SPDR® Barclays High Yield Bond ETF

Latest SPDR® Barclays High Yield Bond ETF News and Updates

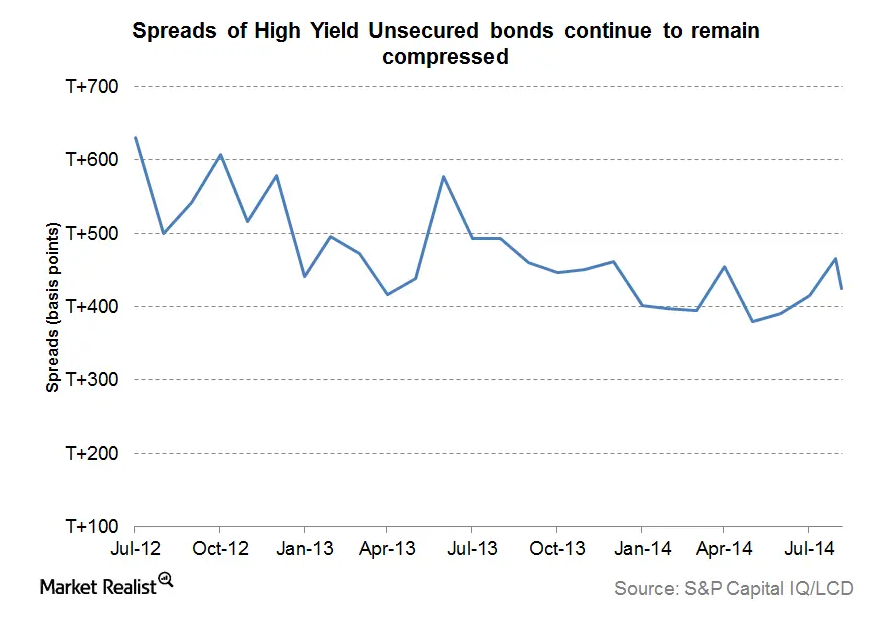

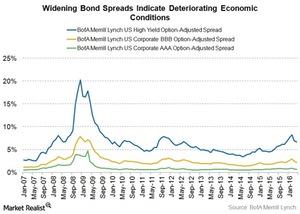

Why tight credit spreads usually mean a period of global expansion

Today, most measures of credit conditions are positive, with tight spreads across all of fixed income. Even high yield spreads have come in after a short scare last month.

When The Net Asset Value Of A Bond ETF Differs From Market Price

The Intraday Indicative Value gives us a more real-time value than the bond ETF’s NAV. It’s considered an implied value of an ETF.

The Difference between Corporate Bonds and Treasuries

Bond investors should understand the difference between Corporate Bonds and Treasuries. Below is a list of the key differences between the two.

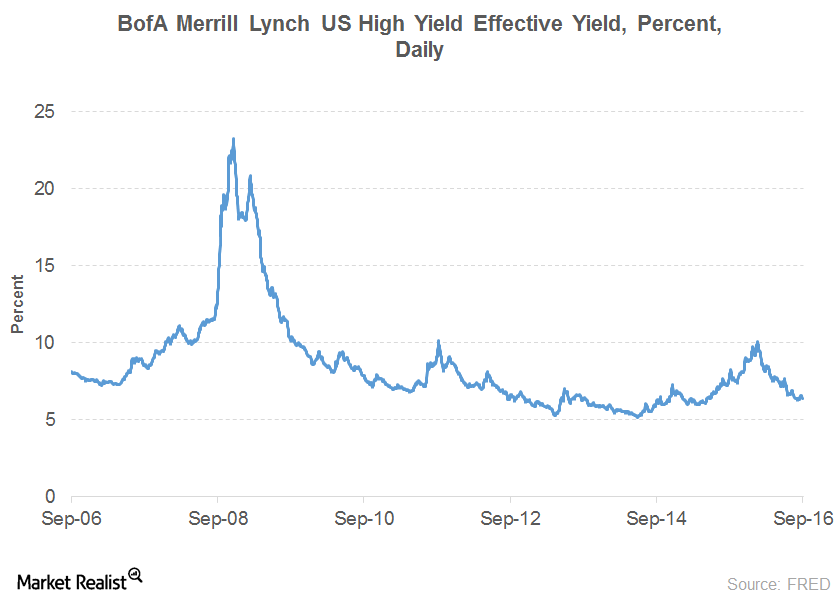

High-Yield Bonds Are Turning Out to Be the Real Winners

High-yield bonds gained popularity due to higher yields compared to Treasury bonds, whose yields were being pushed down by the Fed’s interest rate policy.

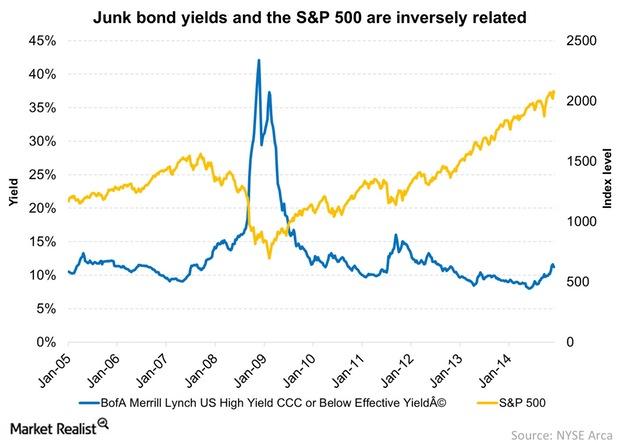

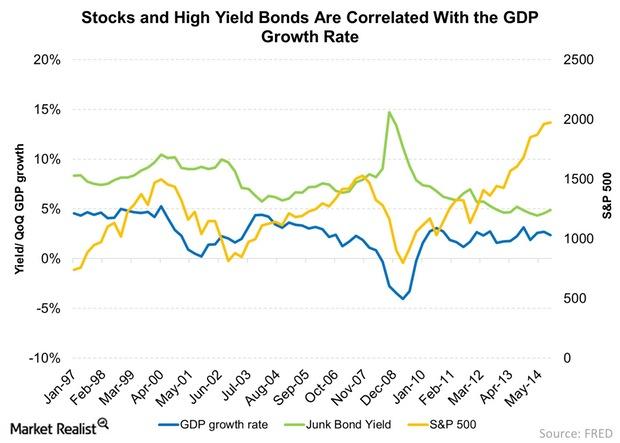

Connection Between Equities And High Yield Bonds

Equities and high yield bonds perform well when the economy is improving, and both underperform when the economy is slumping.Financials An investor’s guide to the US leveraged financial market

According to the Securities Industry and Financial Market Association, SIFMA, the total U.S. fixed income market size is about $38.6 trillion.

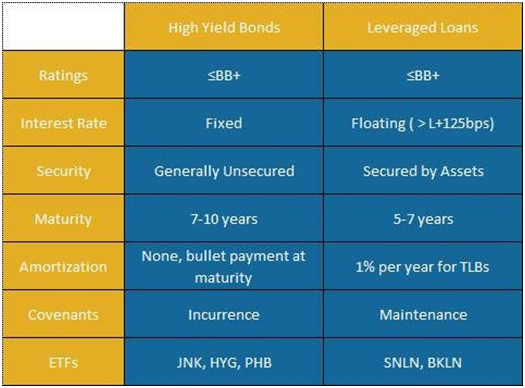

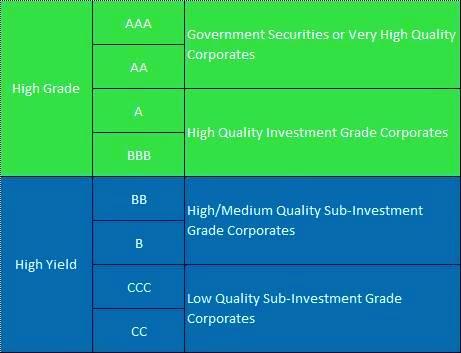

Comparing leveraged loans and high yield bonds: Credit rating

Credit rating measures the credit-worthiness of a debtor with respect to its financial and operational stability. Rating agencies such as Moody’s and Standard & Poor’s specialize in rating credit to government agencies and corporates.Financials Comparing leveraged loans and high yield bonds: Key distinctions

Leveraged loans (BKLN) are almost always secured or backed by a specific pledged asset or some form collateral. On the other hand, high yield bonds (JNK) may be secured or unsecured.Financials Comparing leveraged loans and high yield bonds: Debt terms

Another item that differentiates leveraged loans from high yield bonds is “covenants,” or the financial health metrics that issuers must adhere to.

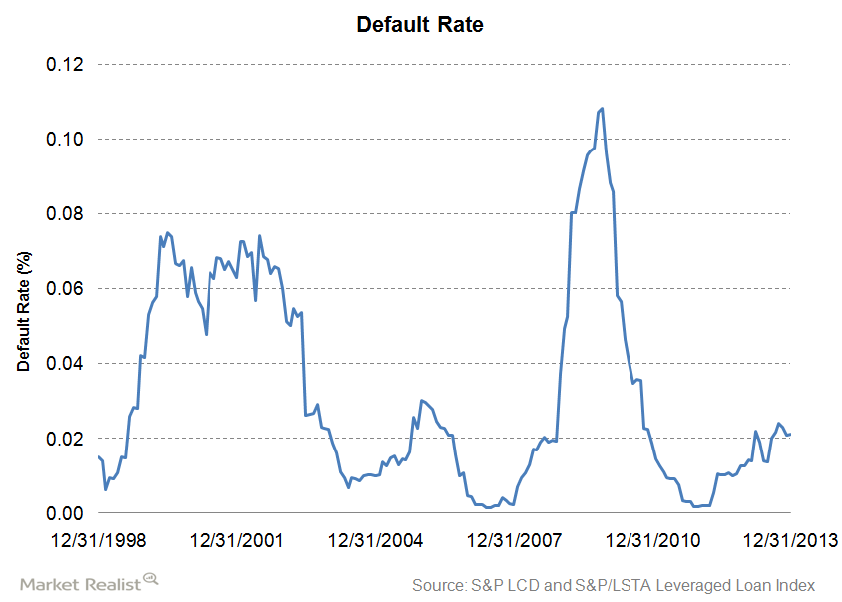

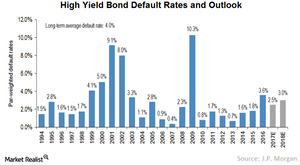

The default rate and its relation to bond and loan prices

Default rate is a key metric of credit risk and is defined as the risk that the counterparty will default on its financial obligations.

Must know: How credit rating affects default rate and bond price

A lower credit rating means higher risk, and therefore, higher yield as investors look for the premium to take the risk and vice versa.

What Do Widening Bond Spreads Indicate?

Widening spreads indicate a slowing economy. Since companies are more likely to default in a slowing economy, credit risk related to their bonds rises.Financials Must-know: The difference between high-yield and leveraged loans

Historically, high-yield securities have outperformed investment grade securities in good times and vice versa in hard times.

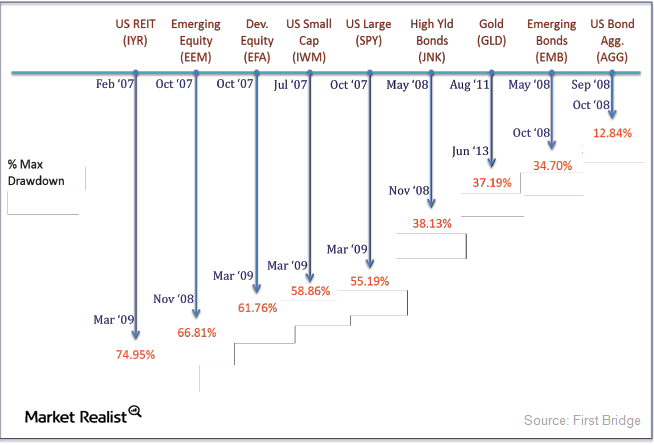

Must-know: Minimizing ETF losses by observing max drawdowns

In practice, asset owners (both retail and institutional) want to avoid significant portfolio drawdowns even if the benchmark index declines.Financials Investing in fixed income: What motivates bond investors?

We can understand the investment objectives of fixed income investors in terms of returns, risks, and constraints. There are two categories of investors.

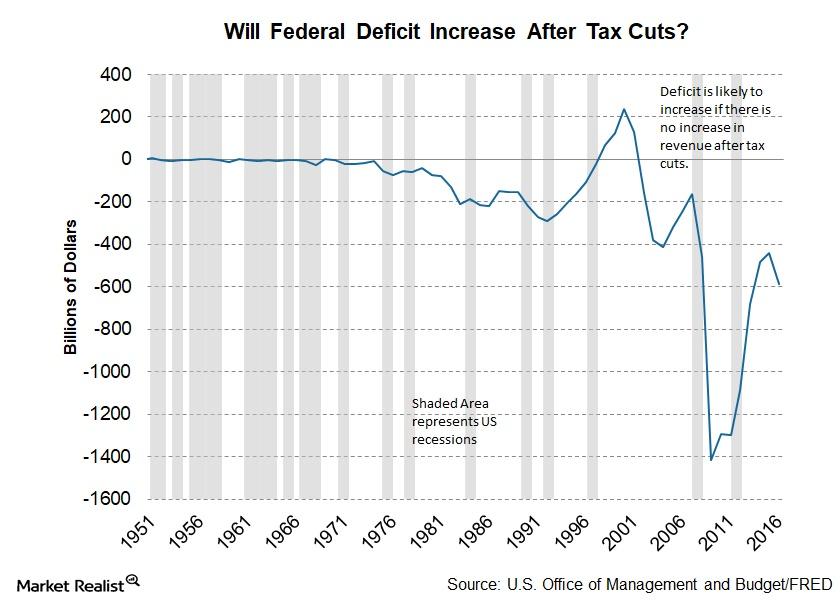

How Will Tax Cuts Impact the Federal Deficit?

The report from the Joint Committee on Taxation included an estimate of budgetary deficits for 2018–2027. Tax reforms could have a limited impact in 2018.

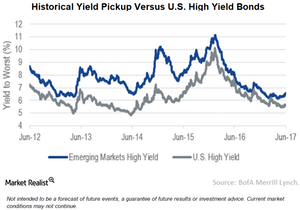

How to Benefit from Emerging Markets Corporate Debt

VanEck Higher Yield and Lower Duration Compared to U.S. high yield bonds, emerging markets high yield bonds offered a 90 bps yield pickup as of June 30, 2017.[1.U.S. high yield bonds and emerging markets high yield bonds are represented by BofA Merrill Lynch US High Yield Index and BofA Merrill Lynch Diversified HY US Emerging […]

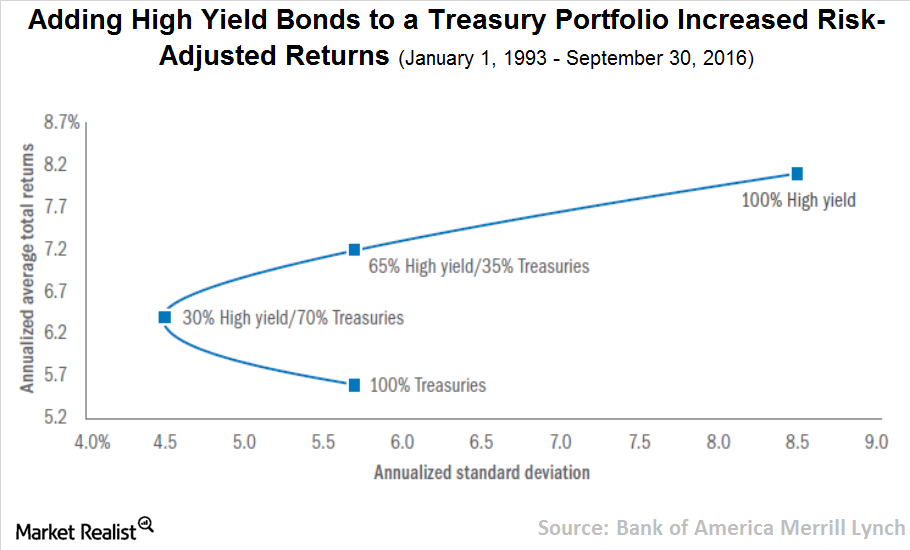

Why High-Yield Bonds Are Needed in a Portfolio

AB Summing It Up High-yield bonds present an alternative for investors at an uncertain crossroads. Equity valuations seem attractive based on some measures, but volatility has led many investors to search for ways to temper the risk in their portfolios. At the same time, bonds—a popular risk reducer—are less attractive than normal due to extremely […]

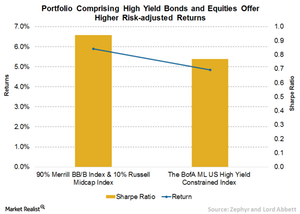

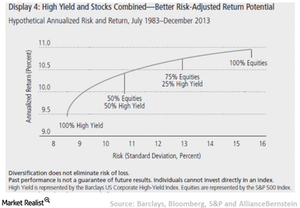

What Role Do High Yield Bonds Play in a Portfolio?

AB High Yield in the Portfolio Framework Given their higher risk levels, we’d expect that stocks would continue to outperform high yield over the long run. However, high-yield bonds have clearly demonstrated that they bring much to the table if they’re combined with stocks in a carefully designed and maintained portfolio. But not every investor […]

How Portfolio Rebalancing Boosts Overall Returns

AB Rebalancing in the Tails Because stocks have been so much more volatile than high yield, periodic portfolio rebalancing tends to occur during performance extremes—the “tails” in return distributions—when the gap between high-yield and equity returns is wide. This magnifies the “buy-low, sell-high” effect that rebalancing contributes to a portfolio’s performance. Of course, the gaps […]

How High-Yield Bonds Can Help Reduce Risk

AB A Place at the Asset-Allocation Table For investors seeking to control volatility in their equity portfolios while still maintaining return potential, high-yield bonds could represent an effective solution. A typical approach to moderating equity volatility is to reallocate assets to the greater stability of investment-grade bonds, or even cash. But this can exact a […]

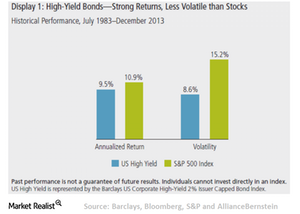

Why High Yield Bonds Are an Effective Match with Equities

AB Keeping Pace with Equity Returns over Time In fact, when we widen the lens to take in the last three decades, high-yield bonds have nearly matched equity performance. And they’ve done it with much lower volatility. Since July 1983, stocks have produced an annualized return of 10.9% (Display 1). High-yield bonds have nearly equaled […]

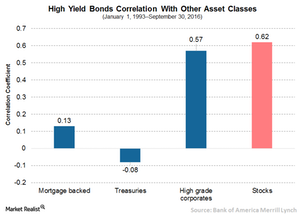

How High-Yield Bonds Are Connected to Other Asset Classes

AB Looks Are Deceiving But even though high-yield bonds look like other bonds, they don’t necessarily act like other bonds. This insight can have important implications for how investors consider them in an overall portfolio context. High-yield performance patterns, for example, don’t track those of other fixed-income sectors very closely over the long term. Looking […]

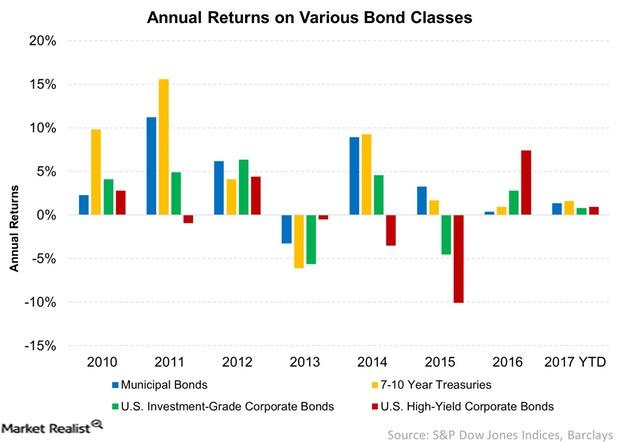

The Many Uncertainties Municipal Bonds Face in 2017

Municipal bonds were the worst-performing bond class in 2016 after solid returns in 2014 and 2015, and high-yield bonds (JNK) outperformed.

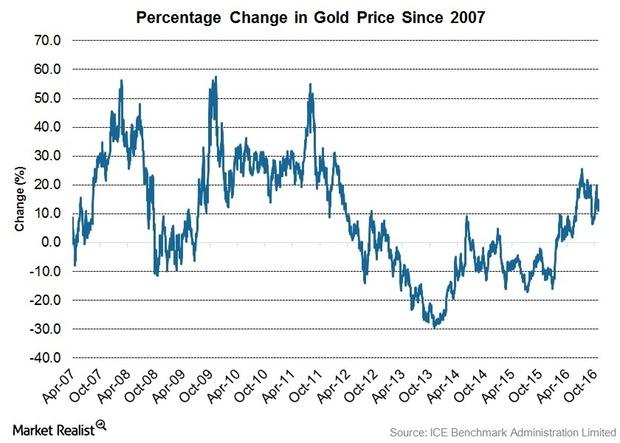

Bull Market: Expected for Gold, Not for Bonds

Long-Term Outlook Remains Positive for Gold Bull Market Our view on the long-term gold price is unchanged. We see the recent weakness as a consolidation phase within what we believe is the early stages of the next bull market for gold. We continue to believe dislocations created by the unconventional policies being implemented by central […]

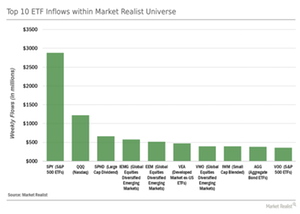

Category Flows: Looking for Yield? Be Picky!

The rise of the actively selective investor becomes more nuanced within the context of our entire ETF universe.

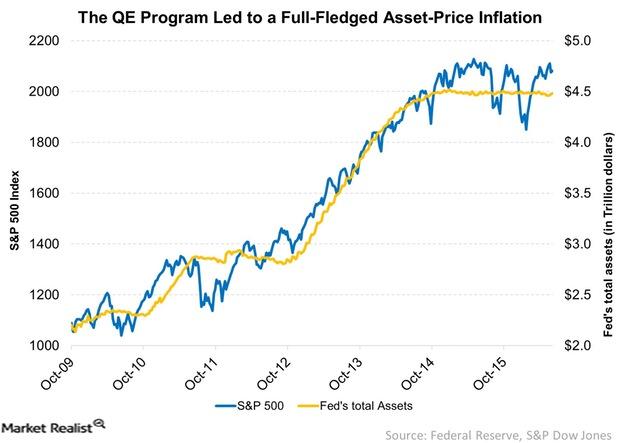

How Central Banks ‘Create’ Inflation

A QE program doesn’t just create inflation; it causes asset prices to rise as well. After the financial crisis of 2008, the Fed resorted to an ultra-accommodative monetary policy.

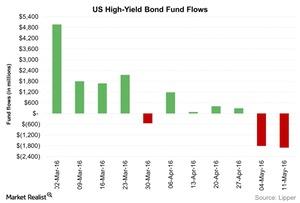

How Did High Yield Bond Fund Outflows Do Last Week?

Investor flows into high yield bond funds were negative last week for the second consecutive week. Net outflows from high yield bond funds totaled $1.9 billion.

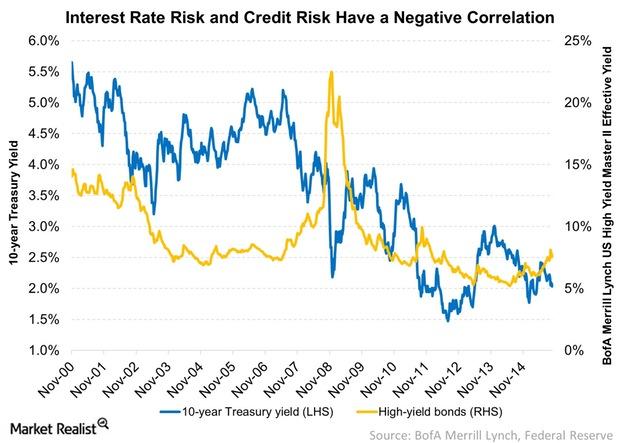

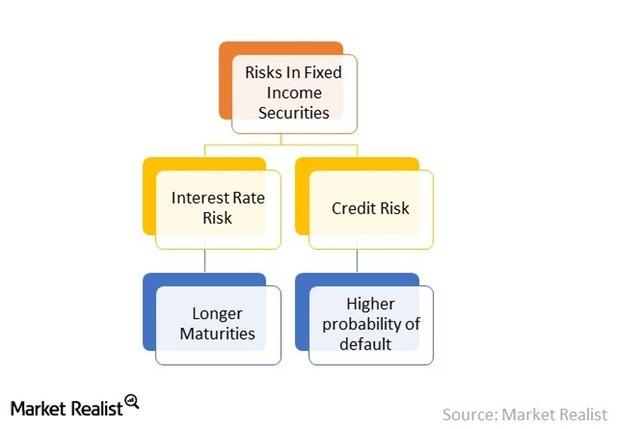

Credit Risk and Interest Rate Risk Have a Negative Correlation

Credit markets tend to improve when the economy is improving. The possibility of a default on corporate bonds (LQD) drops, thus causing their yields to fall.

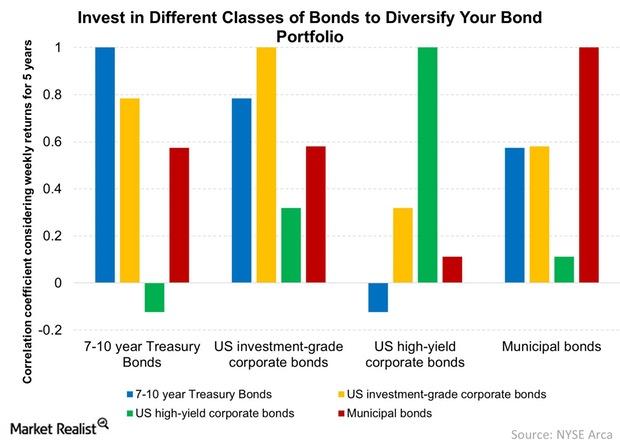

Own Bonds across Credit Quality to Diversify Your Portfolio

Adding bonds across credit classes helps diversify your bond portfolio. The weight of each category depends on your risk appetite and the business cycle.

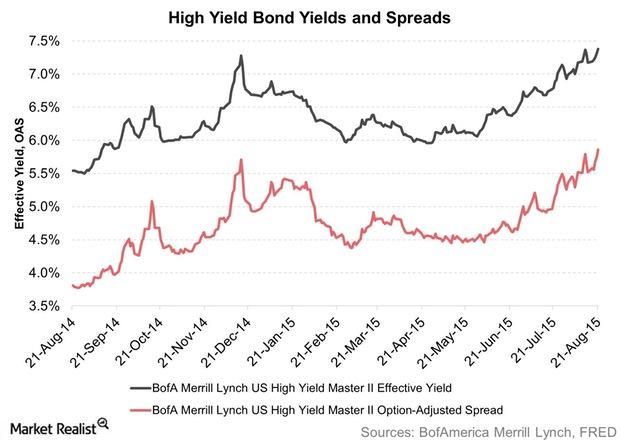

Widening High-Yield Bond Spreads: Opportunity or Threat?

Investors should note that high-yield bonds are risky securities to begin with. The add-on risk of widening spreads may not suit all types of investors.

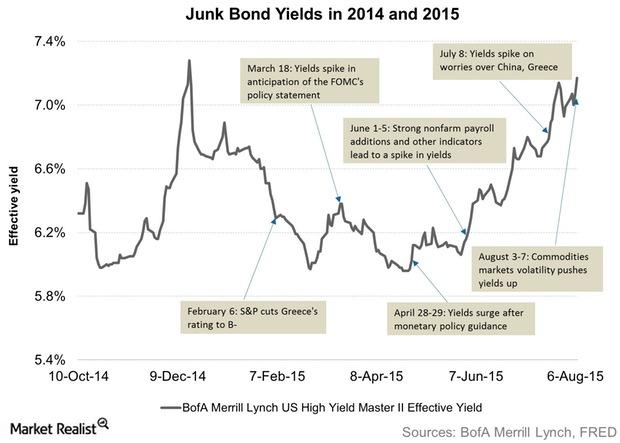

First Data was the Highest Junk Bond Issuer: Week to August 7

Junk bond issuance activity rose in the week ending August 7 after two weeks of subdued activity. The broad market conditions improved.

The Must-Know Risks of Fixed Income Investing

There are no free lunches. The risks involved in fixed income investing are two-fold.

Why Corporate Bonds Correlate to Stocks

Corporate bonds, especially high yield corporate bonds, correlate to equities and hence, so they don’t provide great diversification benefits.Financials What are the risks associated with short-term wholesale funding?

Short-term wholesale funding refers to a bank’s use of short-term deposits from other financial intermediaries—like pension funds and money market mutual funds. It uses the short-term deposits to invest in longer-term assets—like loans to businesses. Using these short-term funds to invest in longer-term assets causes a timing mismatch between assets and liabilities.Technology & Communications The latest word in telecom: Can SoftBank swing a T-Mobile deal?

Masayoshi Son, Chairman and CEO of SoftBank Corp. (SFTBF) and chairman of Sprint (S), has been pushing for more consolidation in the telecom sector in the U.S.