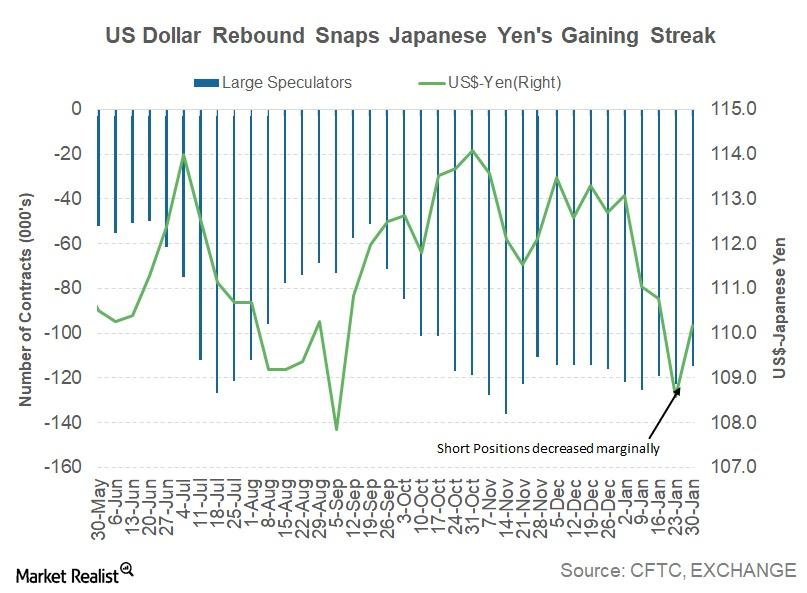

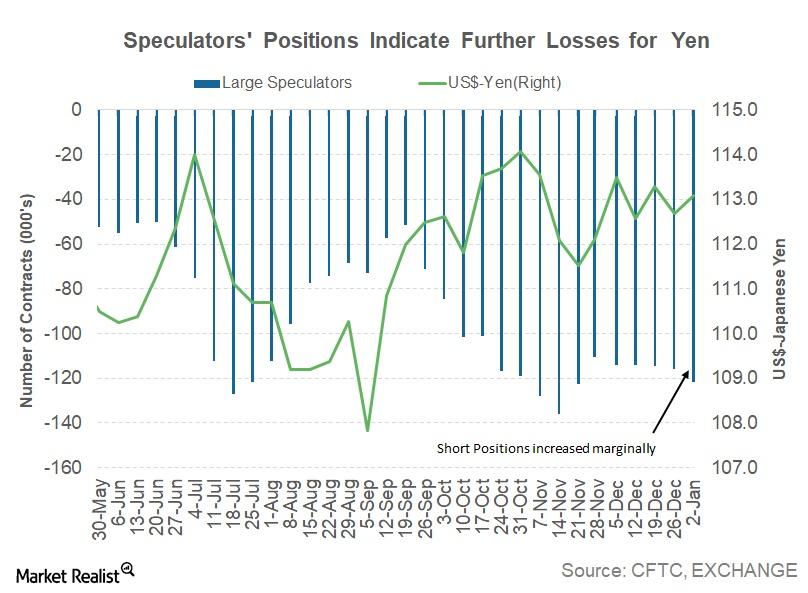

Why the Yen Depreciated against the Dollar

Last week, the Japanese yen (JYN) succumbed to the US dollar’s strength. The Japanese yen (FXY) closed the week at 110.67.

Why the Japanese Yen Depreciated against the Dollar Last Week

The Japanese yen (JYN) retracted against the US dollar last week as US dollar bulls tried to take control.

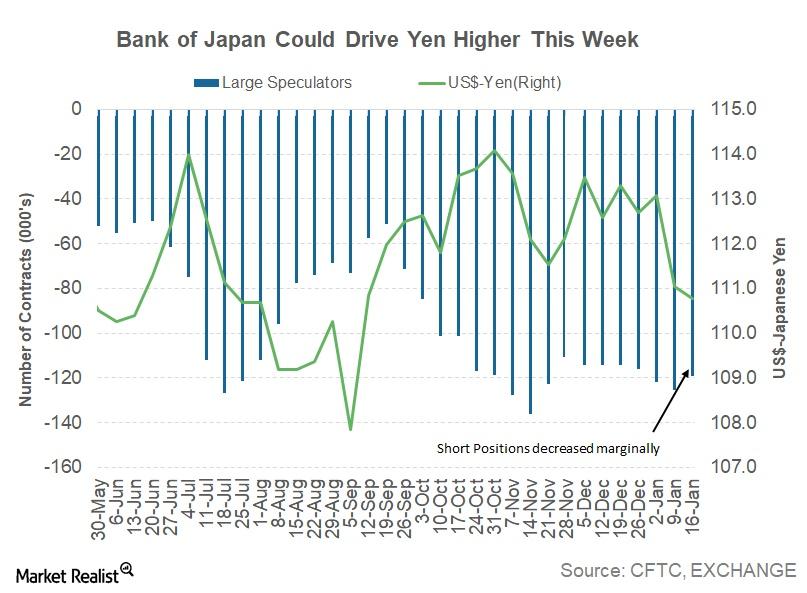

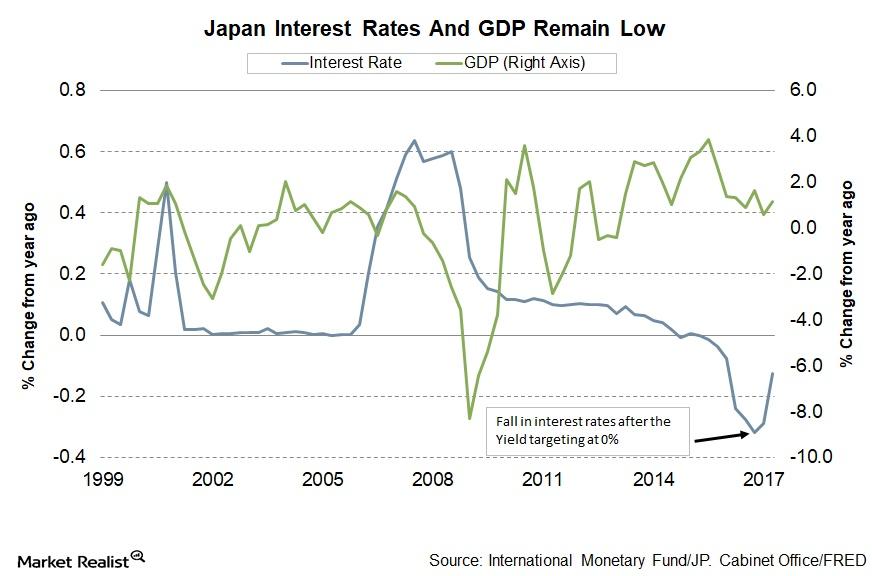

Could the Bank of Japan Drive the Yen Lower this Week?

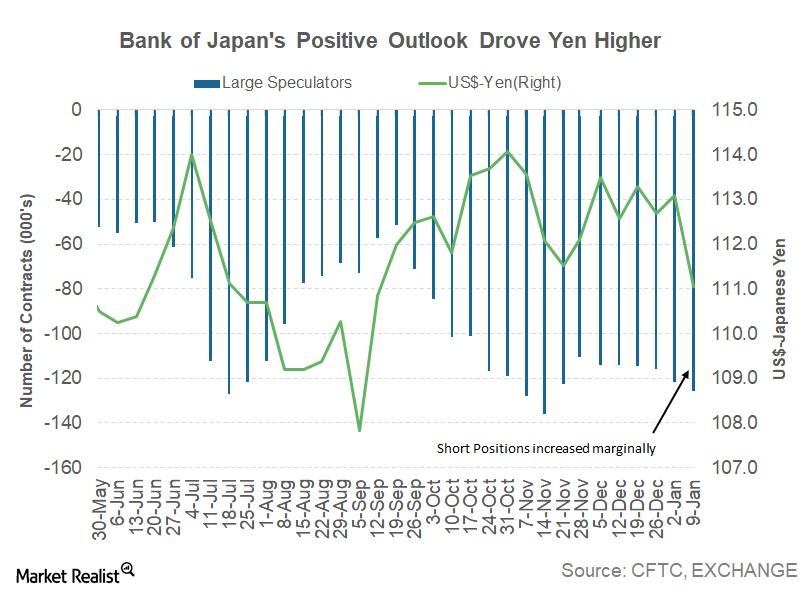

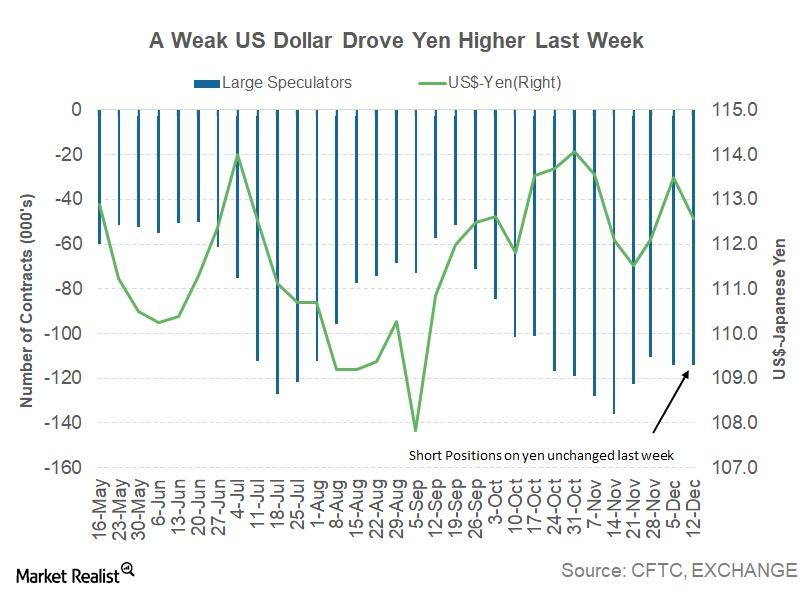

The Japanese yen (JYN) registered its second consecutive weekly gain against the US dollar.

Why the Japanese Yen Finally Appreciated against the US Dollar

During the week ended January 12, the yen (FXY) closed at 111.04 against the US dollar (UUP), compared to 113.08 in the week ended January 5, appreciating by 1.8%.

Can the Japanese Yen Rise against the US Dollar?

The Japanese yen (JYN) is the only currency that is unable to capture the weakness in the US dollar (UUP).

How the Bank of Japan Could Have an Impact on the Yen This Week

For the week ended December 15, the Japanese yen (FXY) closed at 112.58 against the US dollar (UUP), appreciating by 0.79%.

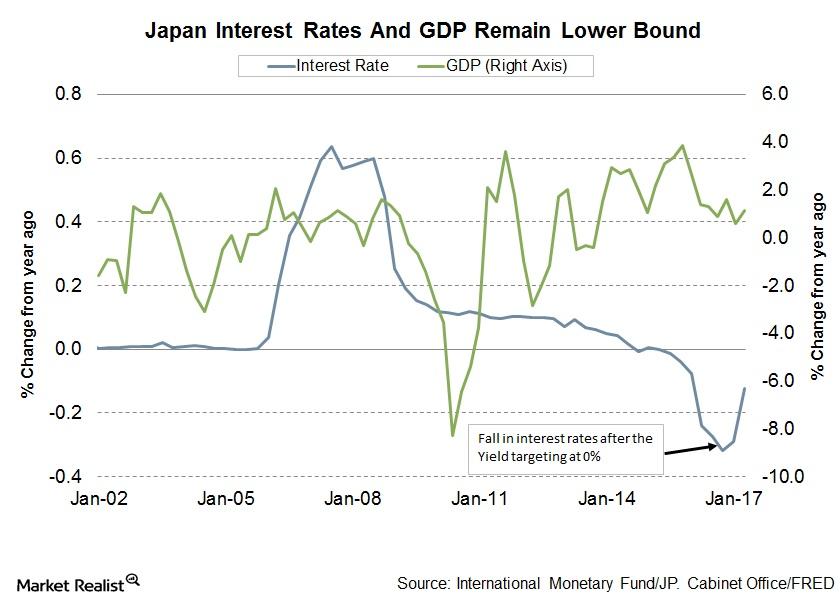

Bank of Japan: No Changes in the October Policy Meeting

At its October policy meeting, the Bank of Japan left its ultra-loose monetary policy unchanged. The decision was made by an 8-1 majority vote.

Update on the Bank of Japan’s September Policy Meeting

The Bank of Japan left its policy unchanged at its September meeting. By an 8–1 majority vote, the policy board decided to leave its policy and its QQE with a yield curve control unchanged.

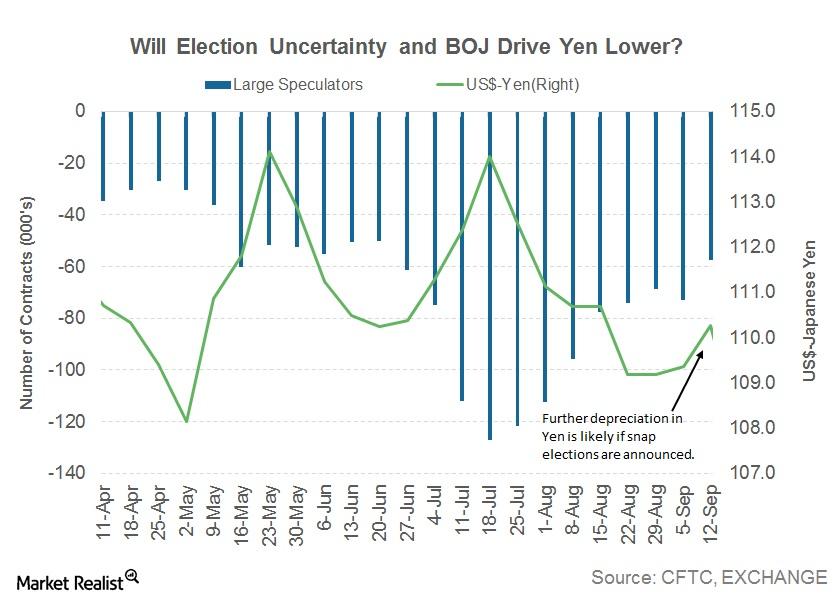

Will Election Uncertainty Drive the Japanese Yen Lower?

The Japanese yen (JYN) continued to depreciate against the US dollar last week.

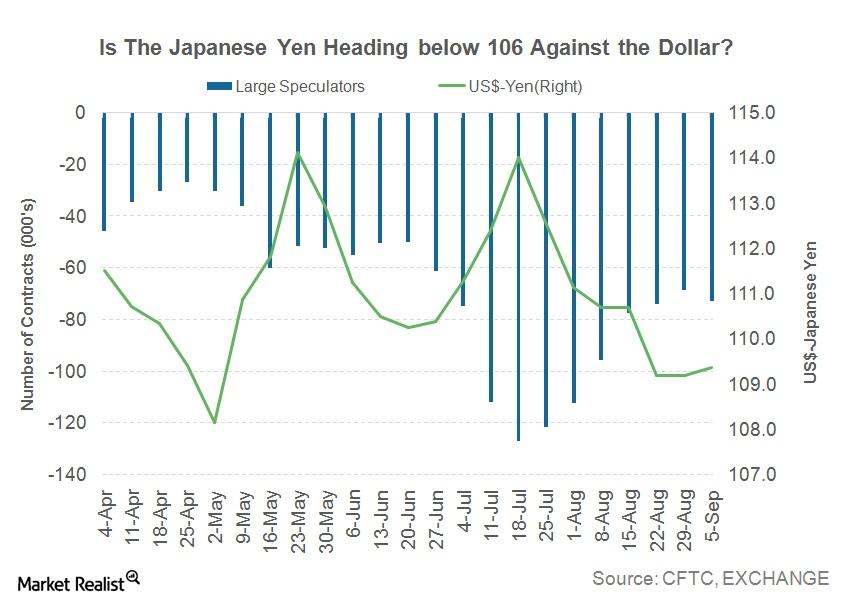

What Drove the Japanese Yen below 108 Last Week?

The Japanese yen gained ground against the US dollar last week, closing at 107.8 against the US dollar, which appreciated 0.56%.

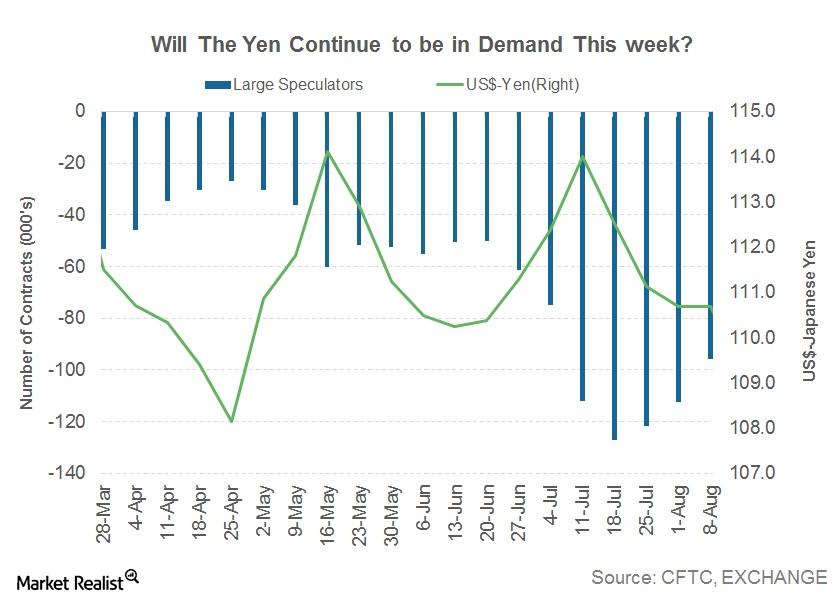

Will the Japanese Yen Appreciate Further This Week?

The Japanese yen (JYN) was back in demand as geopolitical tensions took center stage last week.

The Japanese Yen Could Keep the US Dollar Company

Another week of appreciation The Japanese yen (JYN) had another positive week, posting gains of 1.3% and closing at 111.12 against the US dollar (UUP). The previous week’s close for the currency pair was 112.53. This strength was primarily driven by the US dollar, rather than positive news from the Japanese economy. Most of the […]

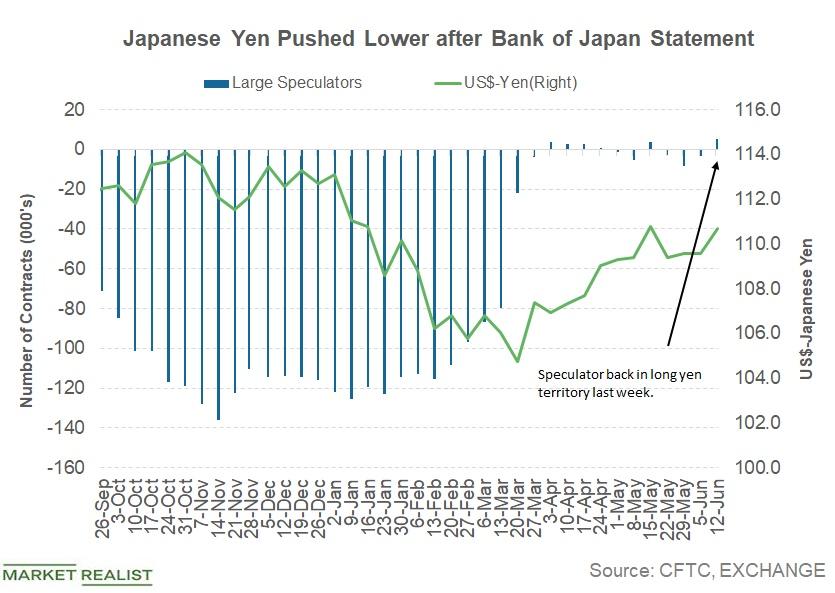

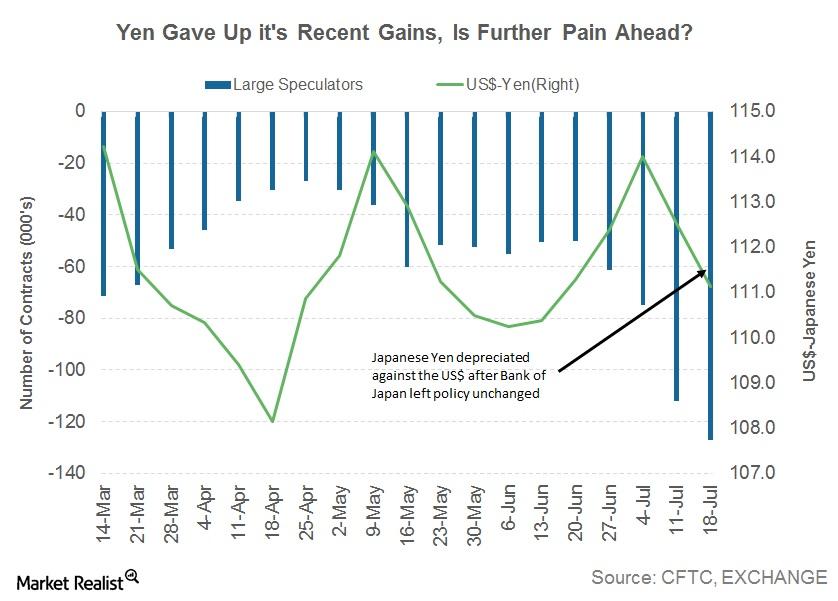

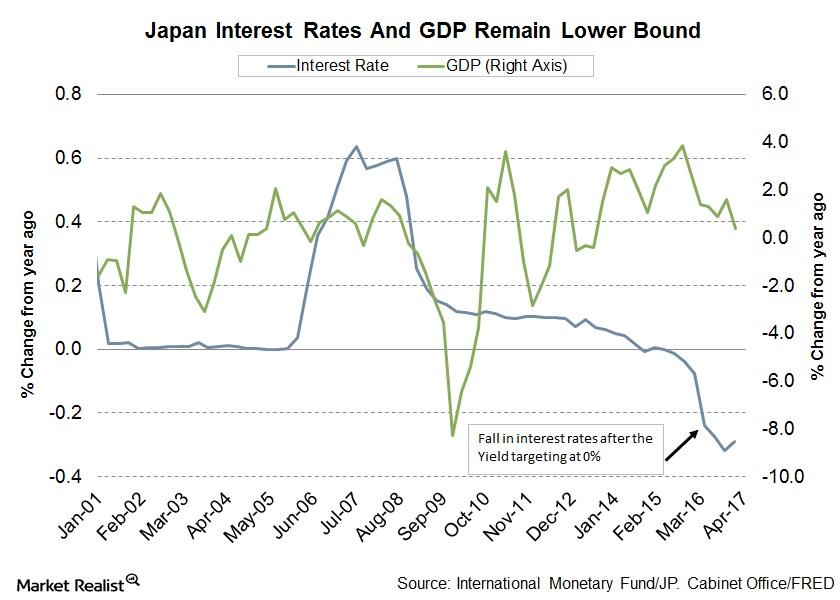

The Bank of Japan Cuts Its Inflation Forecast

According to the statement it released at the end of its two-day meeting on July 20, 2017, the Bank of Japan has left its monetary policy unchanged.

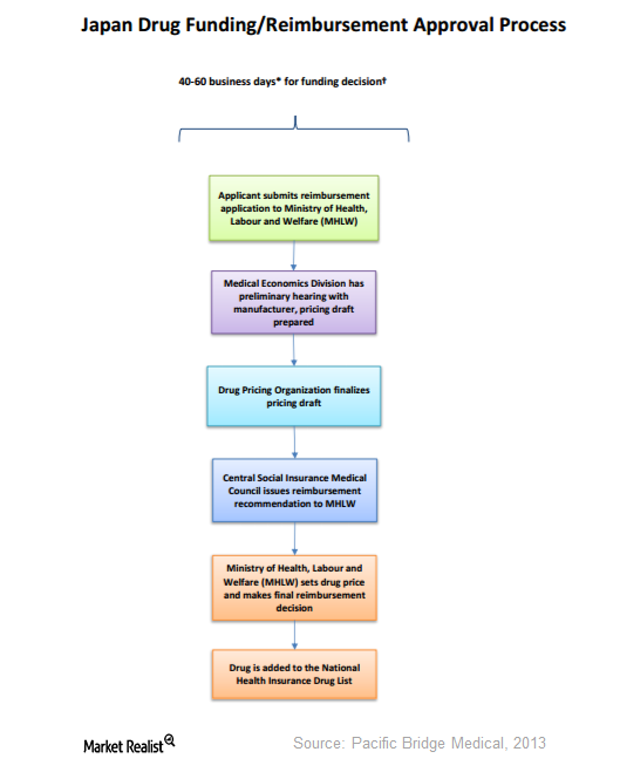

How Are Drugs Priced in Japan?

The NHI revises drug prices every two years. During fiscal 2016, a 6.8% reduction in drug prices is expected.