VanEck Vectors Gaming ETF

Latest VanEck Vectors Gaming ETF News and Updates

Must-know: The most popular casino games

Casinos’ popularity is growing. This suggests that people like to gamble occasionally. Unfortunately, they don’t always win. For most of the people, the real fun is playing the game—not necessarily winning.

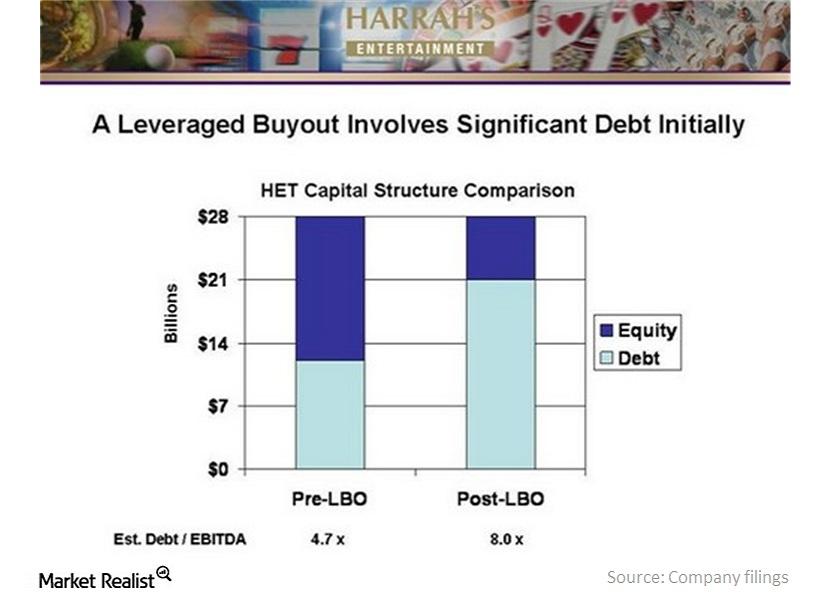

Why Caesars Entertainment has a massive $24 billion debt

Texas Pacific Group and Apollo Management took Harrah’s Entertainment, now Caesars Entertainment, private in a leveraged buyout deal valued at $30.7 billion in 2008.

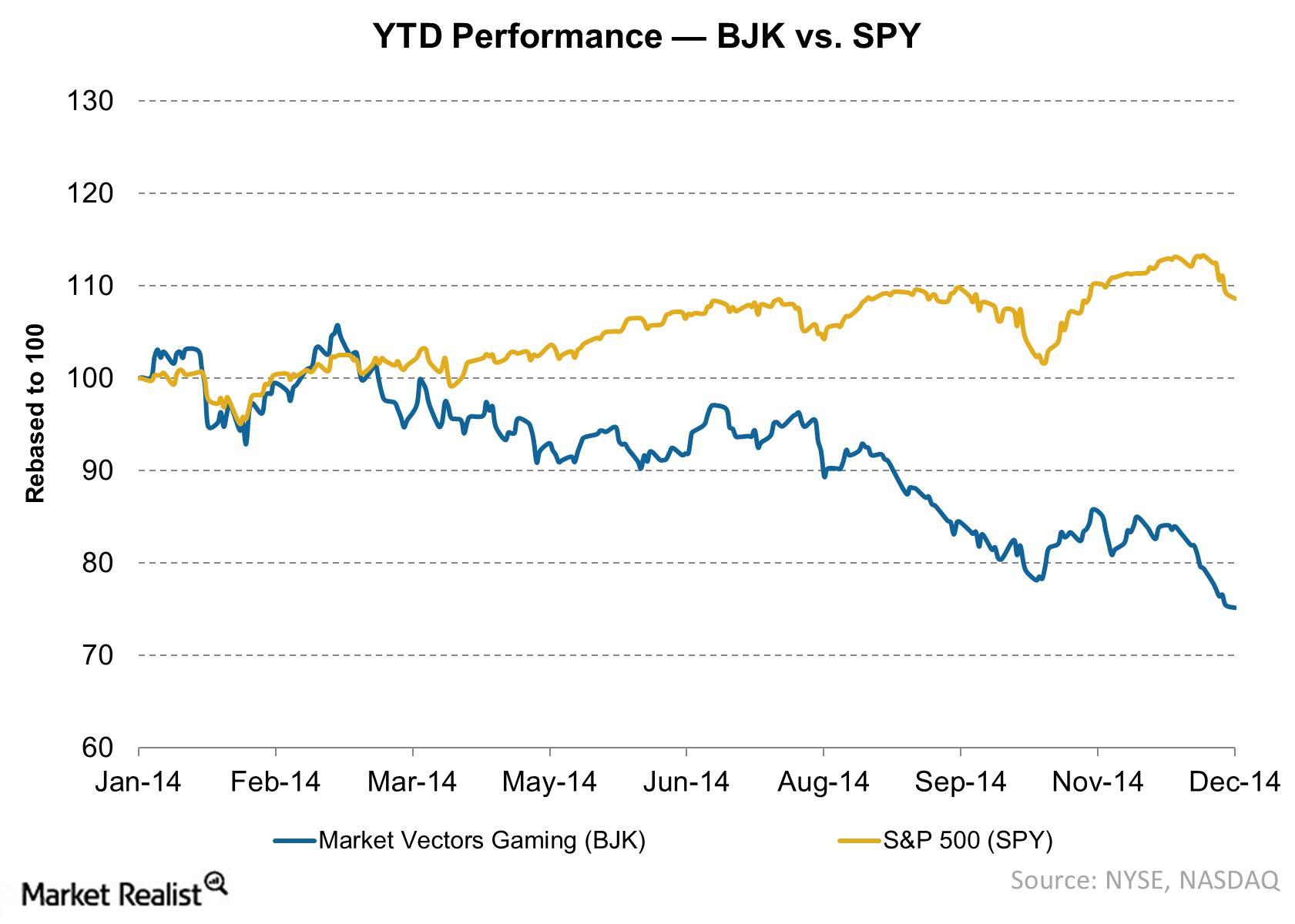

Key Indicators And Recent Trends In The Casino Industry

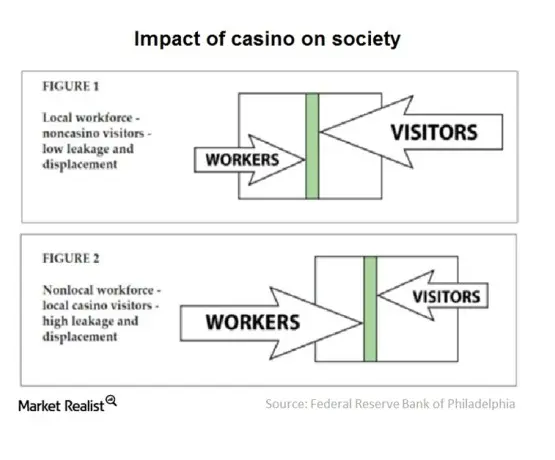

Casino gambling is spread across major destinations around the world. Casinos, at major destinations, are being influenced by certain factors. This is hampering industry growth.

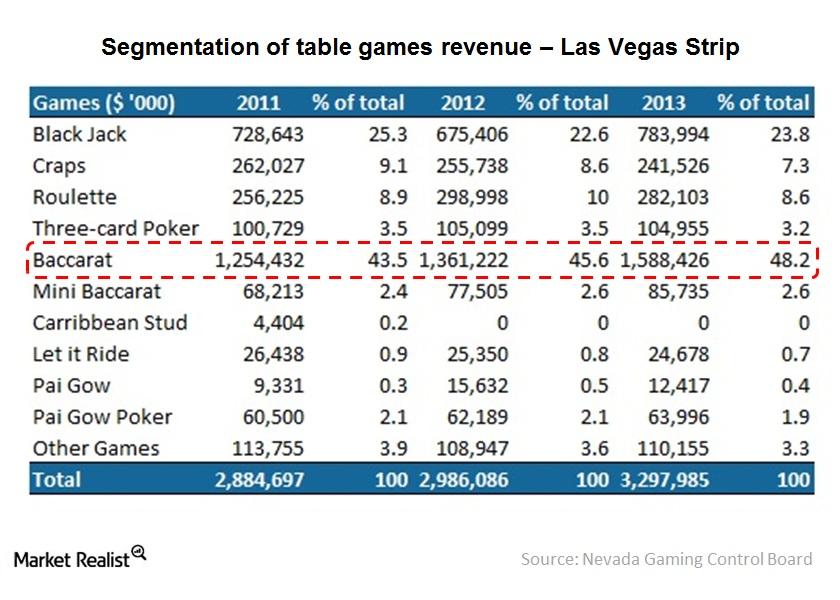

Why Baccarat gambling provides revenue for the Las Vegas Strip

The casinos in the Las Vegas Strip clearly benefit from high-end Baccarat play. Over the last four years, Baccarat revenue ranged from 43.5% of table games revenue in 2011 to 48.2% in 2013.

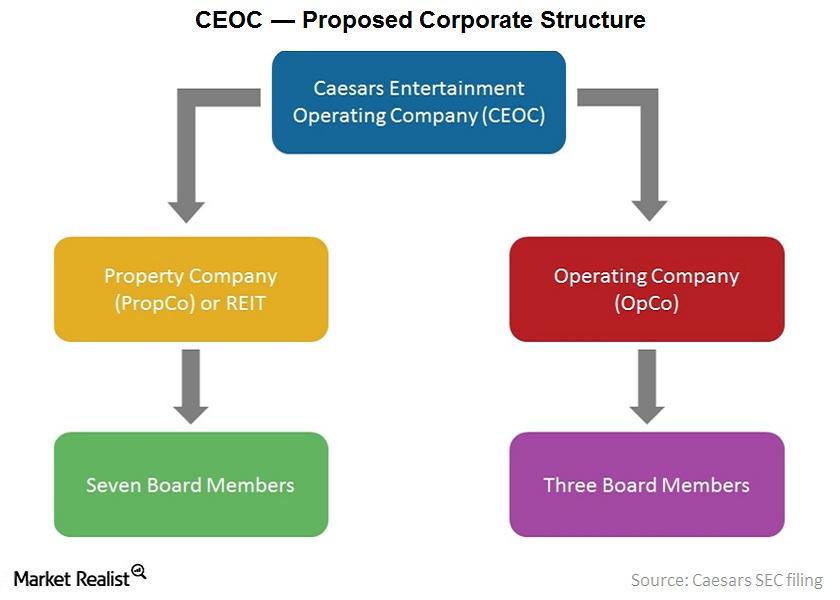

Caesars Entertainment’s New Corporate Structure and Governance

On December 22, 2014, CZR and Caesars Acquisition Company (CACQ) entered into a definitive agreement to merge in an all-stock transaction.

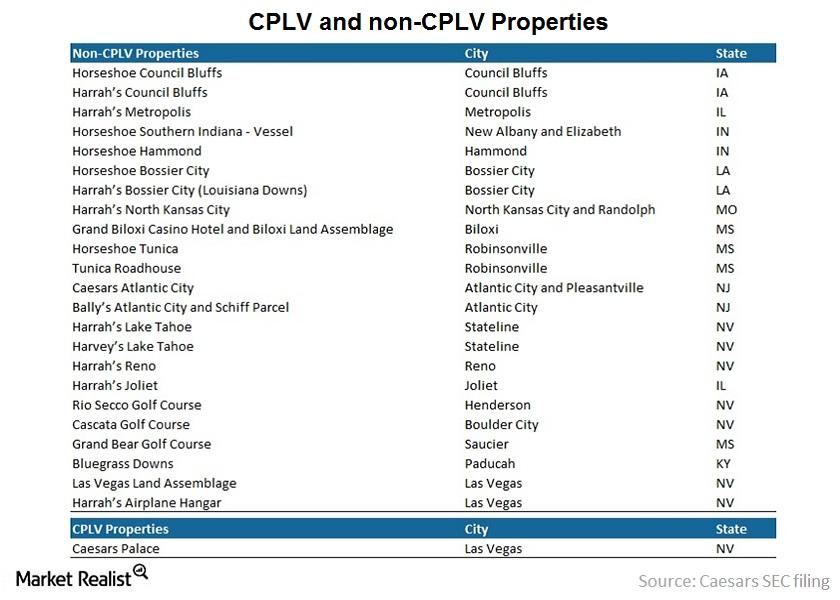

A Quick Guide To The Bifurcation Of Caesars’s Operating Leases

The initial term of each lease will be for 15 years with four five-year renewals. CZR will guarantee payments and performance of the OpCo’s obligations.

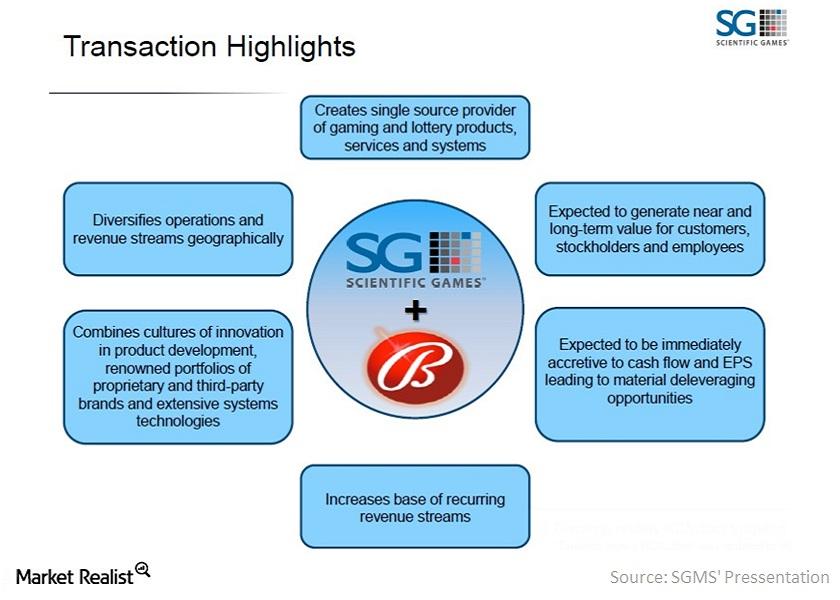

Scientific Games: Strategic Acquisition of Bally Technologies

In its merger agreement with Bally Technologies, Scientific Games agreed to acquire all outstanding Bally common stock for $83.3 cash per share.

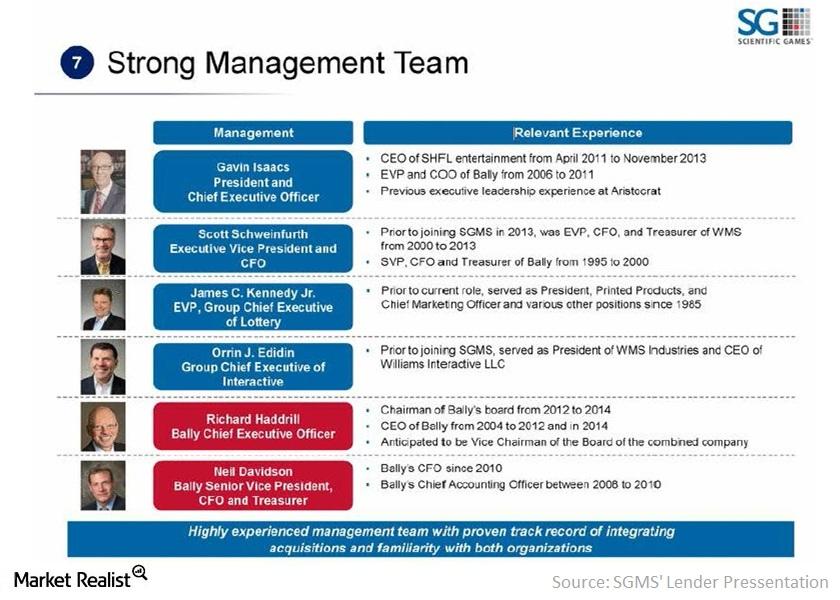

Consolidated Scientific Games: A Stronger Management Team

The executive management team of SGMS includes President and CEO Gavin Isaacs and Executive Vice President and CFO Scott Schweinfurth.

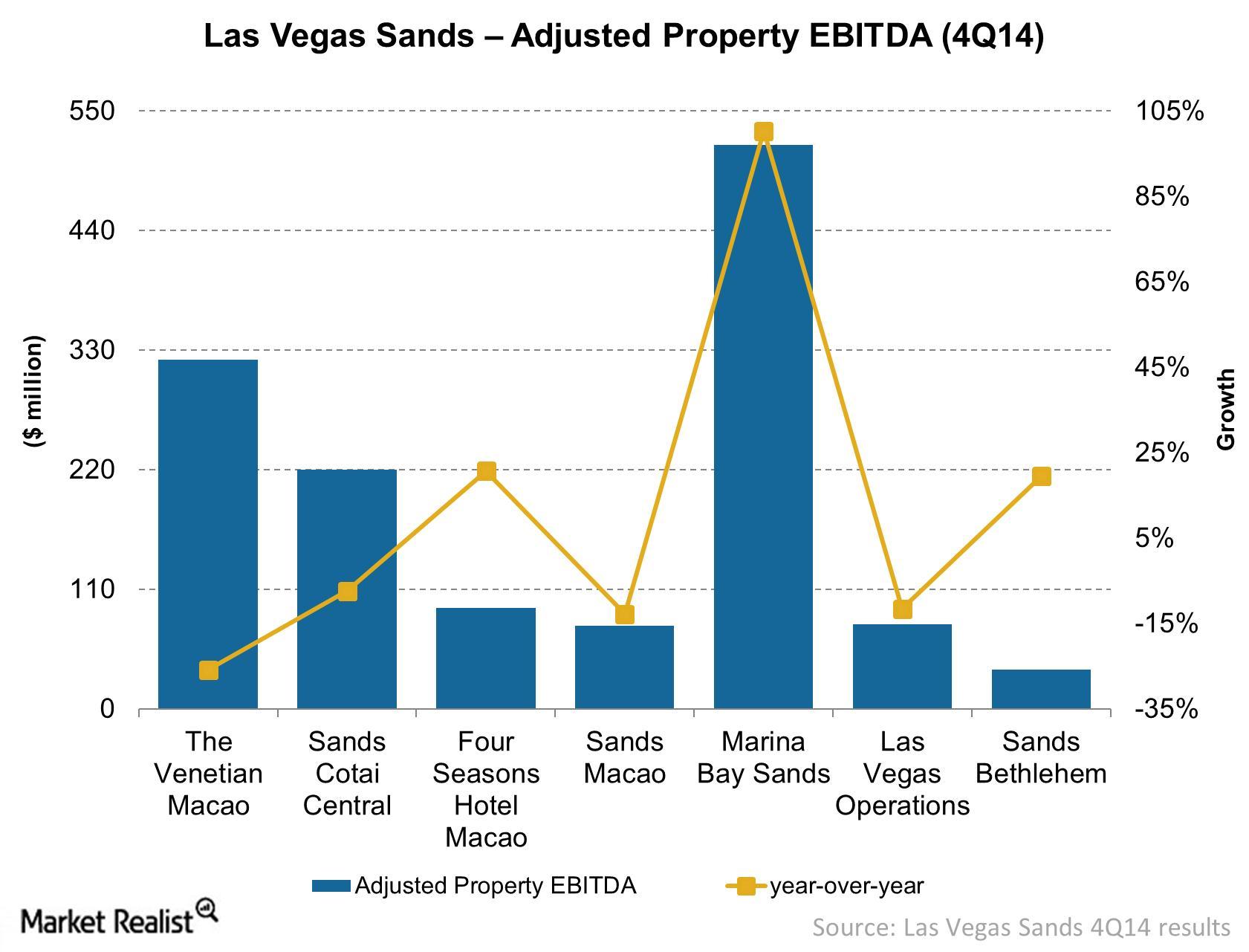

Las Vegas Sands’ adjusted property earnings double in Singapore

Las Vegas Sands’ adjusted property EBITDA at Marina Bay Sands in Singapore doubled, reaching a property record of $518.5 million, up ~100% year-over-year.

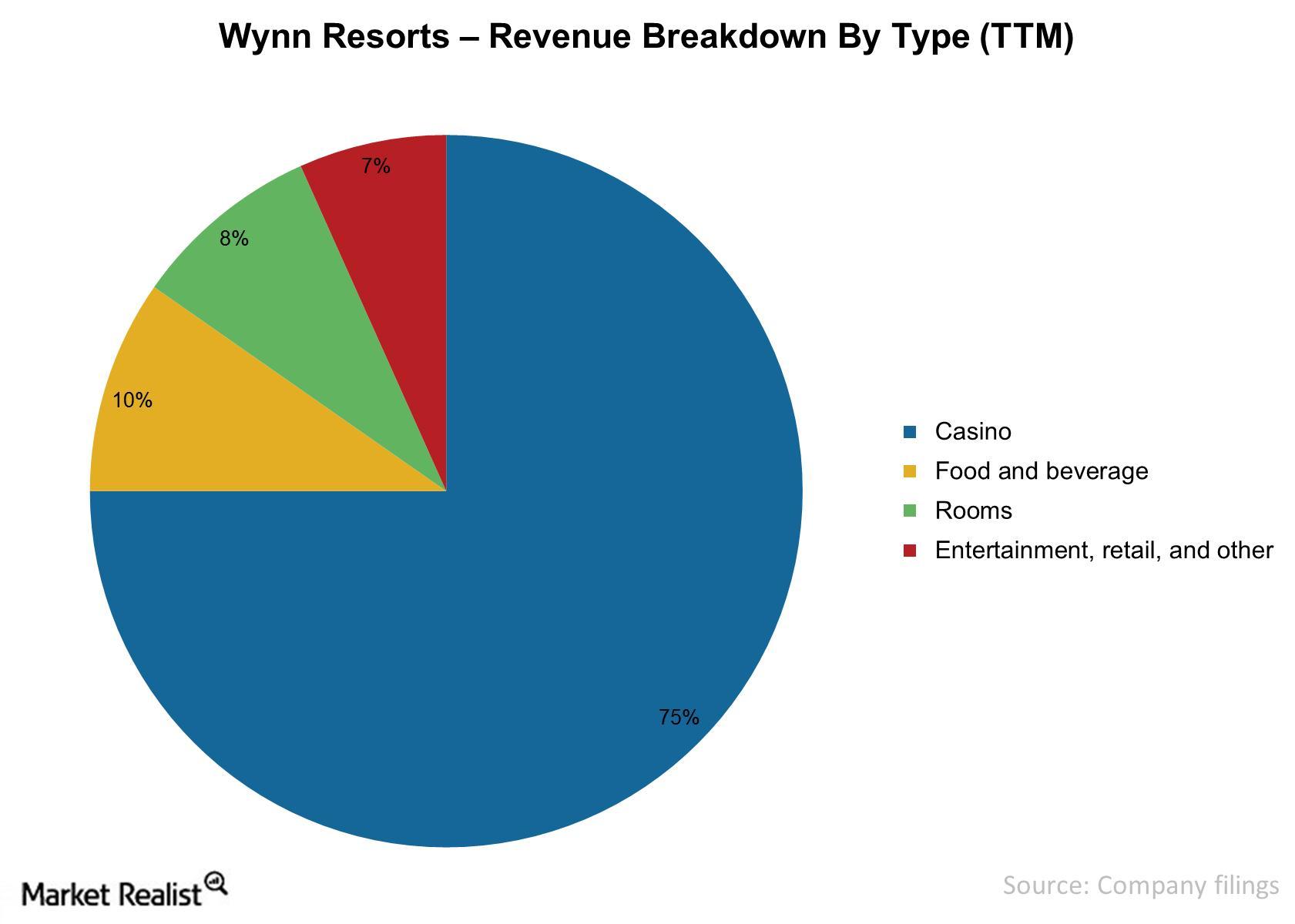

Wynn Resorts: A revenue breakdown

Wynn Resorts (WYNN) earns its revenues through casinos, hotels, food and beverages, and entertainment and retail operations.

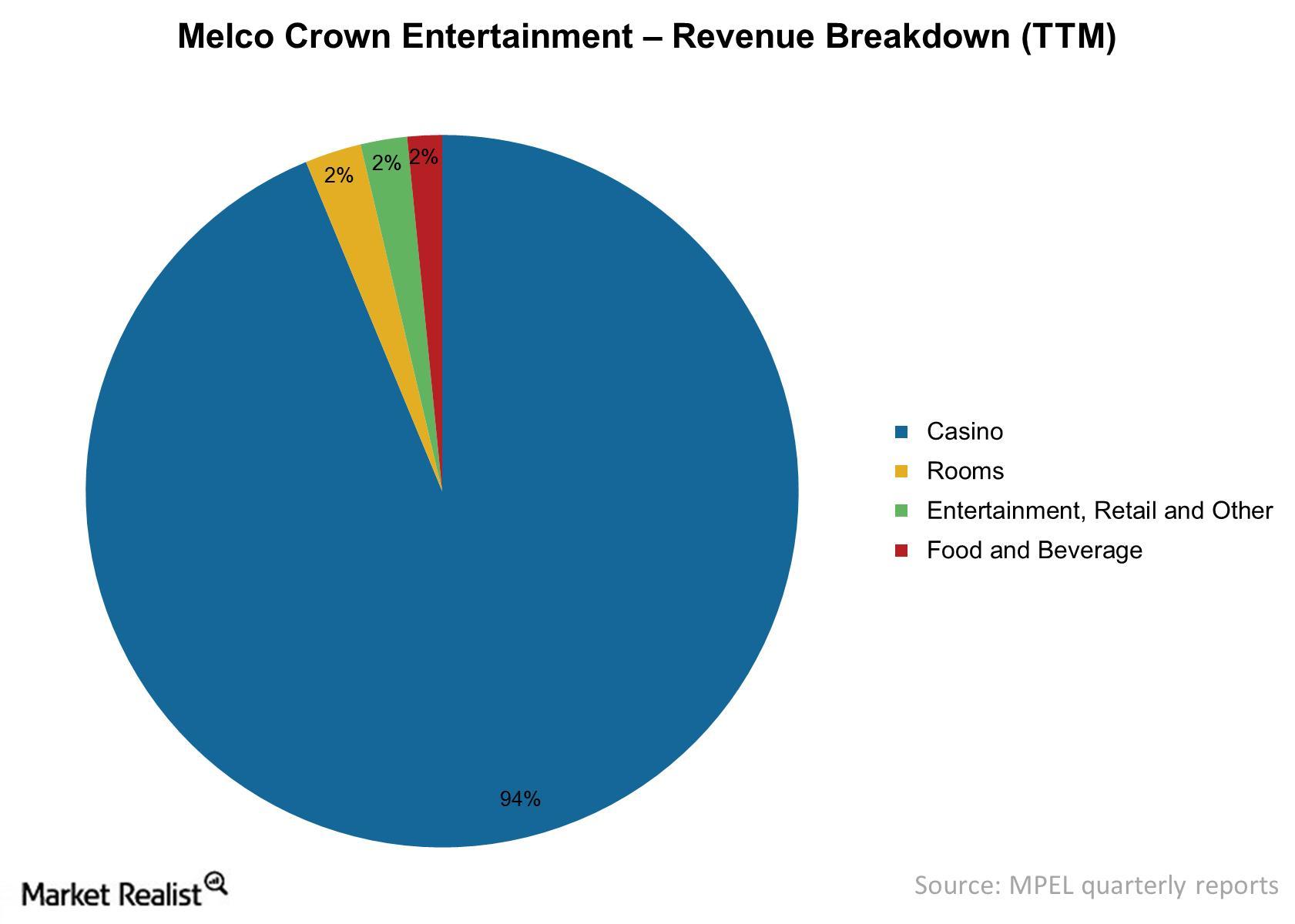

Why Melco Crown Is Profitable In The Casino Space

MPEL derives ~94% of revenues from casino operations. Its casino business gross margin is 50% for the trailing 12-month period ending September 30, 2014.

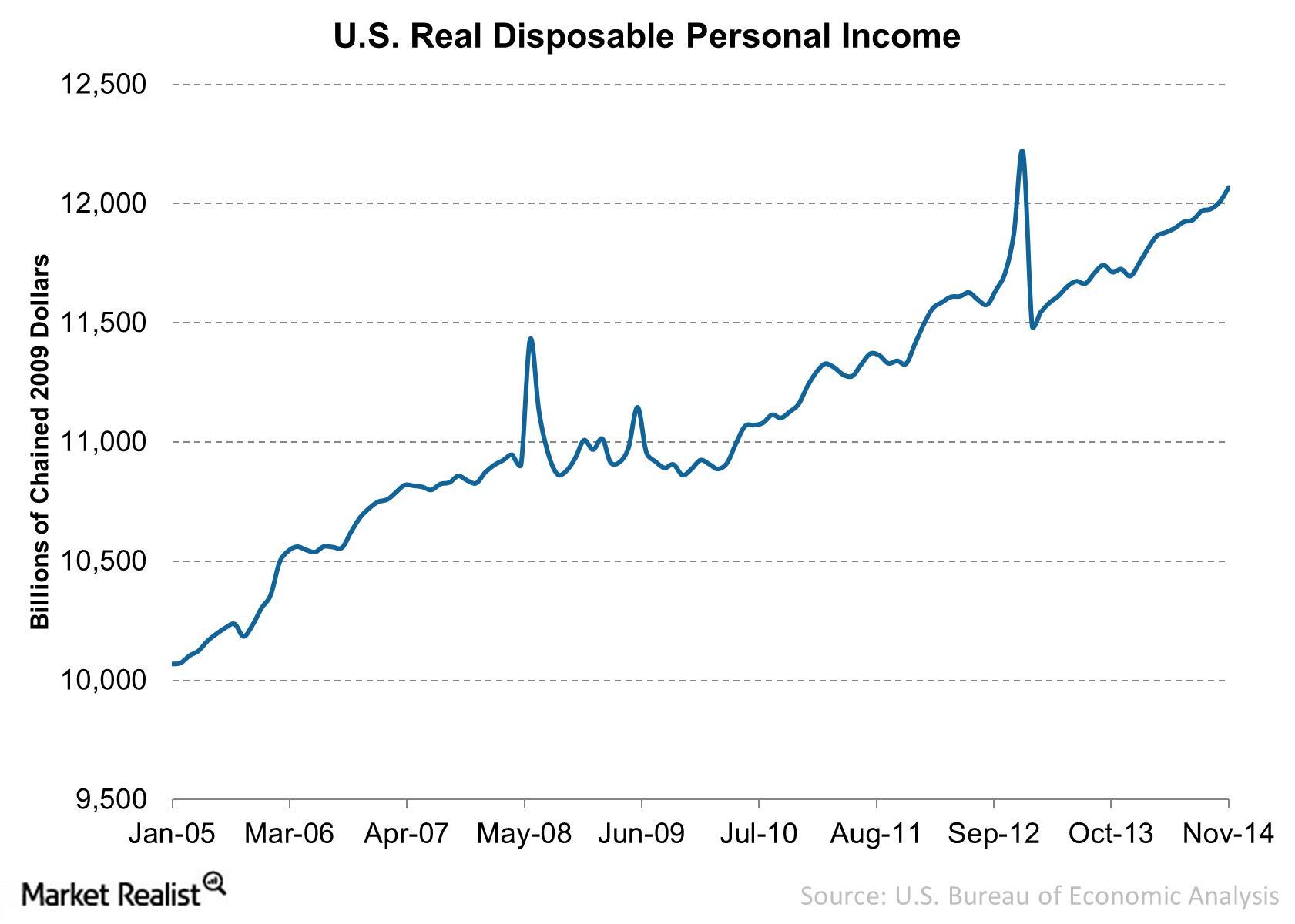

Why Casinos Rely On Disposable Income

On a year-over-year basis, real disposable income increased 2.9%. More disposable income boosts consumer buying power.

An important overview of Las Vegas Sands, a casino company giant

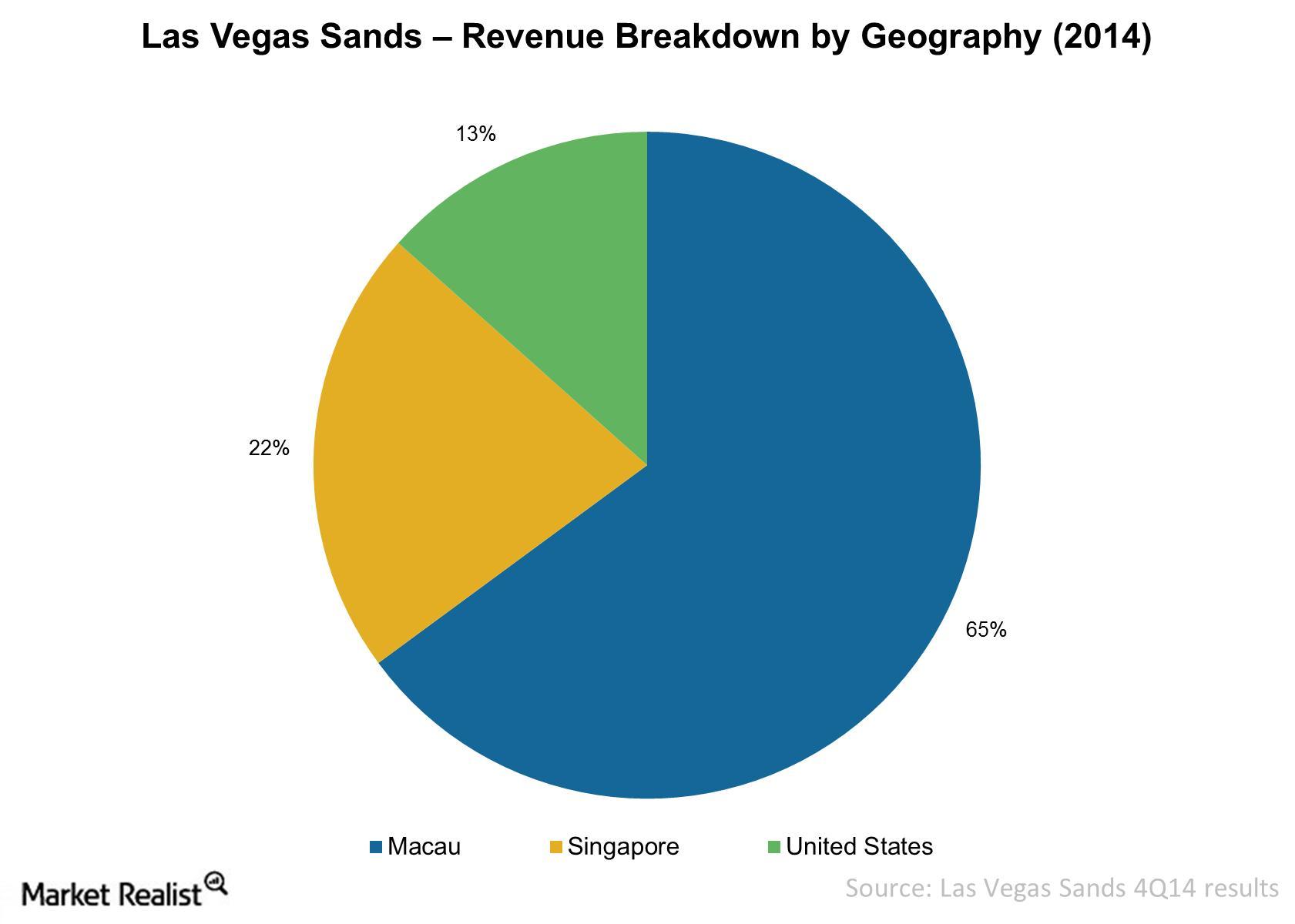

An overview of Las Vegas Sands (LVS) shows that the company currently owns 70.1% of Sands China Ltd., which operates LVS’s four Macao properties.

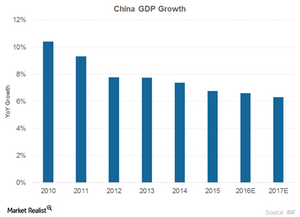

How China’s Weakening Economy Could Hurt Macao Casinos

The Macao region relies heavily on the Chinese mainland, as it garners the huge majority (about 67%) of its visitors and VIP gamers from China and its neighboring countries.

Pinnacle Entertainment’s cost structure

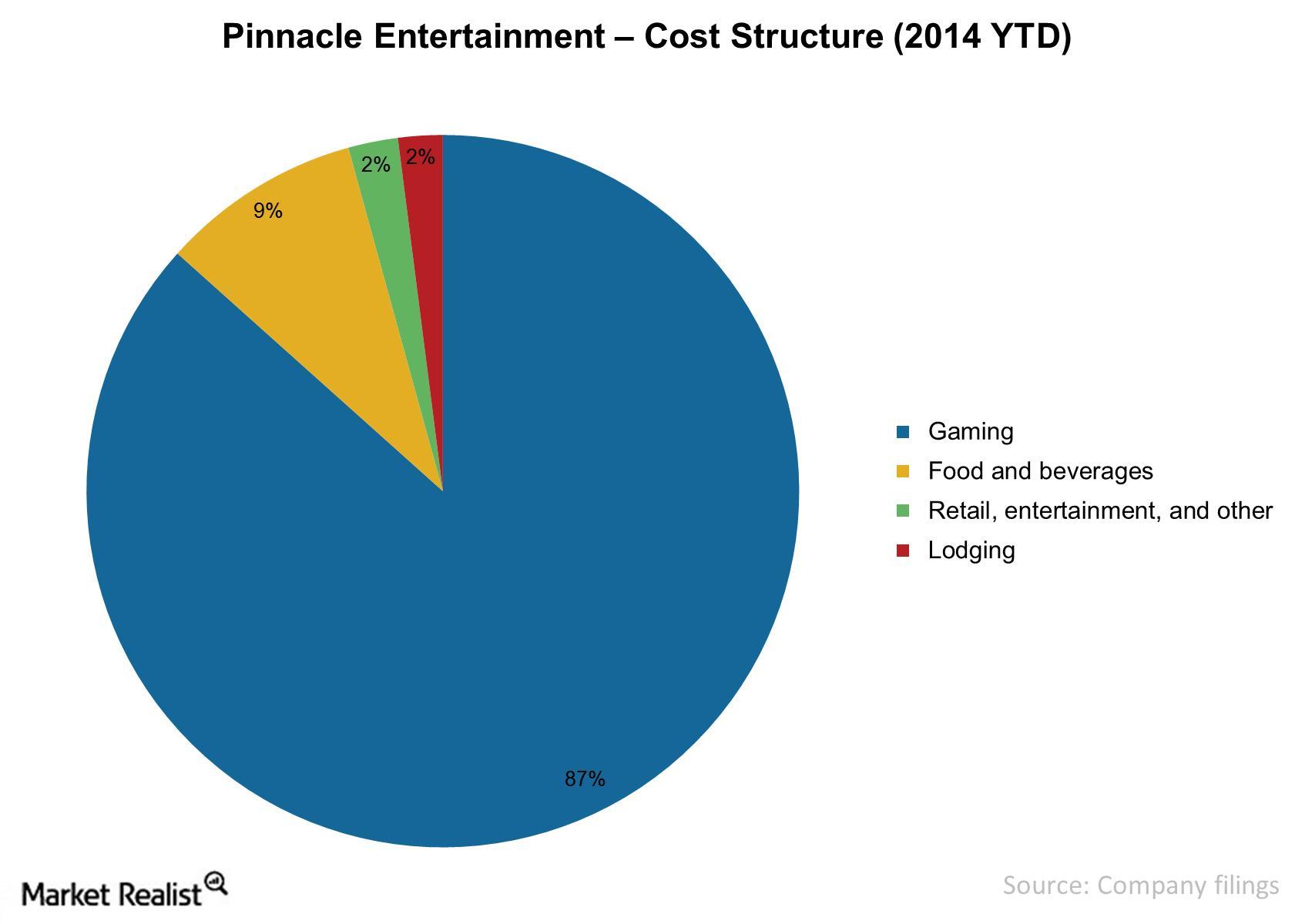

Pinnacle Entertainment (PNK) incurs direct costs in gaming, food and beverage, lodging, retail, entertainment, and other areas.