iShares Russell Mid-Cap Value

Latest iShares Russell Mid-Cap Value News and Updates

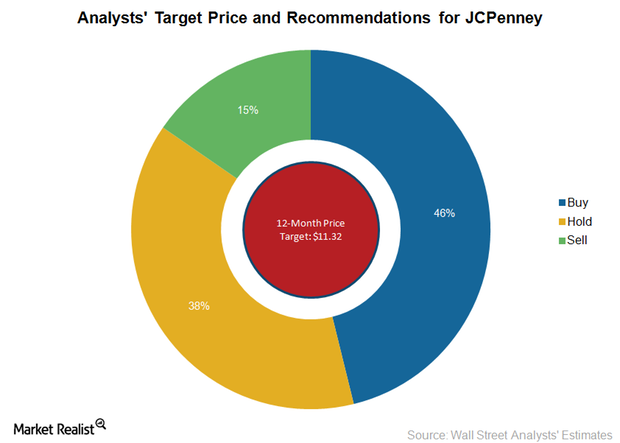

JCPenney: Why Most Analysts Rate the Stock a ‘Buy’

As we mentioned in Part 1 of this series, JCPenney’s (JCP) stock has risen 24.7% since the start of the year to $8.69 as of June 28.

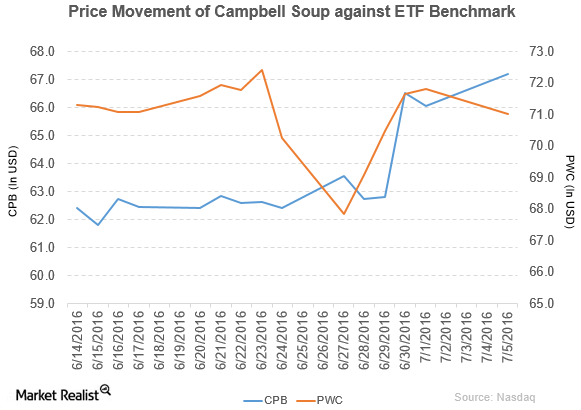

Campbell Soup’s Efforts to Make GMO Labeling Mandatory

Campbell Soup Company (CPB) has a market cap of $20.9 billion. Its stock rose by 1.7% to close at $67.19 per share on July 5, 2016.

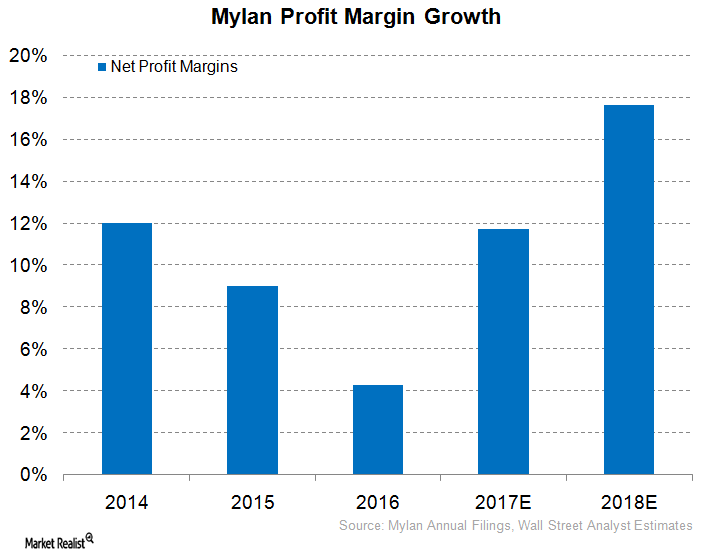

Could Mylan See a Rise in Net Profit Margins in 2017?

In 2Q17, Mylan (MYL) reported gross profit margins of 54.0%, which was lower than 56.0% reported in 2Q16.

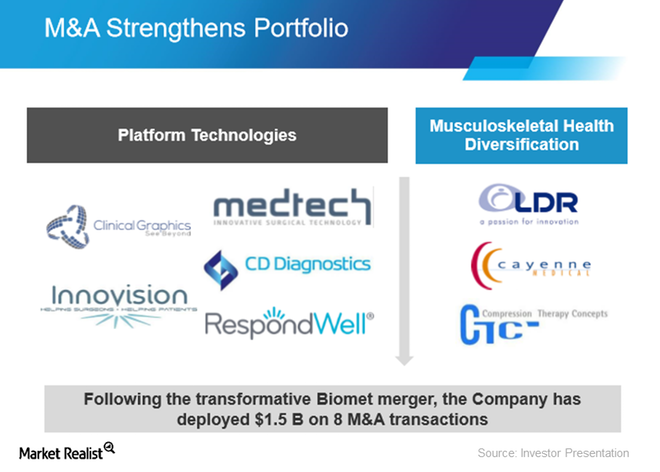

What Zimmer Biomet’s Leadership Transition Could Mean for Its Core Growth Strategy

In July 2017, David Dvorak stepped down as chief executive officer and president of Zimmer Biomet (ZBH) and resigned from its board of directors.

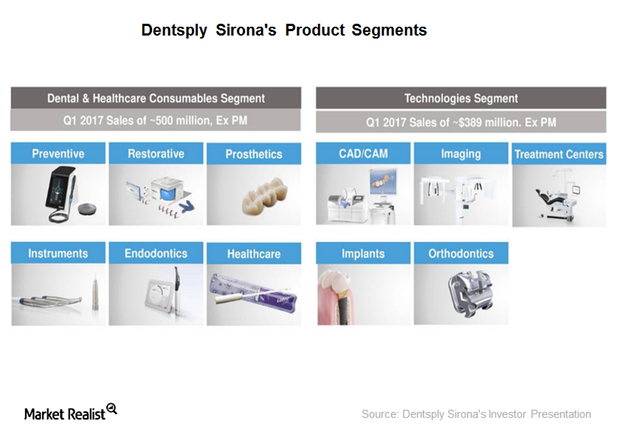

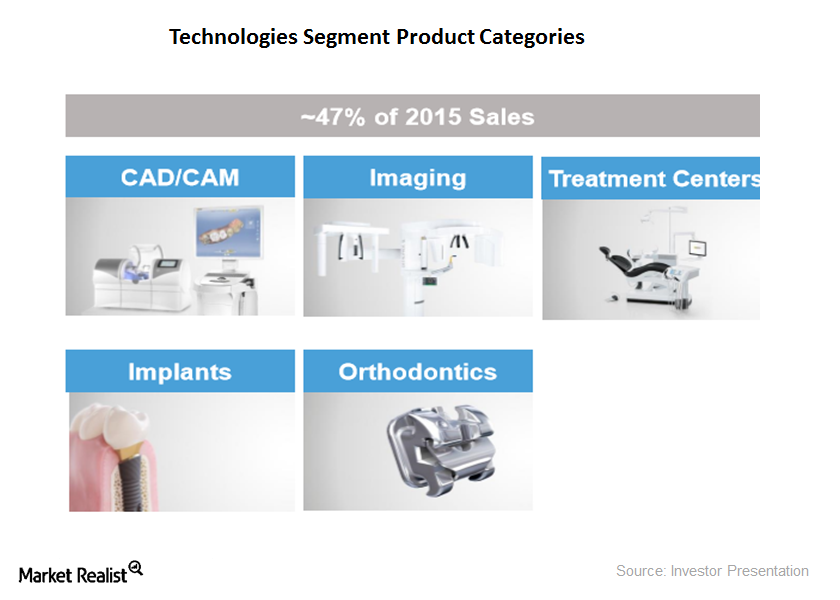

Dentsply Sirona’s New Growth Strategy to Accelerate Digital Dentistry Penetration

Dentsply Sirona is the largest dental equipment and solutions manufacturer in the United States. Digital dentistry is a megatrend in the market.

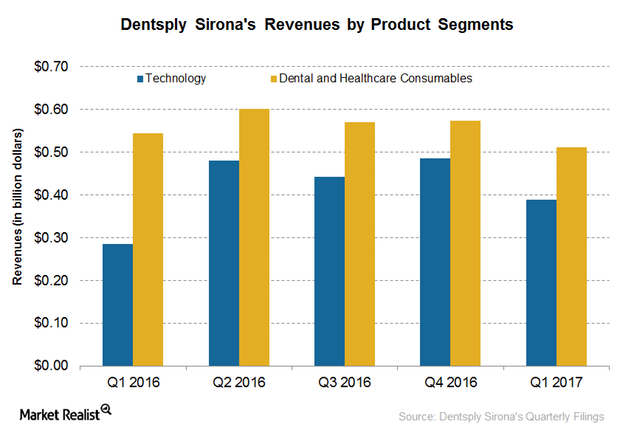

What Dragged Down Technology Business Sales in 1Q17?

Dentsply Sirona’s Technology segment sales Dentsply Sirona (XRAY) reported ~$900 million of revenues worldwide in 1Q17. Of that, ~$389 million was generated through Dentsply Sirona’s Technology segment, which contributed ~43.2% to Dentsply Sirona’s total revenues. On a constant currency basis, the Technology segment’s sales declined by approximately 8.1%. The segment’s sales were flat in Europe. The […]

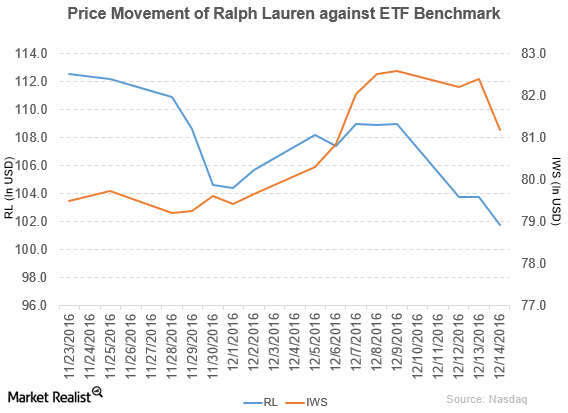

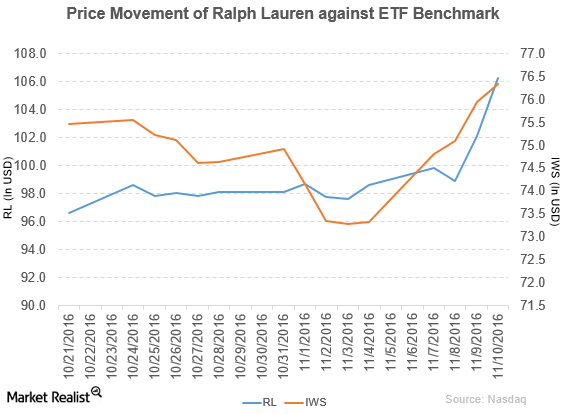

Ralph Lauren Declares a Dividend

Ralph Lauren declared a regular quarterly dividend of $0.50 per share on its common stock. The dividend will be paid on January 13, 2017, to shareholders.

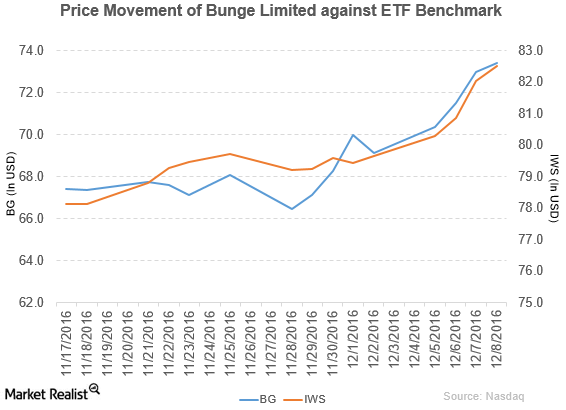

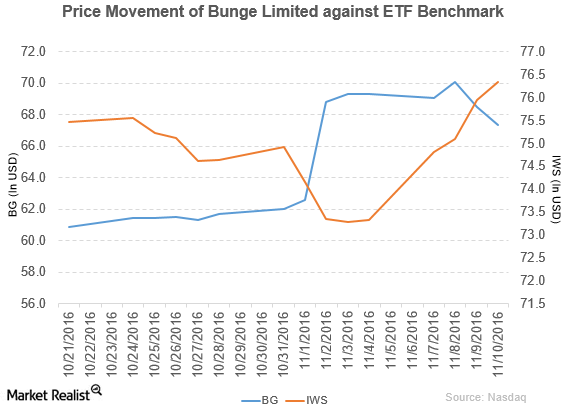

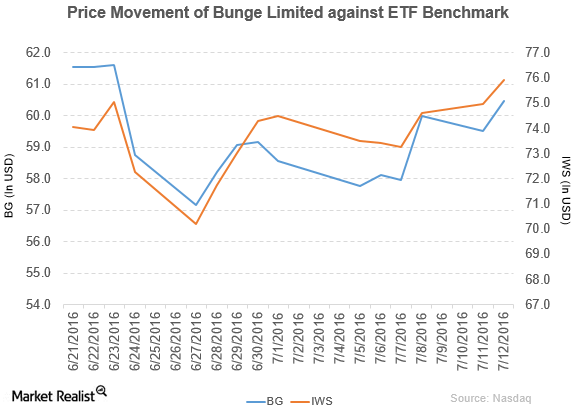

Bunge Limited Has Declared Dividends

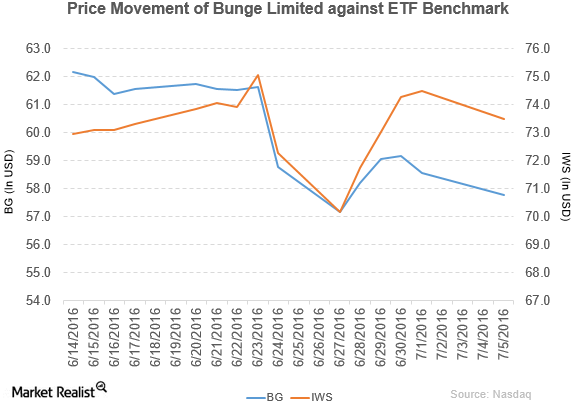

Price movement Bunge Limited (BG) has a market cap of $10.4 billion. It rose 0.55% to close at $73.40 per share on December 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 4.9%, 5.4%, and 10.4%, respectively, on the same day. BG is trading 7.8% above its 20-day moving average, 14.4% […]

How Did Ralph Lauren Perform in 2Q17?

Ralph Lauren (RL) reported fiscal 2Q17 net revenues of ~$1.8 billion, a fall of 7.6% compared to net sales of ~$2.0 billion in fiscal 2Q16.

Why Did Bunge Limited Issue Senior Notes?

Bunge Limited (BG) has declared a regular quarterly cash dividend of $0.42 per share on its common stock. The dividend will be paid on December 2, 2016, to shareholders of record on November 18, 2016.

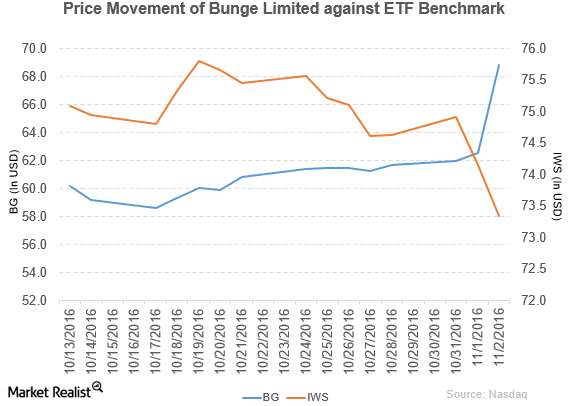

How Did Bunge Perform in 3Q16?

Bunge (BG) has a market cap of $9.6 billion. It rose 10.0% to close at $68.81 per share on November 2, 2016.

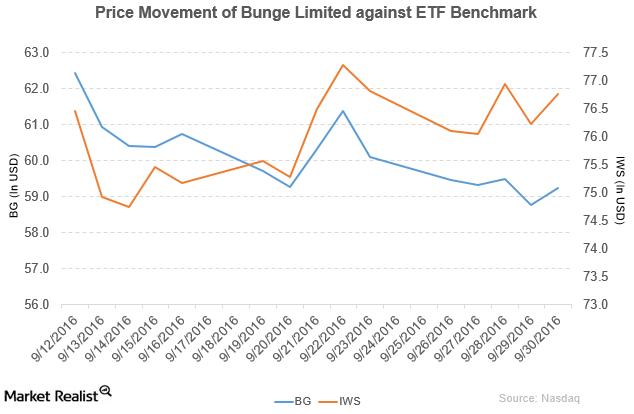

Bunge to Partner with Oleo-Fats

Bunge (BG) has a market cap of $8.3 billion. It rose 0.80% to close at $59.23 per share on September 30, 2016.

Bunge’s New Investment to Increase the Value of Its Business

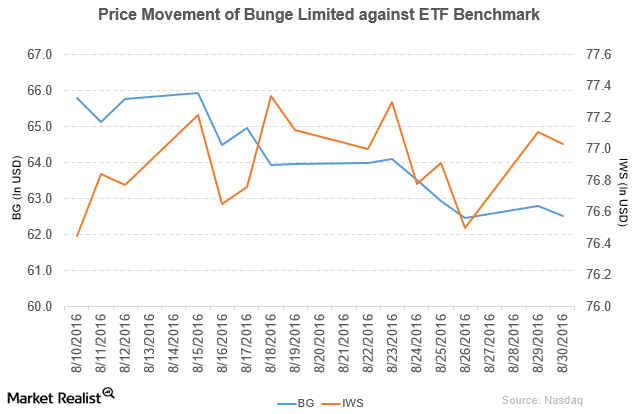

Bunge (BG) has a market cap of $8.8 billion. It fell by 0.45% to close at $62.52 per share on August 30, 2016.

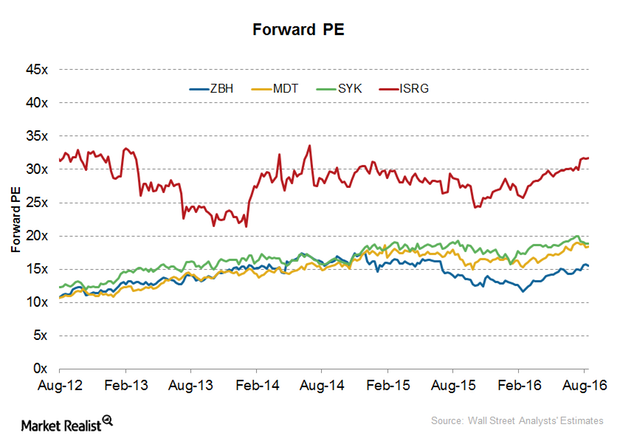

A Look at Zimmer Biomet’s Latest Valuation

After the release of its 2Q16 earnings results on July 28, 2016, Zimmer Biomet Holdings (ZBH) was trading at a forward price-to-earnings multiple in the range of 15.5x–16.2x.

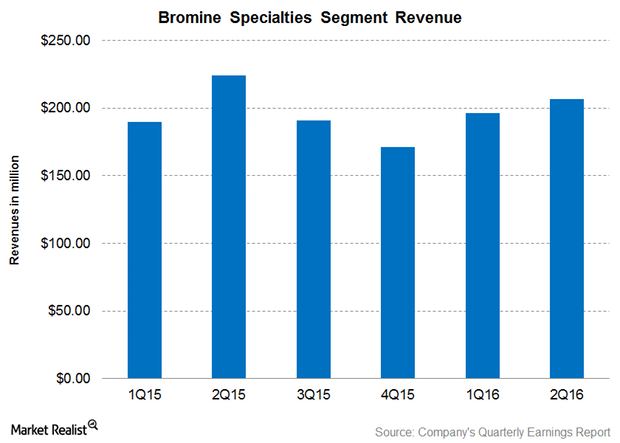

Albemarle’s Bromine Specialties Segment: Why Revenue Fell in 2Q16

In 2Q16, Albemarle’s (ALB) Bromine Specialties segment reported revenue of $206.9 million, representing 30.9% of Albemarle’s total revenue.

Why Is Schlumberger’s Free Cash Flow So Remarkable?

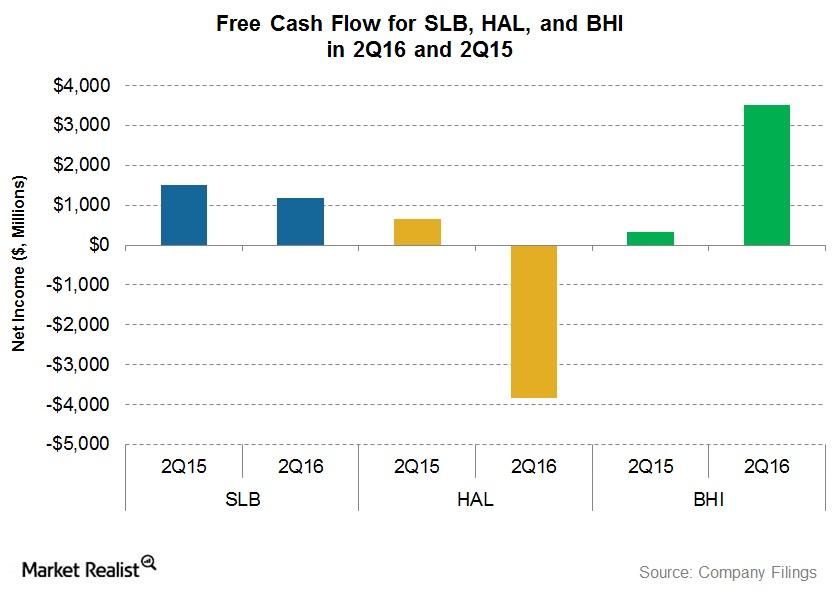

In this part of the series, we’ll take a look at free cash flow for Schlumberger (SLB), Halliburton (HAL), Baker Hughes (BHI), and FMC Technologies (FTI).

A Brief Look at the Technologies Segment Sales in 2Q16

In 2Q16, Dentsply Sirona’s leading position in the Digital Sensor category and rebound in the Lab business drove its Technologies segment sales.

Bank of America/Merrill Lynch Upgraded Bunge Limited to a ‘Buy’

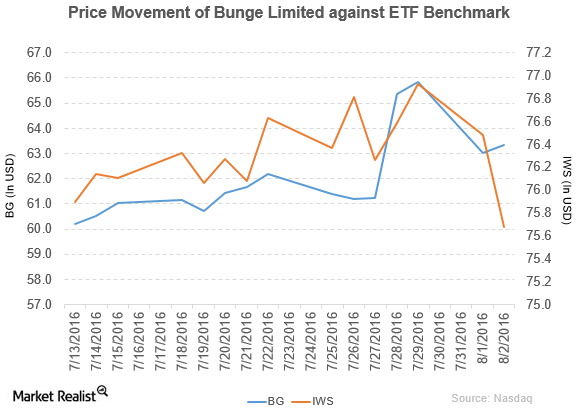

Bunge Limited (BG) has a market cap of $8.8 billion. It rose by 0.48% to close at $63.33 per share on August 2, 2016.

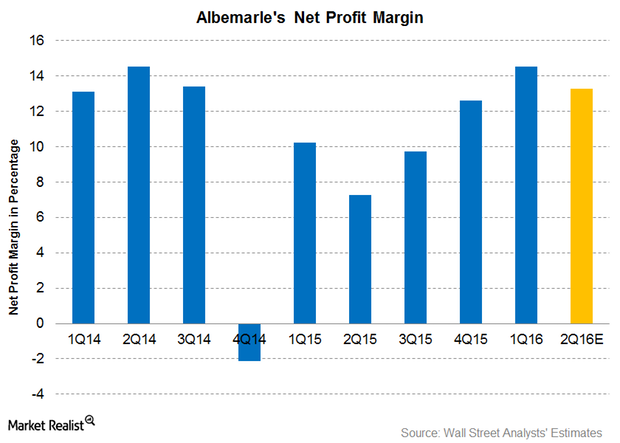

Albemarle: How Much Net Profit Margin Are Analysts Predicting?

As of July 26, 2016, analysts are expecting Albemarle’s (ALB) net profit margin to be about 13.3% in 2Q16. That compares to 7.3% in 2Q15 and 14.5% in 1Q16.

Why Bunge’s Limited Bottom Line Rose in 2Q16

Bunge Limited (BG) has a market cap of $9.1 billion. It rose by 6.7% to close at $65.35 per share on July 28, 2016.

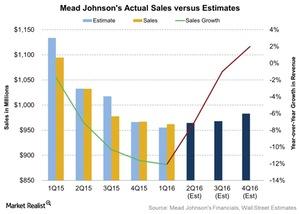

What Will Hurt Mead Johnson’s 2Q16 Revenue?

Analysts are expecting Mead Johnson’s revenue to be $964 million for 2Q16. That’s a fall of 7% compared to 2Q15 revenues of $1.0 billion.

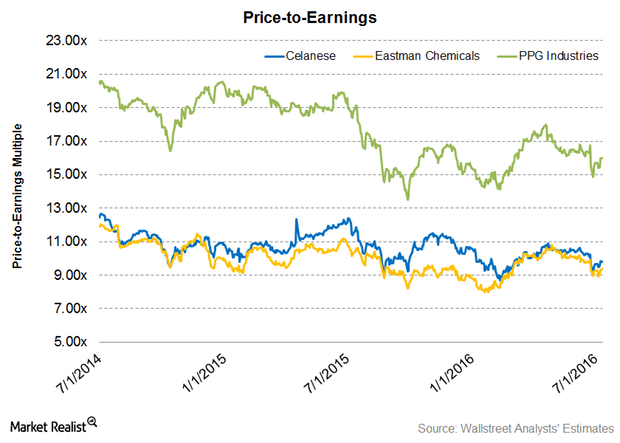

Where Do Celanese Valuations Stand before Its 2Q16 Earnings Report?

On July 11, Celanese’s forward EV-to-EBITDA ratio stood at 7.5x.

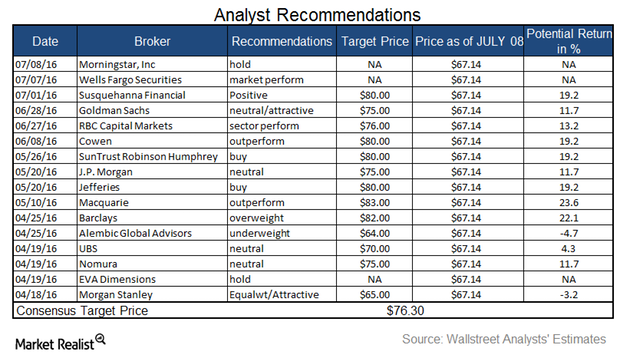

Analysts’ Ratings for Celanese before Its 2Q16 Earnings Release

On July 12, 2016, Celanese’s (CE) consensus 12-month target price was $76.30, indicating a return potential of 11.3% from that day’s closing price of $68.57.

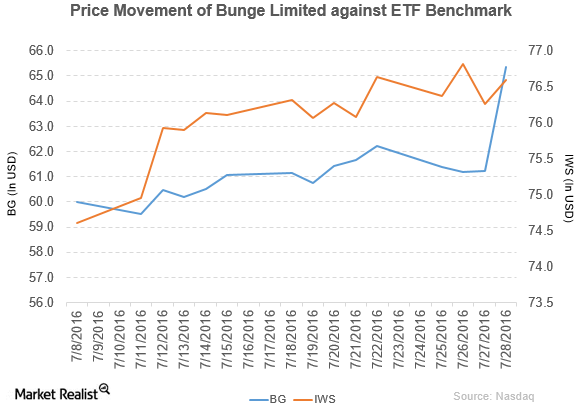

BB&T Capital Rated Bunge a ‘Buy’

Bunge reported 1Q16 net sales of $8.9 billion, a decline of 17.5% compared to net sales of $10.8 billion in 1Q15.

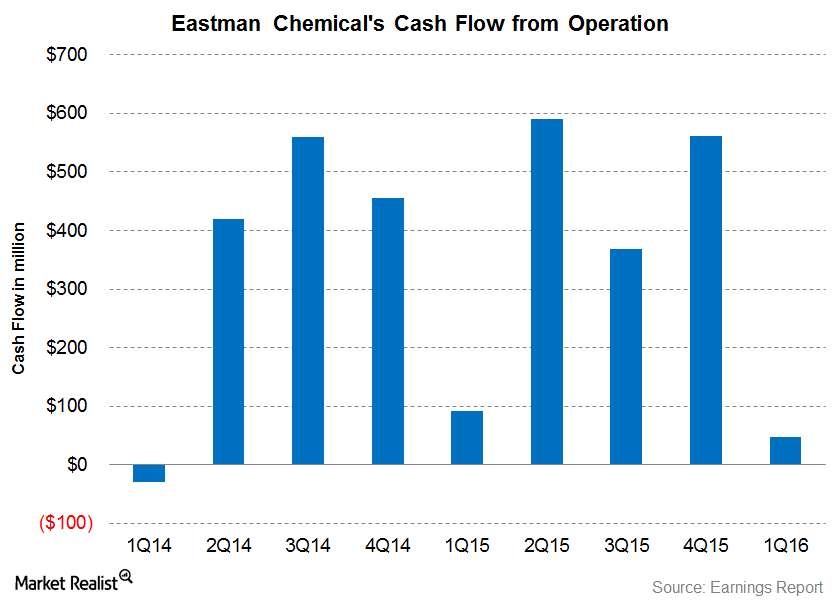

Can Eastman Chemical Generate Higher Operating Cash Flows?

In 1Q16, Eastman Chemical (EMN) reported operating cash flow of $47 million compared to $91 million in 1Q15. The decline was primarily due to the seasonal increase in working capital.

Bunge and Wilmar Form Joint Venture to Increase Market Share

Bunge Limited (BG) has a market cap of $8.2 billion. Its stock fell by 1.4% to close at $57.76 per share on July 5, 2016.

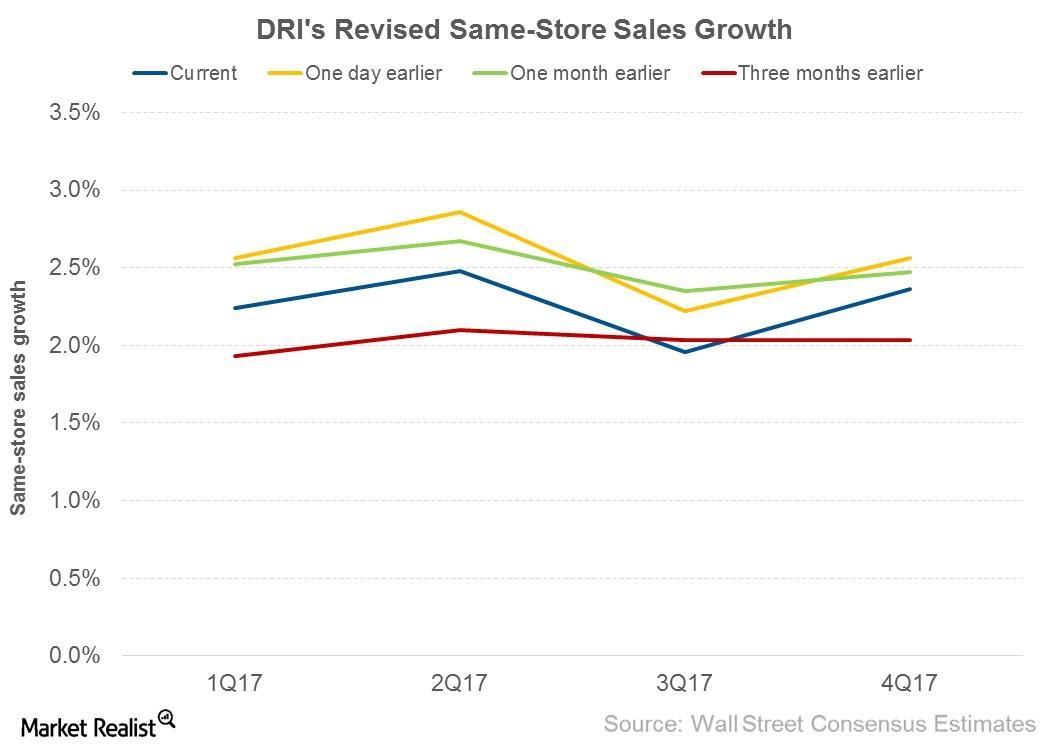

Darden Restaurants Updates Guidance after Fiscal 4Q16 Earnings

After fiscal 4Q16 results, Darden Restaurants’ (DRI) management has revised its same-store sales growth guidance for fiscal 2017 to the range of 1%–2% as compared to earlier estimates of 1%–3%.

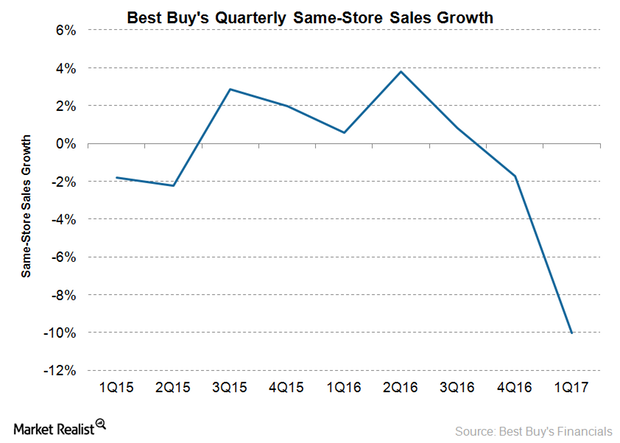

Best Buy Wants to Improve Sales: What’s It Got up Its Sleeve?

Best Buy plans to improve its sales through a series of initiatives across merchandising, marketing, online channels, stores, supply chain, services, and customer care.

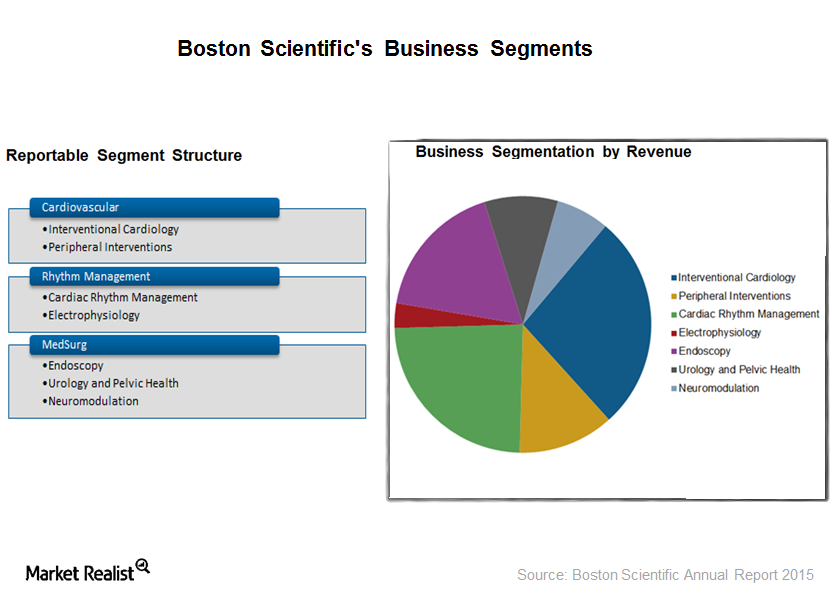

A Brief Look at Boston Scientific’s Business Model

Boston Scientific’s (BSX) Cardiovascular segment consists of minimally invasive technologies to treat patients with a wide range of heart and vascular diseases. It is BSX’s largest business segment and generated ~39% of the company’s total revenues in 2015.