Glencore PLC

Latest Glencore PLC News and Updates

Glencore or Freeport: Which Has More Upside Potential?

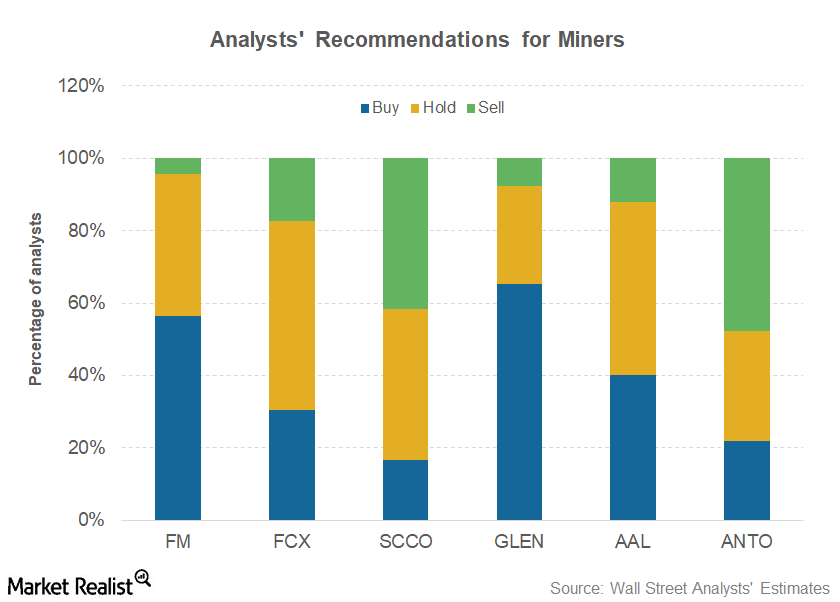

Glencore (GLEN-L) has the highest percentage of “buy” or higher recommendations in our select group of mining stocks.

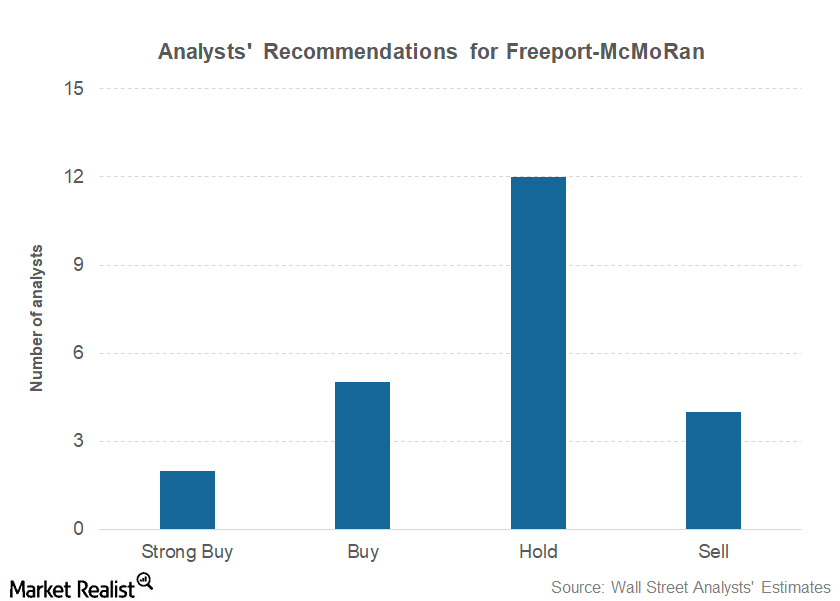

How Analysts View Freeport after Its 3Q17 Earnings Beat

Freeport-McMoRan released its 3Q17 earnings on October 25, posting revenues of ~$4.3 billion in 3Q17, compared with ~$3.7 billion in 2Q17.

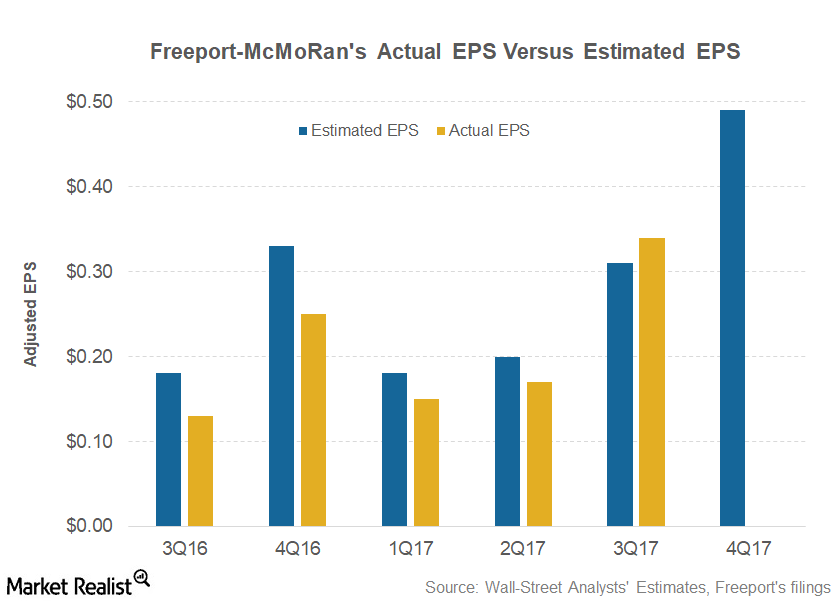

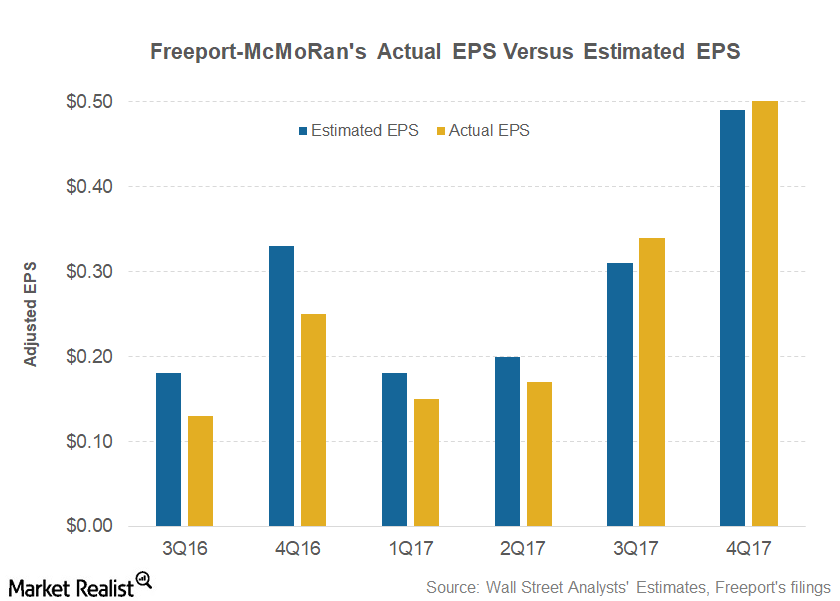

Can Freeport’s 4Q17 Earnings Keep Investor Optimism Alive?

Freeport-McMoRan (FCX), the leading US-based copper miner (XME), is scheduled to release its 4Q17 earnings on January 25.

How Is Bunge Expanding Oilseed Segment’s Global Presence?

In the Oilseeds segment, Bunge’s focus has been to enhance its footprint in the major growth regions.

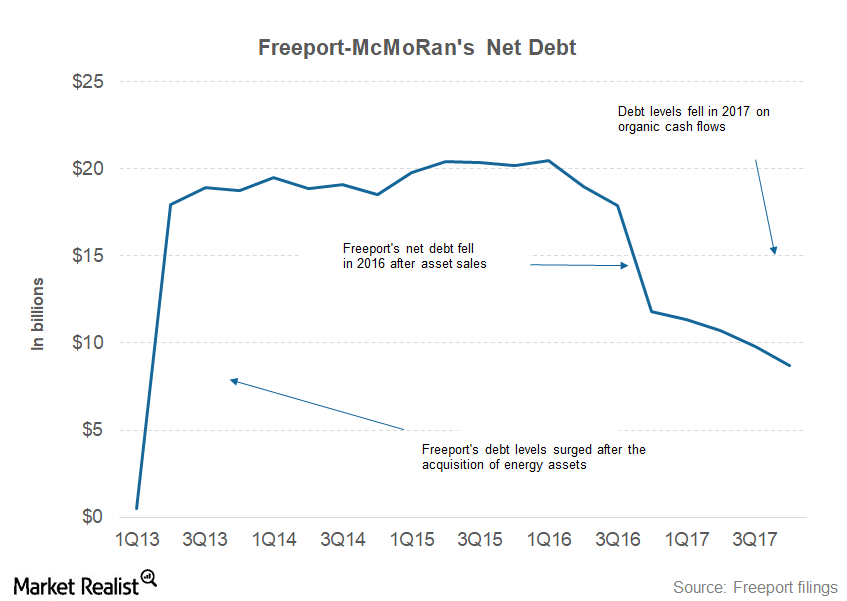

Understanding Freeport’s Capital Allocation Strategy

As copper market conditions have improved, companies have also taken another look at their capital allocation strategies.

How Analysts View Copper Miners amid the Market Carnage

The repercussions of the equity market carnage are evident in commodity markets. Copper, which some analysts see as an indicator of the global economy’s health, has come off its 2018 highs.

Freeport-McMoRan’s 4Q17 Earnings: What You Need to Know

Freeport-McMoRan (FCX) reported its 4Q17 earnings on January 25, 2018. The company reported an adjusted net income of $750 million.

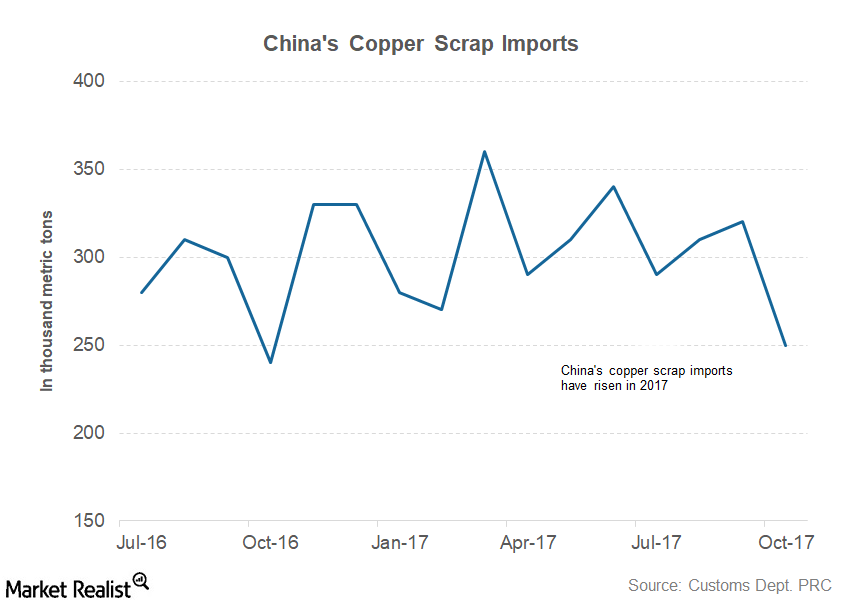

How the Secondary Market Could Impact Copper Prices in 2018

Copper, like other metals, is widely recycled. Last year, we saw improved scrap flows as copper prices moved to higher price levels.

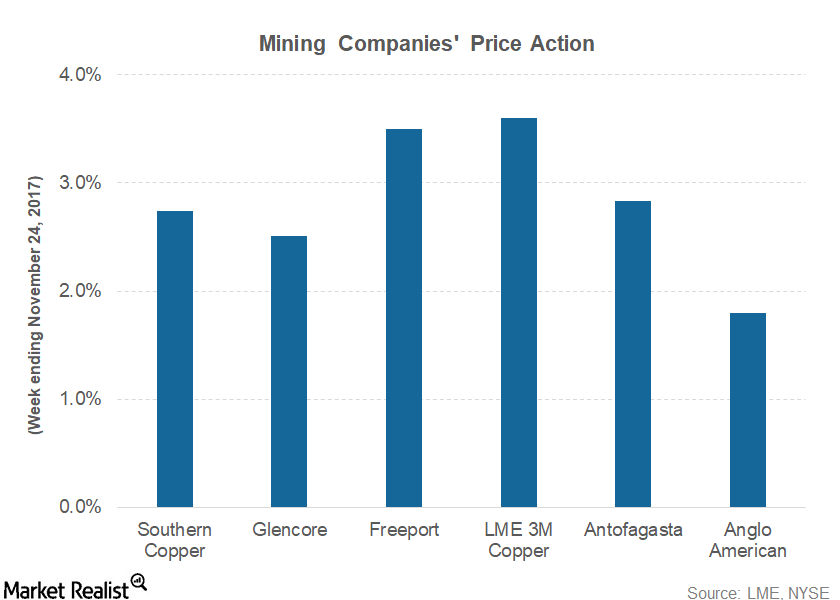

Copper Tests $7,000 as Industrial Metals Rebound

Last week was broadly positive for industrial metals (DBC). Copper rose 3.6%, while aluminum prices rose 1.3% in the week ending November 24.

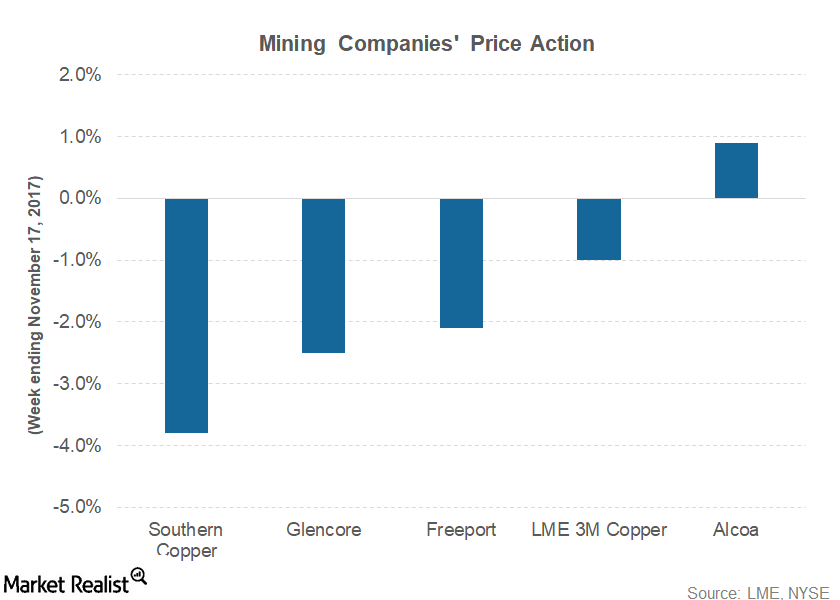

Metal Prices Fell on Demand Concerns Last Week

In this series, we’ll look at the key developments that impacted mining companies last week. We’ll also look at some of the company-specific developments that impacted mining stocks.

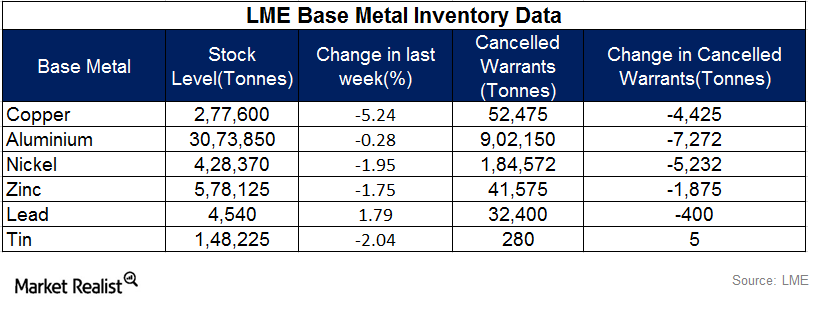

LME Warehouse Data Indicating Support For Metal Prices, But XME Collapses

Analysis of base metal inventories helps us understand the price and usage trends of the respective base metal, as well the price trends of base metal mining companies.

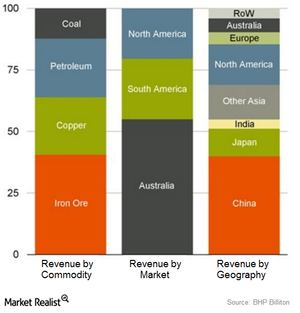

Why Aren’t BHP and RIO Cutting Copper Production?

While major mining companies like Freeport-McMoRan and Glencore are declaring copper production cuts, BHP Billiton says it is reluctant to decrease its copper production.