FirstEnergy Corp

Latest FirstEnergy Corp News and Updates

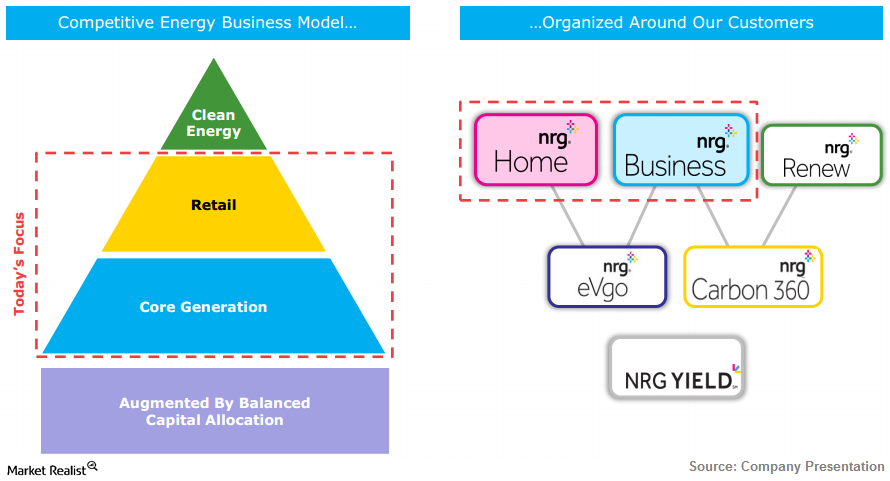

Oaktree Capital Sheds Nearly Half Its Holdings in NRG Energy

NRG Energy is a US-based integrated retail electricity and wholesale power-generation firm. The company has 2.5 million residential customers across the US.

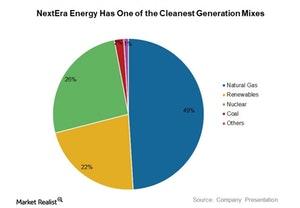

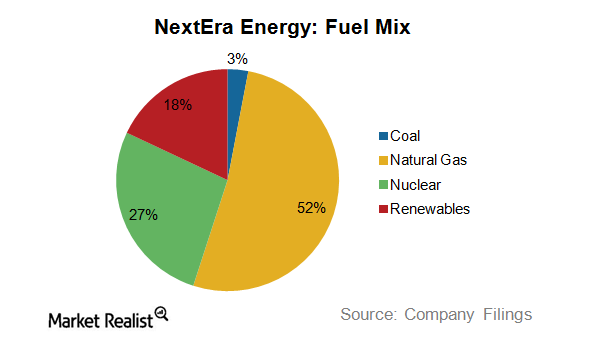

NEE Has One of the Cleanest Generation Mixes in the US

NextEra Energy (NEE) has one of the cleanest generation mixes among peers.

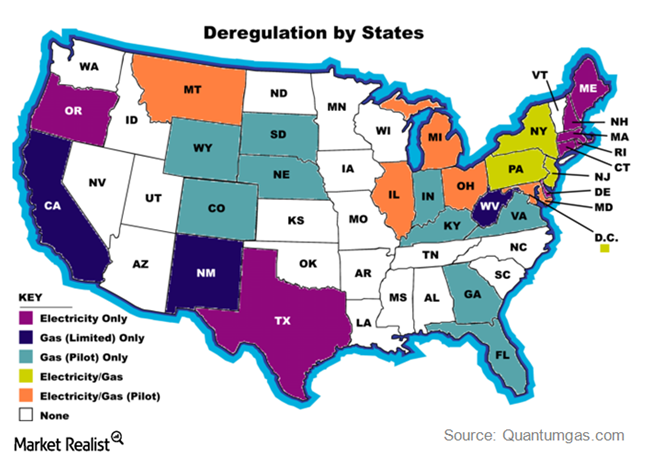

Breaking Down the Regulated and Deregulated US Electric Markets

The US electric utility industry is mostly regulated. The Public Utilities Regulatory Policies Act (or PURPA) was passed in 1978, beginning the deregulation of the utility industry.

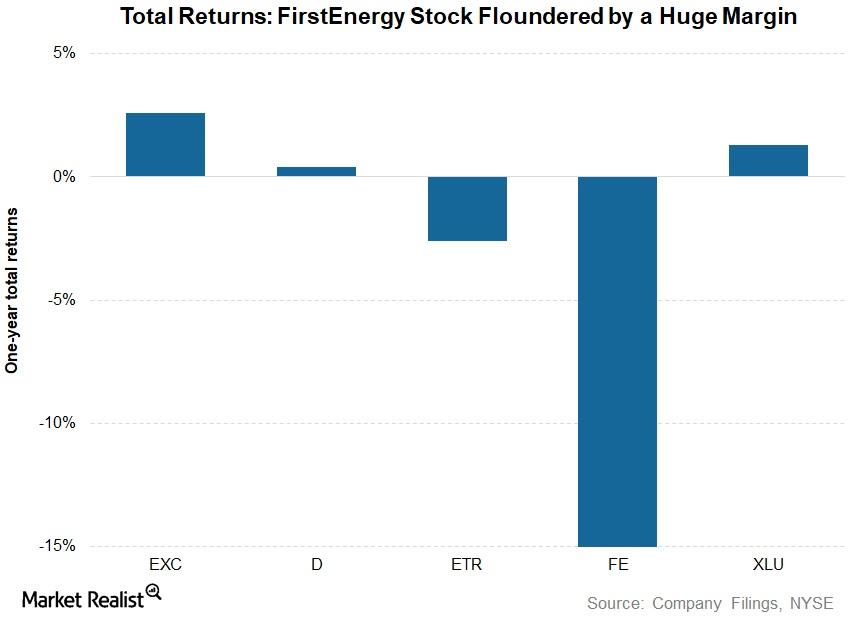

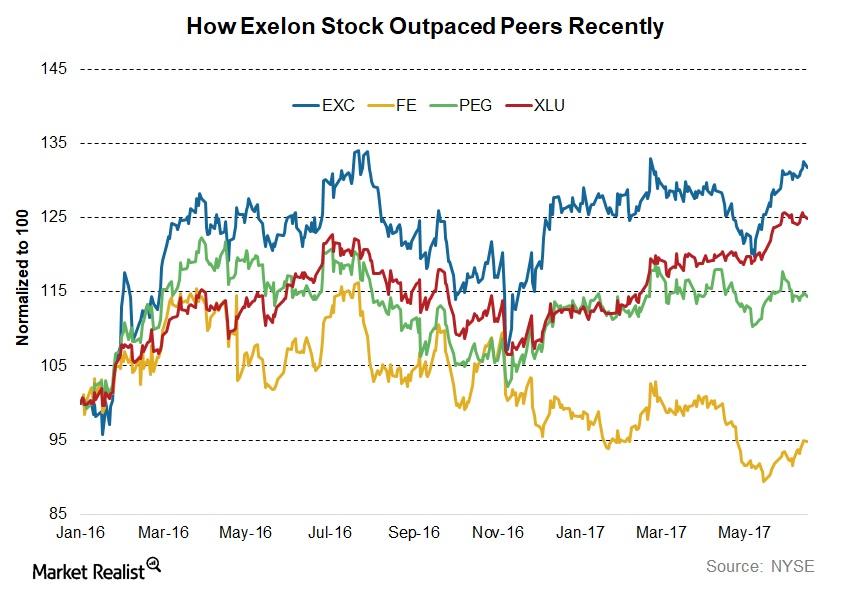

FE, D, EXC, or ETR: Which Utility Stock Stung Investors?

Exelon (EXC) stock has corrected nearly 2% in the last year. Including dividends, its returns have come in at ~3%.

What FirstEnergy’s Chart Indicators Suggest

Utilities have been following a downtrend recently, plummeting more than 10% since early last week.

How FirstEnergy Stock Ranks against Peers

FirstEnergy (FE) has been one of the top-performing stocks among the S&P 500 Utilities Index (XLU) this year.

EXC, FE, and PEG: Are Hybrid Utilities Really Worth the Risk?

US utilities including giants like Duke Energy (DUK) and Southern Company (SO) have done fairly well in the last few months compared to broader markets.

NextEra Energy Seeks Capacity Addition Using Renewables

NEE is further expanding its renewables footprint. In 9M15, it added 225 megawatts of wind capacity and 115 megawatts of solar generation capacity.

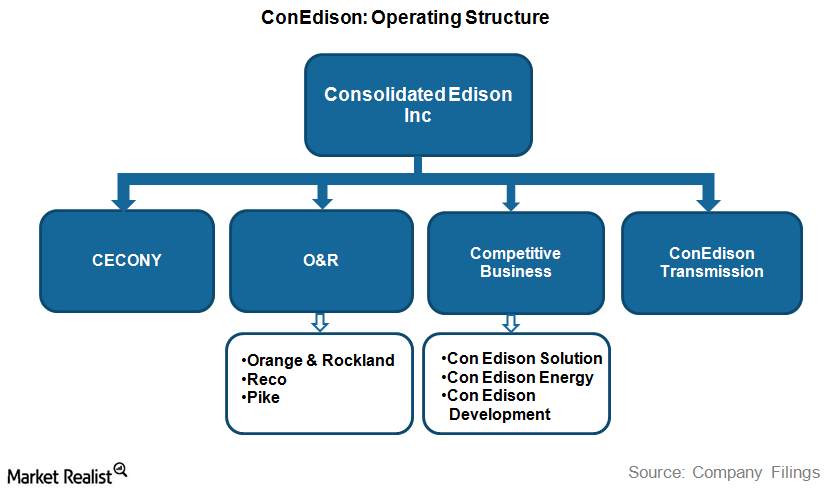

What You Should Know about Con Edison’s Operating Structure

Con Edison handles its competitive energy business through its three wholly-owned subsidiaries: Con Edison Solutions, Con Edison Energy, and Con Edison Development.

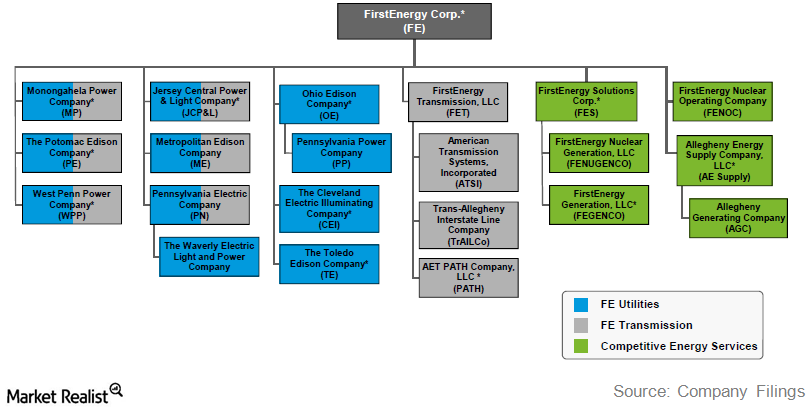

A Key Overview of FirstEnergy’s Operating Structure

FirstEnergy’s revenues are primarily derived from electric services provided by ten subsidiaries. The company serves a combined population of ~13.5 million.

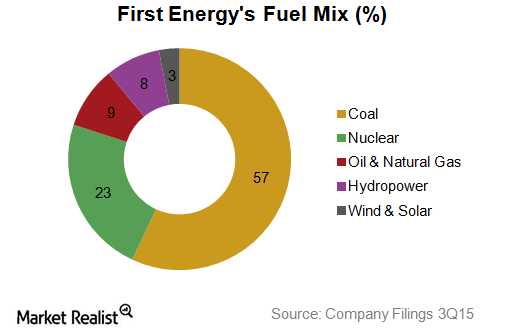

FirstEnergy Relies Heavily on Coal for Power Generation

FirstEnergy generates power from a diverse mix of primary energy sources but is primarily dependent on coal, which accounts for 57% of its power generation.

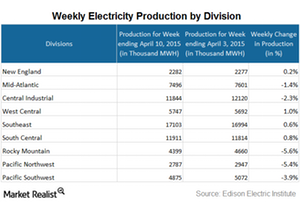

Rocky Mountain Division Sees a Large Drop in Electricity Generation

Out of nine divisions, electricity generation increased in four divisions and decreased in five divisions for the week ending April 10.