iShares S&P 500 Value

Latest iShares S&P 500 Value News and Updates

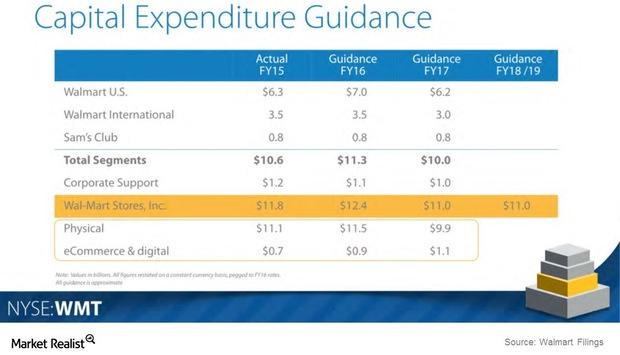

Walmart Lowers Capital Expenditure Projections

Walmart has updated its capital expenditure projections for fiscal 2016. It expects to spend $12.4 billion in fiscal 2016, in the middle of the $11.6–$12.9 billion guidance range provided earlier.

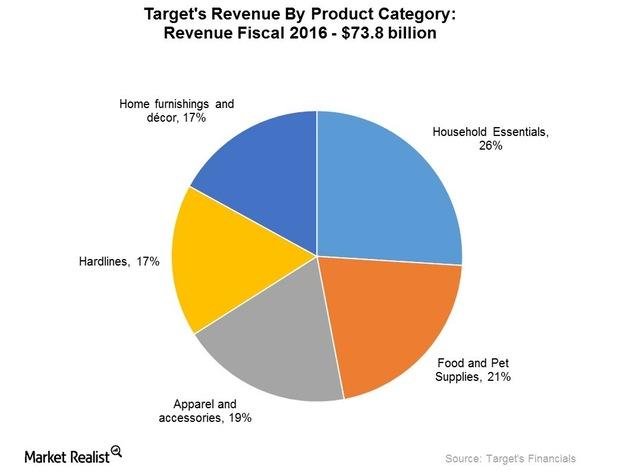

Merchandise Mix: Which Categories Are Performing Best at Target?

In fiscal 2016, Target’s (TGT) performance was upbeat for all merchandise categories with the exception of hardlines.

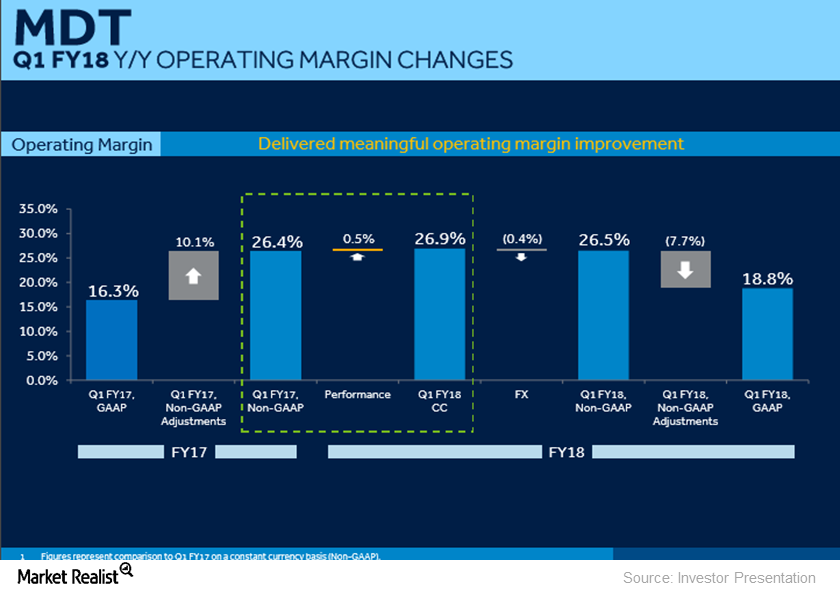

What’s behind Medtronic’s Accelerating Margin Expansion?

In fiscal 1Q18, Medtronic (MDT) reported ~26.9% of operating margin on a constant currency basis. This represented year-over-year growth of ~50 basis points.

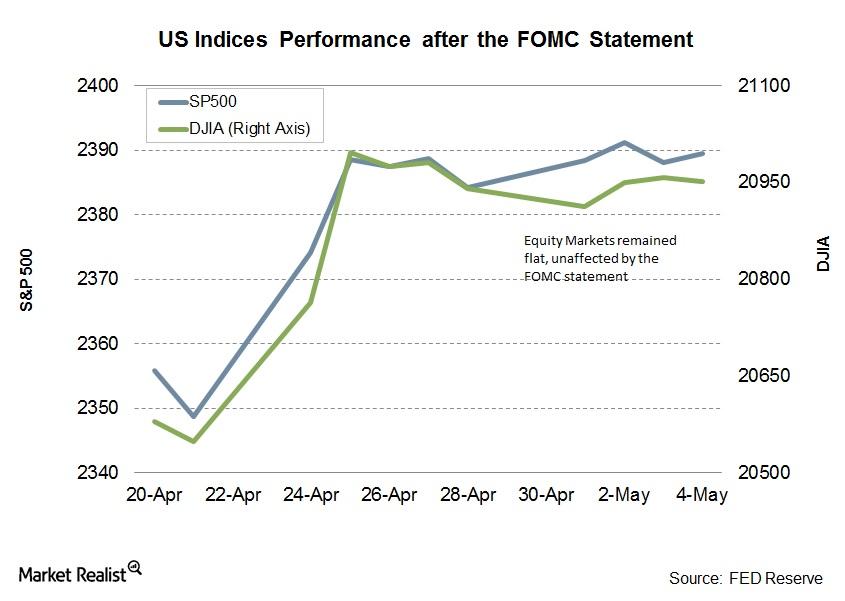

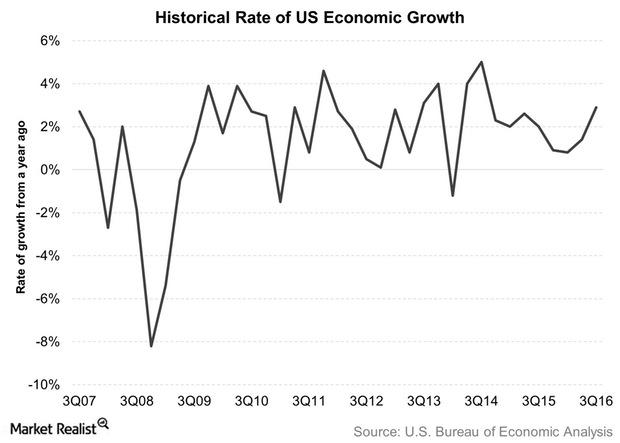

Why the FOMC Statement Didn’t Affect Equity Markets

Since the previous Fed meeting in March, where the Fed announced a 0.25% rate hike, equity markets (IWV) around the globe remained dovish.

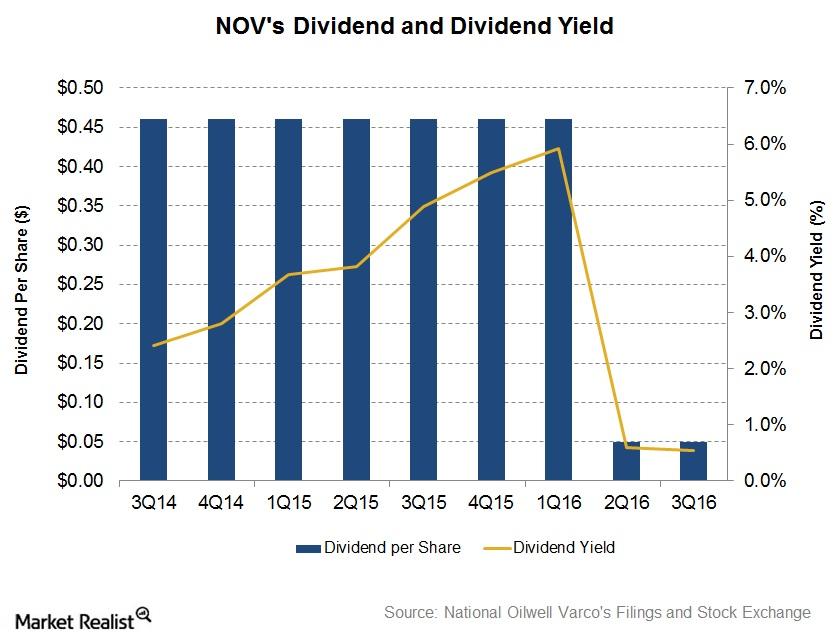

Analyzing National Oilwell Varco’s Dividend

On August 18, National Oilwell Varco (NOV) approved to pay a quarterly dividend of $0.05 per share to shareholders on September 30.

Bill Gross: Monetary Policy on Steady but Slow Path

After the release of the FOMC’s November statement, Bill Gross said that monetary policy in the United States is steadily moving toward normalization, though its pace is slow.

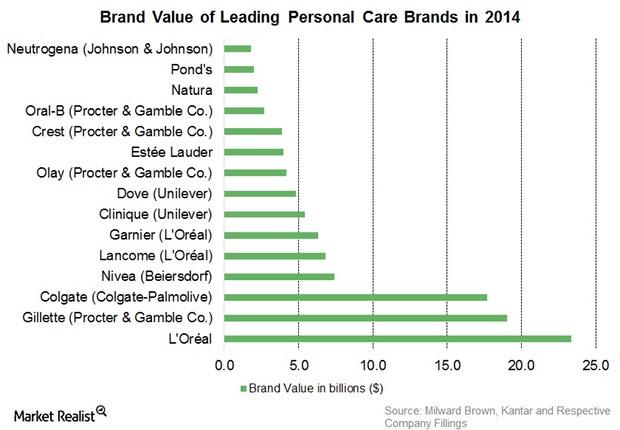

The Story behind Colgate-Palmolive’s Commercial Strategies

Colgate-Palmolive’s global market share is ~45%. It is the leading toothpaste compared to Oral-B and Close-up, especially in emerging markets like India.

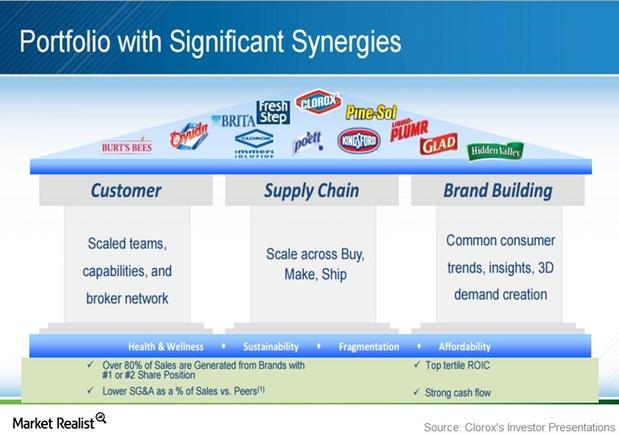

Hurdles in Clorox’s Growth: Weaknesses and Threats

Advertising and promotional events from Unilever and PG’s home cleaners and a rise in the popularity of store brands pose threats to Clorox.

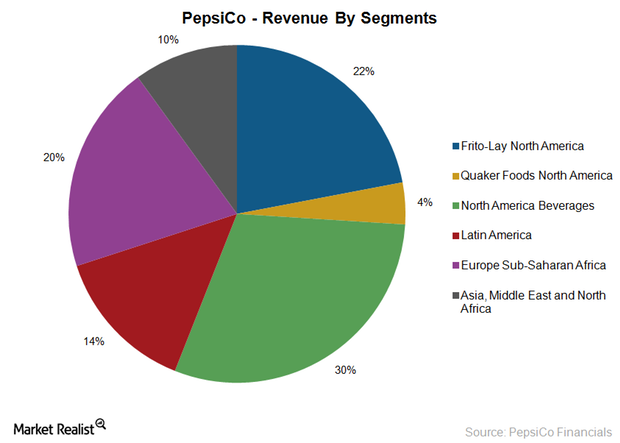

PepsiCo’s Strategy for Its UK Business

PepsiCo’s strategy for its UK business involves continued investment in its core brands across snacks and beverages, including Walkers, Tropicana, Naked, Quaker, and Pepsi.

Is Tesla Pursuing the Correct Sales and Distribution Strategy?

Tesla (TSLA) uses the online sales model coupled with company-owned stores to sell its cars. Selling more vehicles online reduces the company’s selling costs.

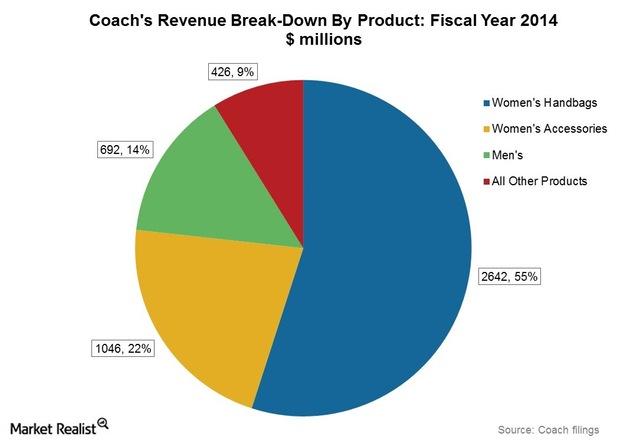

Coach’s Supply Chain And Manufacturing Model

Although the manufacturing process is outsourced, Coach tries to keep a grip on the manufacturing process from design to production.