Con-way Inc

Latest Con-way Inc News and Updates

What Is FedEx Management’s Outlook for the Future?

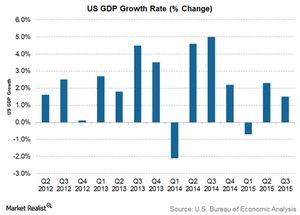

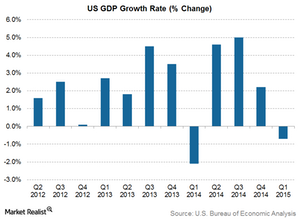

FedEx continues to see growth in the global economy. It expects the US GDP to grow by 2.4% in 2015 and by 2.6% in 2016, driven by increased consumer spending.

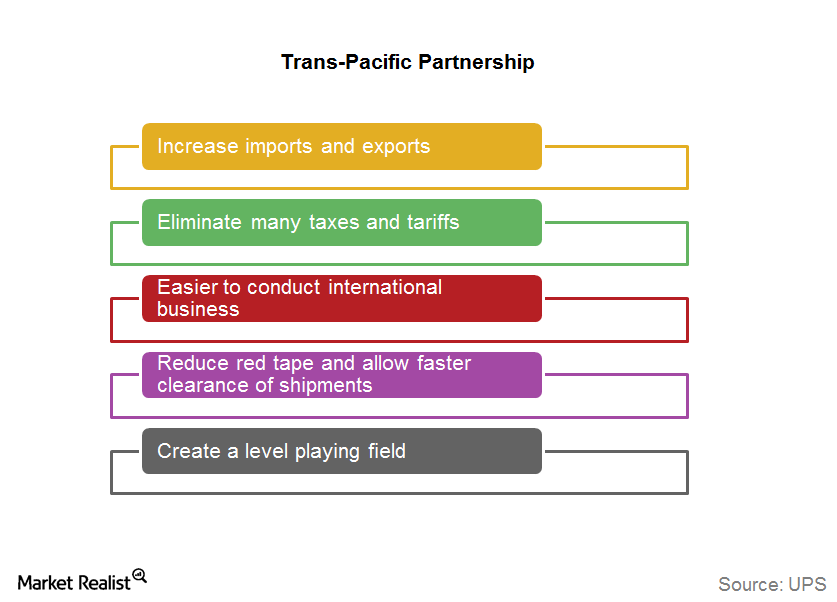

UPS and the Trans-Pacific Partnership: Simplicity in Trade?

The Trans-Pacific Partnership is expected open cross-border trade between member nations by increasing imports and exports and cutting taxes and tariffs.

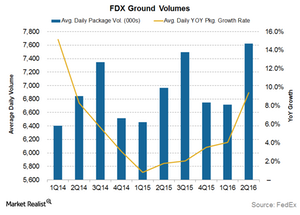

FedEx Ground: Delivering on E-Commerce Growth

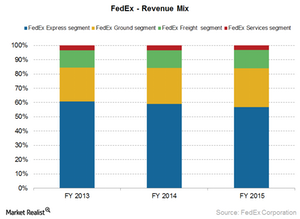

FedEx Ground is being driven by the booming growth in e-commerce, and it contributed to 35% of the company’s revenues but 44% of its profits.

What are UPS’s Revenue Drivers?

Revenue drivers There are three main drivers of revenue growth for United Parcel Service (UPS): package volumes, product mix and pricing, and fuel surcharges. Package volumes and product mix and pricing are in turn driven by economic growth. Economic growth Increasing economic growth increases e-commerce demand, which in turn increases demand for courier services. […]

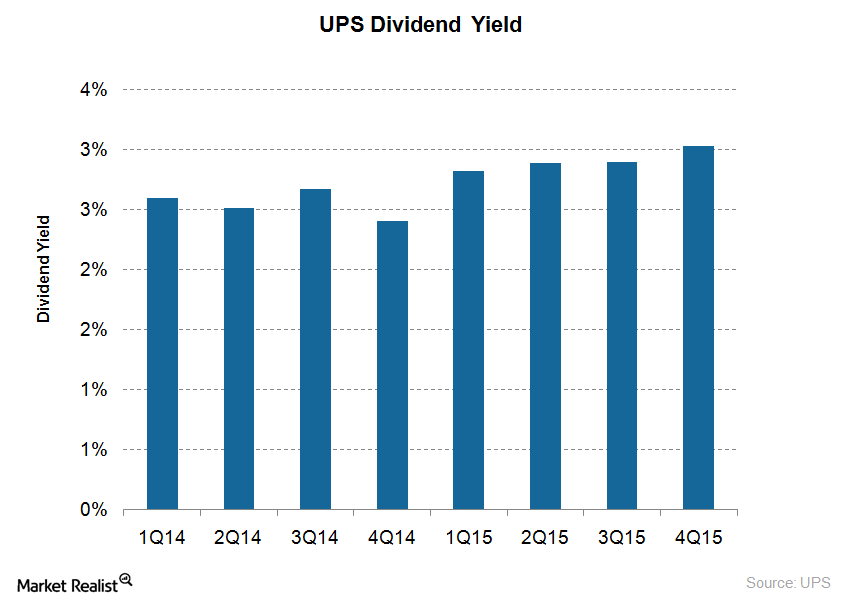

Will United Parcel Service Increase Its Dividend Payout in 2016?

United Parcel Service (UPS) has been a consistent dividend payer for the last 20 years.

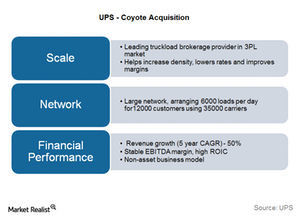

How Does UPS Benefit from Its Acquisition of Coyote Logistics?

United Parcel Services (UPS) announced its agreement to acquire Coyote Logistics. It’s a Chicago-based logistics firm with contract carrier companies.

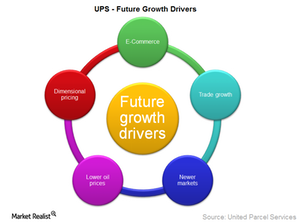

Possible Key Growth Drivers for UPS in the Near Future

The e-commerce industry is poised to grow rapidly in the future. With this growth will come the need for package delivery.

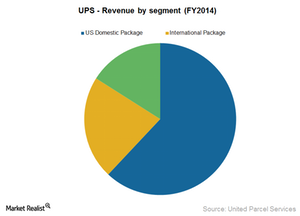

United Parcel Service: How It Delivers Packages to the World

United Parcel Service is the world’s largest package delivery company and a leading global provider of specialized transportation and logistics services. It forms the largest holding of 7.6% in IYT.

What Are FedEx’s Key Strategic Business Advantages?

FedEx has been in the marketplace for over 40 years. It has established a huge network spread across more than 220 countries and territories worldwide.

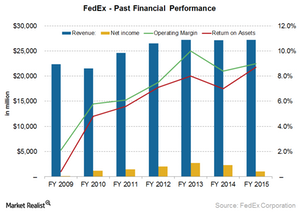

FedEx’s Financial Performance and Long-Term Goals

FedEx’s (FDX) financial performance during the last few years has been extraordinary. It successfully bounced back from the recessionary downturn.

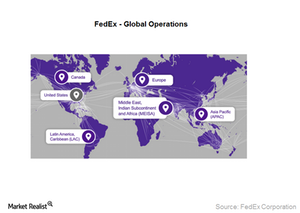

Why FedEx Is Expanding Its Global Reach

FedEx has assembled a portfolio of solutions, from express and freight forwarding to critical inventory logistics, that can solve any global commerce challenge.

A Key Analysis of FedEx’s Business Model

Currently, FedEx is the global leader in the express delivery market. It offers delivery to and from individuals and businesses. It has various business units.