iShares Core S&P Mid-Cap

Latest iShares Core S&P Mid-Cap News and Updates

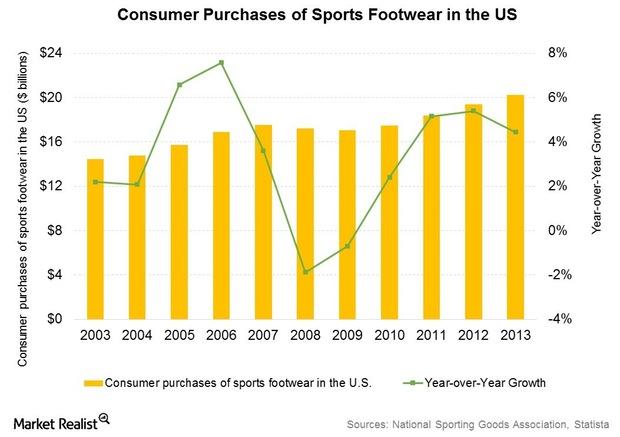

Why Skechers Is Thriving in a Competitive Footwear Market

Skechers grabbed the number two spot in the US footwear market last year. The company’s brands were also ranked number one in walking and work footwear.

Bill Gross: Possibility of Deglobalization in the Economy

Gross warned about deglobalization in the global economy. Trade between nations, exacerbating immigration issues, and stagnant economic growth formed his belief.

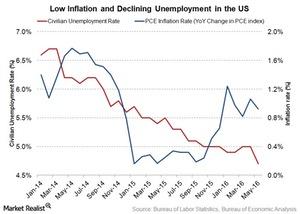

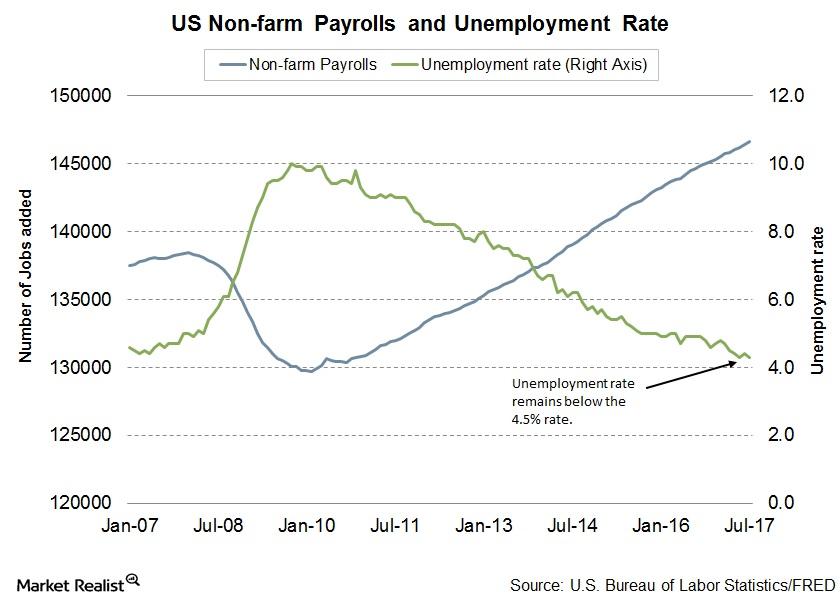

Tax Reforms and Jobs Could Drive the Last Week of Summer

Any negative news from the jobs report will be foreshadowed by the tax reform news. It’s the last jobs report before the September FOMC meeting.

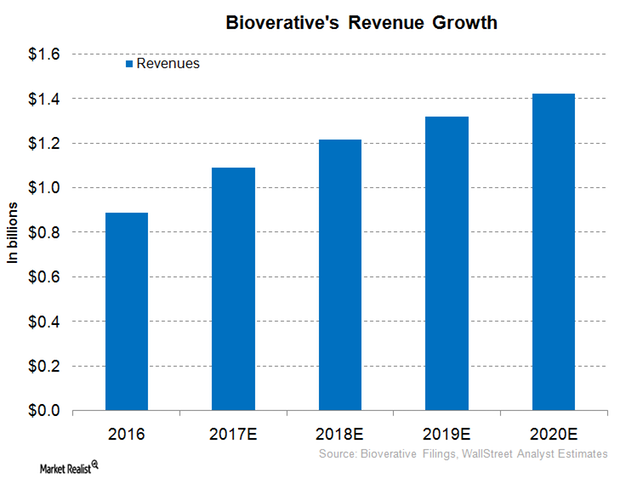

Bioverativ Expected to Report Robust Revenue Growth in 2017

In 1Q17, Bioverativ reported revenues close to $259.0 million, driven by its focus on a commercial strategy for its hemophilia products and optimal cost management.

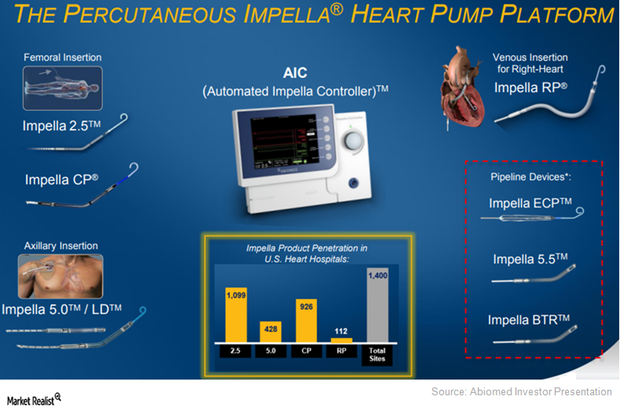

Abiomed Aims to Expand Impella RP’s Penetration Going Forward

In March 2017, Abiomed (ABMD) submitted premarket approval (or PMA) to the FDA for its Impella RP device far ahead of schedule.

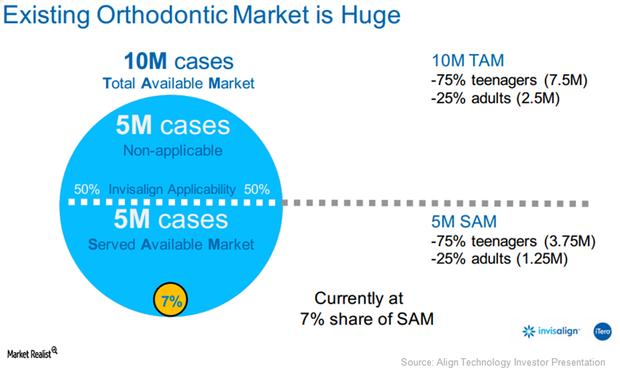

Why Align Technology’s Orthodontics Is a Solid Growth Opportunity in 2017

Align Technology (ALGN) is a medical device provider focused on malocclusion or teeth misalignment condition.

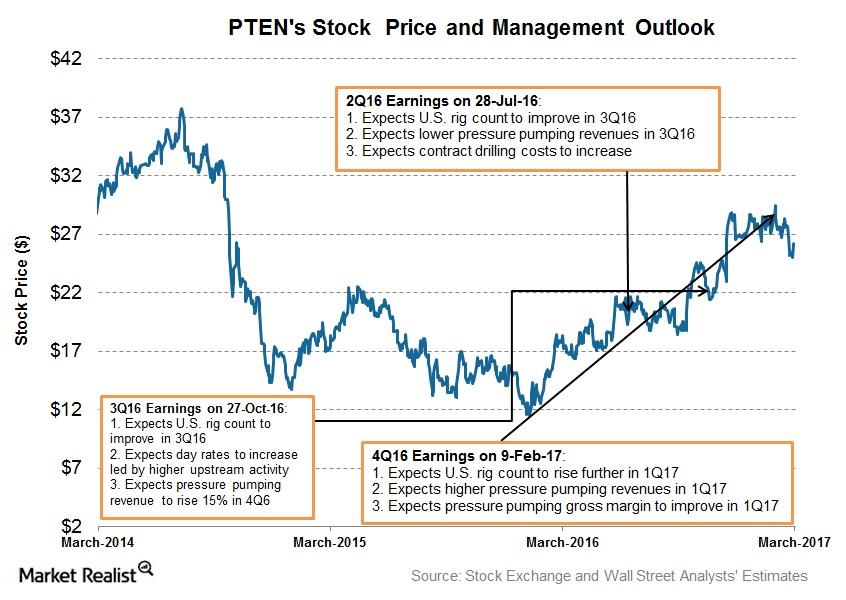

Patterson-UTI Energy’s Forecasts for 2017

Patterson-UTI Energy’s (PTEN) operated average US rig count is expected to rise 21.0% in 1Q17 compared to 4Q16.

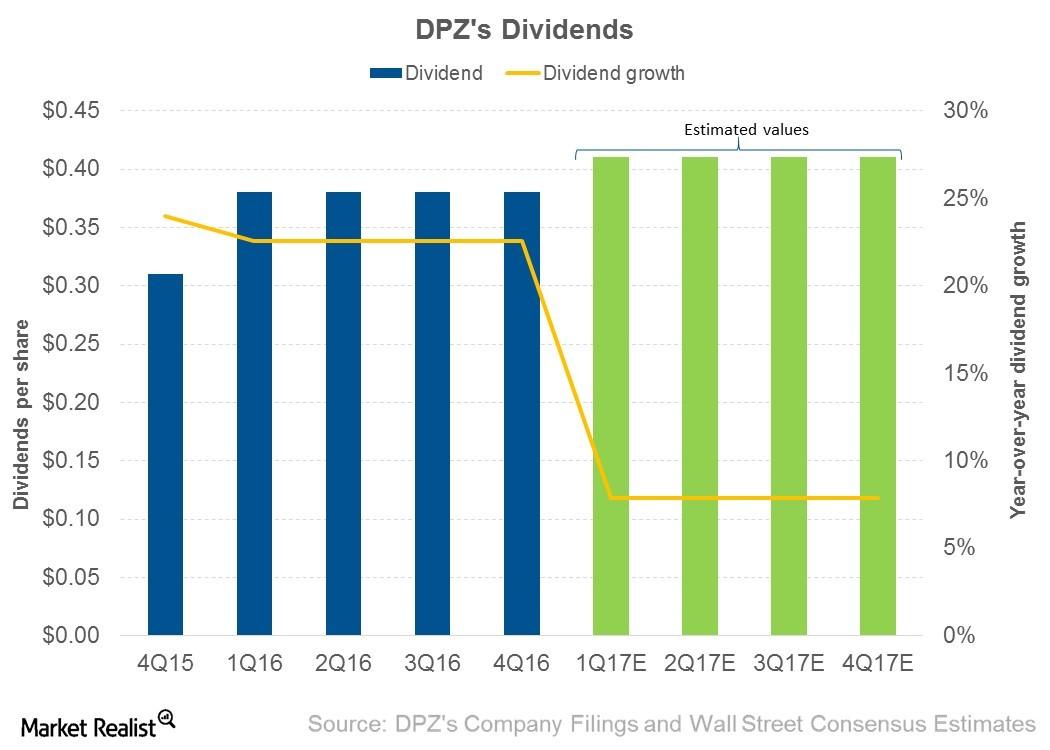

Why Domino’s Dividend Policy Is Important

In 2016, Domino’s Pizza (DPZ) paid dividends of $1.52—growth of 22.5% from $1.24 in 2015. In 2017, analysts expect its dividends to rise 7.9% to $1.64.

Policymakers Are Getting Vocal about the Fed’s Credibility

The issue of the Fed’s credibility is not a new one. The effectiveness of the prolonged monetary accommodation has sparked a lot of debate in the past.

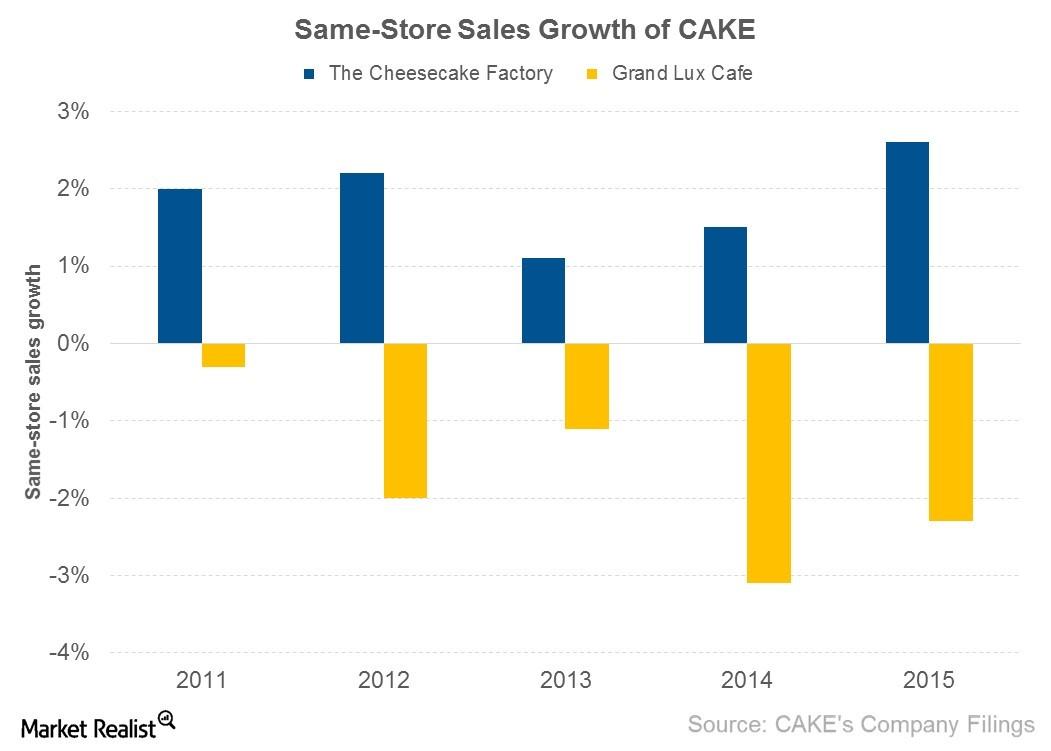

What’s Been the Main Driver of CAKE’s Same-Store Sales Growth?

In the last five years, The Cheesecake Factory’s (CAKE) same-store sales growth was in the range of 1%–3%, largely driven by rises in its menu prices.

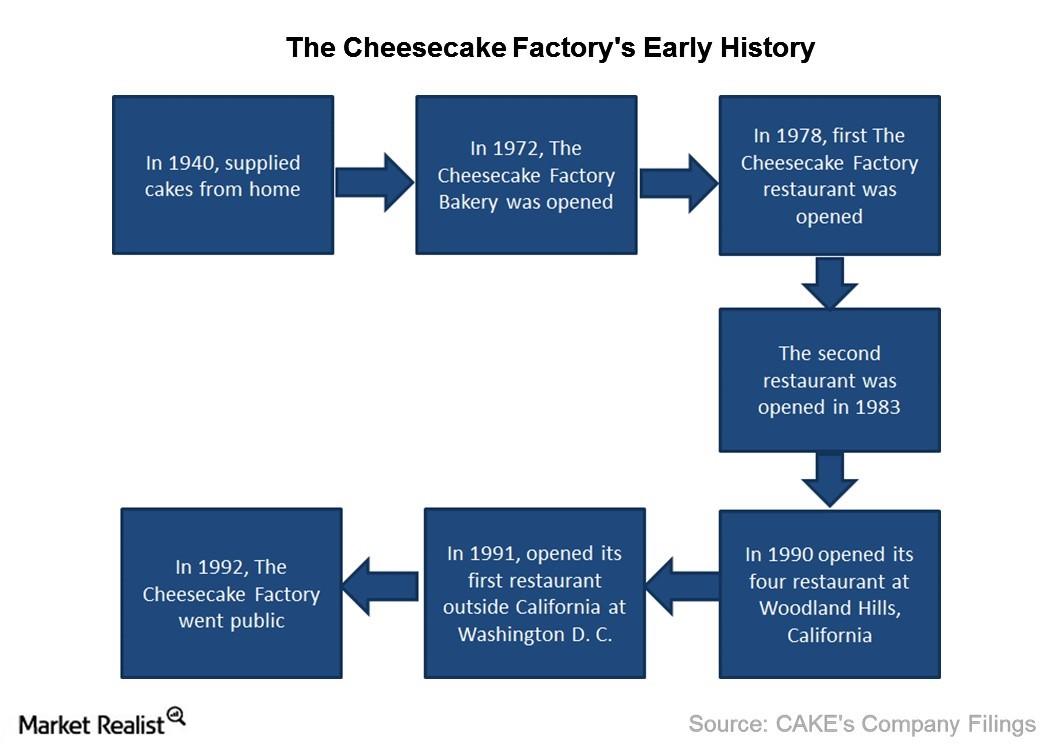

How Did The Cheesecake Factory Come to Exist?

The origin of The Cheesecake Factory dates back to the 1940s, when Evelyn Overton found a recipe in a local newspaper that inspired her original cheesecake.

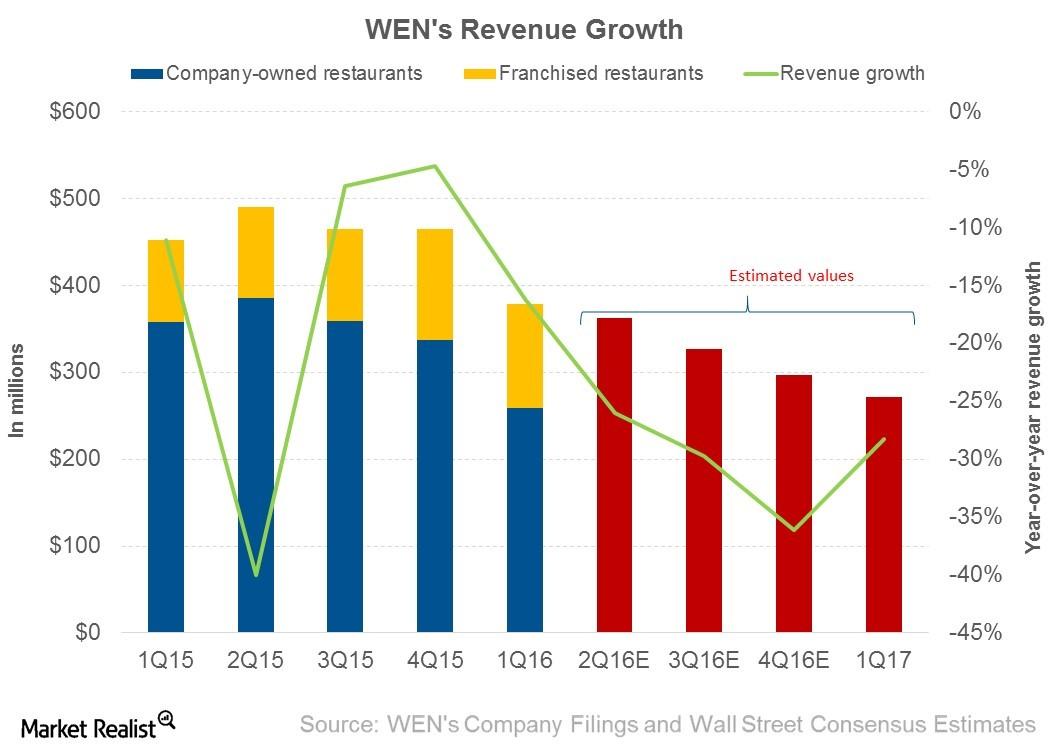

Why Did Wendy’s Revenue Fall in 1Q16?

Wendy’s Company (WEN) generates its revenue through company-owned restaurant sales, franchisee fees, rental income, and royalty collected from franchisees.

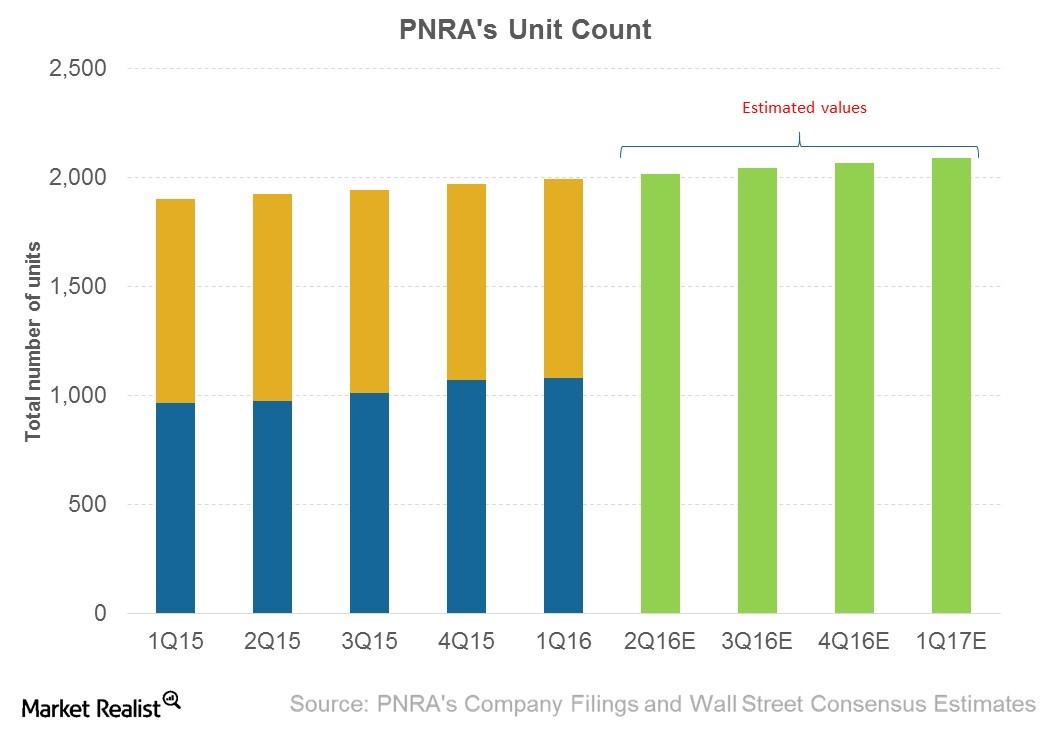

How Is Panera Bread Expanding Its Business?

From the beginning of 2Q15 to the end of 1Q16, Panera Bread (PNRA) increased its unit count by 96, of which 25 units were added in 1Q16.

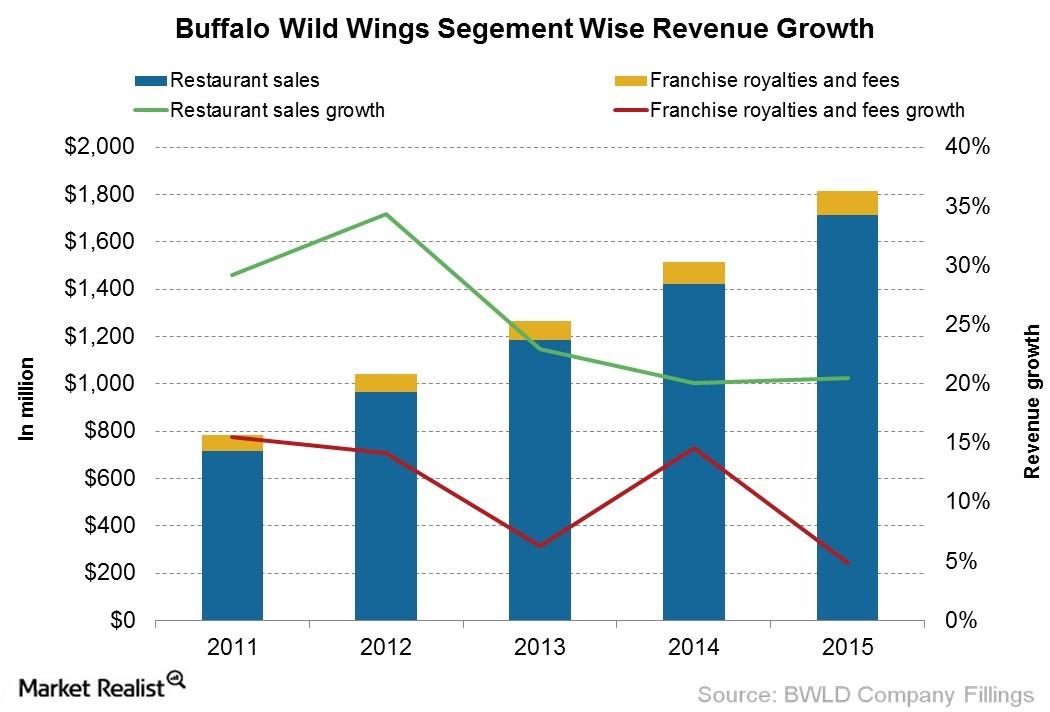

What’s Really Driving Buffalo Wild Wings’ Revenues?

From 2011 to 2015, Buffalo Wild Wings’ (BWLD) revenues increased from $784 million to $1.8 billion—a rise of over 131%.

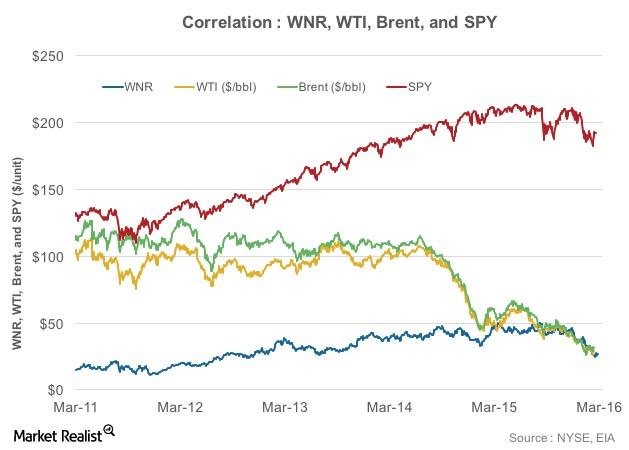

What’s the Relationship between WNR, Crude Oil Prices, and SPY?

The correlation coefficient of Western Refining versus WTI and Brent stands at -0.53 and -0.64, respectively.

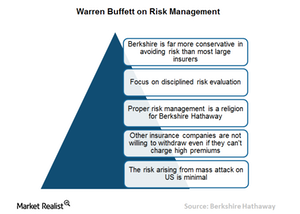

Why Buffett Thinks Risk Management Should Be a Disciplined Affair

Berkshire Hathaway has reported an underwriting profit for 13 straight years, showing a pre-tax gain of $26.2 billion for the period. Buffett states that this was due to Berkshire’s insurance manager’s daily focus on disciplined risk evaluation.

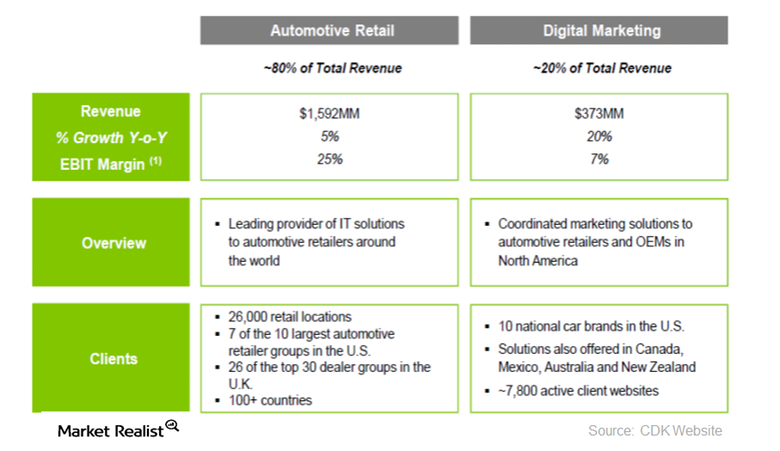

OZ Management Opens New Position in CDK Global

OZ Management commenced a stake in CDK Global Inc. (CDK) by purchasing 4,521,952 shares of the company, representing 0.5% of the fund’s 4Q14 portfolio.

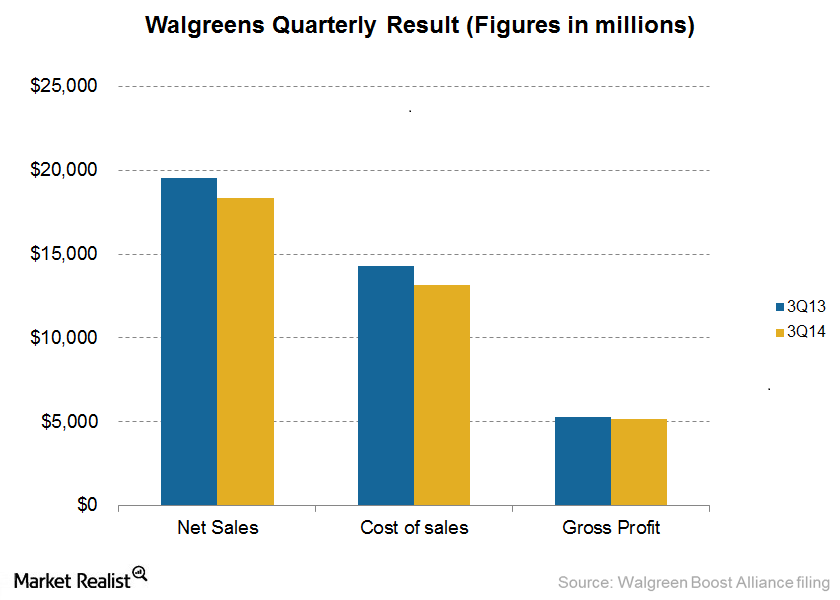

Blue Ridge Capital Opens New Position in Walgreens Boots Alliance

Walgreens Boots Alliance is a firm created by the merger of Walgreens and Alliance Boots in December 2014.