Vanguard Short-Term Bond ETF

Latest Vanguard Short-Term Bond ETF News and Updates

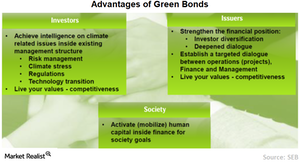

How Green Bonds Can Help Diversify Investor Base

Even if we assume that green bonds don’t offer any significant premium over conventional bonds, there are many who believe in other noteworthy advantages of green investing.

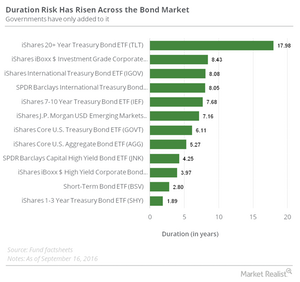

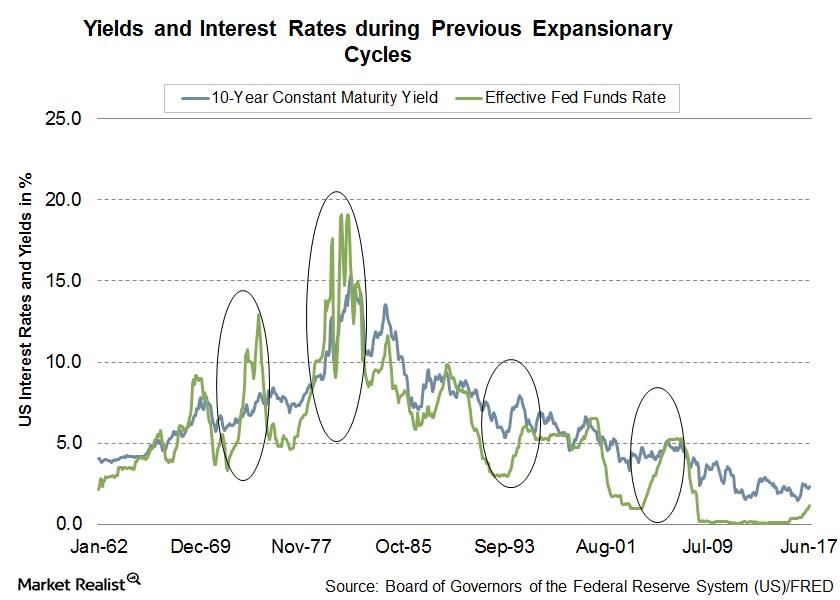

Investors Beware: Duration Risk Has Risen across the Bond Market

If you’re a bond (BSV) (AGG) investor or fund manager, fluctuation in interest rates is one of the key risk drivers for the returns you get from your portfolio.

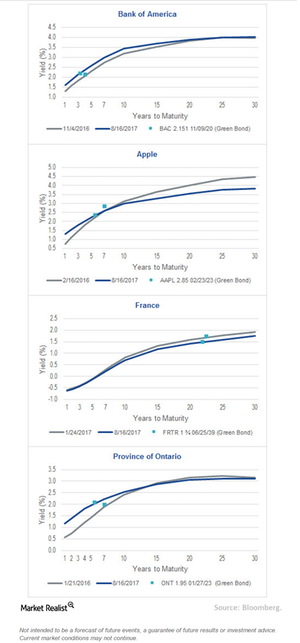

Does the Green Bond Premium Exist?

Despite the rapid rise in issuance, demand for green bonds continues to outshine supply. The excess demand for green bonds has led to higher returns.

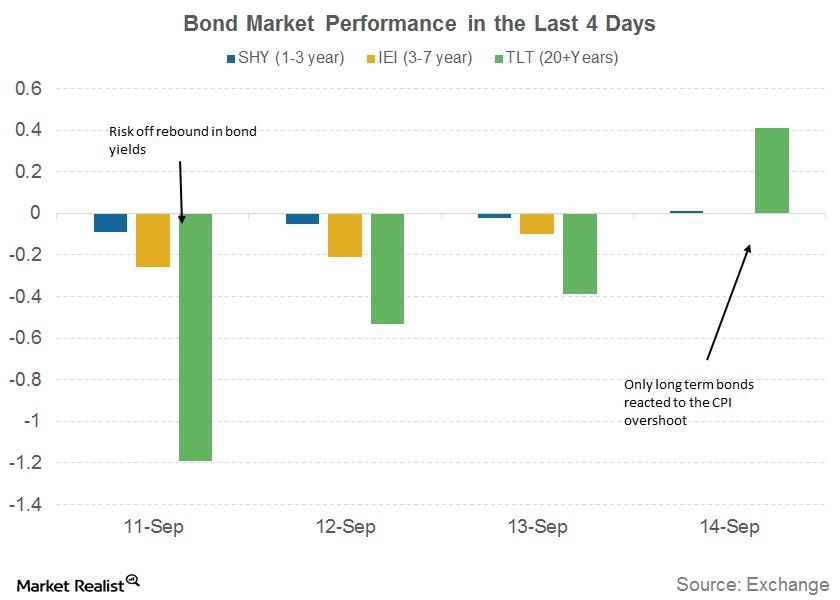

The Bond Market’s Reaction to New Rate Hike Hopes

After three weeks of continuous falls, US bond yields rose in the week of September 10. The benchmark ten-year US Treasury yield (BSV) rose by 10 basis points to 2.20% but remains far from the December 2016 high of 2.64%.

Tax Reforms and Jobs Could Drive the Last Week of Summer

Any negative news from the jobs report will be foreshadowed by the tax reform news. It’s the last jobs report before the September FOMC meeting.

Will Jackson Hole in 2017 Be the Beginning of the End of Monetary Accommodation?

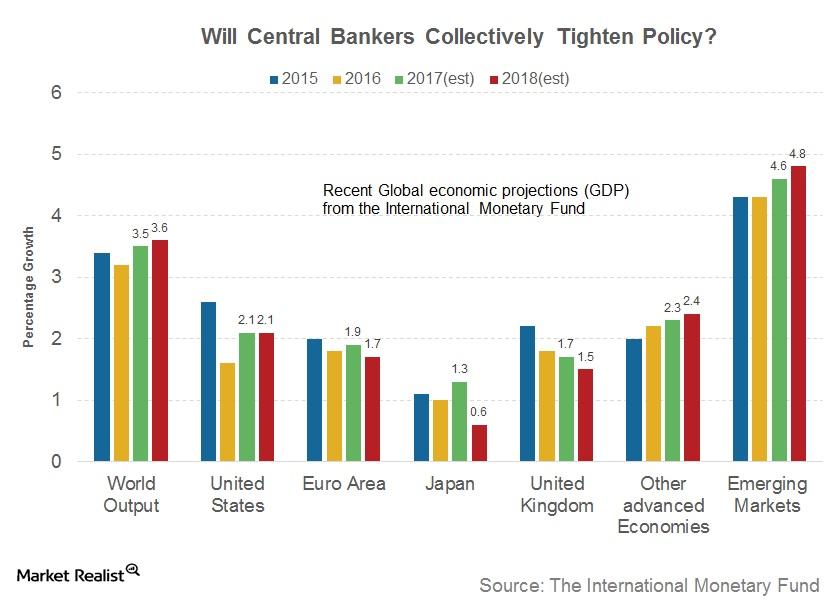

This year’s theme for the annual Jackson Hole Symposium is “Fostering a Dynamic Global Economy.”

Can There Really Be a Bubble in the Bond Market?

Fundamentally, bonds (AGG) are a discount instrument and are generally never expected to be in a bubble. Let’s see why that’s the case.

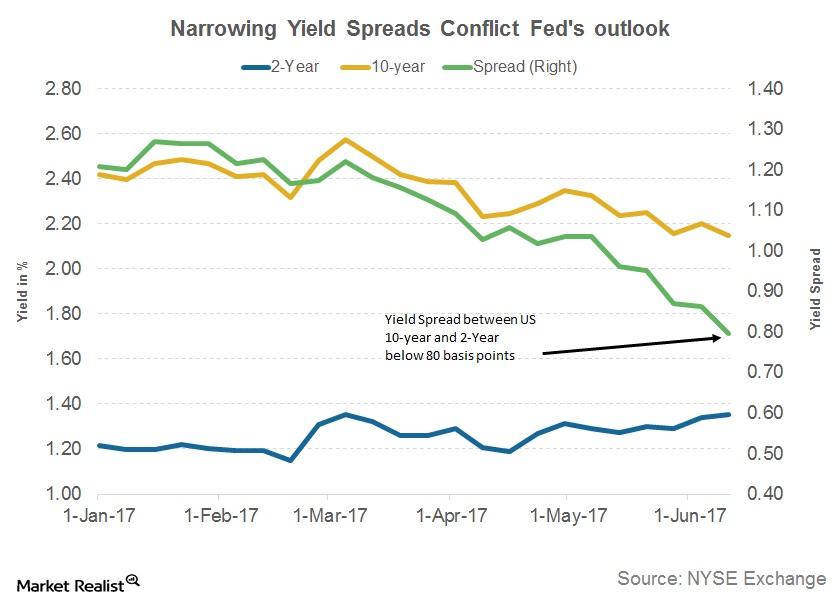

Why NY’s Fed President Doesn’t Feel a Flattening Yield Curve Is Negative

New York’s Federal Reserve president, William C. Dudley, recently spoke at a business forum in New York and said that he was pleased with the current state of the US economy.

Narayana Kocherlakota on Trump and the Federal Reserve

Narayana Kocherlakota, 12th president of the Federal Reserve Bank of Minneapolis, said central banks have been able to control inflation better when left alone by the government.

Richard Bernstein: Be Safe on Your Quest for Safety

After expressing his thoughts on the Baby Boomer generation’s having become risk-averse, Richard Bernstein moved on to the topic of the safety of “safe” investments.

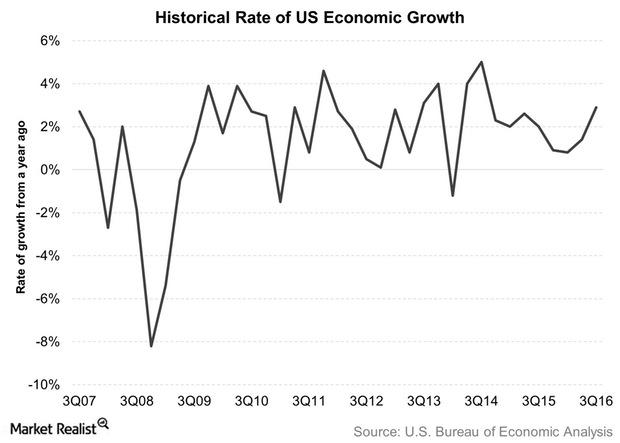

Bill Gross: Monetary Policy on Steady but Slow Path

After the release of the FOMC’s November statement, Bill Gross said that monetary policy in the United States is steadily moving toward normalization, though its pace is slow.

Policymakers Are Getting Vocal about the Fed’s Credibility

The issue of the Fed’s credibility is not a new one. The effectiveness of the prolonged monetary accommodation has sparked a lot of debate in the past.

Why Does Janus Think Inflation Is on the Rise?

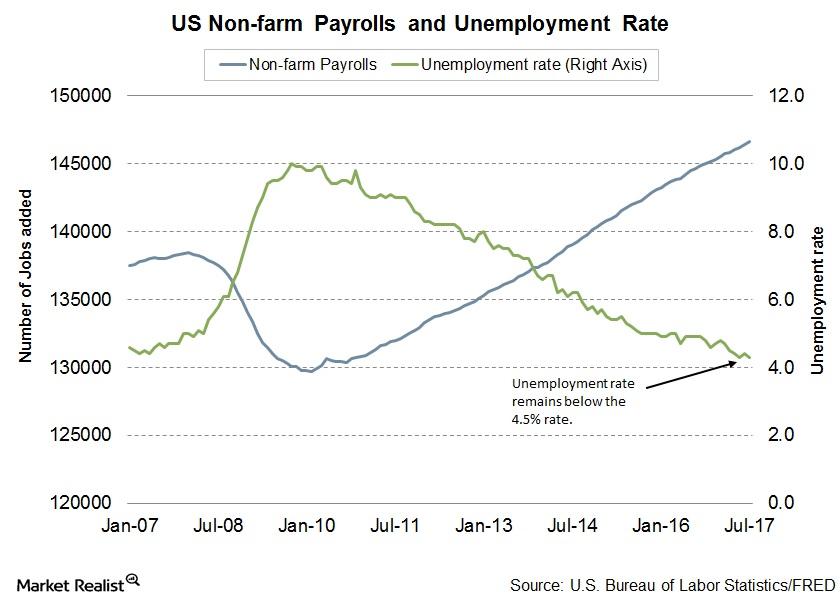

In the “Janus Market GPS,” the team had outlined its belief that a low unemployment rate signaled tighter labor market conditions.

Richard Bernstein Discusses the Risk of Seeking Safety

In his July 2016 Insights newsletter, Richard Bernstein stated, “Safe investments are safe until everyone wants them.”