First Trust Energy AlphaDEX Fund

Latest First Trust Energy AlphaDEX Fund News and Updates

Crude Oil: Price Forecasts and Hedge Funds’ Position

Hedge funds increased their net long positions in US crude oil futures and options by 43,861 contracts or 18.4% to 282,362 contracts on July 25–August 1.

Why Did US Distillate Inventories Fall Again?

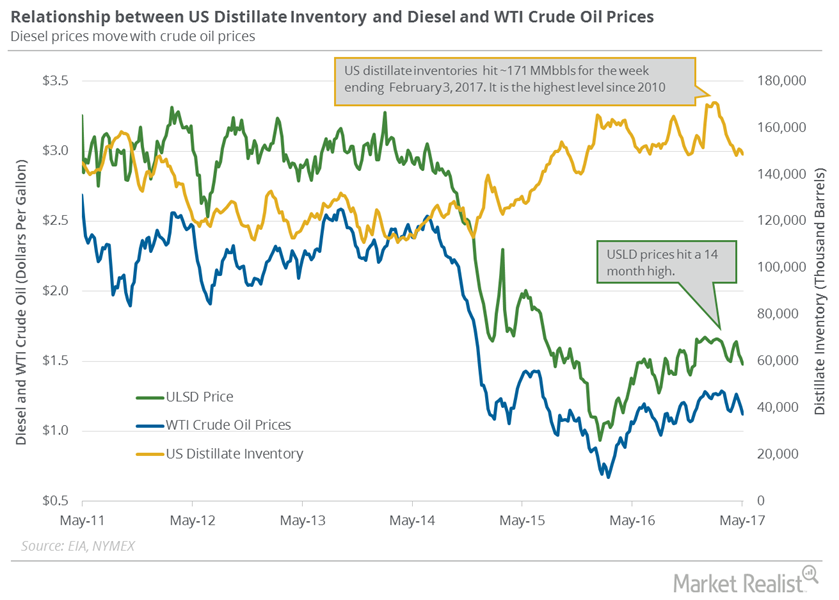

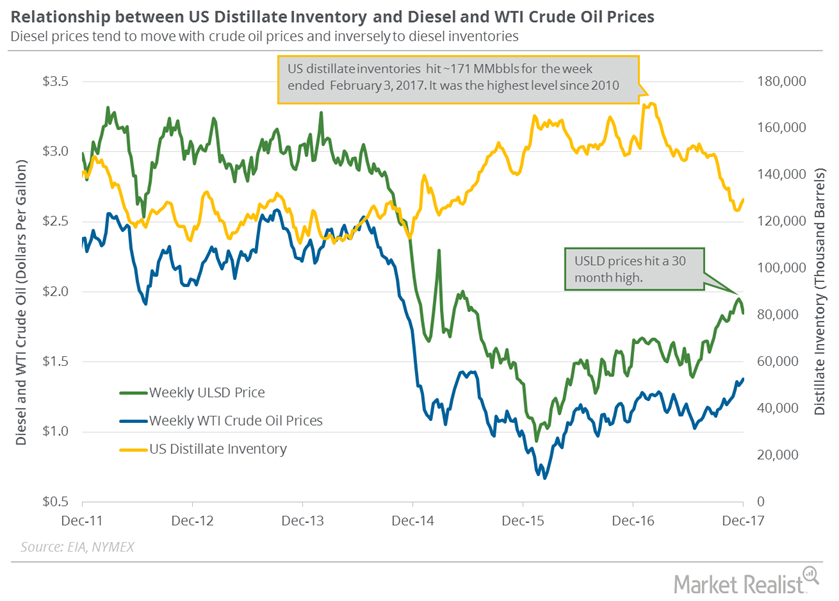

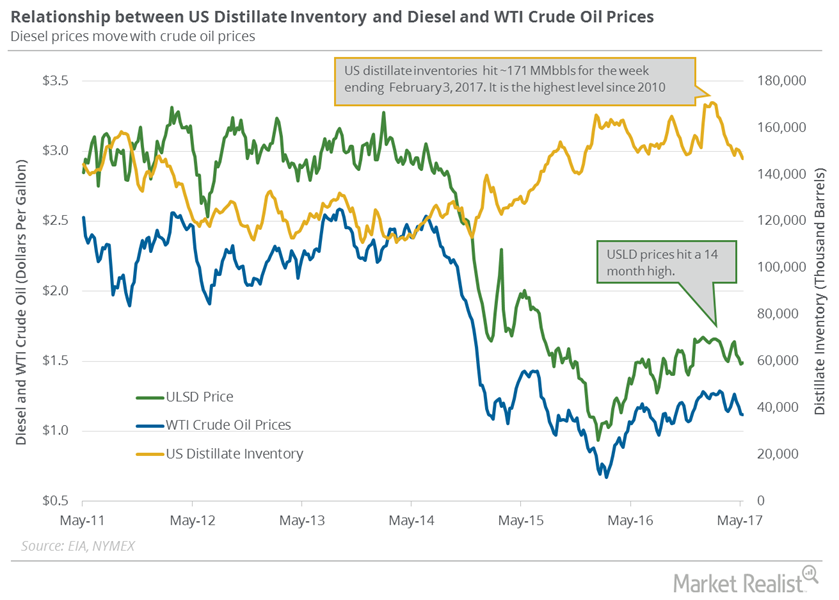

June diesel futures contracts rose 2.1% to $1.47 per gallon on May 10, 2017. Prices rose due to the larger-than-expected fall in distillate inventories.

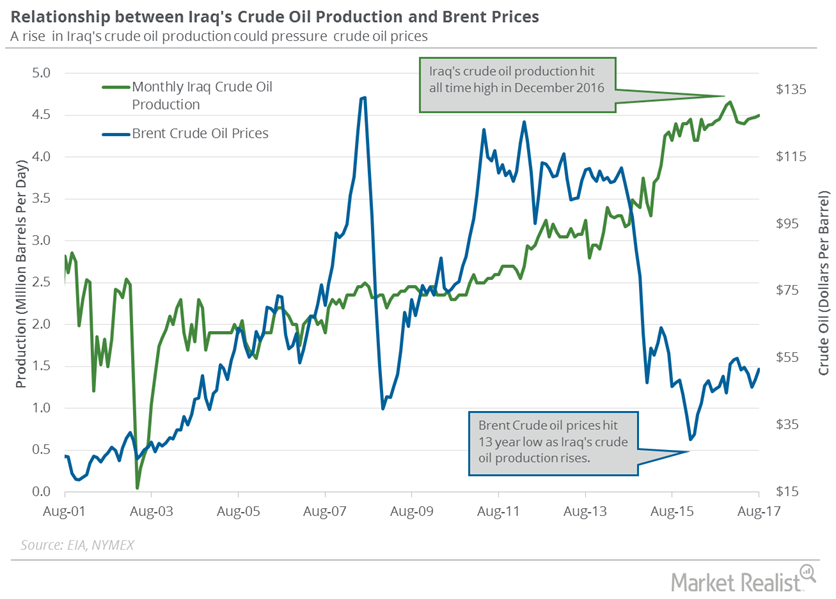

Kurdistan Referendum: Time to Buy Crude Oil Futures?

On September 25, 2017, the people in Kurdistan voted in a referendum for independence. As a result, Turkey blocked 500,000 bpd of crude oil exports.

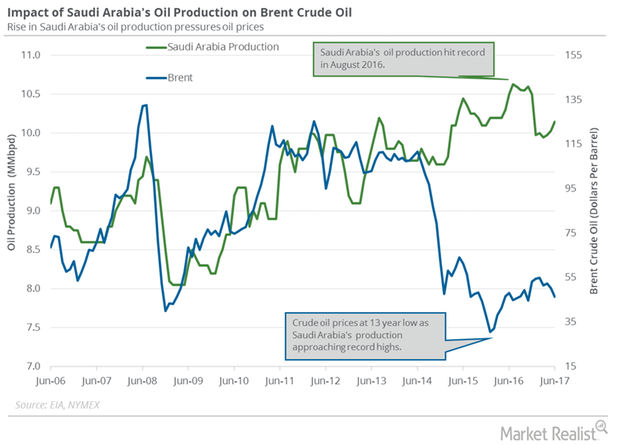

Will Saudi Arabia Remove Excess Oil from the Market?

Saudi Arabia is expected to cut exports 10% to North Asian refiners in September 2017 due to OPEC’s production cut deal.

Hedge Funds’ Net Long Positions in US Crude Oil Rose Again

Hedge funds increased their net bullish positions in US crude oil futures and options rose by 36,834 contracts to 215,488 contracts on July 11–18, 2017.

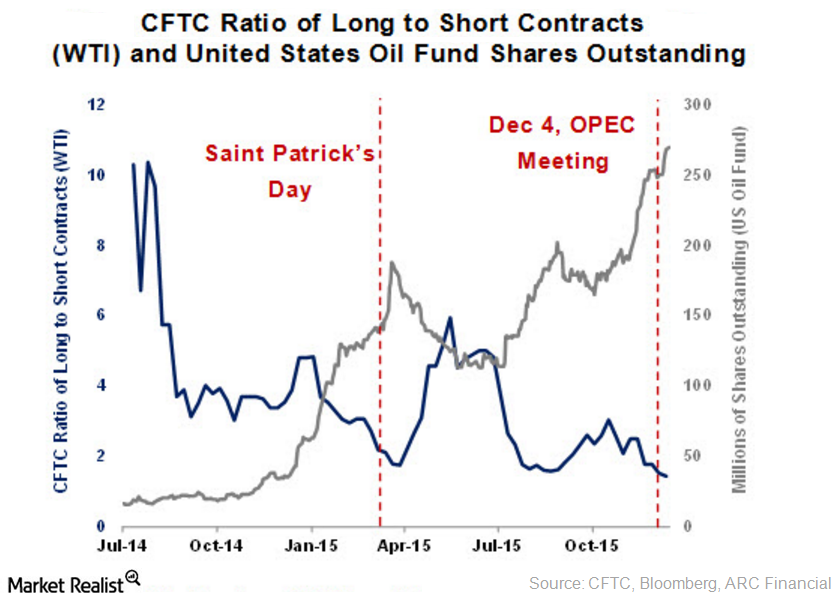

Long Positions Fall in the CFTC’s Commitment of Traders Report

The CFTC’s COT report states that hedge funds reduced their long positions for the week ending January 12, 2016. The net long positions fell by 20,673 contracts to 163,504 contracts during the week.

Hedge Funds’ Net Bullish Positions on US Crude Oil

Hedge funds reduced their net bullish positions in US crude oil futures and options by 1,136 contracts to 133,606 contracts on June 20–27, 2017.

Are US Distillate Inventories Bearish for Oil Prices?

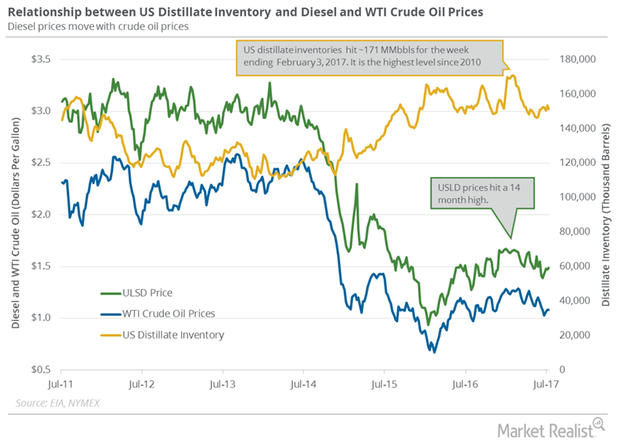

US distillate inventories rose by 1,667,000 barrels or 1.3% to 129.4 MMbbls (million barrels) on November 24–December 1, 2017.

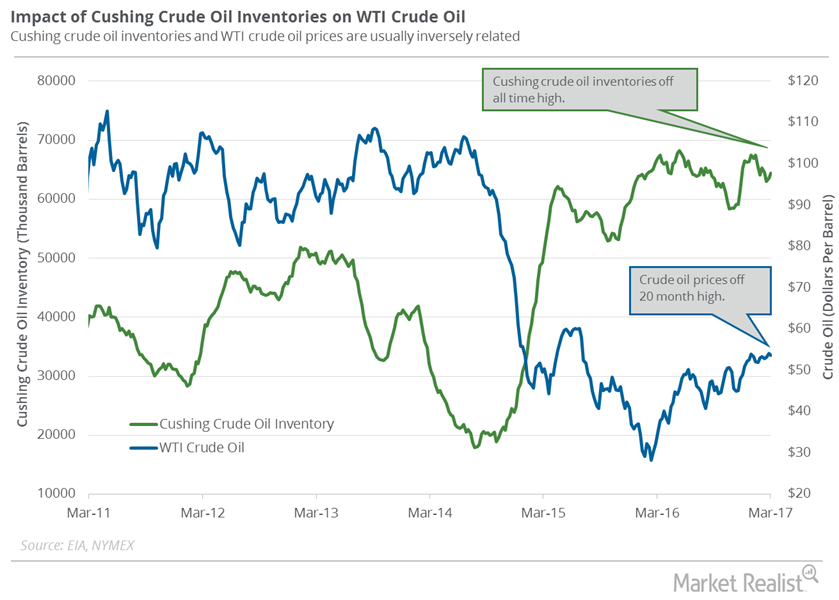

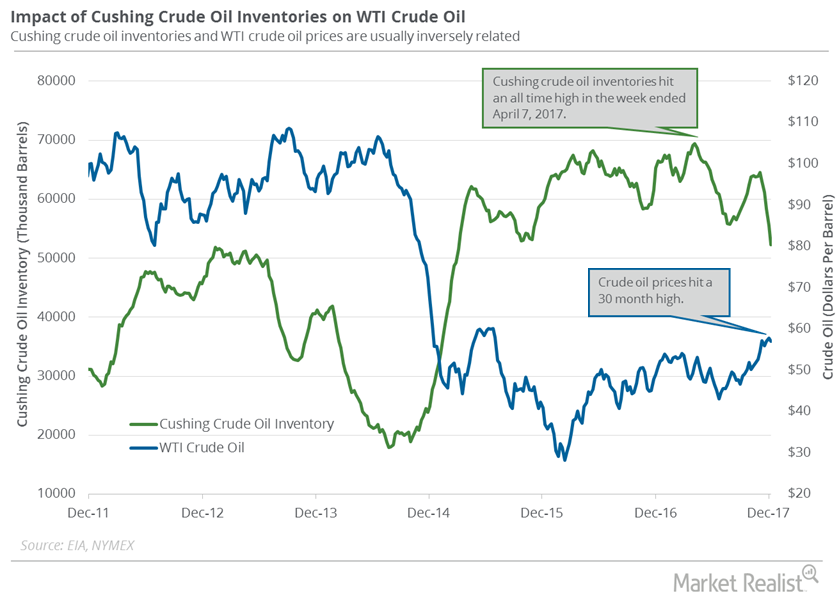

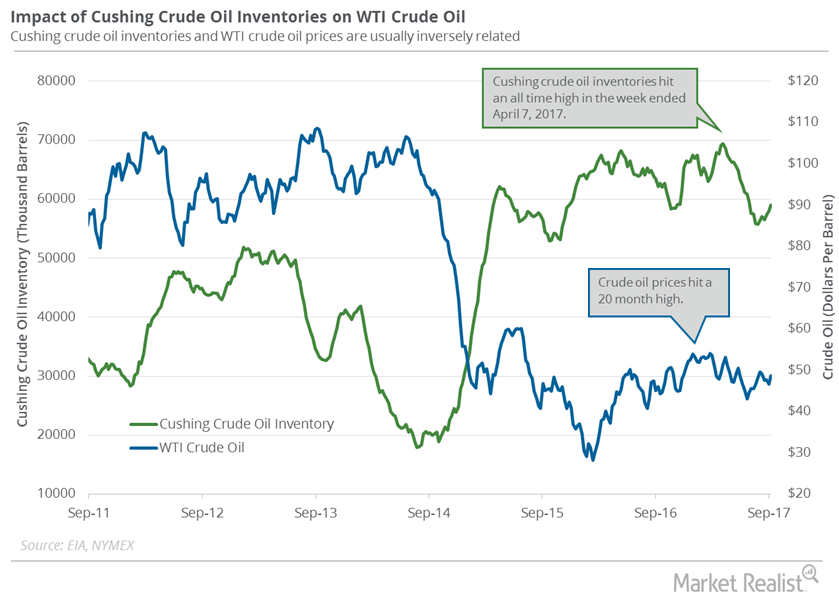

Cushing Crude Oil Inventories: More Pain for Oil Prices?

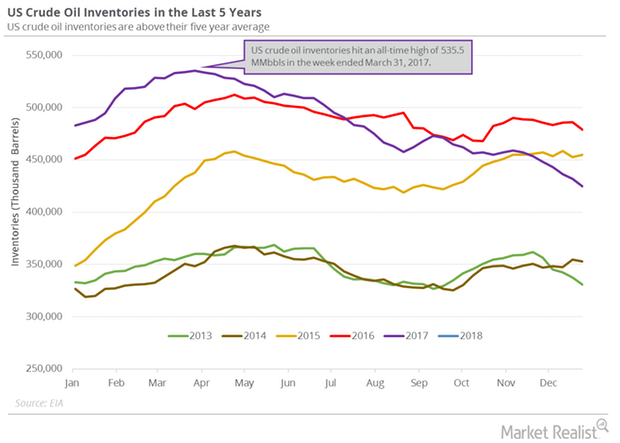

Market surveys estimate that Cushing crude oil inventories rose from March 3–10. A rise in crude oil inventories could pressure US crude oil prices.

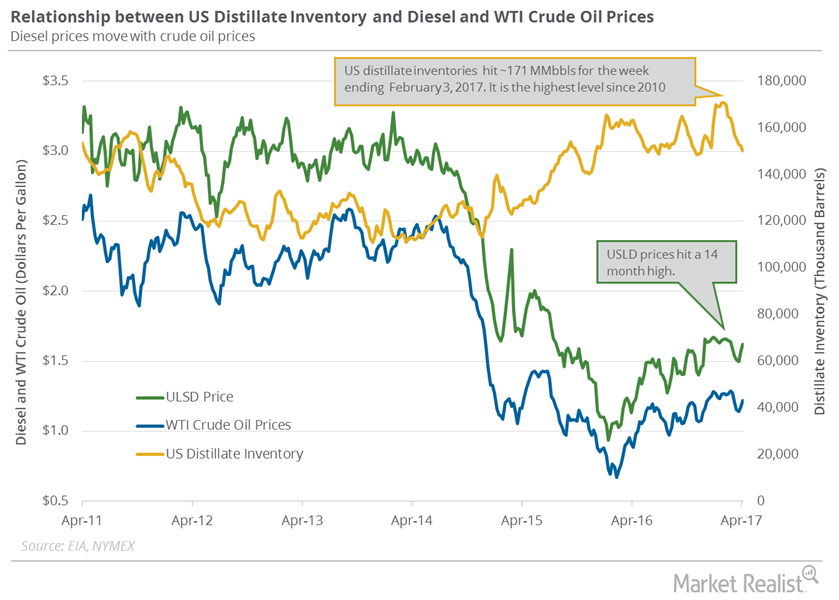

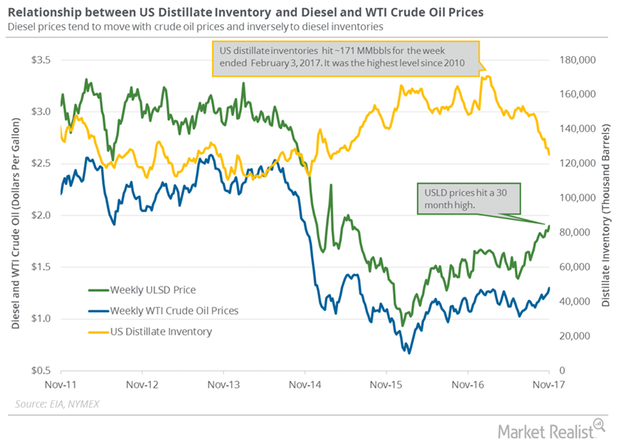

How US Distillate Inventories Affect Diesel and Oil Prices

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 2.2 MMbbls (million barrels) to 150.2 MMbbls between March 31 and April 7, 2017.

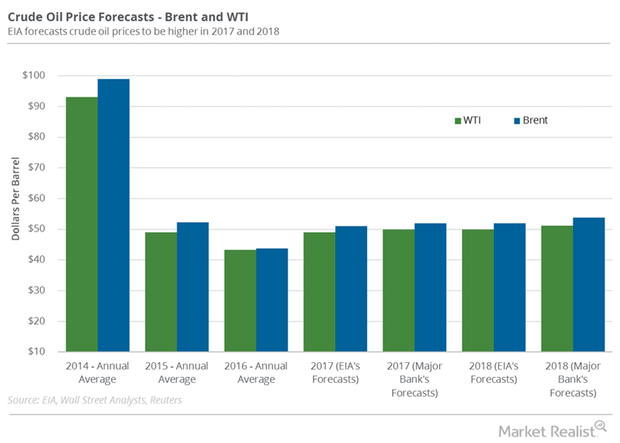

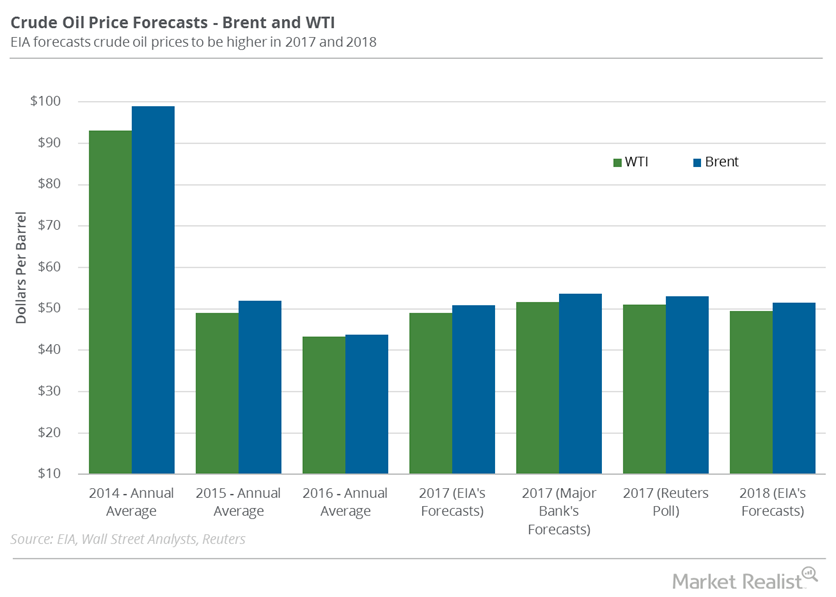

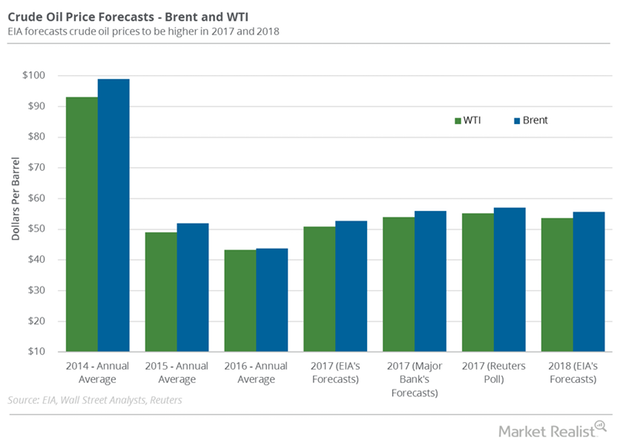

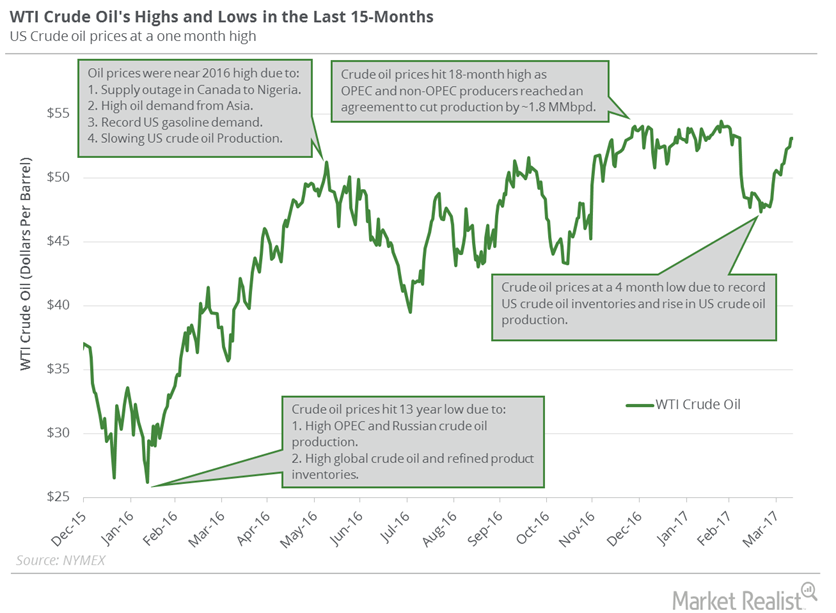

Will Crude Oil Prices Hit a New High?

US WTI crude oil prices were at $54.45 per barrel on February 23—the highest level since June 2015. As of April 10, prices were 2.5% below their high.

US Distillate Inventories Fell for the Tenth Straight Week

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 2 MMbbls to 148.3 MMbbls on April 7–14, 2017.

US Distillate Inventories Are at 32-Month Low

The EIA reported that US distillate inventories fell by 3,359,000 barrels to 125.5 MMbbls (million barrels) or 2.6% between October 27, 2017, and November 3, 2017.

US Distillate Inventories Fell for the Third Straight Week

The EIA reported that US distillate inventories fell by 1.9 MMbbls (million barrels) to 146.8 MMbbls on May 5–12, 2017.

US Distillate Inventories Fell for the Fourth Time in 5 Weeks

The EIA reported that US distillate inventories fell by 1.9 MMbbls (million barrels) to 149.5 MMbbls on July 14–21, 2017.

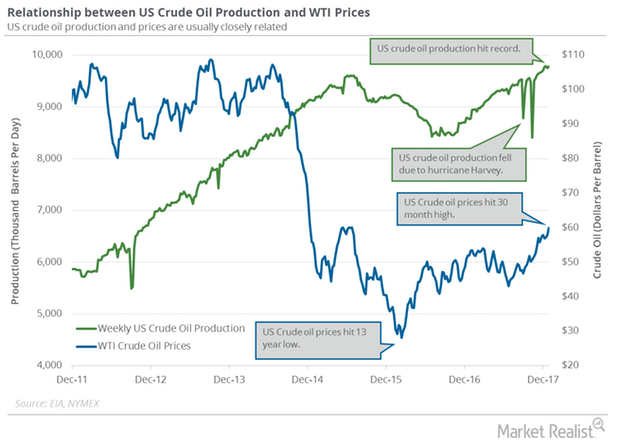

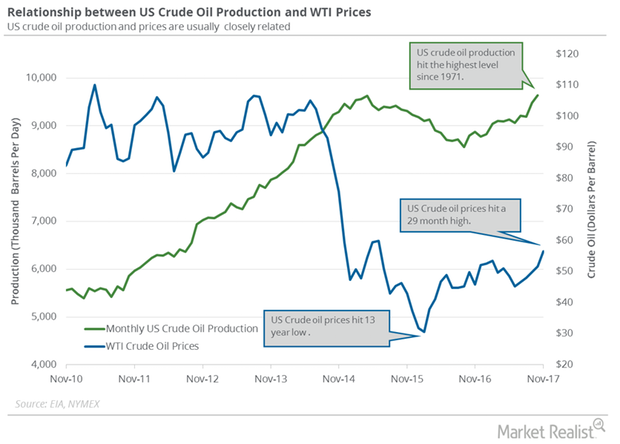

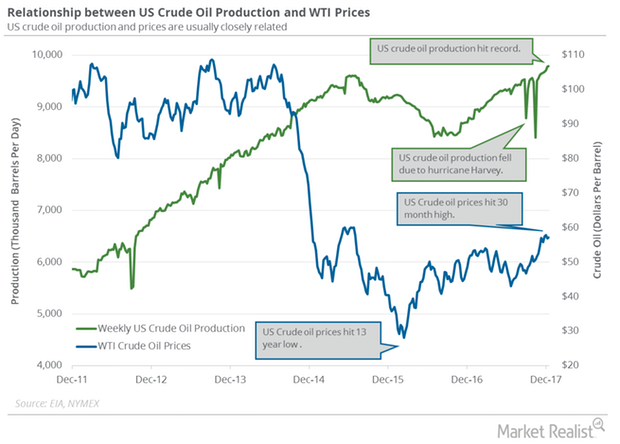

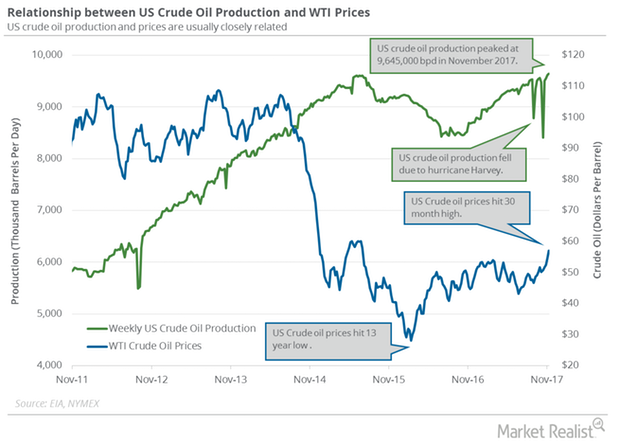

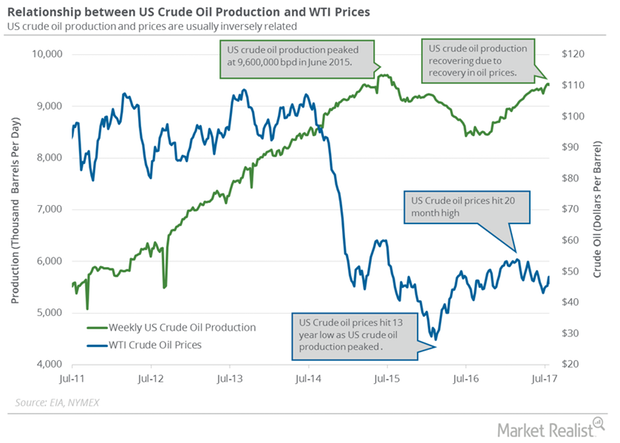

Will US Crude Oil Production Undermine Crude Oil Futures?

According to the EIA, US crude oil production increased by 28,000 bpd (barrels per day) to 9,782,000 bpd on December 22–29, 2017.

US Crude Oil Production Fell and Boosted Oil Futures

US crude oil production fell by 290,000 bpd (barrels per day) or 3% to 9,492,000 bpd between December 29, 2017, and January 5, 2018.

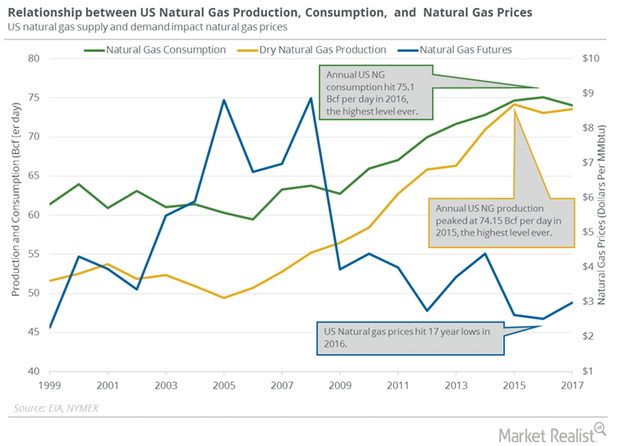

US Natural Gas Production and Consumption Could Impact Prices

According to PointLogic, US dry natural gas production increased by 0.3 Bcf (billion cubic feet) per day to 75.7 Bcf per day on January 11–17, 2018.

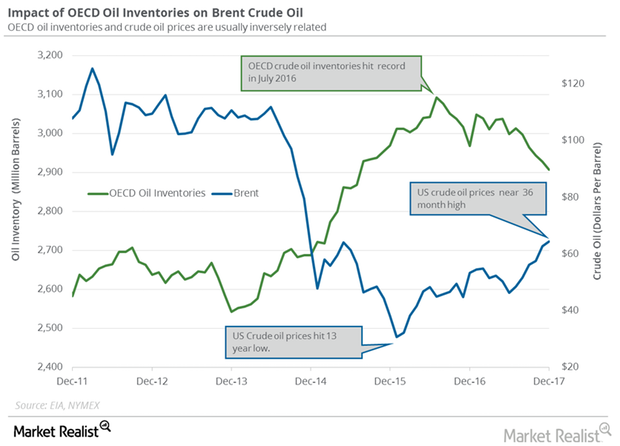

OECD’s Crude Oil Inventories: Trump Card for Crude Oil Bulls?

The EIA estimates that global crude oil inventories could rise in 2018 and 2019, which is bearish for oil prices.

US Crude Oil Output Hit the Highest Level since May 1971

US crude output increased by 167,000 bpd to 9.64 MMbpd in October 2017—compared to the previous month. It was the highest level since May 1971.

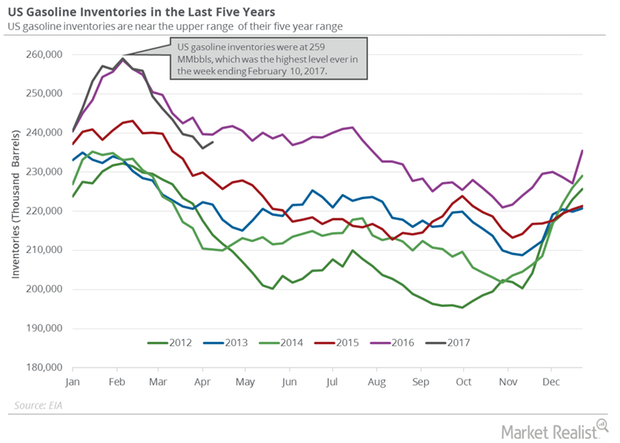

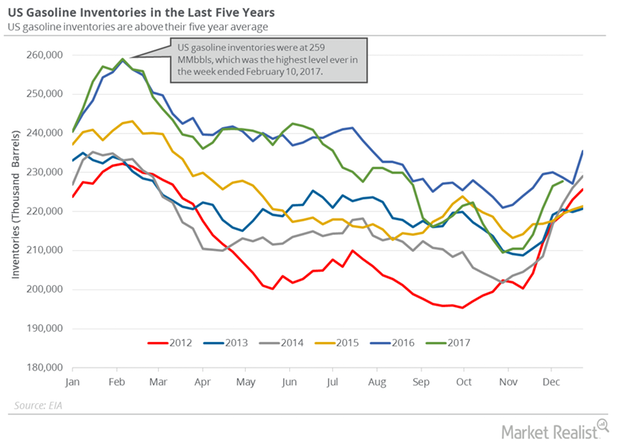

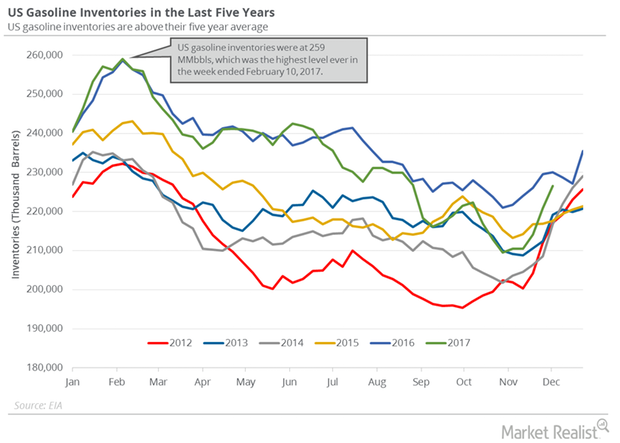

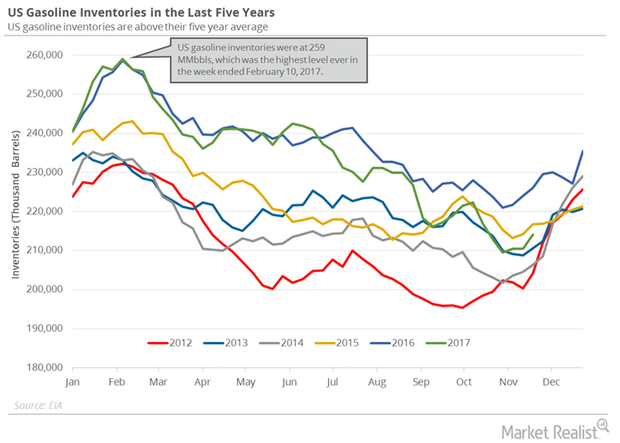

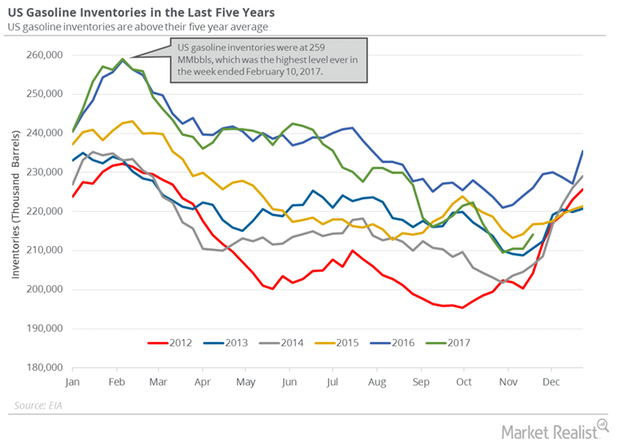

US Gasoline Inventories: Bearish Driver for Crude Oil Futures

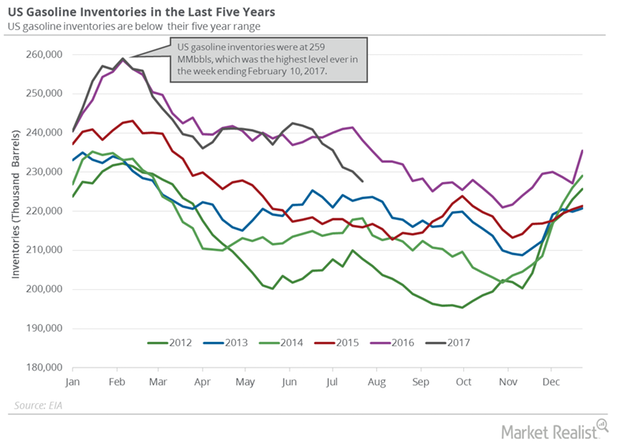

The EIA estimated that US gasoline inventories rose by 1.2 MMbbls (million barrels) to 227.7 MMbbls on December 8–15, 2017.

Crude Oil Prices: Which Factor Could Change the Trend?

The EIA estimated that US crude oil production rose by 9,000 bpd (barrels per day) to 9,789,000 bpd on December 8–15, 2017.

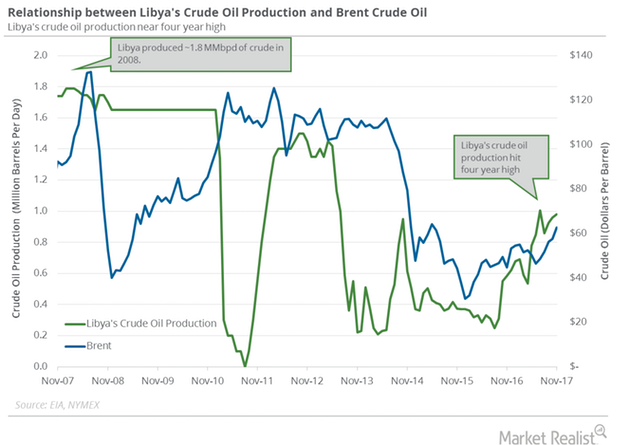

Libya’s Crude Oil Production Is near a 4-Year High

The EIA estimates that Libya’s crude oil production rose by 20,000 bpd (barrels per day) or 2.1% to 980,000 bpd in November 2017.

Cushing Inventories: Largest Weekly Fall since 2009

Cushing inventories fell by 3,317,000 barrels to 52.2 MMbbls (million barrels) on December 1–8, 2017, according to the EIA.

US Gasoline Inventories: Turning Point for Crude Oil Futures?

US gasoline inventories rose by 5.6 MMbbls (million barrels) or 2.6% to 226.5 MMbbls on December 1–8, 2017.

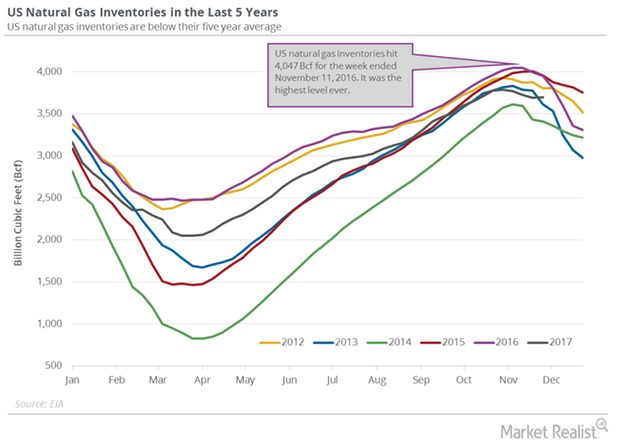

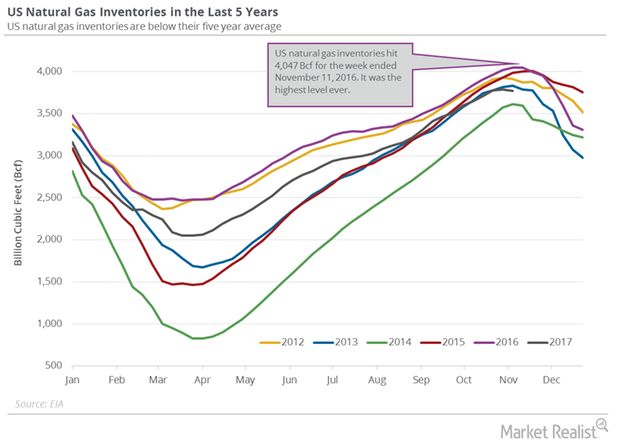

Unexpected Rise in US Natural Gas Inventories

The EIA estimated that US natural gas inventories rose by 2 Bcf (billion cubic feet) to 3,695 Bcf on November 24–December 1, 2017.

Analyzing US Gasoline Inventories and Demand

The API reported that US gasoline and distillate inventories rose by 9,200,000 barrels and 4,300,000 barrels on November 24–December 1, 2017.

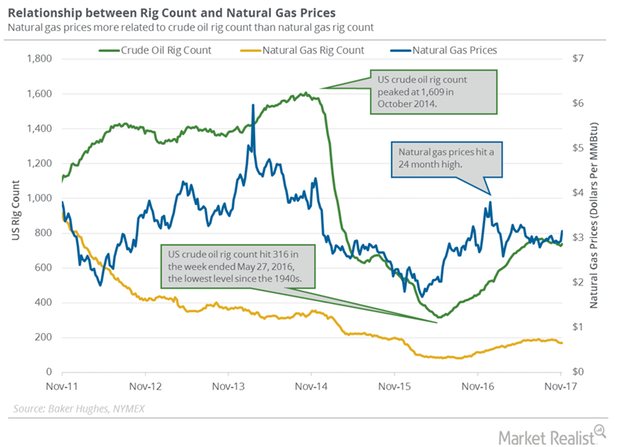

Production Cut Extension Could Influence US Natural Gas Rigs

Baker Hughes, a GE company, is scheduled to release its US crude oil and natural gas rig count report on December 1, 2017.

US Gasoline Inventories Weighed on Crude Oil Futures

US gasoline inventories rose by 3,627,000 barrels to 214 MMbbls (million barrels) on November 17–24, 2017, according to the EIA.

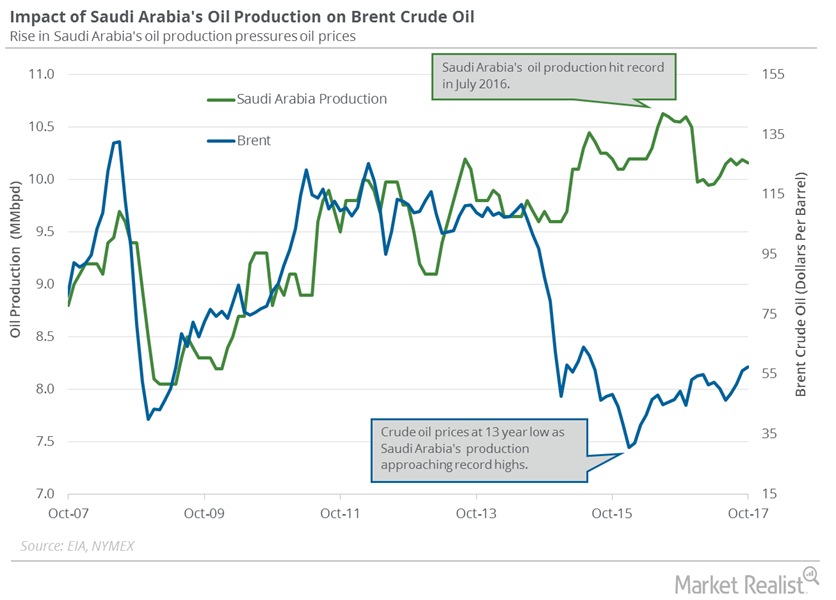

Saudi Arabia Could Help the Global Oil Market

Saudi Arabia’s crude oil exports to the US fell to 525,000 bpd in October 2017—the lowest in 30 years. Exports fell due to ongoing output cuts.

Traders Are Tracking US Natural Gas Inventories

The EIA reported that US gas inventories fell by 18 Bcf (billion cubic feet) to 3,772 Bcf on November 3–10, 2017.

US Crude Oil Production: Bearish Driver for Oil Prices

The EIA estimates that US crude oil production rose by 25,000 bpd (barrels per day) or 0.3% to 9,645,000 bpd on November 3–10, 2017.

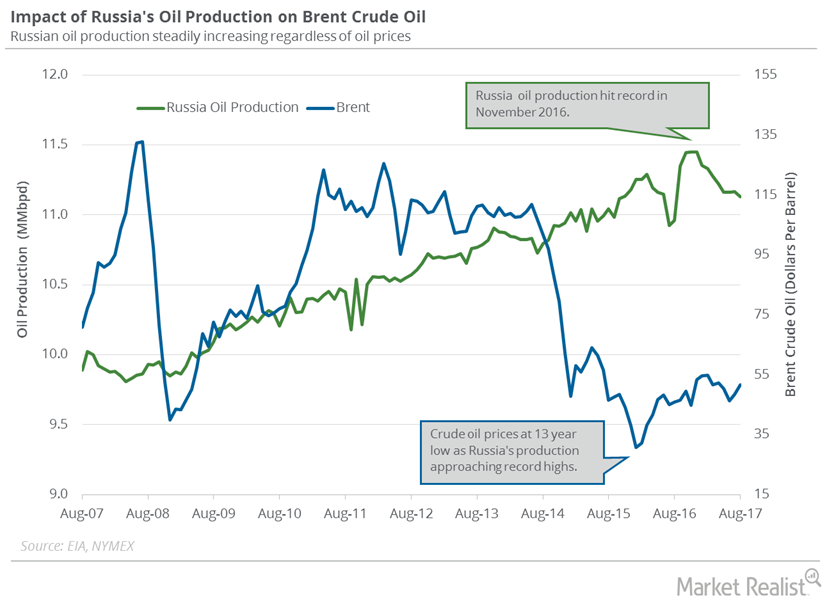

Russia’s Crude Oil Exports Could Pressure Oil Futures

Russia’s energy ministry estimates that the country’s crude oil exports rose 2% or by 160,000 bpd (barrel per day) in the first nine months of 2017.

OPEC’s Crude Oil Production and Exports Impact Crude Oil Prices

The EIA estimates that OPEC’s crude oil production fell by 150,000 bpd to 32.77 MMbpd (million barrels per day) in August 2017—compared to July 2017.

Cushing Inventories: Bullish or Bearish for Crude Oil Prices?

A market survey estimates that Cushing crude oil inventories has risen between September 8 and September 15.

EIA Upgrades US Crude Oil Production Estimates for 2017 and 2018

The EIA released its Short-Term Energy Outlook report on August 8, 2017. It estimates that US crude oil production could average 9.35 MMbpd in 2017.

US Gasoline Inventories Fell, Supported Gasoline Oil Prices

The EIA reported that US gasoline inventories fell 1.1% or by 2.5 MMbbls (million barrels) to 227.7 MMbbls on July 21–28, 2017.

US Gasoline Inventories Drive Gasoline and Crude Oil Prices

The EIA reported that US gasoline inventories fell by 4.4 MMbbls (million barrels) to 231.2 MMbbls on July 7–14, 2017.

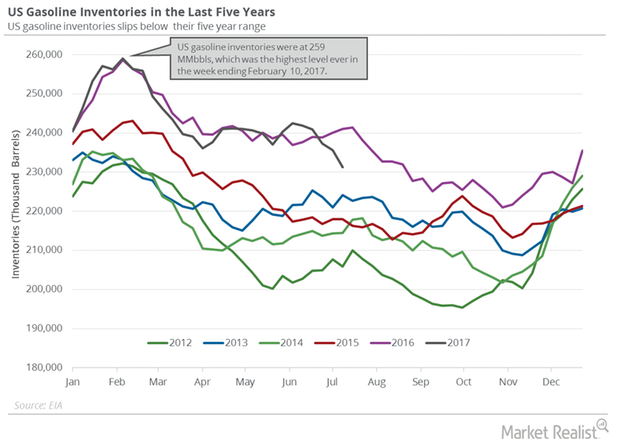

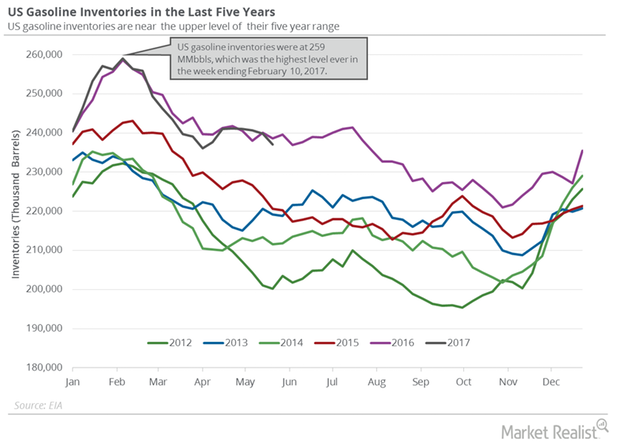

US Gasoline Inventories: More Concerns for Crude Oil Prices

US gasoline inventories are 7.2% below their all-time high. The expectation of a fall in gasoline inventories could support gasoline prices.

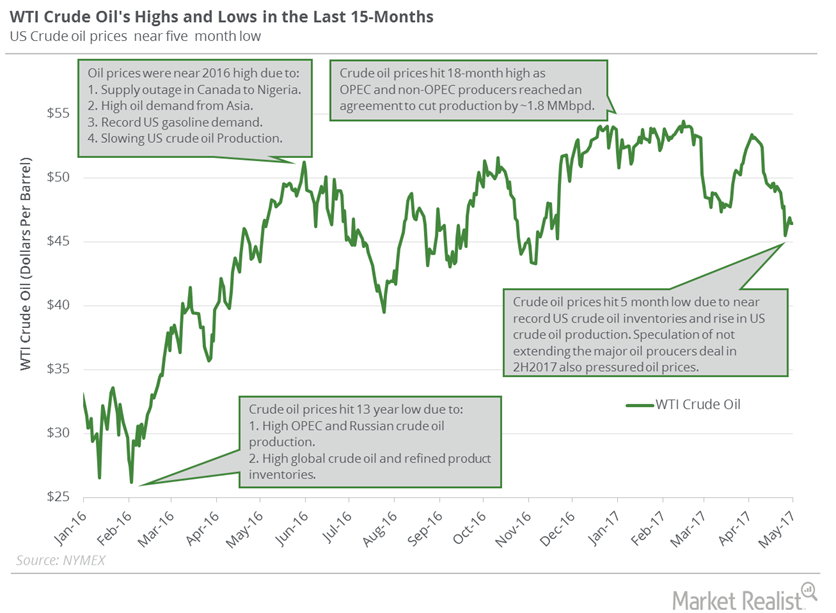

Could Crude Oil Prices Hit Lows from 2016?

WTI (West Texas Intermediate) crude oil (FXN) (SCO) (FENY) futures contracts for June delivery are near a five-month low as of May 9, 2017.

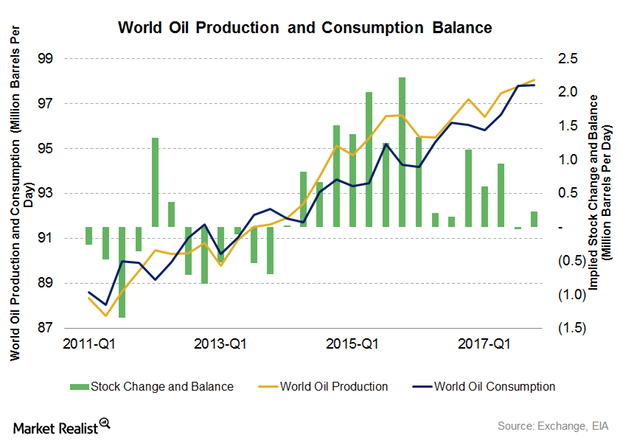

Decoding the World Oil Supply and Demand Gap in 2017

The EIA estimates that the world oil supply and demand gap averaged 780,000 bpd (barrels per day) in 1H16. It’s expected to average 650,000 bpd in 2H16.

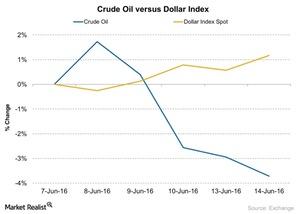

Will the Dollar’s Recovery Affect Crude Oil?

Between June 7 and June 14, 2016, crude oil (USO) fell by ~3.7% while the US dollar index (UUP) rose by around 1.2%.

How Did the Consumer Price Index Affect Crude Oil Prices?

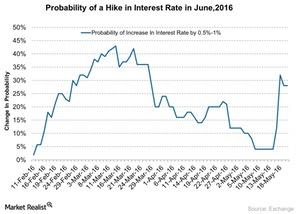

The US (SPY) (VOO) CPI (consumer price index) rose 0.4% on a month-over-month basis in April, according to a US Department of Labor report on May 17, 2016.

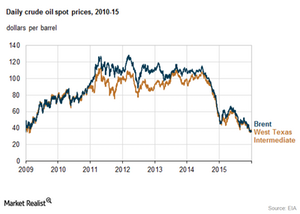

WTI and Brent Crude Oil Prices in 2015, Lowest since 2009

US benchmark WTI crude oil prices averaged at $49 per barrel in 2015. WTI and Brent crude oil prices closed below $40 per barrel in 2015.

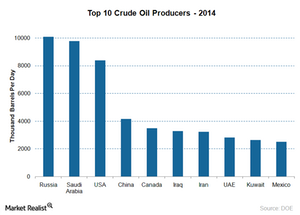

How Top Crude Oil Producers Impact the Crude Oil Market

The world’s largest producer of crude oil is Russia. It is also among the largest crude oil exporters.

How OPEC’s Crude Oil Reserves Affect the Crude Oil Market

OPEC countries control 40% of global crude oil production and have around 81% of global crude oil reserves, as of 2014.