Global X MSCI Greece ETF

Latest Global X MSCI Greece ETF News and Updates

Greek Debt Crisis 101: Getting To The Crux Of The Matter

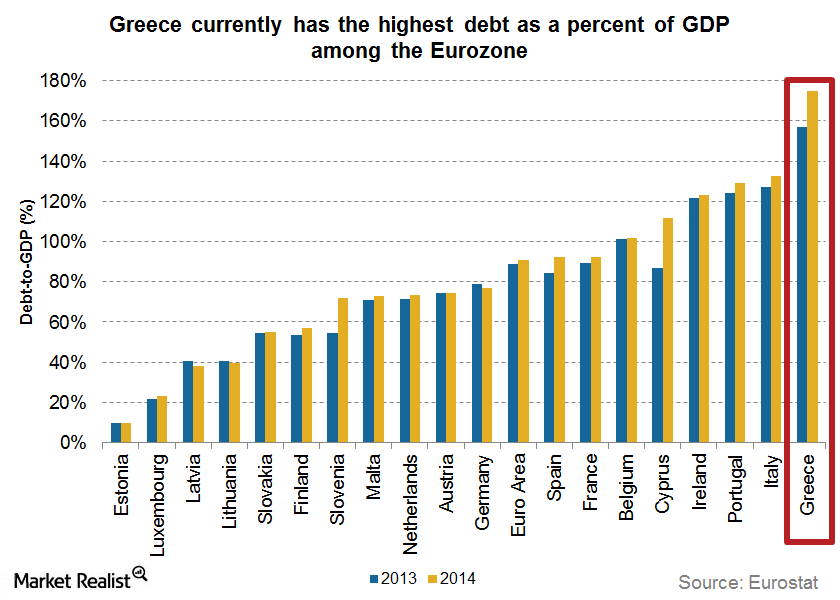

According to estimates by EuroStat, Greek debt stood at more than 315 billion euros at the end of September 2014.

Eurozone grants bailout extension to Greece

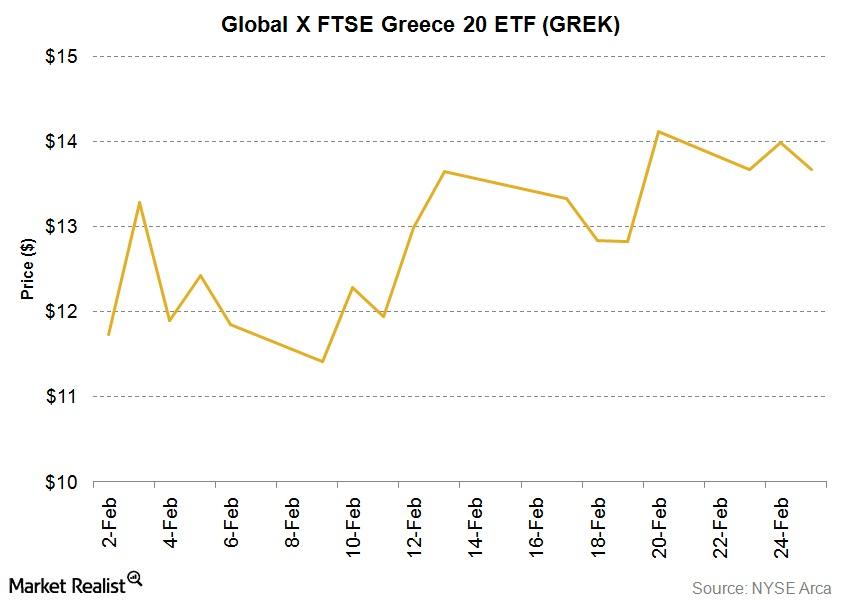

Europe-tracking ETFs gained significantly from February 19 to February 24, when the bailout extension to Greece was approved.

Greece’s Unemployment Falls, but Still the Highest Among Peers

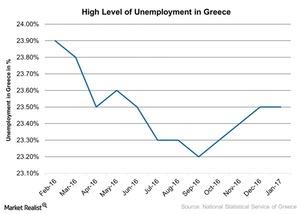

Europe’s average unemployment has fallen to a four-year low of 9.8% as of 2016. Greece’s seasonally adjusted unemployment rate was 23.5% in January 2017.

Structural Issues with the EU Could Lead to Further Referendums

Many European countries want the ability to print their own money and come to their own aid instead of going to the ECB (European Central Bank).

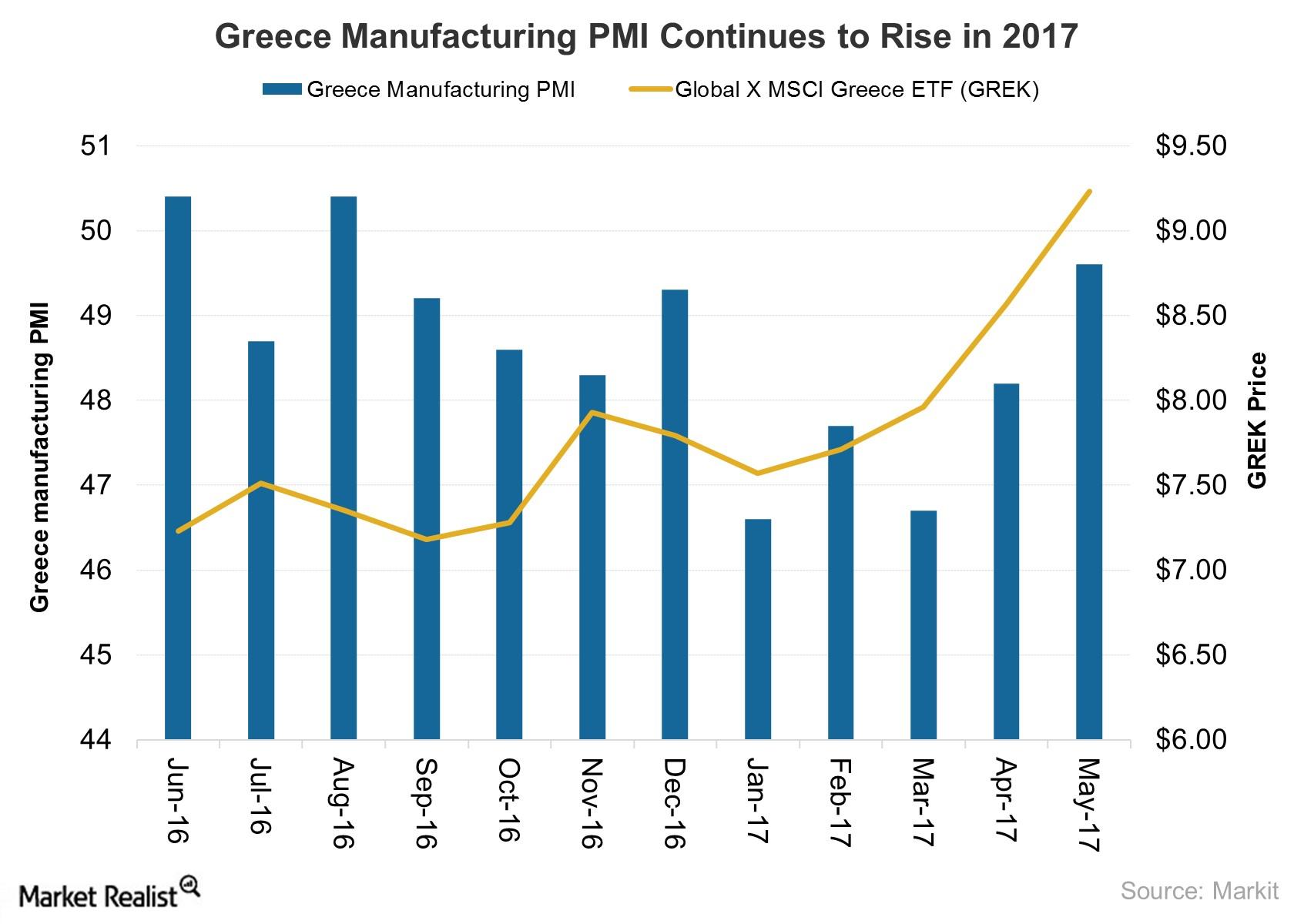

Did Greece’s Manufacturing Activity Improve amid Growth Expectations?

The Markit Greece Manufacturing PMI advanced to 49.6 in May 2017 compared to 48.2 in the previous month.

Why Greece’s Manufacturing Activity Is Struggling amid Improved Expectations

Amid its financial chaos, Greek manufacturing activity rose in April 2017, though it remains below the acceptable mark of 50.

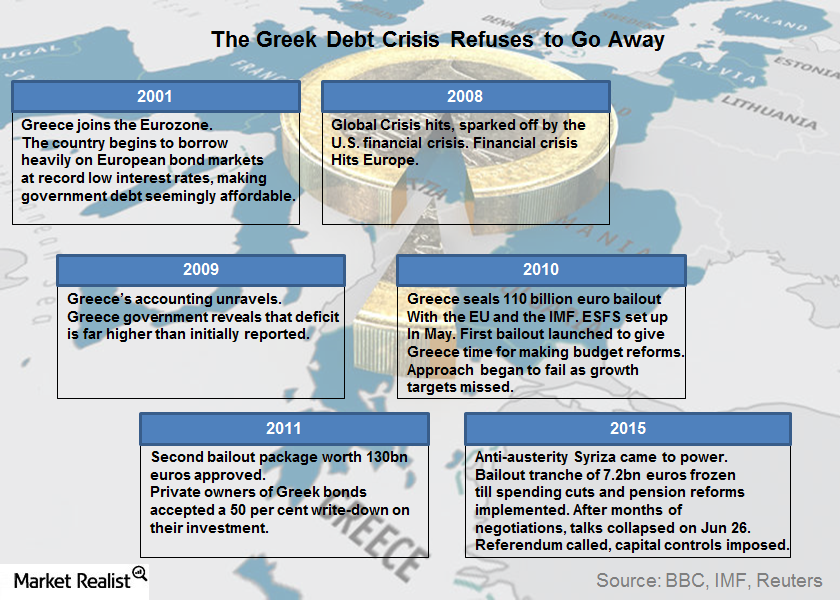

The Greek Debt Crisis Refuses to Go Away

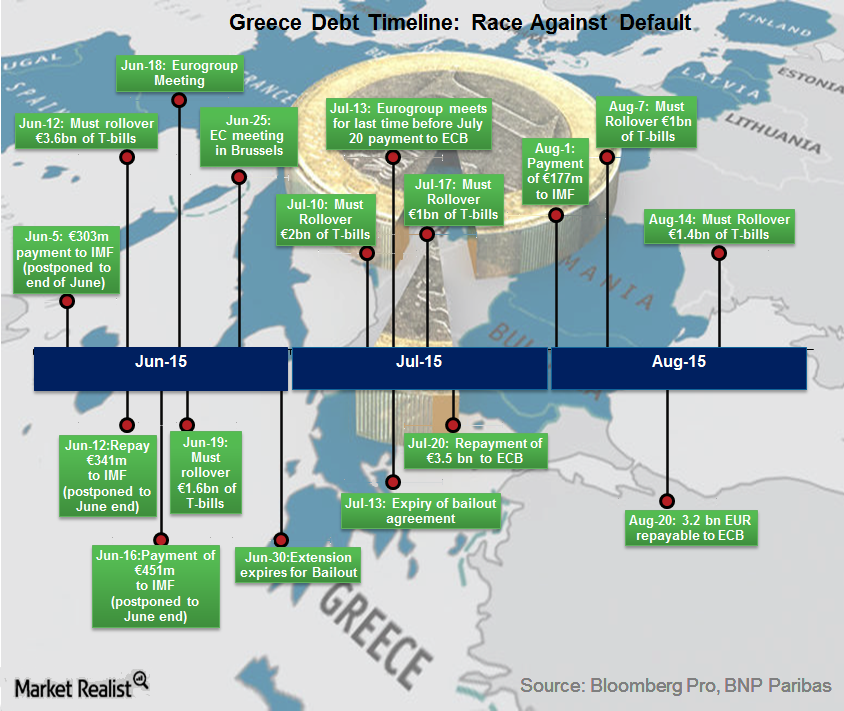

Greek Prime Minister Alexis Tsipras walked away from negotiations this weekend and called for a referendum from his people on July 5. This surprising turn of events has sharply raised the probability of a Grexit.

The Seemingly Never-Ending Greek Debt Saga at a Tipping Point

The seemingly never-ending Greek debt (GREK) saga continues to play out, complete with twists, turns, and obstacles à la typical potboiler.

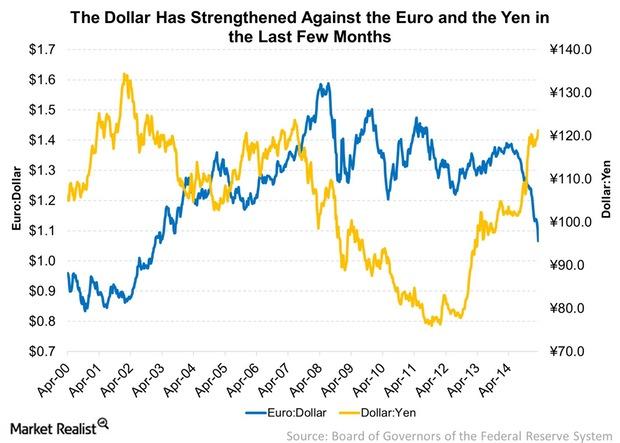

What’s Causing the US Dollar to Strengthen?

The strength in the US dollar is because of divergence in central bank policies. The US dollar is strengthening against most of the major currencies.

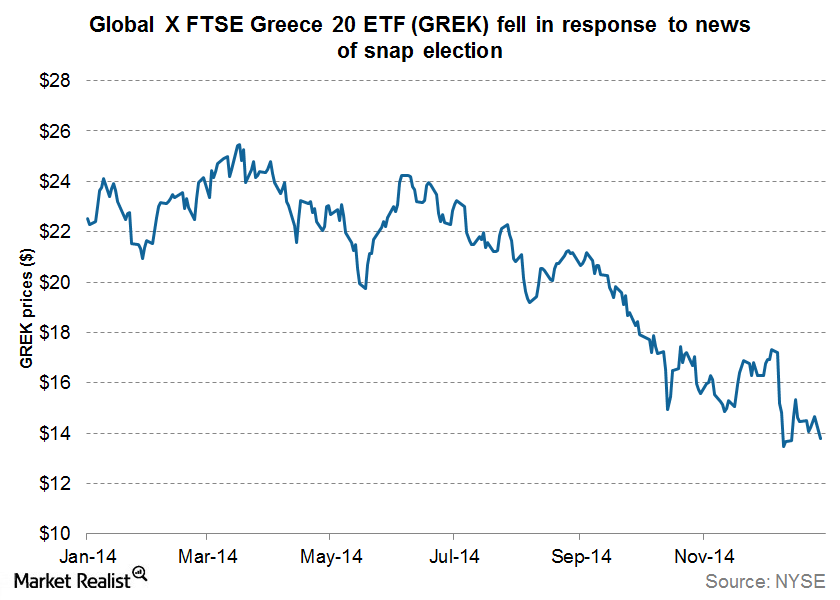

Is Greek Political Instability A Tragedy In The Making?

It’s indeed déjà vu as a fresh round of worry over Greek political instability engulfs the Eurozone (EZU).