iShares US Financials

Latest iShares US Financials News and Updates

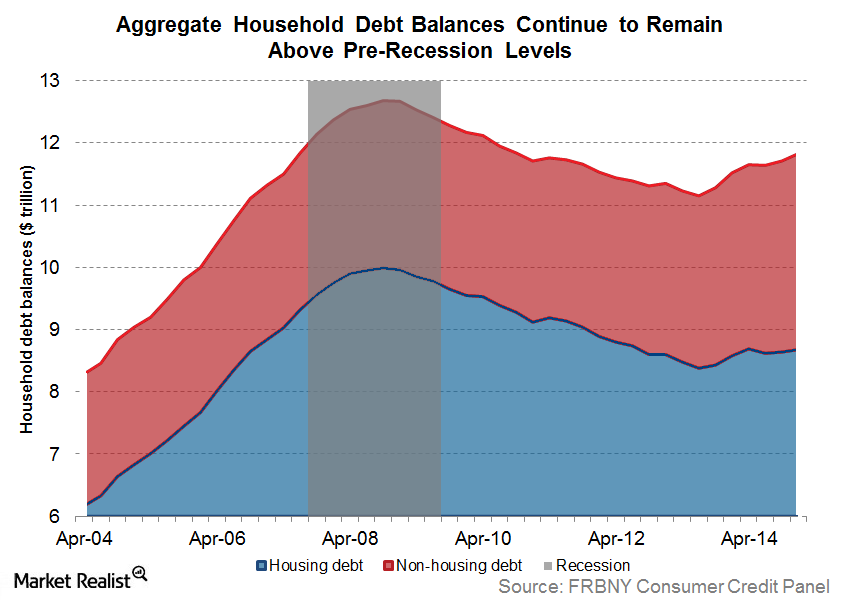

The Great American Deleveraging: Fact or Myth?

The great American deleveraging has largely been limited to the financial sector (XLF) (IYF). Non-financial debt is still much higher than historical averages.

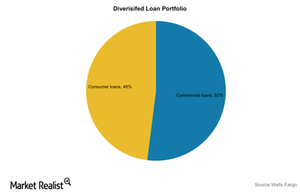

What Do Analysts Recommend for JPMorgan Chase and Wells Fargo?

In a Bloomberg survey of 37 analysts, 19 analysts (51%) have assigned a “buy” rating to Wells Fargo (WFC) while 13 (35%) have rated it as “hold.” The stock currently has five “sell” ratings.

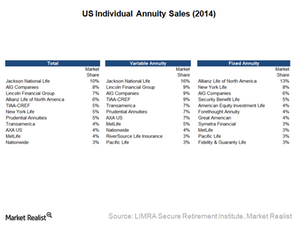

Leading Players in the US Annuity Industry

The market leader in the fixed annuity industry is Allianz Life Insurance Company of North America with 13% market share, followed by New York Life with 8%.

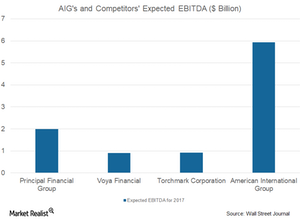

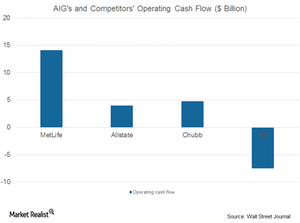

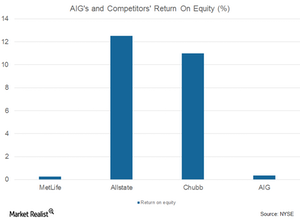

What Could Drive AIG’s Performance in the Future?

According to Brian Duperreault, chief executive officer of American International Group (AIG), a company in any industry has to take the digitization path for long-term growth and success.

How Realty Income’s Dividend Yield Looks

Revenue and earnings Realty Income (O), a retail REIT engaged in US real estate investment, recorded 8% revenue growth in 2016, compared with 10% growth in 2015. The growth was driven by rentals and tenant reimbursements. Its operating costs and other expenses (including interest expenses) rose 6% in 2016 and 8% in 2015. Its gains on asset […]

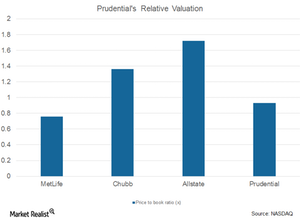

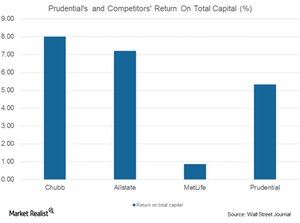

Prudential’s Discounted Valuations in 2Q17

Wall Street analysts recommended a one-year price target of $116.07 per share on Prudential Financial (PRU), reflecting an increase of ~14.1% from the current price.

Understanding Prudential’s Group Insurance and Individual Life Earnings

In 2Q17, on the basis of annualized new business premiums, sales in Prudential’s Individual Life business stood at $153 million, reflecting a marginal decline of ~3.8% year-over-year.

Analyzing AIG’s Life and Personal Insurance Business

AIG’s pretax operating income for personal insurance stood at $330 million in 2Q17. In 2Q16, it stood at $152 million.

Why AIG’s Net Income Fell on a Year-over-Year Basis

AIG is expected to post earnings per share of $1.22 in 3Q17, an ~20.3% decline from its 2Q17 earnings. AIG is expected to report revenues of ~$11.8 billion in 3Q17.

Wells Fargo Benefits from a Solid Business Model

Wells Fargo (WFC) has been considered the strongest and most steady among the “too big to fail” banks in the United States for years.

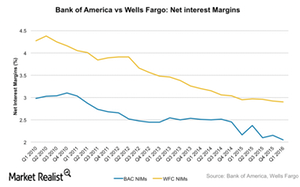

Comparing Wells Fargo and Bank of America’s Profitability

In 1Q16, Wells Fargo’s revenue grew 4% to $22.2 billion. Bank of America’s (BAC) revenue fell 7% YoY (year-over-year) to $19.5 billion.

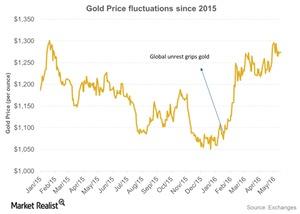

Why Is JPMorgan Chase Positive on Gold?

After seeing three straight years of losses, gold (GLD) performed extremely well at the beginning of 2016.

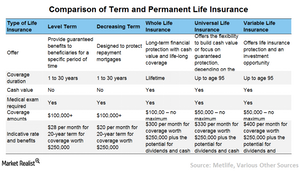

How to Pick a Life Insurance Policy

Term life insurance provides guaranteed benefits to beneficiaries for a specific period of time in case of the sudden death of the insured person.

What Are the Different Types of Life Insurance Policies?

Life insurance (PRU) (MET) policies come in various forms that cater to people in different age groups and with different financial goals.

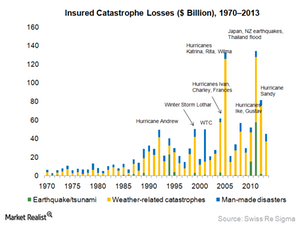

A Closer Look at the Costliest Catastrophes

Hurricanes Sandy, Ike, and Andrew remain near the top of the list of the costliest catastrophes in terms of insured losses.

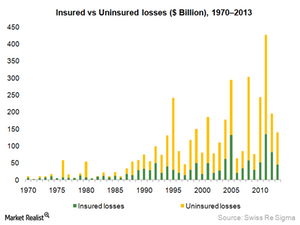

Making Sense of Economic and Insured Losses

Insured losses are the ones that impact the profitability of insurance companies.

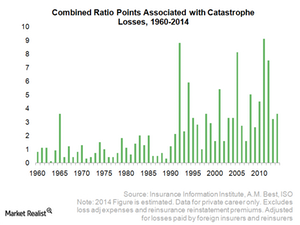

How Catastrophes Impact a P&C Insurer’s Combined Ratio

The percentage points for catastrophe losses in the combined ratio have increased in recent years.

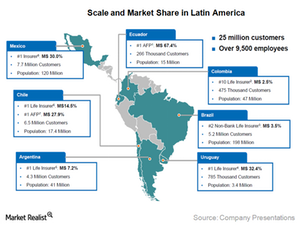

MetLife is the largest player in Latin America

MetLife plans to grow its retail and group business in Latin America, capitalizing on the growing middle class, affluent class, and corporate needs.