TechnipFMC plc

Latest TechnipFMC plc News and Updates

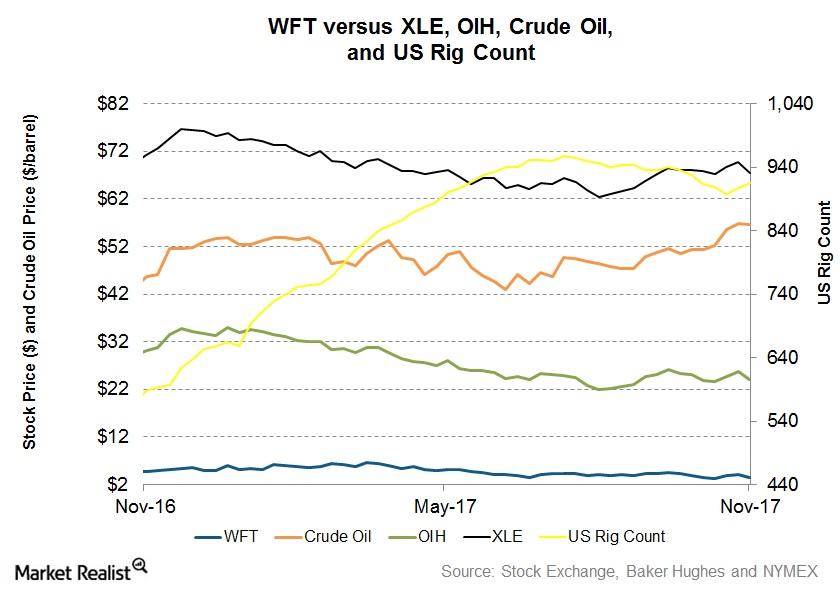

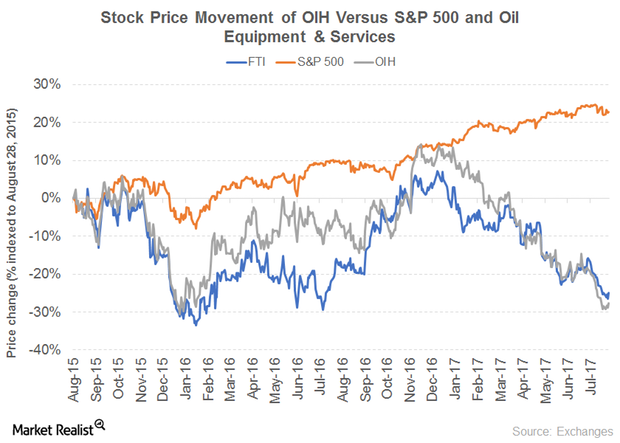

How Weatherford Stock Moved in the Week Ended November 17

Weatherford International (WFT) stock fell 16.0% in the week ended November 17, 2017. The VanEck Vectors Oil Services ETF (OIH) generated a return of -6.0% during this period.

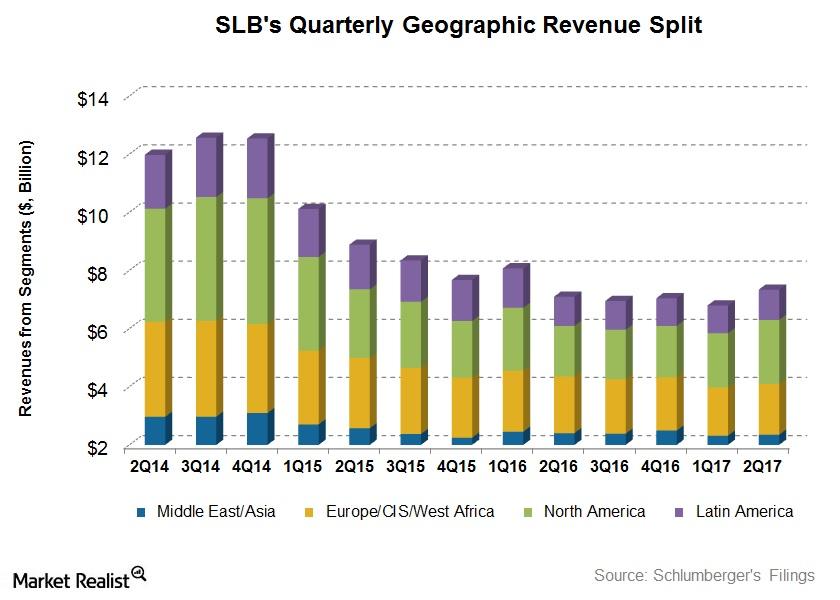

What Were Schlumberger’s Drivers in 2Q17?

In 2Q17, Schlumberger reported a net loss of ~$74 million—a sharp improvement compared to 2Q16 when it reported a net loss of $2.16 billion.

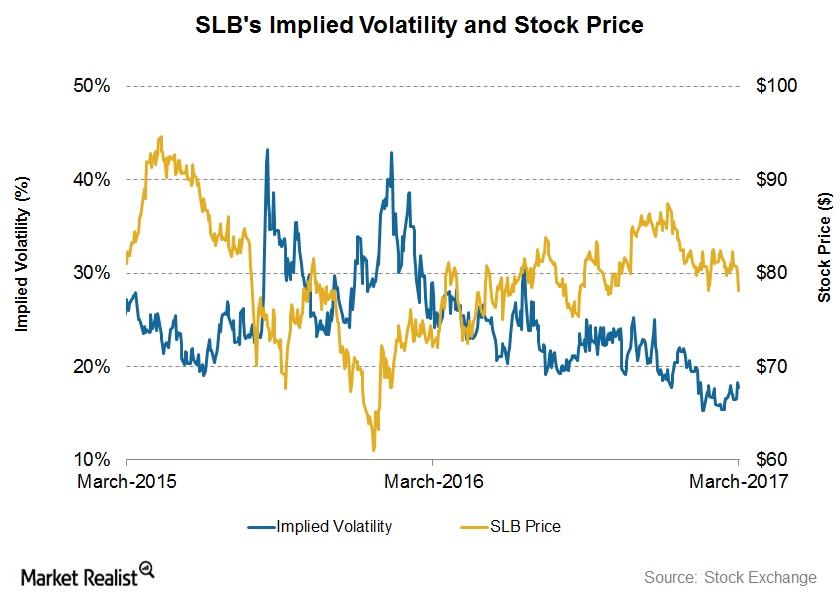

Schlumberger by Implication: Reading Implied Volatility

On March 10, 2017, Schlumberger’s (SLB) implied volatility was 17.7%, having fallen from 19% since its 4Q16 financial results were announced on January 20.

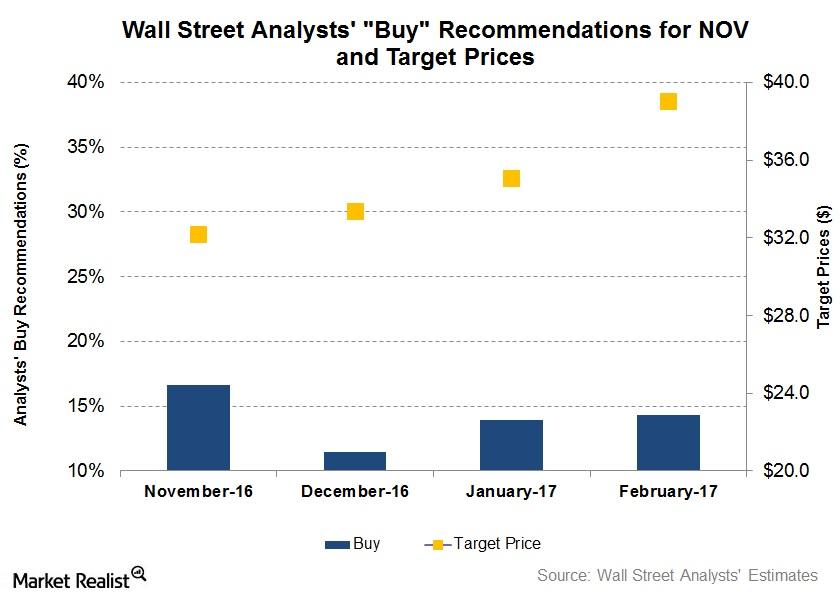

Wall Street Analysts’ Forecasts for National Oilwell Varco

On February 24, ~14% of the analysts tracking National Oilwell Varco rated it as a “buy,” ~74% rated it as a “hold,” and 12% rated it as a “sell.”

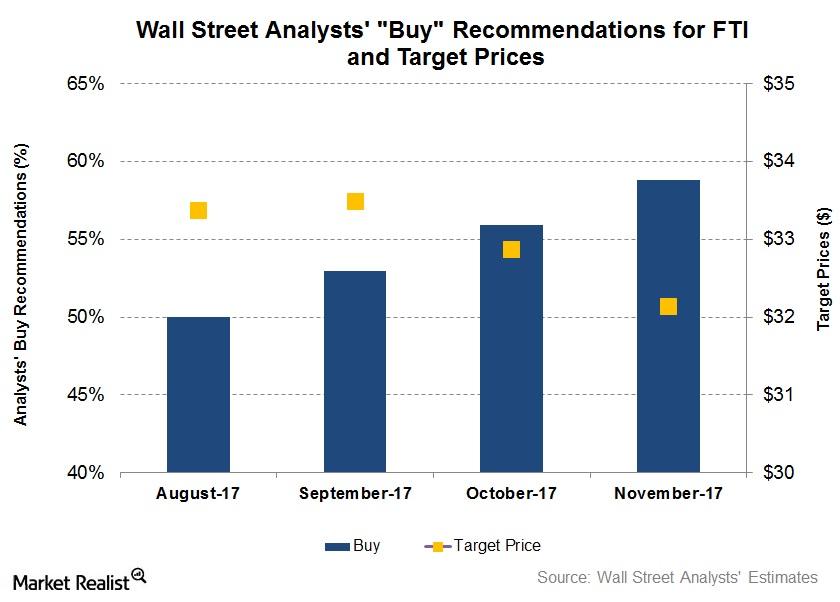

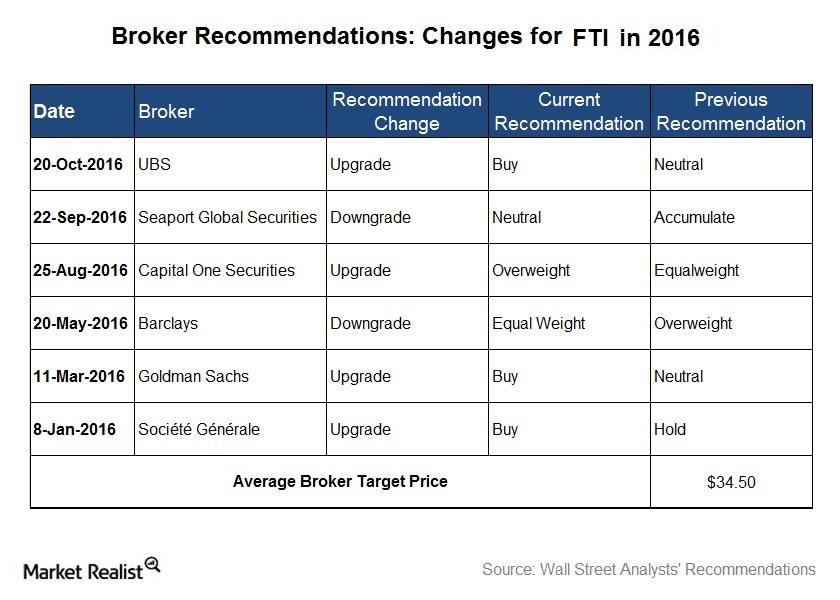

Wall Street Analysts’ Recommendations for TechnipFMC

In this article, we’ll look at Wall Street analysts’ recommendations for TechnipFMC (FTI) on November 9.

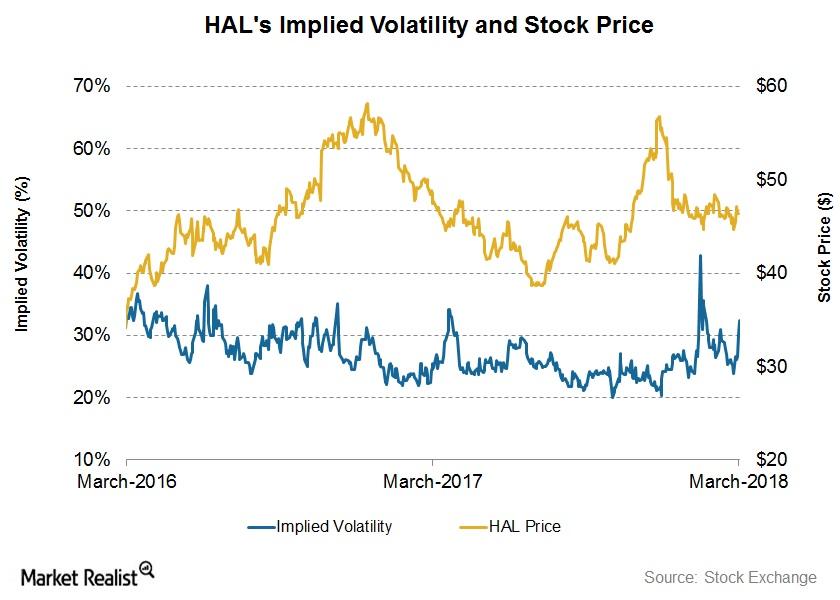

Halliburton’s Next 7-Day Stock Price Forecast

Halliburton stock will likely close between $48.52 and $44.36 in the next seven days—based on its implied volatility.

What Could Drive TechnipFMC’s Dividend Yield

How TechnipFMC intends to maintain its yield FMC Technologies and Technip merged to become TechnipFMC (FTI) in 2017, an international provider of subsea, onshore, offshore, and surface projects. The synergy aims to combat the challenges of low oil prices and a challenging outlook through cost cutting and the enhancement of efficiency. The company recorded 51% revenue […]

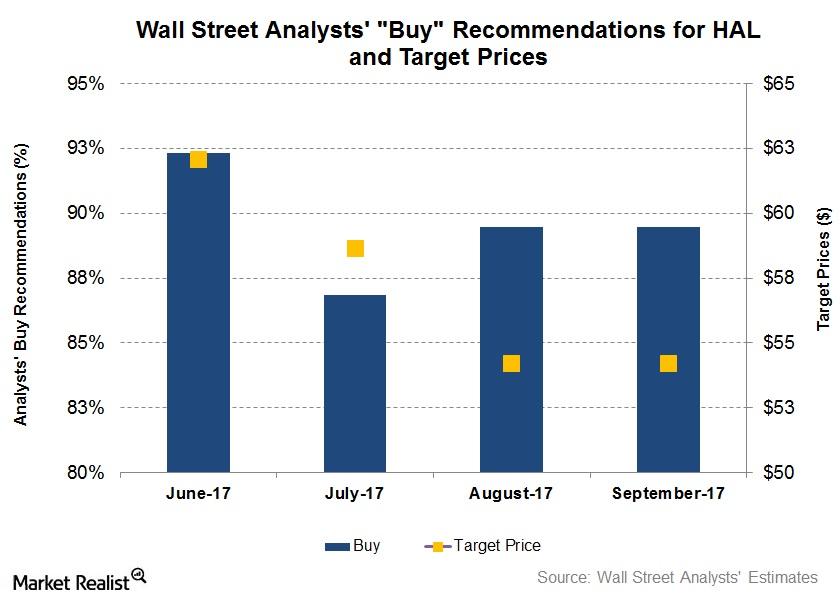

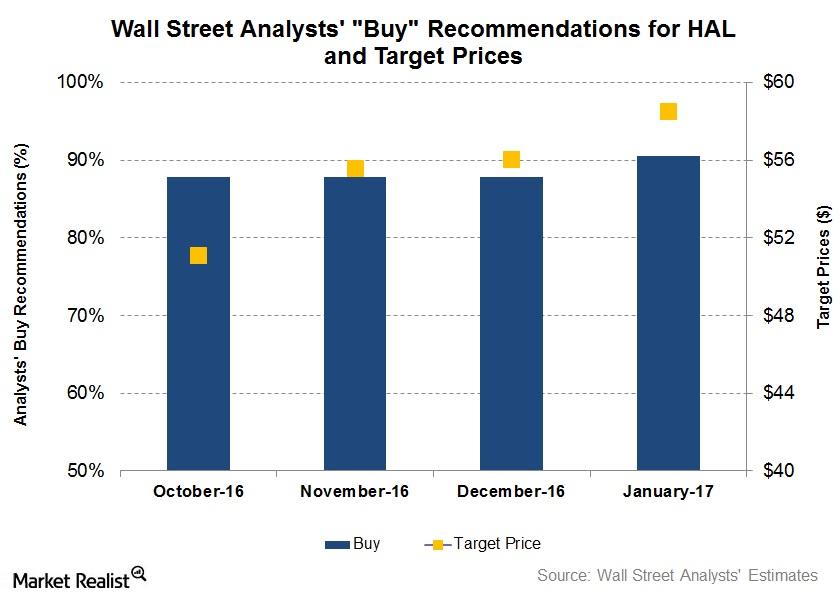

What Wall Street Analysts Are Recommending for Halliburton

On September 5, 2017, 89.0% of Wall Street analysts who are tracking Halliburton stock rated it a “buy” or some equivalent.

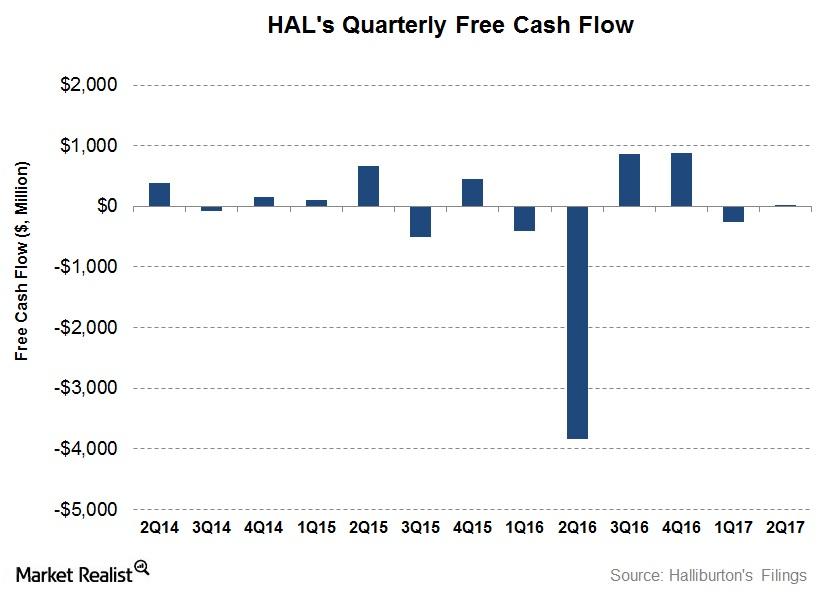

Behind Halliburton’s Free Cash Flow, Capex, and Acquisition Strategies

Halliburton’s (HAL) CFO (cash from operating activities) in 2Q17 showed a remarkable improvement over 2Q16. HAL’s CFO was a $346 million in 2Q17.

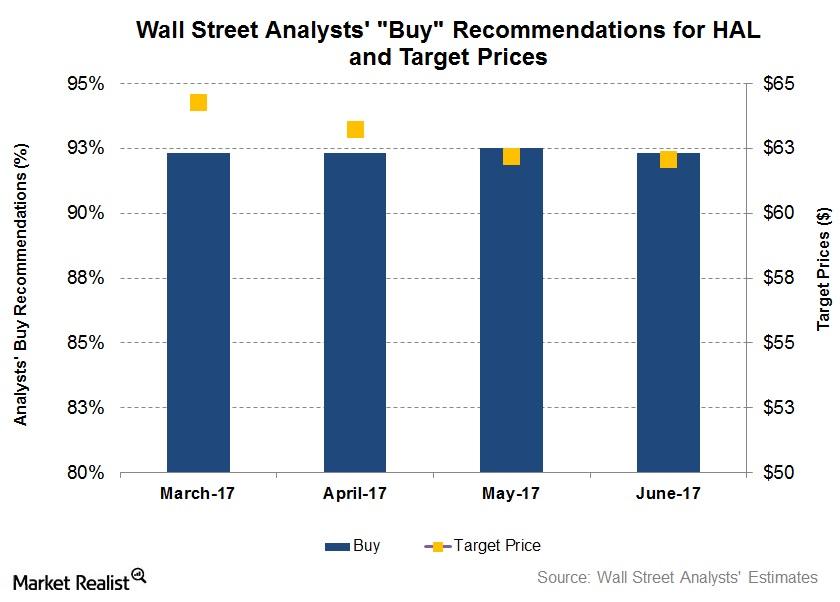

Analysts’ Recommendations for Halliburton

On June 12, 92% of the analysts tracking Halliburton rated it as a “buy,” ~3% of the analysts rated it as a “sell,” and the other 5% rated it as a “hold.”

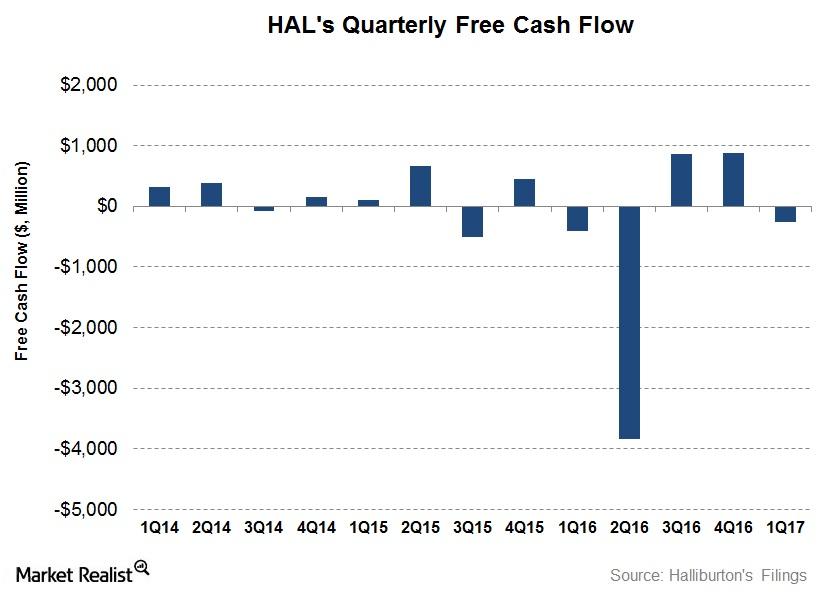

Analyzing Halliburton’s Free Cash Flow and Capex Plans

Halliburton’s cash from operating activities (or CFO) in 1Q17 was an improvement over 1Q16, although it was a steep deterioration compared to 4Q16.

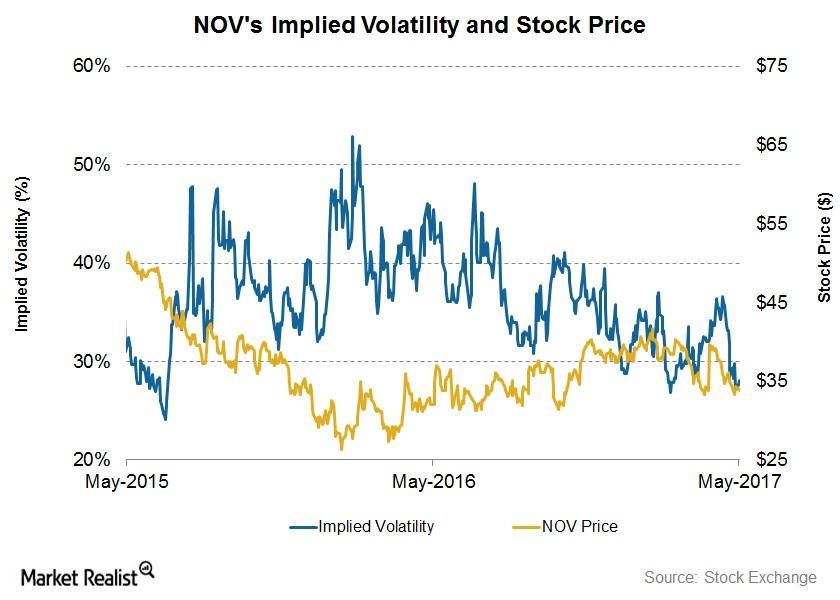

What’s National Oilwell Varco’s 7-Day Stock Price Forecast?

NOV stock will likely close between $35.11 and $32.49 in the next seven days. The stock was trading at $33.80 on May 11, 2017.

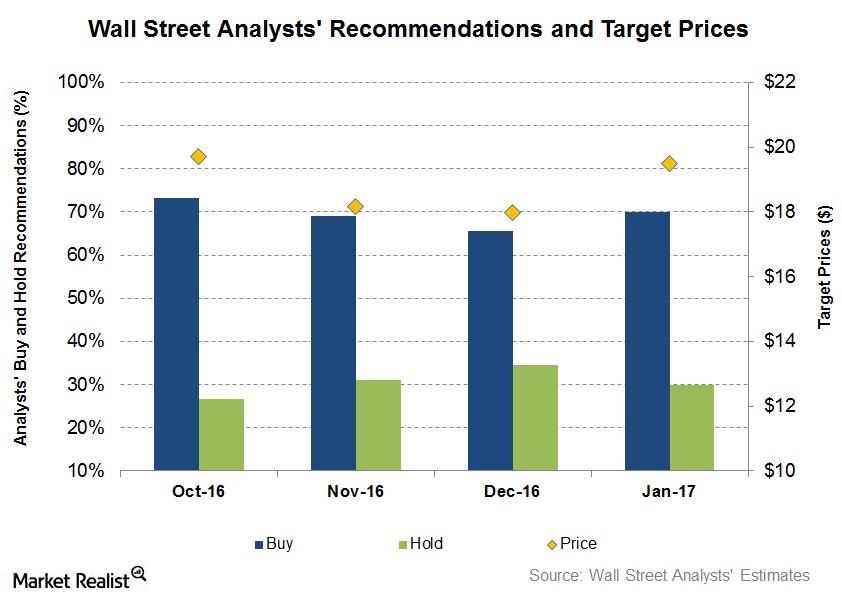

How Have Superior Energy’s Recommendations Changed before the 4Q16 Earnings?

On January 6, 2017, ~70% of the analysts tracking SPN recommended a “buy” or some equivalent for the stock, while ~30% of the analysts issued a “hold.”

Wall Street’s Forecasts for Halliburton before Its 4Q16 Earnings

On January 3, 2017, 90% of the analysts tracking Halliburton (HAL) rated it a “buy” or some equivalent.

What Do Analysts Recommend for FMC Technologies?

In November, 34% of the analysts tracking FMC Technologies rated it a “buy,” ~55% rated it a “hold,” and only 3% of the analysts rated it a “sell.”

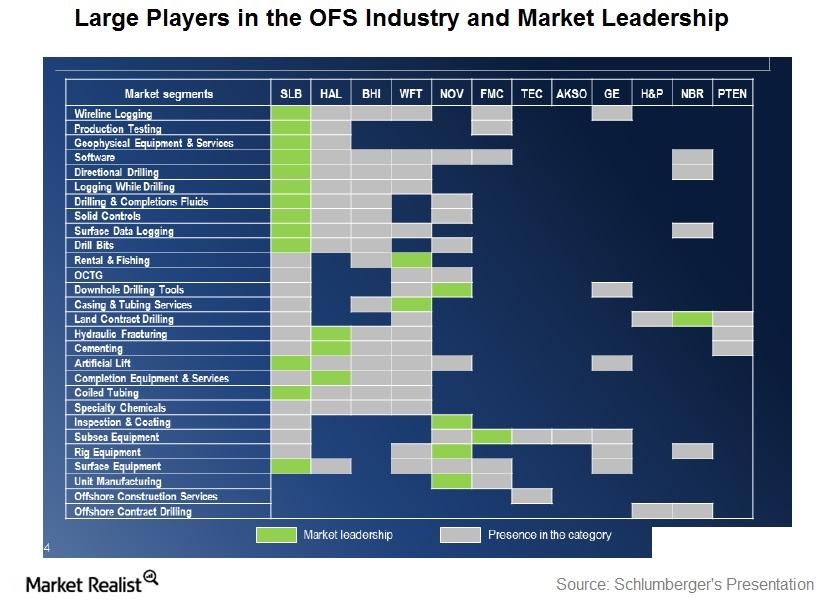

The Oilfield Services Industry: A Brief Introduction

The oilfield equipment and services industry refers to all products and services associated with the oil and gas exploration and production process, or the upstream energy industry.

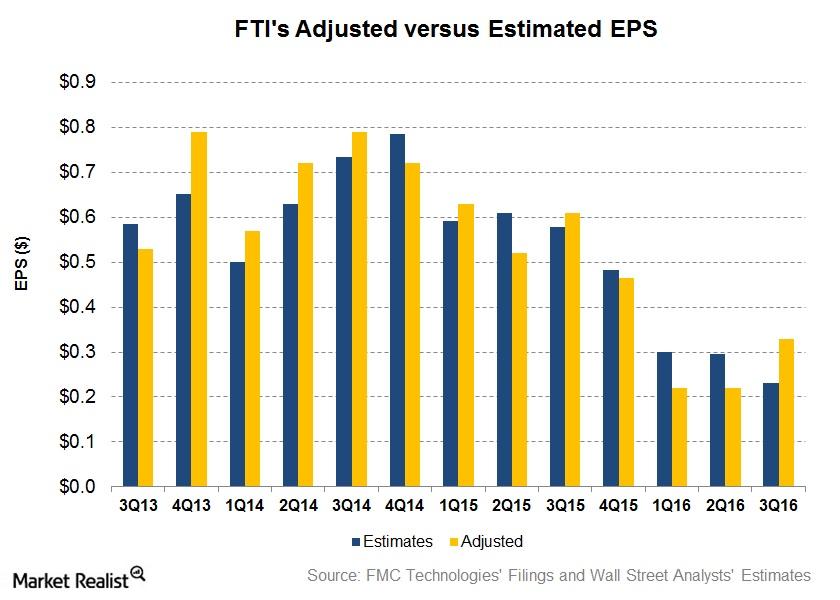

Why Did FMC Technologies’ 3Q16 Earnings Beat Estimates?

The 3Q16 adjusted net EPS (earnings per share) for FMC Technologies is $0.33. This exceeded sell-side analysts’ EPS estimates significantly by 43.0%.

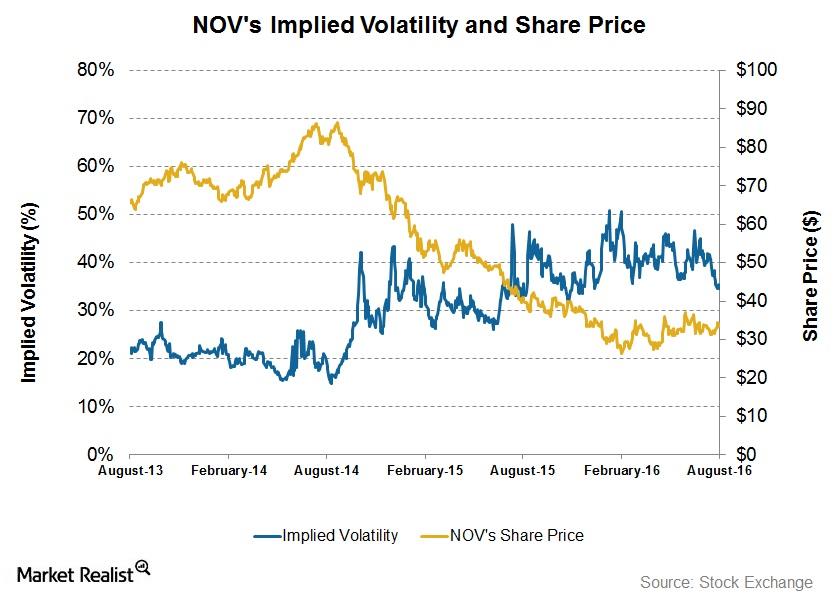

How Volatile Is National Oilwell Varco?

On August 16, 2016, National Oilwell Varco (NOV) had an implied volatility of ~35%.

Why Is Schlumberger’s Free Cash Flow So Remarkable?

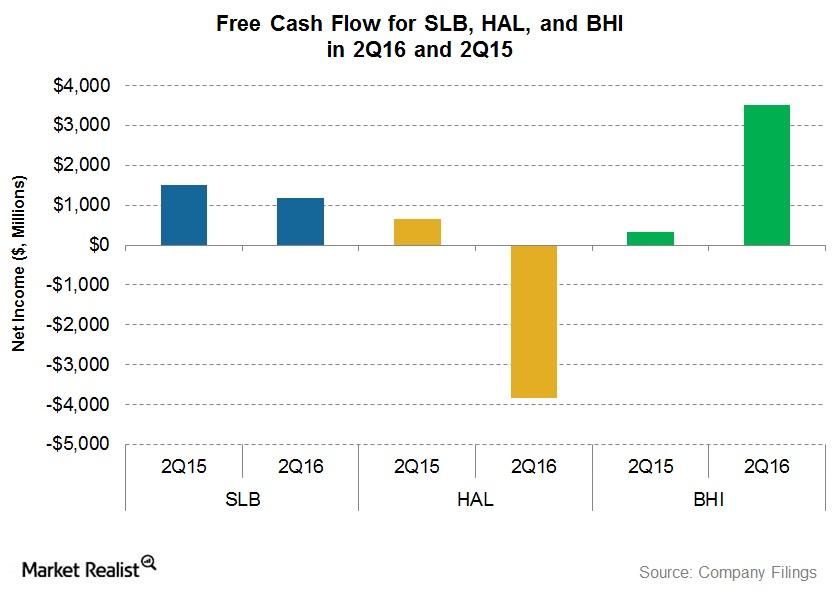

In this part of the series, we’ll take a look at free cash flow for Schlumberger (SLB), Halliburton (HAL), Baker Hughes (BHI), and FMC Technologies (FTI).

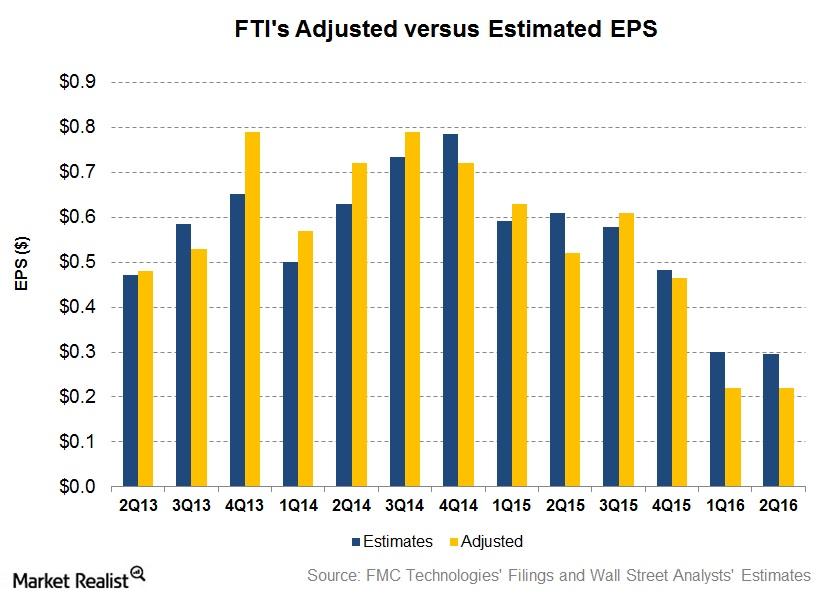

Why Did FMC Technologies’s 2Q16 Earnings Miss Estimates?

FMC Technologies (FTI) released its 2Q16 financial results on July 20. The company recorded total revenues of ~$1.2 billion in 2Q16, down by ~32% from ~$1.7 billion recorded in 2Q15.

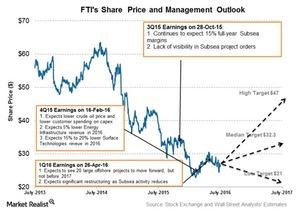

A Look at FMC Technologies’ Outlook and the Technip Merger

FMC Technologies’ management believes that the company’s subsea segment could win a number of projects, which could help steady its revenue and income.

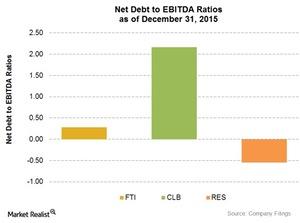

Analyzing the Net-Debt-to-EBITDA Ratios of 4 Major Mid-Cap OFS Companies

In fiscal 2015, RPC’s (RES) net-debt-to-EBITDA ratio stood at -0.54, down from the 0.34 it saw in 2014. The company’s long-term debt stood at zero in 2015.